Table of Contents

ToggleTL;DR

What it is: AI credit scoring uses machine learning to evaluate creditworthiness by analyzing 100+ data points, not just traditional credit history.

Why it matters:

- 40% more accurate risk predictions than traditional methods

- 3x faster decisions; approvals in minutes, not days

- 30% reduction in default rates

- 20-30% more approvals for previously unscorable borrowers

How it works: AI models analyze traditional data (credit reports, income) plus alternative data (banking behavior, payment patterns, spending habits) to predict loan repayment likelihood in real-time.

Key benefits:

- More inclusive lending for thin-file borrowers

- Personalized interest rates based on actual risk

- Real-time monitoring and continuous learning

- Built-in fraud detection and bias testing

You’re making the calls. Loans, credit cards, overdraft pitches, hundreds of conversations every month. But no matter how good the pitch, there’s one thing that drives the final call: credit scoring.

It’s the dealbreaker.

Doesn’t matter if someone has 10 years of credit history or none at all, lenders still rely on that score to assess risk.

But here’s the thing: traditional credit scoring? It’s showing its age.

AI credit scoring is flipping the script.

Instead of static reports and outdated models, it pulls from 100s of data points, spending habits, income trends, even real-time behavior. We’re talking up to 40% more accurate risk predictions, 3x faster decisions, and a 30% drop in default rates.

If you already know the basics of credit scoring, it’s time to see what AI adds to the mix.

Let’s break it down.

What is credit scoring?

Credit scoring is the process lenders use to evaluate how likely someone is to repay borrowed money.

Traditional credit scores—like FICO scores—range from 300 to 850 and are calculated by credit bureaus (Equifax, Experian, TransUnion) based on five main factors: payment history, credit utilization, length of credit history, types of credit, and recent credit inquiries.

For decades, this system has been the standard. It works for people with established credit histories, but it leaves millions out. No credit history? Thin file? You’re often denied, even if you’re financially responsible.

That’s where AI is changing the game.

What is AI credit scoring?

AI powered credit scoring takes a smarter approach to evaluating creditworthiness, using advanced AI and machine learning instead of relying on the same old narrow financial datasets.

AI based credit scoring goes beyond traditional methods by analyzing patterns across hundreds of data sources, delivering more accurate, fair, and inclusive lending decisions.

Traditional credit scoring looks at limited factors like past loans and repayment history, but AI models dig deeper, analyzing a wide range of data to predict how likely someone is to repay a loan.

Banks and financial institutions use AI-driven credit scoring to assess both individuals and businesses more accurately.

These models consider everything from credit history, income, and spending patterns to non-traditional data like online behavior and even social media activity.

With this deeper insight, lenders can fine-tune loan terms, interest rates, and repayment plans to match a borrower’s real financial situation—making credit more accessible and fair.

