Table of Contents

ToggleYour payroll is a promise. But for about one in every five payroll cycles, that promise is broken. That is not a minor inconvenience. It is a systemic failure affecting millions. In fact, more than half of all workers in the U.S. have faced issues with their pay.

Think of your company’s revenue as water filling a bucket. Manual and semi-automated payroll processing is a series of invisible leaks. Each error is a steady drip. A miscalculation. A missed deadline. A wrong tax deduction. It is not the single drop that sinks you. It is the constant, unaddressed loss.

This is not a problem you solve with more spreadsheets or another software patch. It requires a fundamental shift in thinking. It requires an AI Agents for Payroll Management. The real issue is not a lack of effort from your HR team.

The problem is a reliance on outdated tools that were never designed for the complexity of the modern workforce.

And that leaky bucket? It’s losing more than just money.

With 63 percent of employees living paycheck to paycheck, a single error places them in real jeopardy. It is an emotional event, not just a financial one. It erodes the most valuable currency you have: your team’s trust.

This is a Leadership Decision

The decision to upgrade your payroll system is no longer just an operational choice. It is a leadership decision about the kind of company you want to build. Do you want a company that risks eroding trust with every pay cycle? Or one that builds it?

The market is moving quickly. The global market is targeted to reach over $15 billion by 2030. Adopting this technology is not a luxury; it is a competitive necessity. The companies that embrace this shift will attract and retain better talent. They will be more efficient, more resilient, and more trusted.

