- Lyzr Marketplace

- Banking

- AI Loan Servicing Agent

AI Loan Servicing Agent

Loan servicing involves constant coordination between customers, agents, and systems, leaving room for delays and errors. The AI Loan Servicing Agent automates query resolution, repayment tracking, and document management

- Head of Retail Lending

- Loan Servicing Managers

- Customer Experience Leaders

Trusted by leaders: Real-world AI impact.

The problems we hear from leaders like you

Loan servicing is the backbone of banking operations, yet manual workflows, fragmented data, and slow responses can erode both efficiency and trust.

High volume of repetitive queries

Servicing teams spend countless hours addressing common customer questions around EMIs, due dates, and loan statuses, diverting focus from complex cases.

Delayed repayments and follow-ups

Manual tracking of repayment schedules often leads to missed reminders or delayed outreach, impacting recovery rates and increasing delinquency risks.

Document overload

Servicing agents juggle multiple systems and formats to retrieve KYC records, agreements, and payment proofs , creating inefficiencies and compliance gaps.

Limited visibility and analytics

Without unified insights across loan portfolios, leaders lack real-time visibility into borrower behavior, risk patterns, and operational bottlenecks.

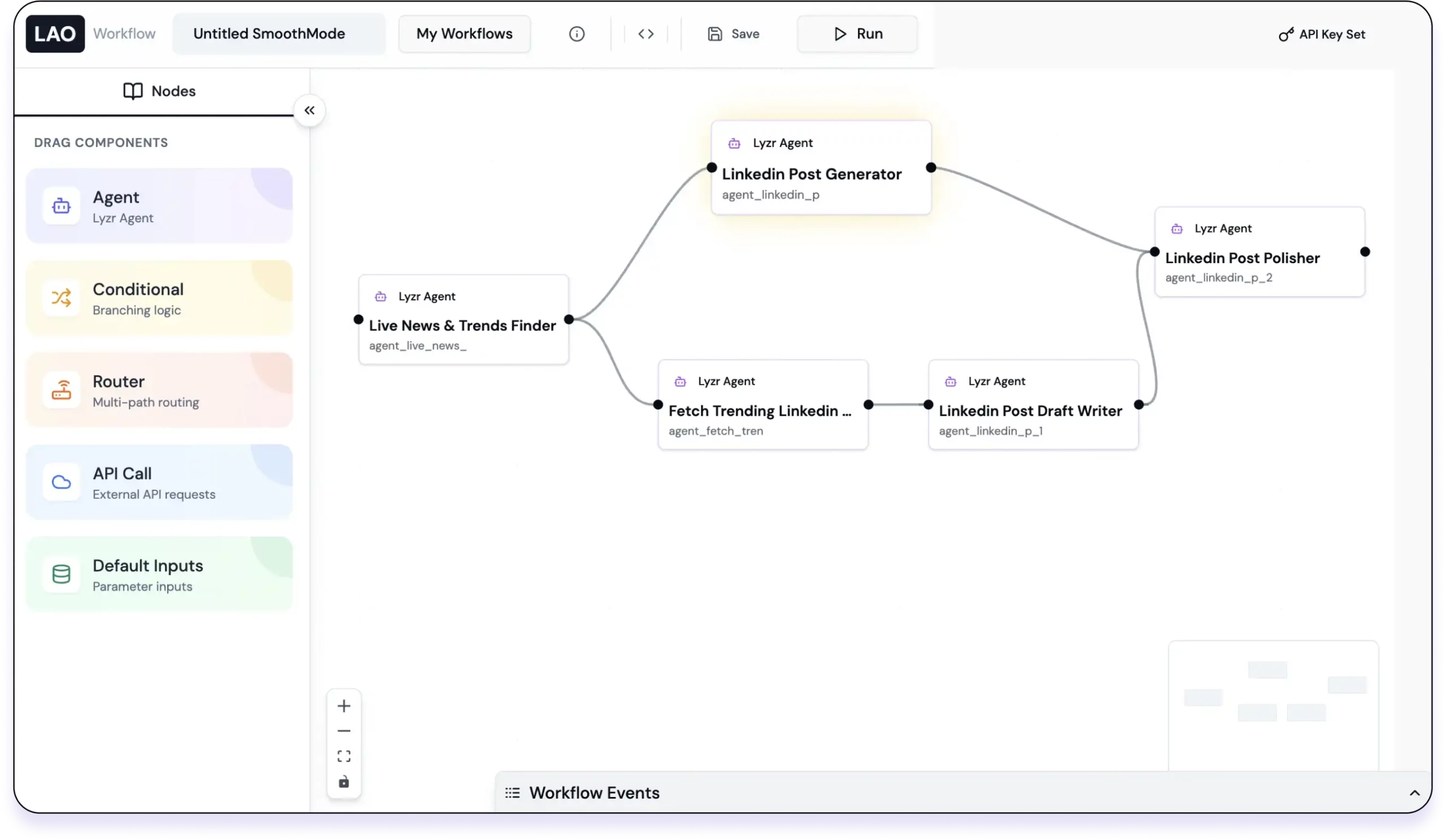

Agent workflow for regulatory monitoring

Why Leading

Organizations Choose Lyzr?