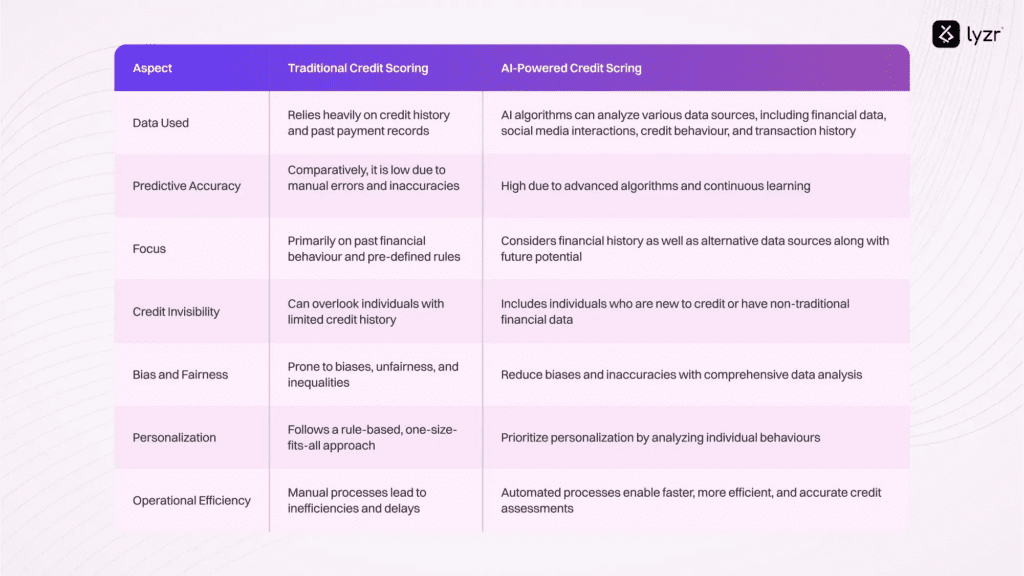

Traditional credit scoring vs AI credit scoring

The traditional credit assessment process often relies solely on financial history, limiting its accuracy and inclusiveness.

The difference? Traditional scoring tells you what happened. AI credit scoring predicts what will happen.

Why AI powered credit scoring is better?

AI based credit scoring improves on traditional methods in several ways:

- More Inclusive: AI considers a wider range of data, helping people with little or no credit history get assessed fairly.

- More Accurate: Machine learning analyzes patterns in real-time, reducing the risk of defaults.

- Faster Decisions: AI processes applications instantly, speeding up loan approvals.

- Always Up-to-Date: AI adapts to new data and trends, keeping credit assessments relevant and effective.

- More Transparent: AI enhances credit risk assessment by providing clearer insights into financial behavior.

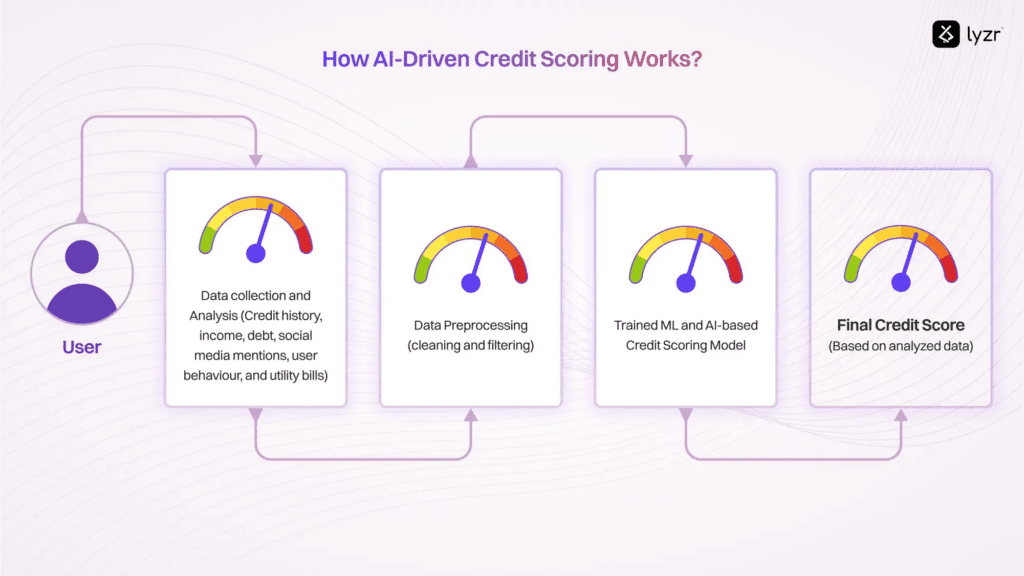

How does AI credit scoring work?

AI based credit scoring is reshaping how banks and lenders assess credit risk and creditworthiness. Instead of relying on limited financial data, AI analyzes a vast range of sources—both traditional and unconventional—to make smarter lending decisions.

By integrating predictive analytics and data analysis methods, AI enhances the assessment and management of borrower creditworthiness, making credit scoring more efficient, adaptive, and accurate. Here’s how it works:

1. Smarter data collection

AI-powered credit scoring systems pull insights from multiple sources, offering a more complete financial picture.

- Traditional Data: Credit reports, transaction history, income statements, and banking details.