The Real Cost of “Good Enough” Payroll

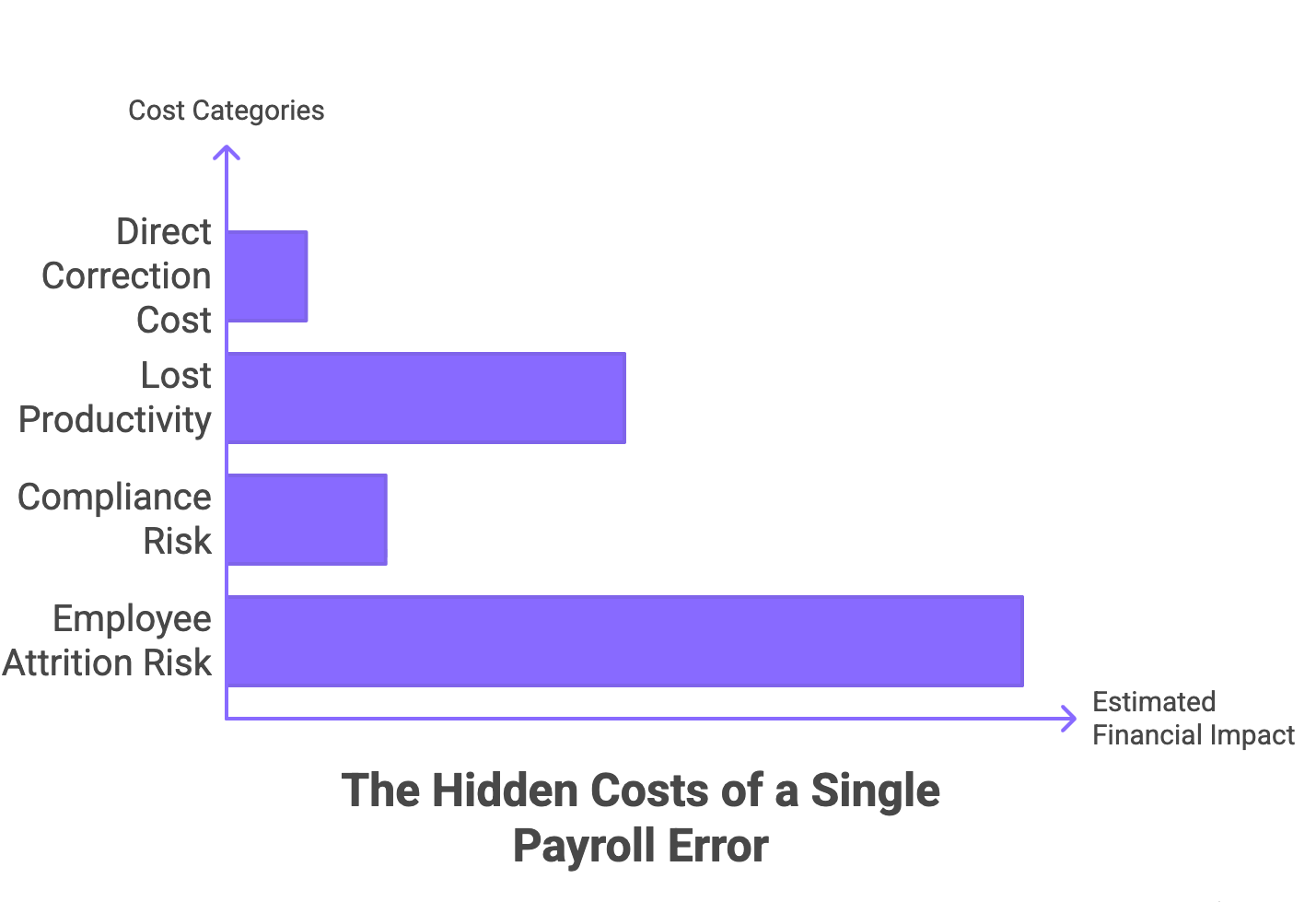

You might think these costs are just part of doing business. They are not. They are a tax on inefficiency. These costs come in three distinct forms: the direct financial drain, the escalating compliance risk, and the quiet corrosion of your company culture.

1. The Financial Drain

The financial calculus is brutal. It costs an average of $291 to fix each payroll error. For a company running bi-weekly payroll, that is over $1,500 a year in completely avoidable costs, assuming you only make one error per cycle. The reality is often worse. Manual payroll processes have an error rate between 1-8%. For a company with 100 employees, that translates to an annual correction cost of $2,600 to $20,800.

Then there is the wasted time. Manual payroll can consume up to 25% of an HR professional’s time. That is one week every month spent on administrative churn instead of strategic work like talent development or workforce planning. This is not just an HR problem; it is a drag on the entire organization’s productivity.

2. The Compliance Minefield

The second leak is compliance.Fines for misclassifying employees or missing overtime payments can run into the millions. A single Connecticut business faced $100,000 in penalties for misclassification, while another was fined $1.2 million for overtime violations.

These are not edge cases. They are the predictable outcomes of a system that cannot keep up. With 45% of companies stating that tax law changes are hard to track, compliance has become the single biggest challenge for payroll professionals. An outdated system turns this challenge into a constant, high-stakes risk. An outdated system turns this challenge into a liability, especially when businesses rely on manual processes instead of online paystubs that offer better efficiency and accuracy in payroll management.

3. The Erosion of Trust

The most damaging leak is the one you cannot see on a balance sheet. A single mistake makes an employee feel devalued. That feeling is contagious. It kills morale and productivity. When paychecks are continually wrong, employee morale drops considerably, and low morale spreads through a department like a virus.

This leads to the most expensive problem of all: attrition. Research shows that 49% of workers would begin a job search after just one or two payroll problems.One in three employees has actually quit a job because of it. You spend a fortune on your talent strategy. Yet, your payroll system is actively pushing your best people out the door. Your payroll is not a back-office function; it is a direct threat to your talent retention.

Why Your “Automated” Software Fails ??

The conventional answer has always been to buy payroll software. You might be thinking, “We don’t do payroll manually; we have software for that.” we understand. But here is the paradox: most payroll software does not solve the problem. It just automates a flawed process. This is the core design flaw that leaves your organization exposed.

