Table of Contents

Toggle4–8 hours. That’s how much manual effort a single banking onboarding application often takes. Teams spend that time extracting data from forms, validating documents, running compliance checks, and fixing mismatches across systems.

When volumes scale, those hours quickly turn into backlogs, delayed account activation, and higher operational risk.

A Customer Onboarding Agent can change this flow by handling ingestion, data extraction, validation, and compliance checks as one coordinated process.

This guide shows how to build a production-ready Customer Onboarding Agent using Lyzr Agent Studio, based on real banking onboarding workflows that move applications from submission to account-ready with minimal manual effort.

Where Banking Onboarding Breaks

Customer onboarding in banks often starts on paper and ends in fragmented systems.

Hand-signed forms, scanned documents, and emailed PDFs still dominate the first step of onboarding. These inputs require manual data entry, slow down turnaround time, and introduce errors that are difficult to detect early.

At the same time, onboarding workflows are split across teams. Credit checks, compliance verification, document preparation, and approvals live in different systems, creating delays and inconsistent decisions.

As volumes grow, these issues become harder to manage:

- Processing time increases

- Error rates rise

- Compliance reviews become reactive instead of built-in

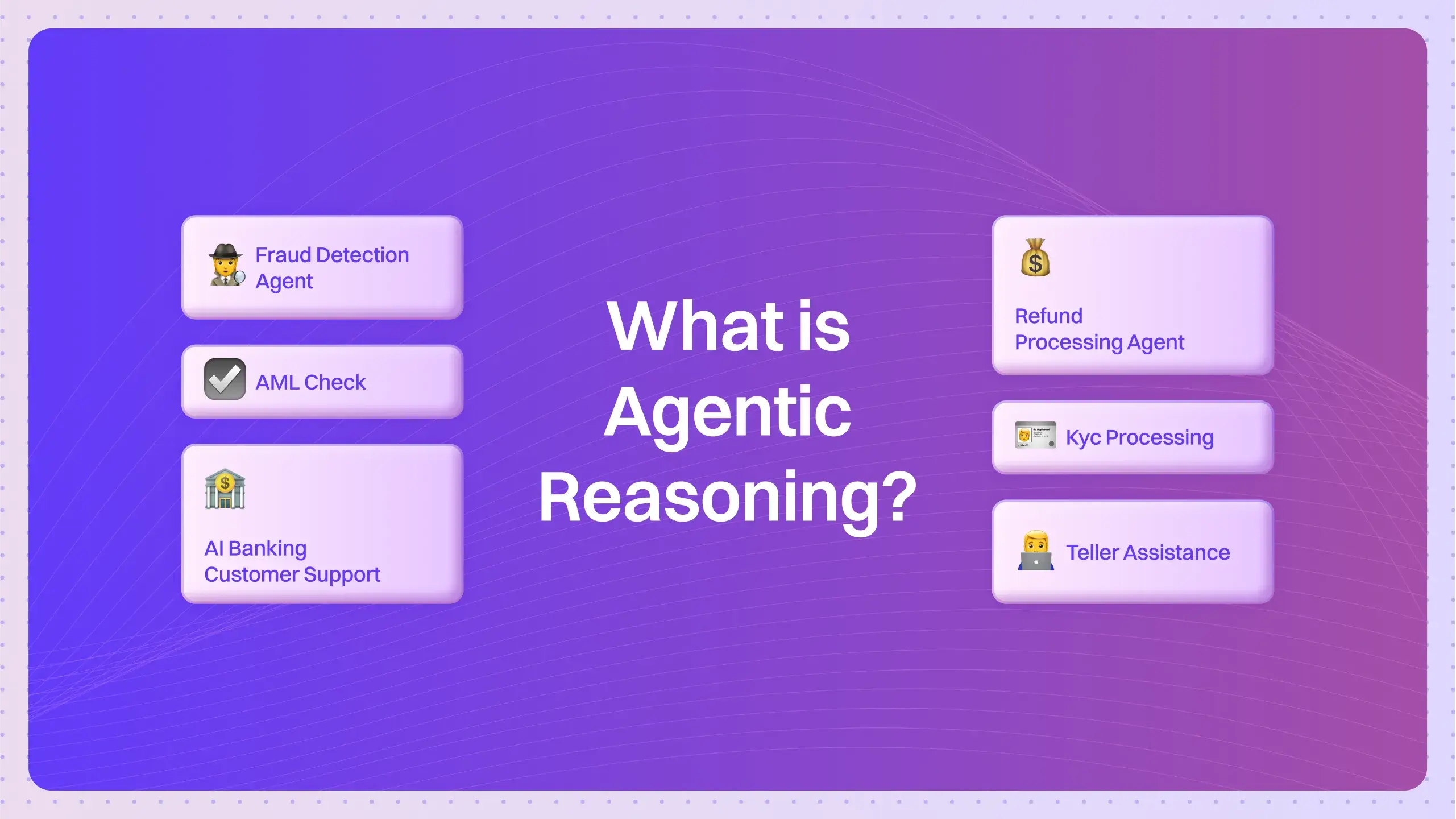

Lyzr’s Customer Onboarding Agent addresses this by breaking onboarding into clearly governed agents, each responsible for a specific step.