- Alternative Data: Social media interactions, shopping behavior, and even browsing history.

- Real-Time Data: Unlike traditional systems that rely on past records, AI models update continuously, factoring in real-time spending and income patterns.

With AI, lenders go beyond outdated credit scores to assess real financial behavior.

2. Cleaning up the data

Raw data is messy, and an AI credit scoring system first cleans, filters, and standardizes it—removing errors and irrelevant details. This ensures only high-quality, reliable data is used to assess creditworthiness.

3. Machine learning does the heavy lifting

Artificial intelligence models are trained on millions of past loan applications, identifying patterns that determine repayment behavior. Machine learning algorithms analyze thousands of data points to categorize borrowers into risk levels, helping lenders make better, data-driven decisions.

- Traditional credit scoring considers 5–10 key factors.

- AI models analyze 100+ data points for a more precise assessment.

4. Predicting borrower behavior

AI doesn’t just assess creditworthiness—it enhances credit risk management by predicting future financial behavior.

When someone applies for a loan, AI evaluates their financial history and real-time data to estimate how likely they are to repay. And since AI continuously learns, its predictions get sharper over time.

5. Generating the final credit score

After crunching the numbers, AI provides a final credit score—along with recommendations on loan amounts, interest rates, and risk management strategies.

- AI-based scoring can increase loan approval rates by 20–30% for previously unscorable individuals.

- It can also reduce default rates by up to 15% by making more accurate predictions.