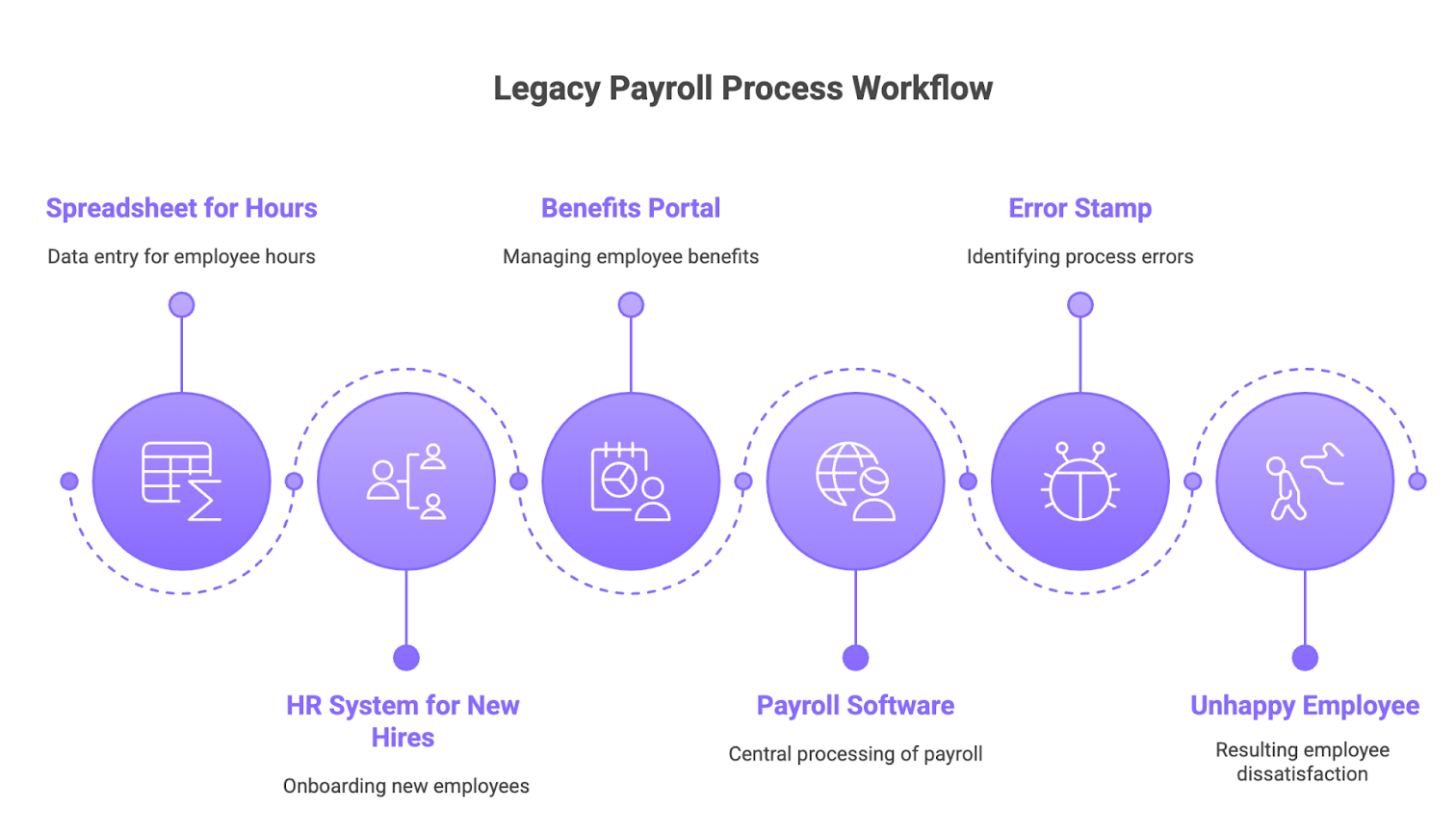

1. The Illusion of Automation

Legacy systems are built on a “garbage in, garbage out” principle. They rely on manual data entry from siloed sources. An error in a timesheet, an HRIS update, or a benefits platform flows directly into the final calculation. The software has no intelligence to question it. It simply processes what it is given, accurately calculating the wrong number.

It’s the digital equivalent of using a calculator that trusts you to type in the right numbers every single time. We all know how that goes after the second cup of coffee. These systems are reactive, not proactive. You only find the mistakes after the fact, during costly audits and reconciliations.

2. The Static Rules Engine

Compliance is another critical weak point. These systems operate on fixed, pre-programmed rules. They require constant manual updates to keep up with the ever-changing landscape of tax laws and labor regulations. This creates a significant bottleneck and a point of failure.

A new state-level tax withholding rule or a federal overtime update requires a developer to patch the system. This process is slow, expensive, and prone to error. The software is always a step behind reality, leaving you perpetually at risk of non-compliance.

3. The Data Silo Trap

Perhaps the biggest failure of traditional software is its inability to see the whole picture. Data lives in disconnected islands: the HRIS, the time and attendance system, the benefits portal, and the accounting software. The “integration” is often just a nightly batch file upload.

