- Lyzr Marketplace

- Banking

- AI Loan Origination Agent

AI Loan Origination Agent

Loan origination involves multiple touchpoints that slow down approvals. The AI Loan Origination Agent automates application intake, credit assessment, and document verification, helping lenders make faster, more consistent decisions.

- Chief Lending Officers

- Credit Operations Heads

- Retail Banking Product Managers

Trusted by leaders: Real-world AI impact.

The problems we hear from leaders like you

Traditional loan origination systems rely heavily on manual work, fragmented data, and outdated evaluation methods ,causing delays, errors, and missed opportunities.

Lengthy approval timelines

Loan officers spend excessive time gathering documents, verifying details, and cross-checking credit histories ,leading to slower turnaround and poor customer experience.

Inconsistent credit evaluations

Without intelligent automation, risk scoring often depends on subjective human judgment, which can lead to inconsistencies and higher default risks.

Data fragmentation across systems

Customer, credit, and financial data are spread across multiple systems, making it difficult to get a unified borrower profile for decision-making.

High operational costs

Manual underwriting, data entry, and document validation processes consume resources that could be better used in portfolio growth and customer engagement.

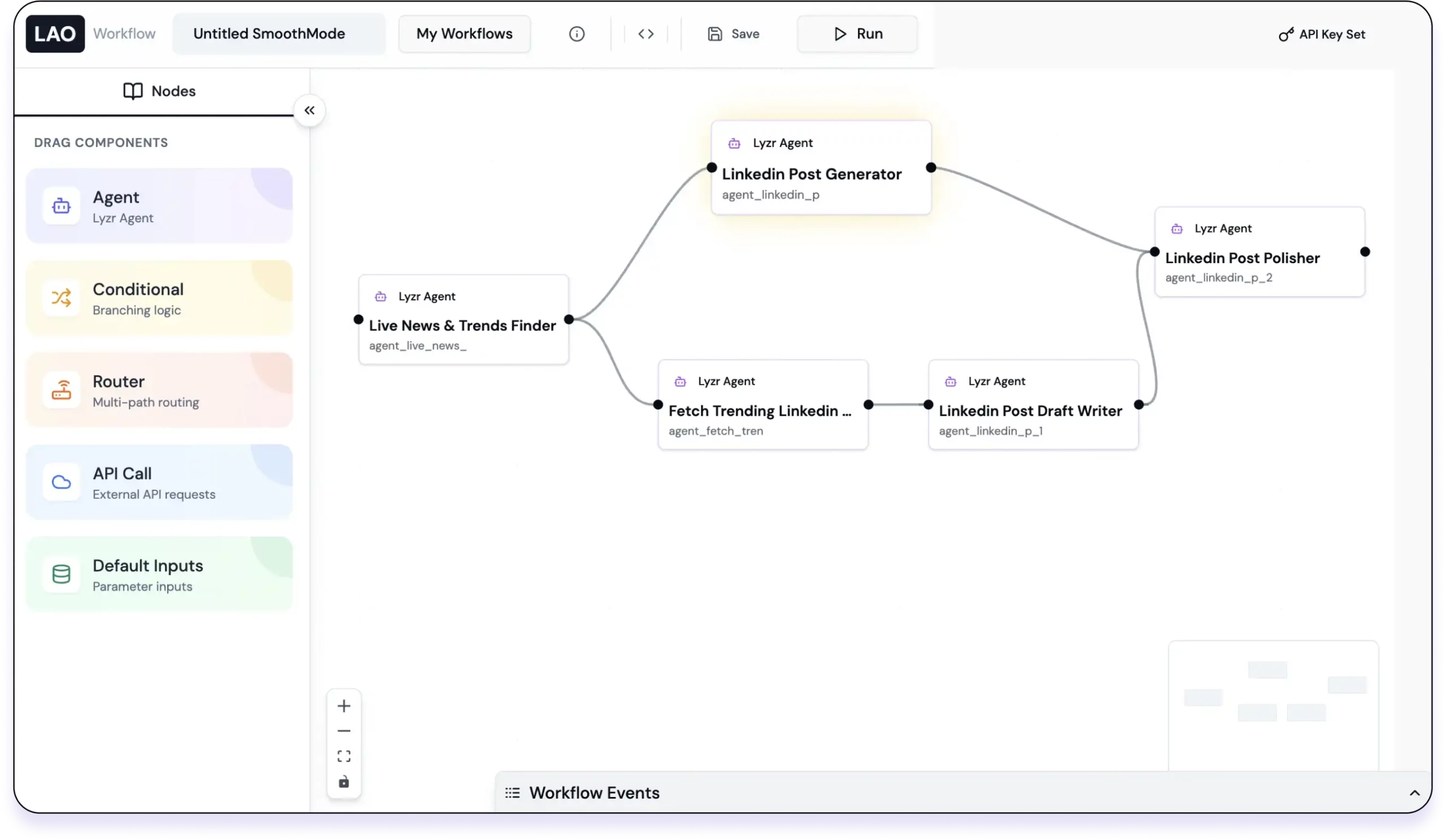

Agent workflow for regulatory monitoring

Why Leading

Organizations Choose Lyzr?