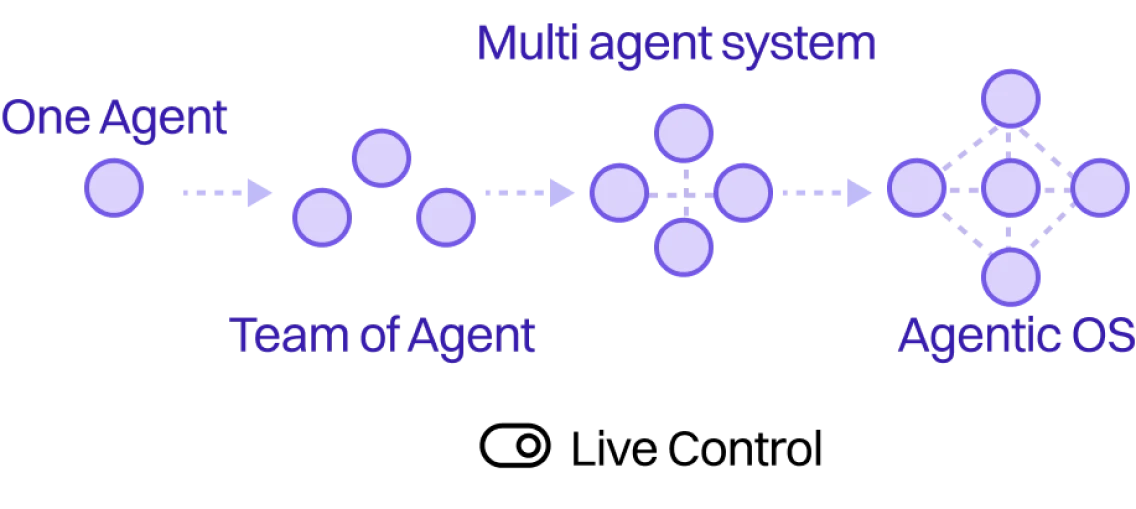

Lyzr provides the full-stack platform to transform your business functions into a unified Agentic Operating System, guaranteed.

Data Privacy & IP Ownership

Agents run in your cloud/on-prem.

We guarantee zero access to your data, ensuring 100% privacy that your AI workforce is always your unquestionable IP.

Full Flexibility,

Zero Vendor Lock-In

Integrate Lyzr as a plug-and-play solution within your existing ecosystem. No forced migration, no vendor dependency, just pure value.

Scalability & Real-Time

Customization

Start with one agent and build toward an Agentic OS for the entire function. Full control lets you customize and deploy changes in real-time.

Agentic Operating System

for your org

Unify your agents on a central knowledge graph to unlock the next-level enterprise intelligence: OGI.

Quantifiable value for your institution

Automation in loan servicing translates directly into measurable operational gains and improved customer satisfaction.

- 70%

reduction in routine servicing workload, through automated query handling and follow-ups

- 50%

improvement in repayment adherence, driven by timely, AI-based reminders and notifications

- 40%

faster document retrieval, reducing compliance risk and turnaround times

- 30%

higher customer satisfaction scores, due to proactive, real-time support

Outcomes you can expect

The AI Loan Servicing Agent simplifies operations, enhances customer relationships, and enables better control over loan portfolio performance.

Automated query management

Handle routine customer questions instantly through intelligent responses integrated across chat, email, and voice channels.

Proactive repayment management

Send timely alerts and personalized nudges to borrowers, minimizing late payments and improving cash flow predictability.

Smart document handling

Centralize all borrower documents, automate retrieval, and ensure compliance through secure, audit-ready workflows.

Portfolio insights and analytics

Monitor key metrics such as delinquency trends, repayment rates, and borrower engagement , enabling data-backed decision-making.

How to start building from here

The journey from a promising pilot to a deployed solution can be a challenge. We are your partner in implementation, sharing the risk and ensuring your AI agents make it to production. We don't just provide a platform; we provide a clear pathway to success.

Dedicated AI expertise

We invest in a Forward Deployment AI Engineer (FDE) to work directly with you. Our FDE acts as a hands-on AI startup CTO for your project.

A partner in risk management

We take on the risk of ensuring your agent goes from concept to a fully functional, production-ready solution. We'll work with you every step of the way to get you live.

Strategic guidance & workshops

Our dedicated team will provide strategic guidance and training sessions, empowering your internal teams to own and scale your AI capabilities once your first use case is live.

Project management oversight

We assign a project manager to oversee your agent's journey, providing a clear roadmap and ensuring a smooth, frictionless path to production.

Agents used for this use case.

The Regulatory Monitoring Agent is often built on a combination of specialized agents. Here are some you can use to enhance this use case on the Lyzr platform:

- KYC Processing Agent

- Fraud Detection Agent

- AML Agent

- Legal Document Drafting Agent

- Compliance Agent

Frequently asked questions

It automates the core functions of loan servicing , from customer support to repayment tracking and document management , helping banks operate more efficiently and deliver faster borrower service.

The agent uses natural language processing to understand and respond to common loan-related questions, such as EMI schedules, interest calculations, and prepayment options, reducing dependency on manual intervention.

Yes. The agent connects with leading LMS and CRM platforms, ensuring a continuous flow of borrower and transaction data for accurate, up-to-date servicing.

By sending timely, personalized reminders across channels, the agent helps borrowers stay on track with their payments, reducing delinquency rates.

Absolutely. The agent can interact with borrowers through chat, email, voice, or WhatsApp , ensuring consistent and timely communication.

It securely manages borrower data, generates audit-ready logs, and ensures document workflows comply with banking and regulatory standards.

Yes. It automates document retrieval, verification, and classification using OCR and AI tagging, minimizing manual workload and errors.

By handling repetitive servicing tasks, the agent frees up staff to focus on high-value borrower interactions and complex case resolutions.

Yes. The agent monitors borrower payment behavior and engagement data to flag early signs of delinquency for proactive intervention.

Yes. It can manage servicing across personal, home, auto, education, and SME loans, adapting responses and workflows for each product.

Institutions typically see lower operational costs, faster servicing cycles, reduced delinquency, and higher customer retention within the first few quarters of deployment.

Build your first AI workflow today.

Start with a blueprint. Launch it. Customize it. Deploy it. All inside Lyzr.