How the Customer Onboarding Agent Is Structured in Lyzr

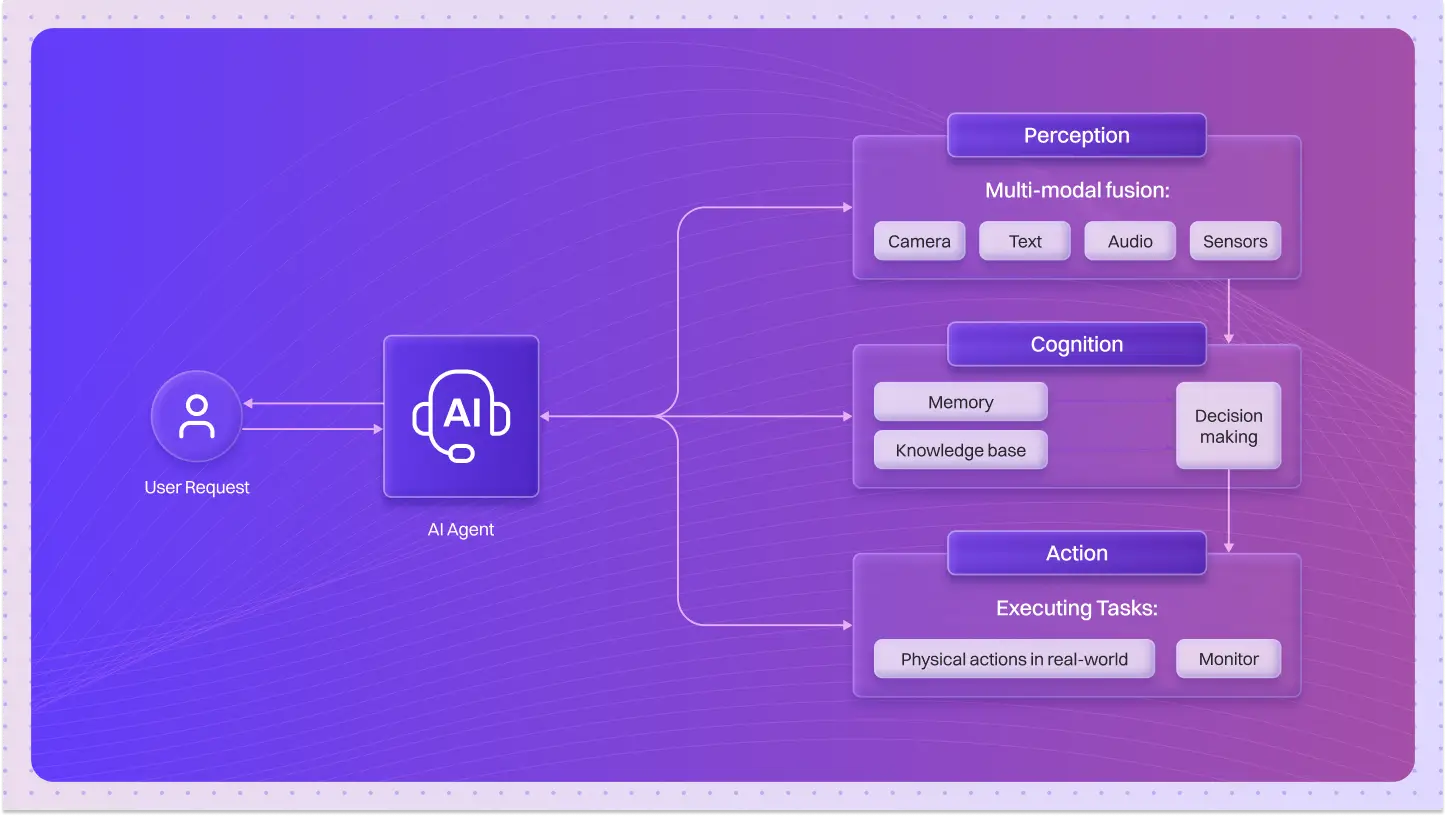

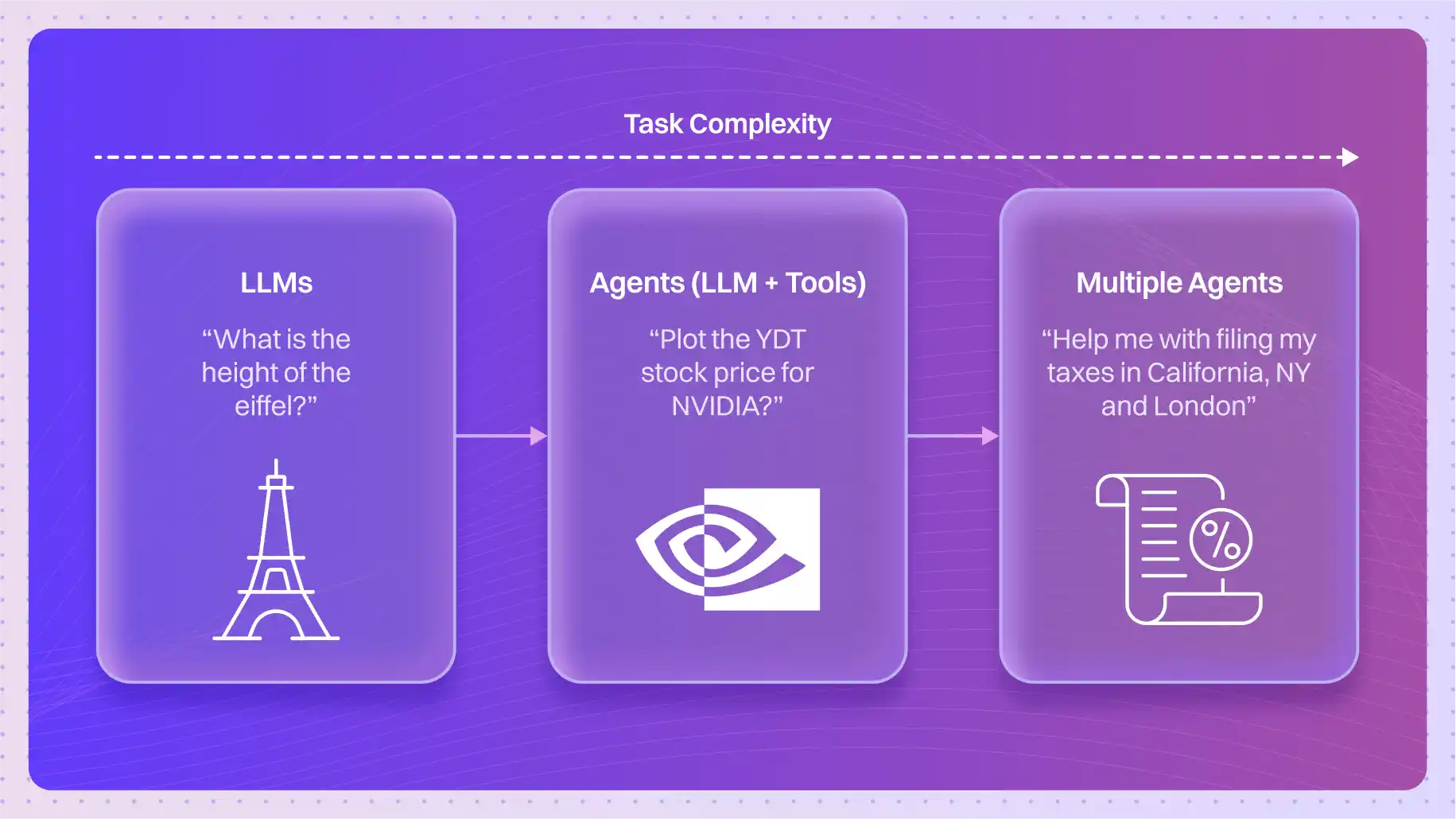

Instead of a single agent handling everything, onboarding is implemented as a multi-agent workflow inside Lyzr Agent Studio.