Lyzr provides the full-stack platform to transform your business functions into a unified Agentic Operating System, guaranteed.

Data Privacy & IP Ownership

Agents run in your cloud/on-prem.

We guarantee zero access to your data, ensuring 100% privacy that your AI workforce is always your unquestionable IP.

Full Flexibility,

Zero Vendor Lock-In

Integrate Lyzr as a plug-and-play solution within your existing ecosystem. No forced migration, no vendor dependency, just pure value.

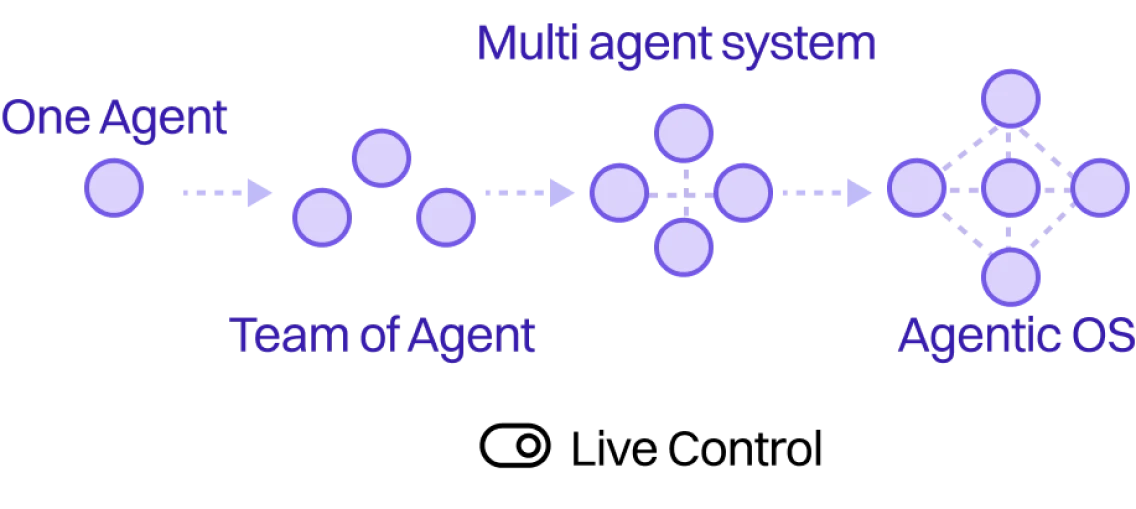

Scalability & Real-Time

Customization

Start with one agent and build toward an Agentic OS for the entire function. Full control lets you customize and deploy changes in real-time.