This fragmented workflow is where most errors originate. A new hire’s details are entered into the HR system but do not sync to payroll in time. A manager approves overtime on one platform, but it is not reflected on another. The software cannot validate information across these silos, making it impossible to catch discrepancies before they become costly problems. This is why 85% of organizations report having problems with their payroll technologies.

| Feature | Traditional Payroll Software | Lyzr’s AI Payroll Agent |

| Data Handling | Manual/Batch Uploads from Silos | Real-Time, Cross-System Integration |

| Error Detection | Post-Facto Reporting & Audits | Proactive Anomaly Flagging in Real-Time |

| Compliance | Rule-Based (Requires Manual Updates) | Predictive & Self-Updating Intelligence |

| Strategic Value | Administrative Efficiency | Workforce & Financial Insights |

Traditional payroll software runs on rigid rules. AI agents think differently.

Before diving into how an intelligent agent fixes these systemic flaws, watch this 60-second breakdown of what makes autonomous AI agents fundamentally different from conventional automation.

The Dawn of the Intelligent AI Agents for Payroll Management

Let’s put it another way. Your current payroll software is like a basic calculator. It’ll give you the right answer, but only if you punch in the exact right numbers in the exact right order. And it has no idea if the numbers you’re putting in even make sense.

A true AI Agent is more like having a seasoned financial controller on your team.

This controller doesn’t just do the math. It looks at the numbers and asks, ‘Wait, why is Bob’s overtime 200% higher this month? Is that right?’ It anticipates questions, spots anomalies, and learns what’s normal for your business. It provides context, not just calculations.