Each agent performs one task, hands off clean output, and operates under defined rules.

Agents in the Onboarding Flow

| Agent | What it handles |

|---|---|

| Document Intake Agent | Ingests scanned and handwritten onboarding forms |

| Data Extraction Agent | Converts documents into structured customer data |

| Compliance Agent | Runs AML, sanctions, and regulatory checks |

| Credit Evaluation Agent | Fetches and evaluates credit reports |

| Account Setup Agent | Generates account-opening documents |

| Orchestration Agent | Controls execution, approvals, and exceptions |

This structure keeps the system predictable, auditable, and easier to scale.

Step 1: Ingesting Customer Documents at Scale

Onboarding begins with document intake.

Banks typically receive:

- Hand-signed account opening forms

- Identity and address proofs

- Supporting documents uploaded in bulk

The Document Intake Agent in Lyzr Agent Studio is configured to accept both single and batch uploads. This allows onboarding teams to process hundreds or thousands of customer profiles in one run.

Key controls applied at this stage:

- File format validation (PDF, JPEG, PNG)

- Schema awareness for expected form fields

- Automatic rejection of incomplete or corrupted files

Only validated documents move forward in the workflow.

Step 2: Extracting Structured Data from Handwritten Forms

Handwritten applications are one of the biggest bottlenecks in banking onboarding.

The Data Extraction Agent converts unstructured documents into structured customer profiles that downstream agents can reliably consume.

Typical data points extracted include:

- Customer name and contact details

- Address information

- Account type selection

- KYC identifiers

Extraction is governed by confidence thresholds. Fields that fall below the acceptable confidence level are automatically flagged and routed for review instead of silently passing through.

Example structured output:

{

"customer_name": "Ravi Kumar",

"pan": "ABCDE1234F",

"address": "Bangalore",

"account_type": "Savings",

"confidence_score": 0.94

}

This ensures data quality before any compliance or credit checks begin.

Compliance checks are not treated as an afterthought.

The Compliance Agent runs immediately after data extraction, using the structured customer profile as input.

Checks typically include:

- AML screening

- Sanctions list verification

- Watchlist matching

The agent follows deterministic rules:

| Outcome | What happens next |

|---|---|

| No match | Workflow continues |

| Partial match | Routed for compliance review |

| Confirmed match | Onboarding stops |

Every decision is logged with timestamps and inputs, creating a complete audit trail.

Step 4: Credit Evaluation Without Manual Back-and-Forth

Once compliance checks clear, the Credit Evaluation Agent retrieves and evaluates credit data.

The agent applies predefined scoring logic to categorize customer risk and eligibility.

Typical evaluation outcomes:

| Credit Score Range | Risk Category | Action |

|---|---|---|

| Above 750 | Low | Auto-approve |

| 650–750 | Medium | Manual review |

| Below 650 | High | Reject |

This removes subjective interpretation while keeping decision logic transparent.

Step 5: Generating Account Opening Documents

The Account Setup Agent prepares all onboarding documentation once approvals are complete.

Its responsibilities include:

- Populating account opening templates

- Locking verified customer data

- Generating internal approval records

Document generation is gated. If any upstream step fails or pauses, this agent does not execute.

Step 6: Orchestration, Approvals, and Visibility

The Orchestration Agent controls how all other agents interact.

It manages:

- Execution order

- Retry logic for recoverable failures

- Pauses for manual review or approval

Onboarding states remain visible throughout:

| Status | Meaning |

|---|---|

| In Progress | Agents are executing |

| Review Required | Manual action needed |

| Approved | Ready for account creation |

| Rejected | Workflow terminated |

This gives both agents and back-office teams a clear view of where each customer stands.

Why This Works in Regulated Banking Environments

Lyzr Agent Studio enforces:

- Clear separation of responsibilities across agents

- Rule-driven decision-making

- Audit-ready logs by default

This makes the Customer Onboarding Agent suitable for regulated use cases across retail banking, commercial banking, and NBFCs.

Closing Notes

This Customer Onboarding Agent reflects a practical implementation inside Lyzr Agent Studio, not a conceptual example.

By structuring onboarding as a governed, multi-agent workflow, banks gain speed, consistency, and compliance, without increasing operational risk.

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here