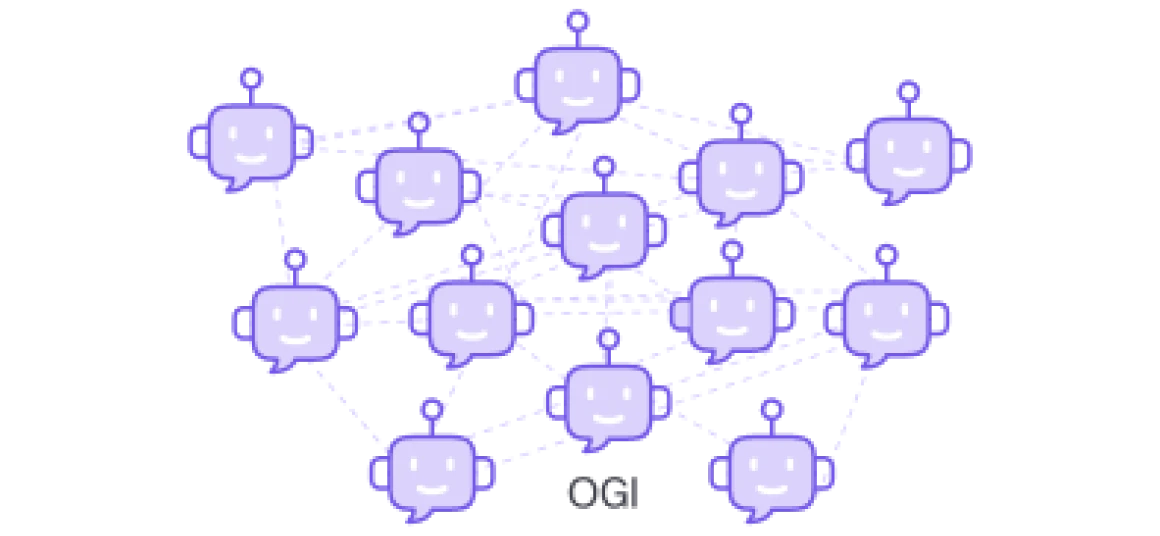

Agentic Operating System

for your org

Unify your agents on a central knowledge graph to unlock the next-level enterprise intelligence: OGI.

Quantifiable value for your institution

AI-driven loan origination delivers measurable speed, consistency, and cost efficiency across your lending workflows.

- 70%

faster loan approvals, cutting down end-to-end processing time

- 50%

reduction in manual review effort, through intelligent document parsing and credit analysis

- 40%

improvement in risk accuracy, using AI-driven credit scoring and anomaly detection

- 35%

lower operational costs, by automating repetitive origination tasks

Outcomes you can expect

With the AI Loan Origination Agent, lenders can focus on growth, not paperwork, making every decision smarter and faster.

Faster application processing

Automate data collection, verification, and document handling to accelerate approval timelines without compromising compliance.

Smarter risk assessment

Leverage predictive credit scoring and AI models to evaluate borrowers accurately and reduce the likelihood of bad loans.

Unified borrower profiles

Aggregate data from internal systems and credit bureaus into one unified view, enabling transparent and informed decisions.

Cost-efficient operations

Reduce manual intervention and human errors by automating verification, scoring, and reporting workflows.

How to start building from here

The journey from a promising pilot to a deployed solution can be a challenge. We are your partner in implementation, sharing the risk and ensuring your AI agents make it to production. We don't just provide a platform; we provide a clear pathway to success.

Dedicated AI expertise

We invest in a Forward Deployment AI Engineer (FDE) to work directly with you. Our FDE acts as a hands-on AI startup CTO for your project.

A partner in risk management

We take on the risk of ensuring your agent goes from concept to a fully functional, production-ready solution. We'll work with you every step of the way to get you live.

Strategic guidance & workshops

Our dedicated team will provide strategic guidance and training sessions, empowering your internal teams to own and scale your AI capabilities once your first use case is live.

Project management oversight

We assign a project manager to oversee your agent's journey, providing a clear roadmap and ensuring a smooth, frictionless path to production.

Agents used for this use case.

The Regulatory Monitoring Agent is often built on a combination of specialized agents. Here are some you can use to enhance this use case on the Lyzr platform:

- KYC Processing Agent

- Fraud Detection Agent

- AML Agent

- Legal Document Drafting Agent

- Compliance Agent

Frequently asked questions

It automates the entire loan origination process ,from application intake to credit analysis ,enabling lenders to process more loans, faster, and with greater accuracy.

The agent automates document collection, verification, and data extraction. It eliminates repetitive manual checks, enabling same-day or even real-time approval in some cases.

Yes. The agent connects seamlessly with loan management, CRM, and risk assessment systems to ensure data consistency across the origination pipeline.

By using AI models trained on credit history, income patterns, and repayment behavior, it produces consistent, bias-free risk assessments that enhance decision quality.

Absolutely. The agent is designed to operate under strict regulatory standards, maintaining audit trails and data transparency throughout the loan process.

No. It supports underwriters by handling repetitive checks, document validation, and preliminary scoring ,allowing experts to focus on complex or high-value cases.

Yes. The agent uses pattern analysis and anomaly detection to flag suspicious data entries or inconsistencies across submitted documents.

All data is processed using enterprise-grade encryption and access controls, ensuring borrower and institutional information remains protected.

Yes. Faster decisions, fewer document resubmissions, and transparent communication make the loan journey smoother for customers.

Yes. The agent supports personal, auto, mortgage, SME, and commercial loans, with adaptable workflows for each.

Banks and lenders typically experience shorter loan cycles, lower operational costs, and improved approval accuracy, directly impacting profitability and customer retention.

Build your first AI workflow today.

Start with a blueprint. Launch it. Customize it. Deploy it. All inside Lyzr.