- Lyzr Marketplace

- Insurance

- Policy Underwriting Support Agent

Policy Underwriting Support Agent

Manual underwriting is slow and costly. This agent automates data intake and analysis to accelerate decisions and improve risk accuracy.

- Chief Underwriting Officers

- VPs of Operations

- Heads of Risk Management

Trusted by leaders: Real-world AI impact.

The problems we hear from leaders like you

The administrative burden of traditional underwriting creates bottlenecks that directly impact your bottom line and competitive edge.

Administrative overload

Underwriters spend up to 40% of their time on manual data entry, not on high-value risk assessment.

Slow turnaround

A 20-day average from quote to bind leads to lost business opportunities and frustrated brokers.

Fragmented data

Pulling information from dozens of siloed sources increases the risk of errors and inconsistent decisions.

Talent drain

High administrative burdens lead to burnout, turnover, and the loss of critical institutional knowledge.

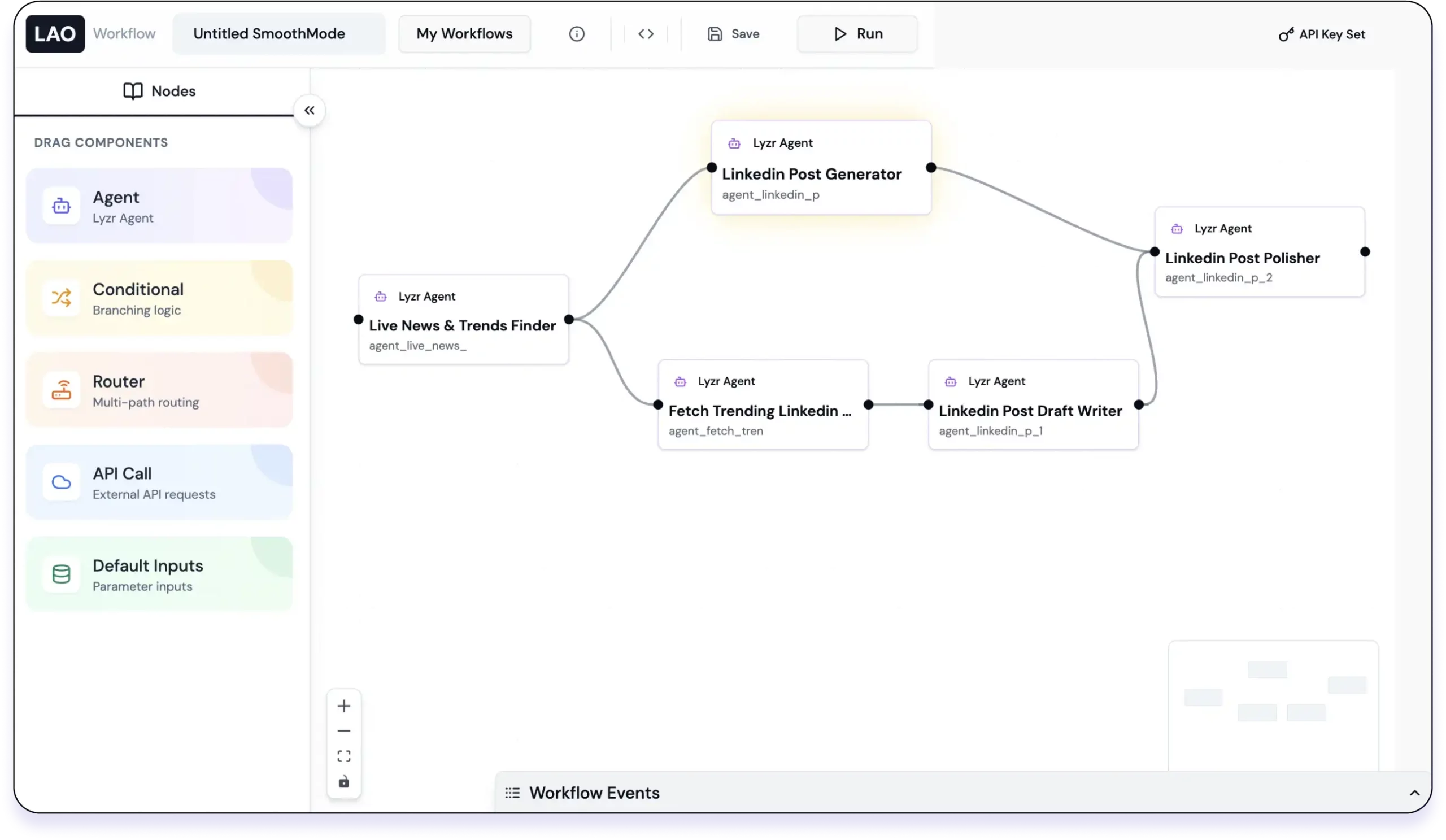

Agent workflow for regulatory monitoring

Quantifiable value for your operations

By automating key underwriting tasks, you can achieve significant, measurable improvements in efficiency, profitability, and risk management.

- 45%

reduction in underwriting review time, slashing processing from 14 days to just 4.

- 40%

reduction in manual document handling, freeing up your expert teams.

- 35%

improvement in loss ratio due to more accurate, data-driven risk assessment.

- 30%

increase in underwriting capacity without the need for additional headcount.

Outcomes you can expect

Implementing this agent transforms your underwriting function from a cost center into a strategic driver of profitability and growth. Here’s what you can expect.

Accelerated quoting

Drastically reduce processing times, allowing you to win more business and improve broker relationships.

Strategic underwriters

Elevate your underwriters from administrators to strategic advisors by automating low-value, repetitive tasks.

Enhanced risk accuracy

Leverage predictive analytics to achieve more precise risk selection and pricing, directly improving your loss ratio.

Proactive fraud mitigation

Automatically identify and flag suspicious applications, preventing fraud before it impacts your portfolio.

How to start building from here

The journey from a promising pilot to a deployed solution can be a challenge. We are your partner in implementation, sharing the risk and ensuring your AI agents make it to production. We don't just provide a platform; we provide a clear pathway to success.

Dedicated AI expertise

