- Japanese Bank Automated Customer Onboarding

How a leading Japanese Bank Automated Customer Onboarding with Lyzr

Unified multi-agent automation

Accelerated onboarding workflow

Compliance-first intelligence

The problem statement

-

Manual

data entry

Customer applications were handwritten and needed manual transcription or OCR conversion, leading to delays and data inconsistencies.

-

Disconnected

systems

Core platforms like eWAC Flow, Temenos, and Customer Management operated independently, creating fragmented workflows and delayed handoffs.

-

Compliance

complexity

Mandatory checks such as Mareva injunction verification required manual handling, resulting in slower processing and inconsistent records.

- How Lyzr solved it ?

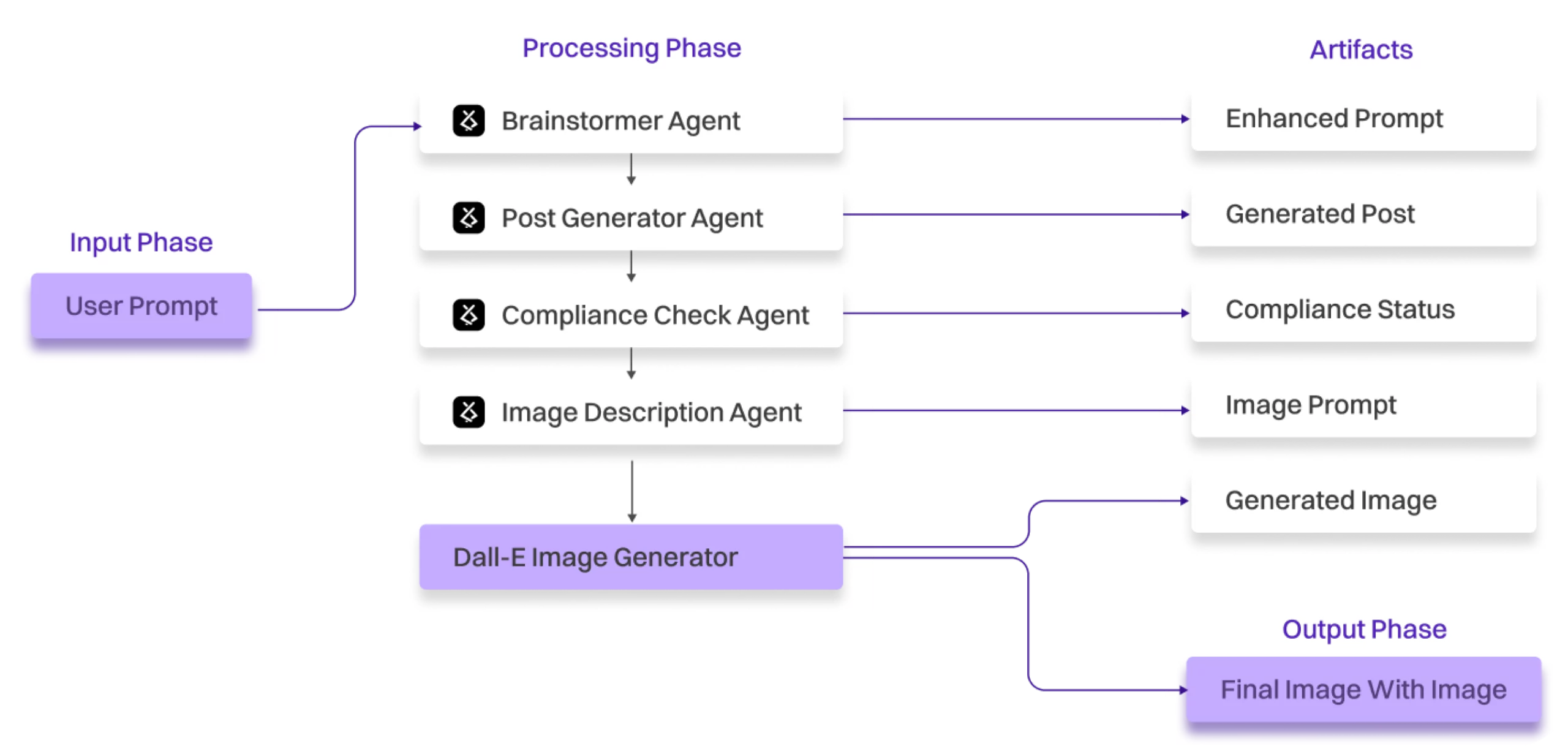

- Lyzr implemented a governed multi-agent system that automated document processing, verification, and account creation while maintaining full human control at key approval stages.

- Extracted handwritten and physical form data with high accuracy, flagging uncertain entries for manual review.

- Automated Mareva injunction checks for company and owner validation, ensuring compliance consistency.

- Managed agent coordination, triggered human review for exceptions, and handled approvals across departments.

- Initiated account setup in Temenos and synchronized records across all connected systems.