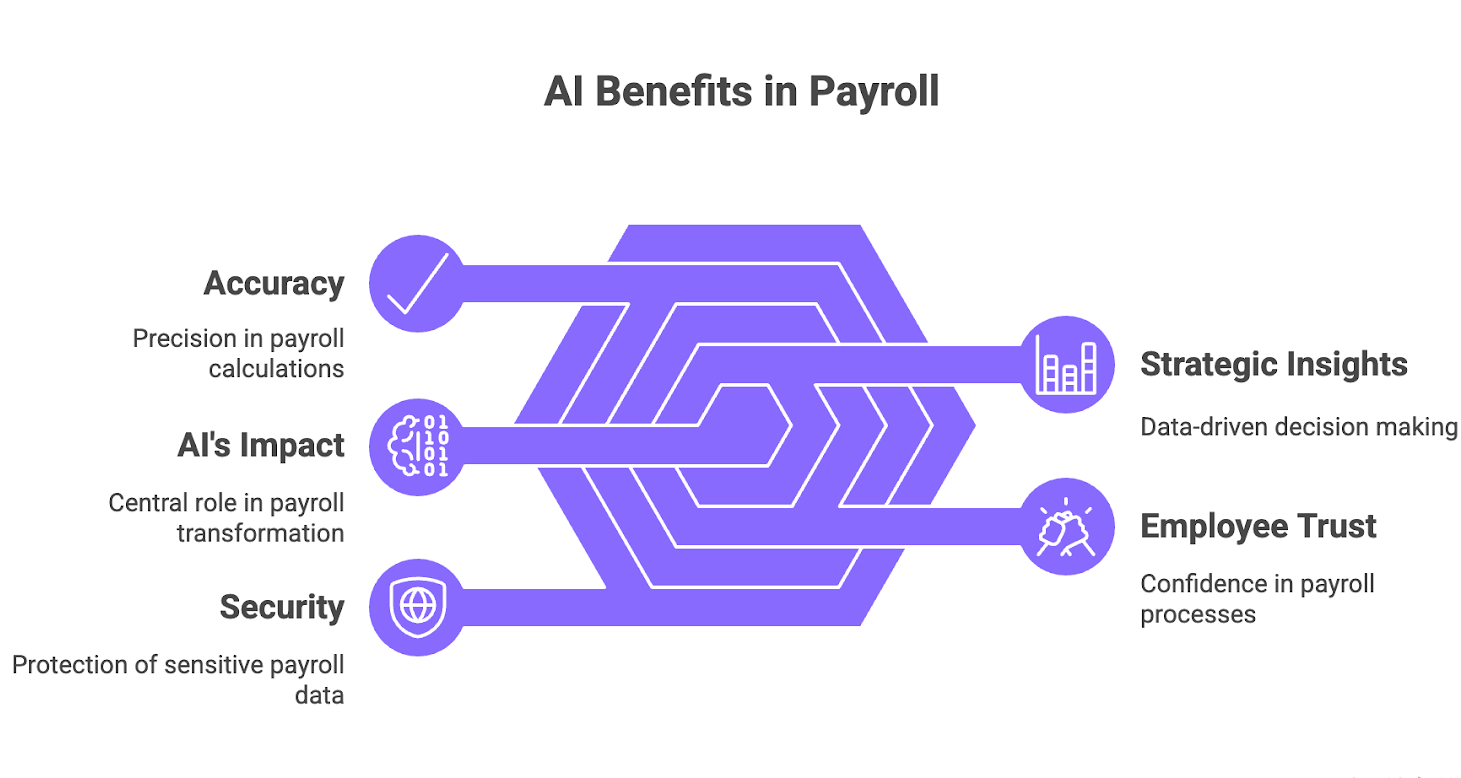

1. Intelligent Data Validation in Real-Time

The first capability is intelligent data validation. The AI agent connects to all your systems in real-time, not through batch files.9 It acts as a central nervous system, constantly cross-referencing information from your AI Hiring Assistant, time tracking tools, and Customer Onboarding platforms.10 It flags discrepancies before they become errors. For example, if a new employee’s start date in the HRIS does not match the first timesheet entry, the agent flags it for review.

2. Predictive Compliance, Not Reactive Fixes

Second, the agent provides predictive compliance. Using machine learning, it stays ahead of regulatory changes. It monitors legal and tax databases, automatically updating its own rules and flagging potential non-compliance issues before they become penalties. This moves your organization from a reactive stance to a proactive one, creating a truly paperless and automated compliance environment.

3. Autonomous Anomaly Detection

Third, the agent performs autonomous anomaly detection. It learns your company’s normal payroll patterns over time. If a salaried employee suddenly has massive overtime, or a sales commission is ten times the average, the agent flags it for human review. It catches the human errors and potential fraud that legacy software always misses. This continuous, intelligent monitoring provides a layer of security that rule-based systems cannot match.

| What the AI Detects | Why It’s a Red Flag | Traditional System’s Response |

| A salaried employee suddenly has massive overtime. | Salaried staff typically don’t log overtime; this could be a clerical error or policy violation. | Processes the payment without question. |

| A sales commission is 10x the monthly average. | This could be a typo (an extra zero) or a sign of a fraudulent sale. | Processes the payment without question. |

| Two new employees have the same bank account number. | This is a classic indicator of a “ghost employee” or potential fraud. | Processes the payment without question. |