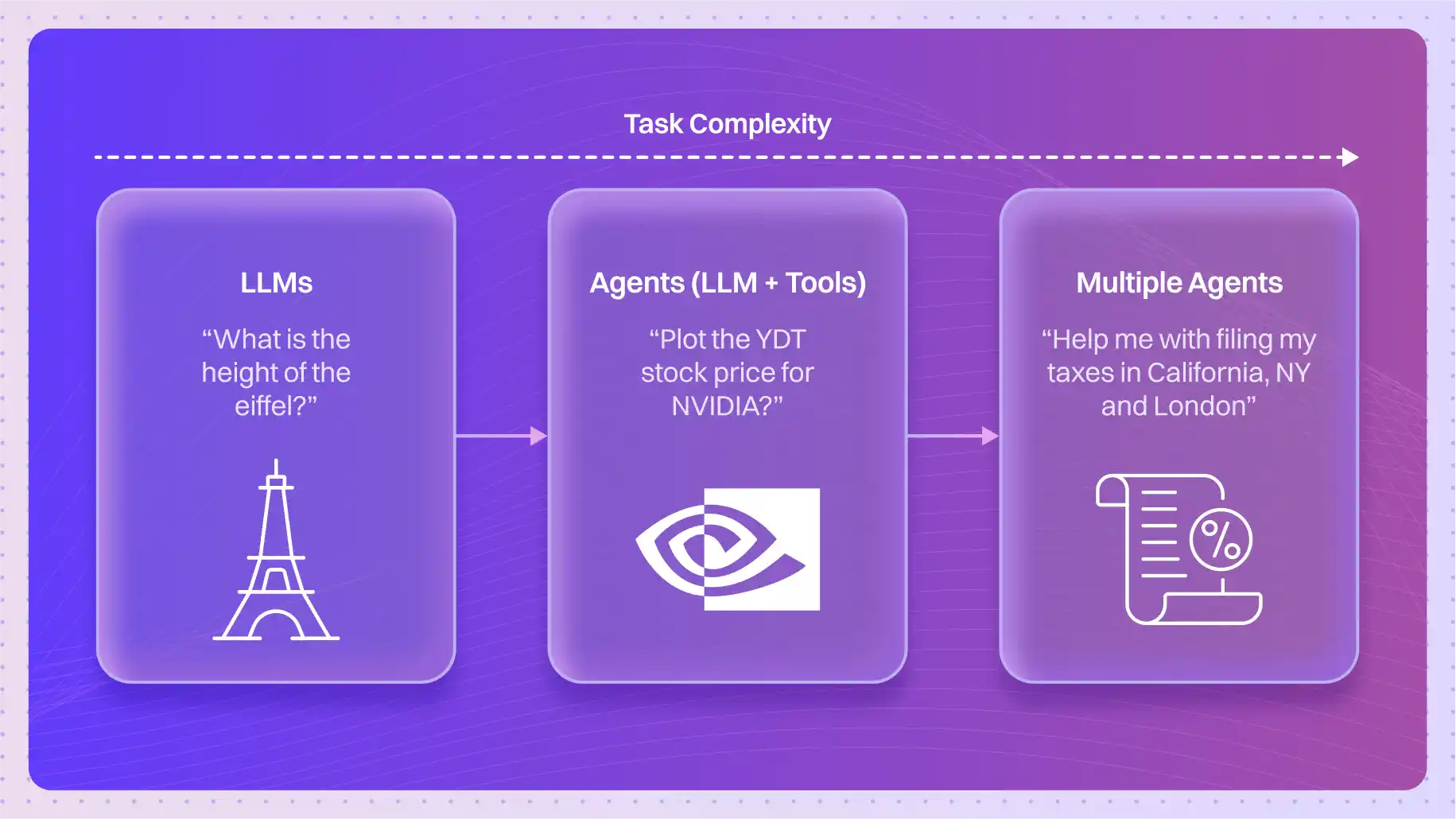

Types of AI credit scoring models

AI credit scoring systems rely on Machine Learning (ML) to assess creditworthiness. Based on the techniques used, there are three main types of AI credit scoring models:

1. Supervised learning models

These models learn from historical data where outcomes (like loan repayment or default) are already known.

Highly Accurate Predictions – Identifies patterns in past data to predict future creditworthiness and improve credit risk assessment.

Comprehensive Data Analysis – Evaluates both traditional (credit history, income) and alternative data (social media, online behavior).

Better Risk Assessment – Assesses default risks, helping lenders make informed decisions.

Personalized Loan Offers – Adjusts terms based on individual borrower profiles.

Fraud Detection – Flags suspicious activity by learning from historical fraud cases.

2. Unsupervised learning models

These models analyze data without predefined labels, discovering hidden patterns.

Customer Segmentation – Groups borrowers based on behavior and demographics for better credit offers. Feature Selection – Uses techniques like Principal Component Analysis (PCA) to focus on key factors that impact credit scores.

Anomaly Detection – Flags unusual financial patterns that might indicate fraud and potential credit risk.

Hidden Insights – Uncovers trends that traditional models might miss, improving risk assessment.

3. Hybrid learning models

A mix of supervised and unsupervised learning, combining the best of both worlds.

More Accurate Predictions – Uses unsupervised learning to detect patterns and supervised learning to make precise credit assessments.

Handles Complex Relationships – Captures intricate financial behaviors more effectively.

Reduces Bias – Minimizes errors by leveraging multiple AI techniques, enhancing credit risk management.

Improved Interpretability – Some hybrid models make credit scoring decisions easier to understand.

How to implement AI credit scoring

Implementing AI credit scoring doesn’t have to take years. With the right approach and platform, financial institutions can deploy AI-powered credit assessment models in weeks, not months.

Here’s how the process works:

1. Define your objectives

Start by identifying what you want to achieve. Are you looking to reduce default rates? Speed up loan approvals? Expand credit access to underserved populations? Clear goals shape everything—from model selection to success metrics.

2. Assess your data infrastructure

AI credit scoring models need quality data to work effectively. Evaluate what you have:

- Traditional data: Credit reports, transaction history, loan records

- Alternative data sources: Payment history (utilities, rent), banking behavior, employment data

- Real-time data feeds: Income verification, spending patterns, account activity

The more diverse your data sources, the more accurate your AI models become.

3. Choose your AI models

Based on your objectives and data, select the right machine learning approach:

- Supervised learning for high-accuracy predictions when you have historical loan data

- Unsupervised learning for customer segmentation and pattern discovery

- Hybrid models for complex credit scenarios requiring nuanced risk assessment

Modern AI agent platforms let you deploy pre-trained models and customize them to your specific lending criteria—no need to build from scratch.