- Delivered a real-time view of onboarding progress, pending tasks, and compliance checkpoints.

The outcome

- Faster onboarding

End-to-end automation reduced manual intervention and improved turnaround time across departments.

- Governed compliance

Each workflow step maintained full auditability and compliance with SOC2, ISO 27001, and HIPAA standards.

- Scalable foundation

The multi-agent architecture created a secure, extensible base for future process automation.

The outcome

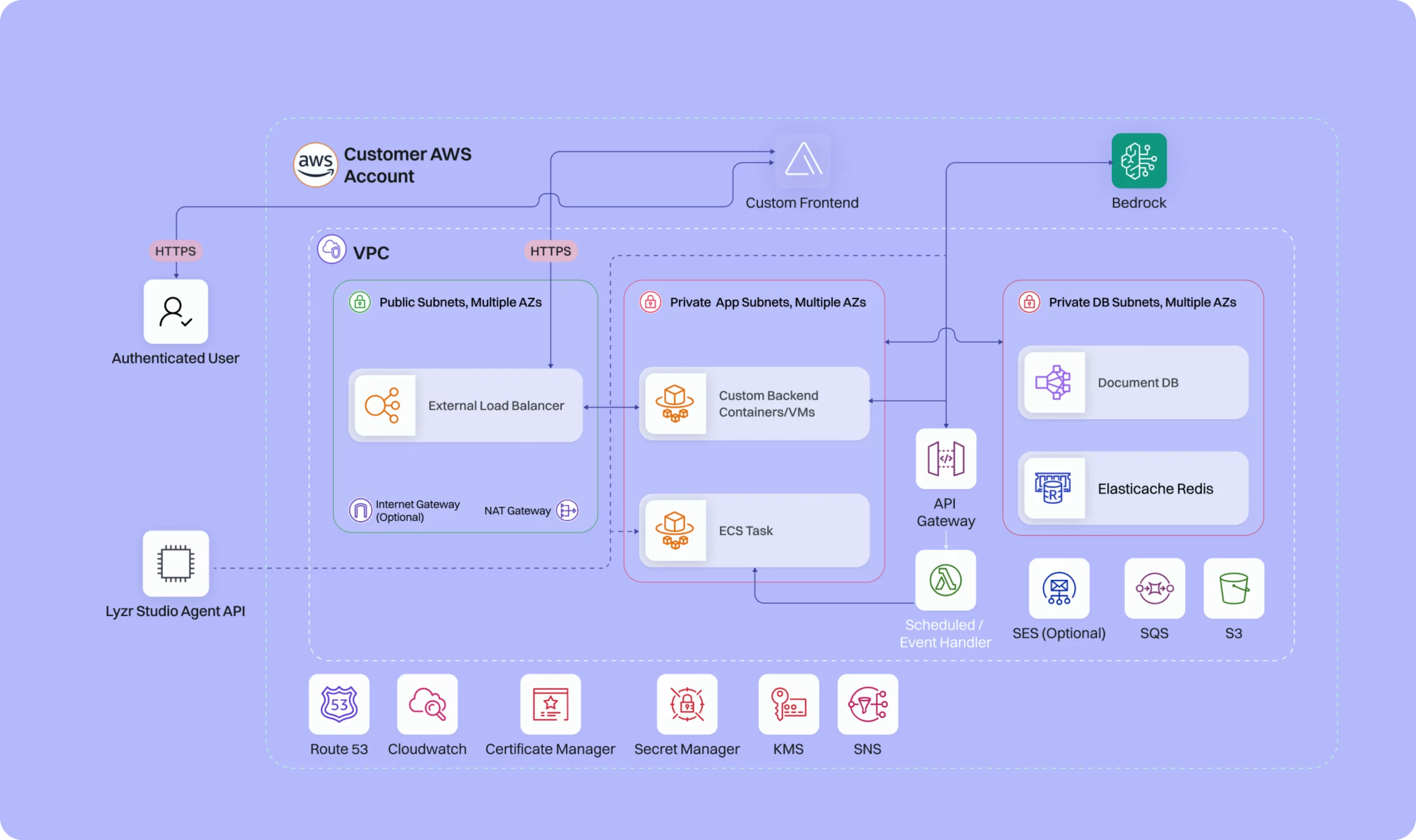

Behind the scenes: How Lyzr builds enterprise AI on AWS

How Lyzr handled security for a leading AI & automation research firm

- Compliance

Lyzr Agent Platform is SOC2, GDPR, and ISO 27001 compliant, ensuring enterprises can run their critical workloads safely.

- Data Residency

The data resides within the customer's own cloud, ensuring100% ownership and adherence to data residency requirements.

- Reflection

Lyzr's reflection module reduces the chances of hallucination. This feature is enabled in most critical applications for higher accuracy.

Similar case-studies

- Global AI infrastructure leader scaled inbound SDR operations

- Leading retail company deliver faster, smarter customer support

- Mentorcloud