From Transactional Data to Strategic Insight

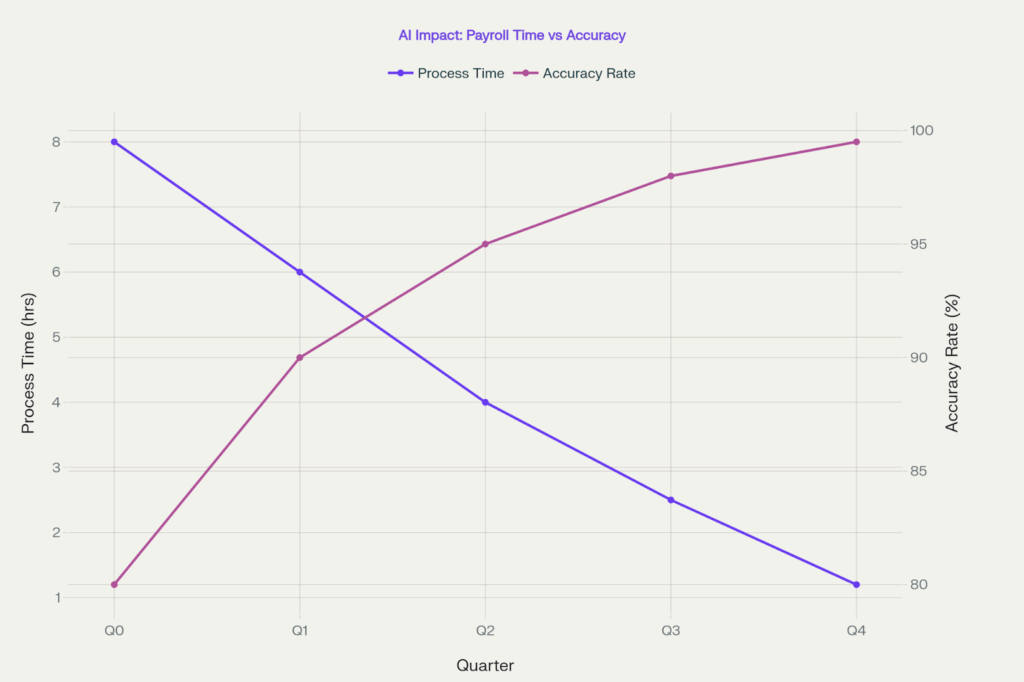

Finally, the agent transforms payroll data from a historical record into a predictive, strategic tool. It can forecast labor costs with greater accuracy, model the financial impact of new hiring plans, and provide leadership with the real-time people analytics solutions needed for high-level decision-making. The impact is immediate. Organizations using these systems see 30% fewer payroll errors and process payroll up to 80% faster.

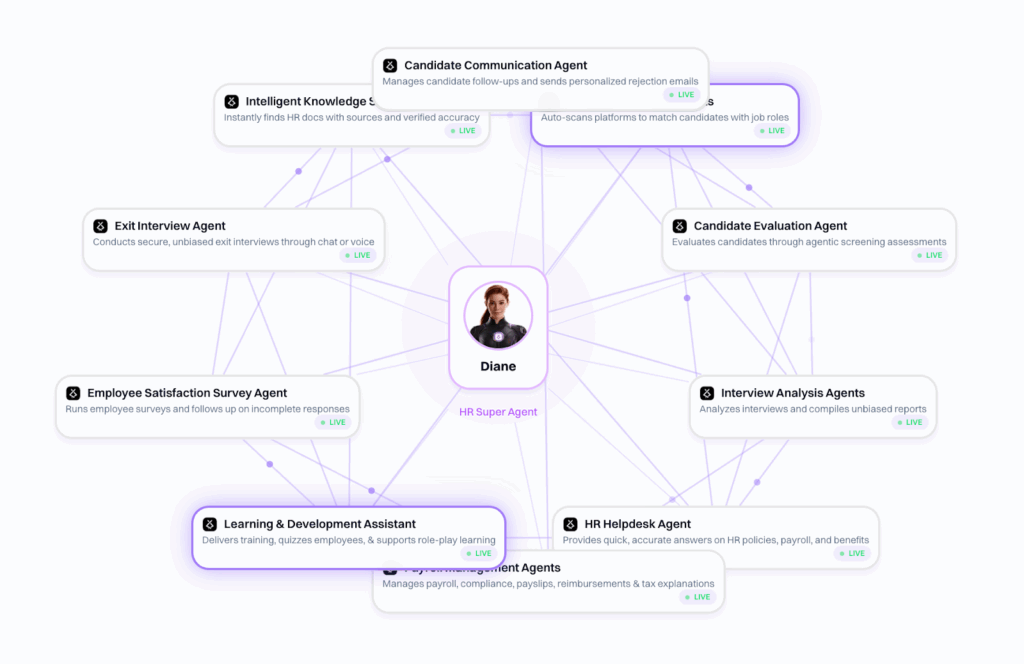

Meet Diane for HR: Your Payroll Prodigy, Powered by Lyzr

This is not a futuristic concept. This is what we have built at Lyzr. Meet Diane, our specialized super AI agent designed to transform your HR and payroll functions. We provide the AI solutions that turn this powerful idea into a practical reality.

See Diane in action. This 50-second demo shows how 17 interconnected AI agents work together to automate 70% of HR’s daily workload, including payroll validation, compliance monitoring, and anomaly detection.

No chaos. No burnout. Just intelligent automation.

1. Built on a True Agent Framework

Many tools add AI as a feature. Lyzr is built on a true agent framework. This is a critical distinction. Our agents are not just chatbots or simple automations. They are sophisticated, task-oriented entities designed for complex workflows.

Think of it this way. Most AI features are reactive. You ask a question, and they provide a single answer. The transaction is over.

An agent, however, is given a mission.

It is a proactive system designed not just to answer, but to achieve a complex goal. It reasons, plans, and executes a series of tasks, operating with a defined purpose.

This architecture allows for greater flexibility and power than traditional software. You can build and customize agents to fit your exact workflows using our powerful low-code platform, without needing a team of data scientists.

2. Enterprise-Grade Security by Design

We know that for C-suite leaders, security is non-negotiable. That is why Lyzr is built with responsible AI at its core. Our platform offers enterprise-grade security, is SOC2, GDPR, and ISO 27001 compliant, and uses private SDKs to give you full control over your data and infrastructure.