4. Ensure regulatory compliance

AI credit scoring must meet strict regulatory requirements:

- Fair Credit Reporting Act (FCRA): Accurate reporting and dispute resolution

- Equal Credit Opportunity Act (ECOA): Non-discriminatory lending practices

- GDPR/CCPA: Data privacy and consumer rights

- Model explainability: Ability to explain credit decisions to applicants and regulators

Choose platforms with built-in compliance frameworks to avoid costly violations.

5. Integrate with existing systems

Your AI credit scoring solution needs to work seamlessly with:

- Core banking systems

- Loan origination software

- CRM platforms

- Fraud detection tools

- Document verification systems

API-based integrations make this process faster and more flexible than legacy implementations.

6. Test and validate

Before going live, rigorously test your AI models:

- Backtesting: Run models against historical data to verify accuracy

- A/B testing: Compare AI decisions with traditional scoring

- Bias testing: Ensure fair treatment across demographic groups

- Performance monitoring: Track approval rates, default rates, and processing times

Continuous validation ensures your models stay accurate as market conditions change.

7. Deploy and monitor

Launch your AI credit scoring system with:

- Phased rollout: Start with a pilot program before full deployment

- Real-time monitoring: Track model performance and flag anomalies

- Continuous learning: Models improve as they process more applications

- Regular audits: Periodic reviews ensure ongoing compliance and accuracy

Timeline expectations

- Traditional custom build: 12-18 months

- Modern AI agent platforms: 6-12 weeks for initial deployment

AI credit scoring in action: real-world use cases

AI credit scoring isn’t just theory, it’s transforming lending across multiple sectors. Here’s how different industries are using it:

Consumer lending

Banks and fintech companies use AI credit scoring to evaluate personal loan and credit card applications faster and more accurately.

Impact:

- Approval decisions in minutes instead of days

- 25-30% increase in approved applications by assessing thin-file borrowers

- Personalized interest rates based on real-time financial behavior

Example: A borrower with limited credit history but consistent income and responsible banking behavior gets approved, someone traditional scoring would have rejected.

Mortgage underwriting

AI analyzes comprehensive financial data to assess mortgage risk more precisely.

Impact:

- Faster pre-approvals mean buyers can act quickly in competitive markets

- Alternative data helps self-employed and gig workers qualify

- More accurate property valuations combined with borrower assessment

Example: Freelancers with irregular income but strong cash reserves and low debt ratios can now qualify for mortgages that were previously out of reach.

Small business loans

Traditional business credit scoring often fails small businesses and startups. AI changes that by analyzing business bank accounts, cash flow patterns, and industry trends.

Impact:

- Same-day loan decisions for working capital needs

- Better assessment of seasonal businesses

- Reduced default rates through real-time monitoring

Example: A restaurant with strong daily revenue but no established credit history can secure equipment financing based on actual cash flow data.

Buy Now, Pay Later (BNPL)

BNPL platforms need instant credit decisions at checkout. AI makes this possible.

Impact:

- Real-time approval in seconds

- Lower fraud rates through behavioral analysis

- Dynamic credit limits based on purchase history and payment patterns

Example: A first-time BNPL user with no credit history gets approved for a small purchase, then sees their limit increase as they make on-time payments.

Microfinance and financial inclusion

AI credit scoring is bringing financial services to underbanked populations in emerging markets.

Impact:

- Mobile money and alternative data replace traditional credit reports

- Millions gain access to formal credit for the first time

- Lower operating costs make small loans profitable

Example: A small farmer in a rural area gets a micro-loan based on mobile payment history and agricultural data—no credit bureau required.

Auto lending

Car dealerships and auto lenders use AI for faster financing decisions on the lot.