We invest in a Forward Deployment AI Engineer (FDE) to work directly with you. Our FDE acts as a hands-on AI startup CTO for your project.

A partner in risk management

We take on the risk of ensuring your agent goes from concept to a fully functional, production-ready solution. We'll work with you every step of the way to get you live.

Strategic guidance & workshops

Our dedicated team will provide strategic guidance and training sessions, empowering your internal teams to own and scale your AI capabilities once your first use case is live.

Project management oversight

We assign a project manager to oversee your agent's journey, providing a clear roadmap and ensuring a smooth, frictionless path to production.

Agents used for this use case.

The Regulatory Monitoring Agent is often built on a combination of specialized agents. Here are some you can use to enhance this use case on the Lyzr platform:

- KYC Processing Agent

- Fraud Detection Agent

- AML Agent

- Legal Document Drafting Agent

- Compliance Agent

Frequently asked questions

It's an AI tool that automates data ingestion, risk analysis, and flagging for insurance applications, speeding up the entire underwriting process.

It uses Intelligent Document Processing (IDP) to read, classify, and extract key data from documents like medical reports and applications.

No. It augments their expertise by handling repetitive tasks, allowing them to focus on complex, high-value cases that require human judgment.

The agent uses predictive analytics on historical and third-party data to identify risk patterns that a human underwriter might miss.

Yes. It analyzes data to identify suspicious patterns and misrepresentations, flagging high-risk applications for human review.

Clients have seen a 70% reduction in review times, a 12% improvement in loss ratio, and millions in annual cost savings.

We start with a pilot to demonstrate value quickly. The full implementation timeline depends on complexity, but we provide a clear roadmap.

Yes, it's designed to work with your current systems, acting as an intelligent layer that enhances your existing workflow.

Our IDP technology achieves up to 99.2% data extraction accuracy, minimizing errors from manual data entry.

It flags complex or outlier cases and routes them to a human underwriter with a summarized report, ensuring expert oversight.

Yes, the agent can be trained to verify submissions against specific compliance rules, ensuring consistency and creating an audit trail.

We adhere to enterprise-grade security protocols to ensure all sensitive information is handled with the highest standards of privacy.

Build your first AI workflow today.

Start with a blueprint. Launch it. Customize it. Deploy it. All inside Lyzr.