Of course, a list of security acronyms can often feel like a necessary but uninspiring part of the conversation. They are the table stakes.

But compliance is not the same as control. The fundamental question for any leader is not just about checking a box.

It’s about answering this: Where, exactly, does our data live?

You can deploy on-premise or in your private cloud, ensuring your most sensitive employee data remains secure.

The Proof is in the Process

We believe in results, not just promises. Our case studies in adjacent HR and operational fields demonstrate our platform’s power to drive tangible business outcomes. Look at our work with Curatal, an AI-powered hiring platform. They faced challenges with inconsistent interviews and an inability to scale their evaluation process. We developed an AI agent framework to automate their interview and assessment workflow. The outcomes were faster, more efficient interviews, reduced bias through standardized evaluation, and data-driven optimization of their hiring process.19 This is clear evidence of our capability in the broader Gen AI space.

Our clients validate this impact. Michael Howe, CEO of NPD Powered, states, “Lyzr is harnessing our Task Agents to move information throughout our system seamlessly… Lyzr provides the platform for us to grow rapidly and not lose control”. We helped them achieve 70% cost savings in customer support. Imagine applying that level of efficiency to your payroll.

This is what the transformation looks like. You move from spending weeks on post-payroll audits to having an AI agent that flags potential issues before the run. Your payroll function evolves from a cost center to an intelligence hub, using Lyzr’s data analysis capabilities to give your CFO unprecedented visibility into workforce costs. It is a smarter way to work, as highlighted in our developer blog.

Final Thoughts

Fixing your payroll is not about buying new software. It is about adopting a new, more intelligent way to automate processes. It is about finally plugging the leaks in the bucket, not just of money, but of trust, compliance, and talent.

If you are ready to transform payroll from your biggest liability into a strategic asset, let’s have a conversation. Chat with our team and see how an AI Agents for Payroll Management builds a more resilient and trusted foundation for your business.

Frequently Asked Questions (FAQs)

1. How difficult is it to implement an AI payroll agent?

It is simpler than you think. Lyzr’s low-code platform and dedicated enterprise support streamline the process. Our agents are designed to integrate with your existing systems, minimizing disruption and accelerating time-to-value.

2. Is our sensitive payroll data secure with an AI system?

Absolutely. We prioritize enterprise-grade security with private SDKs, flexible on-premise or private cloud deployment, and full compliance with GDPR, SOC2, and ISO standards.15 Your data’s integrity and confidentiality are paramount.

3. Will an AI agent replace our HR staff?

No, it empowers them. The agent automates repetitive tasks, freeing your team to focus on strategic work. Studies show 78% of payroll staff transition to more strategic roles like data analysis and compliance strategy after automation.

4. Can the AI agent handle complex, multi-state tax regulations?

Yes, this is a core strength. The AI’s predictive compliance engine is designed to manage and adapt to complex, changing regulations far more effectively than any manual or static rule-based system.

5. What kind of ROI can we expect?

Your return on investment comes from drastically reduced error correction costs, elimination of compliance penalties, massive time savings, and most importantly, reduced employee turnover.

6. How does the AI learn our company’s specific payroll patterns?

Our AI agents are trained on your historical data to establish a secure baseline of what is normal for your business. From there, it uses machine learning to continuously refine its understanding, making its anomaly detection more precise over time.

7. What makes Lyzr different from other “AI-powered” payroll software?

Many tools add AI as a feature. Lyzr is built on a true agent framework. Our unique AgentMesh technology ensures seamless communication across your entire enterprise stack, eliminating the data silos that are the root cause of most errors.

8. Can we start small and scale up?

Yes. Lyzr’s platform is built for seamless scalability. You can begin by deploying Lyzr Automata for a specific part of your payroll workflow and expand its capabilities as your business grows.

9. What kind of support does Lyzr offer?

We provide 24/7 dedicated enterprise support with proactive monitoring and a 24-hour upgrade SLA. We ensure your AI agents run smoothly, so you can focus on your business.

10. How does this fit into our broader digital transformation strategy?

Adopting an AI payroll agent is a foundational step. It cleans up your most critical employee data, builds a more efficient operational backbone, and provides the strategic insights from our enterprise solutions needed to make smarter, data-driven decisions across the entire organization.

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here