Impact:

- Instant pre-qualification improves customer experience

- More accurate residual value predictions reduce risk

- Better detection of income misrepresentation

Cross-industry benefits

Regardless of sector, AI credit scoring delivers:

Faster decisions = Better customer experience and lower operational costs

Higher approval rates = More revenue without increasing risk

Lower defaults = Healthier loan portfolios

Greater inclusion = Access to previously underserved markets

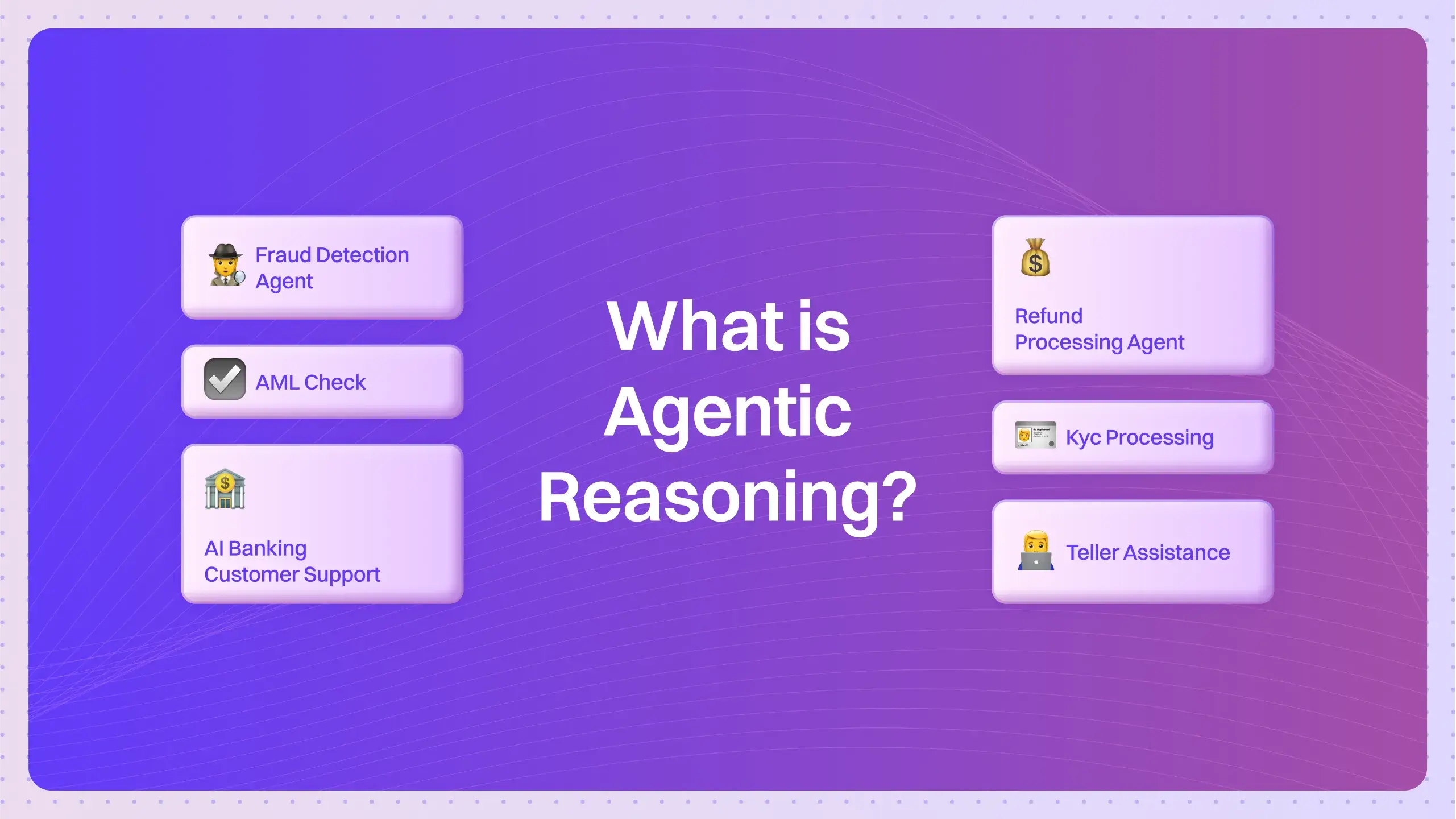

Lyzr’s AI agents can be deployed across any of these use cases from loan origination to fraud detection to KYC compliance, giving financial institutions a complete AI-powered lending infrastructure.

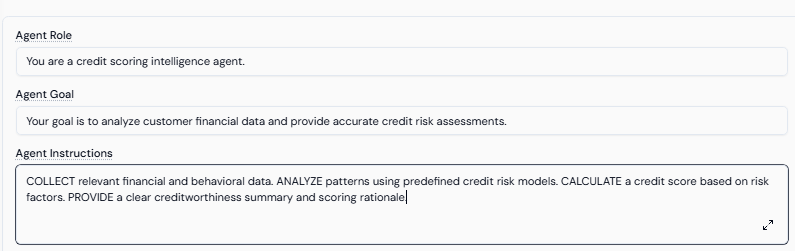

Build AI credit scoring agents with Lyzr Agent Studio

Lyzr Agent Studio makes building secure, reliable AI tools and AI agents seamless—integrate them into your workflows, automate tasks, and customize them to fit your business goals. When using generative AI in an insurance agency, it is crucial to protect sensitive information to prevent accidental data leaks.

1: Define Your Agent: Give your agent a name and purpose. Choose your preferred LLM provider and model, then outline the instructions or idea to get started.

2. Easy integrations: Run your agent, ask questions, and evaluate its responses. Refine the prompts as needed for perfection.

3. Rapid Development and Testing: Launch your agent as an app on Lyzr’s app store and let others discover, access, and benefit from your creation.

Ready to get started? Try out our platform now

FAQs

How accurate is AI credit scoring?

AI credit scoring delivers up to 40% more accurate risk predictions compared to traditional methods. Machine learning models identify complex patterns in financial behavior that rule-based systems miss, resulting in better borrower assessments and 30% lower default rates.

Is AI credit scoring fair and unbiased?

When properly designed, AI credit scoring can be more fair than traditional methods. It evaluates a wider range of factors beyond credit history, helping people with thin files access credit. However, AI models must be regularly tested for bias and monitored to ensure they don’t discriminate based on protected characteristics like race, gender, or geography.

What data does AI credit scoring use?

AI credit scoring combines traditional data (credit reports, loan history, income) with alternative data sources like bank account activity, utility payments, rent payments, employment history, and spending patterns. The specific data used varies by lender and regulatory requirements, but more diverse data generally leads to more accurate assessments.

How long does AI credit scoring take?

AI credit scoring delivers decisions in real-time, typically within seconds to minutes. This is dramatically faster than traditional credit assessment, which can take days or weeks for manual review and approval.

Can AI credit scoring help people with no credit history?

Yes. AI credit scoring analyzes alternative data sources that traditional scoring ignores, making it possible to assess creditworthiness for people with limited or no credit history. This includes young adults, recent immigrants, and anyone who hasn’t used traditional credit products but has demonstrated financial responsibility through other means.

Is AI credit scoring compliant with lending regulations?

Reputable AI credit scoring platforms are designed to comply with major regulations like the Fair Credit Reporting Act (FCRA), Equal Credit Opportunity Act (ECOA), and data privacy laws (GDPR, CCPA). The platform should provide explainable decisions, audit trails, and adverse action notices that meet regulatory requirements.

How much does AI credit scoring cost?

Costs vary based on application volume, deployment model, and customization needs. Modern AI platforms typically use subscription pricing that scales with usage. While custom-built solutions can cost $500K-$2M+, platform-based solutions offer predictable monthly costs and faster ROI through operational savings and revenue growth.

Will AI replace human underwriters?

AI augments rather than replaces human underwriters. It handles routine applications automatically, freeing underwriters to focus on complex cases that require human judgment. Many lenders use a hybrid approach where AI processes straightforward applications and flags edge cases for manual review.

How secure is AI credit scoring?

Enterprise-grade AI credit scoring platforms use bank-level security including end-to-end encryption, role-based access controls, and regular security audits. Reputable providers maintain certifications like SOC 2 and ISO 27001. Always verify a platform’s security credentials before deployment.

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here