Table of Contents

ToggleHow intelligent agents are reshaping compliance and reporting workflows across enterprises

What Are AI Agents for Regulatory Reporting Automation?

AI agents for regulatory reporting automation are intelligent, autonomous software entities designed to streamline and enhance how enterprises gather, validate, analyze, and submit regulatory data.

These agents operate within a multi-layered architecture;connecting internal databases, applying compliance logic, identifying discrepancies, and generating timely reports for auditors and authorities.

Unlike legacy automation tools, AI agents can handle unstructured data, learn from regulatory updates, and collaborate with other agents or humans in real time.

Platforms like Lyzr are helping companies deploy these agents quickly, with built-in safety, explainability, and domain-specific customization.

Why Regulatory Reporting Needs Intelligent Automation

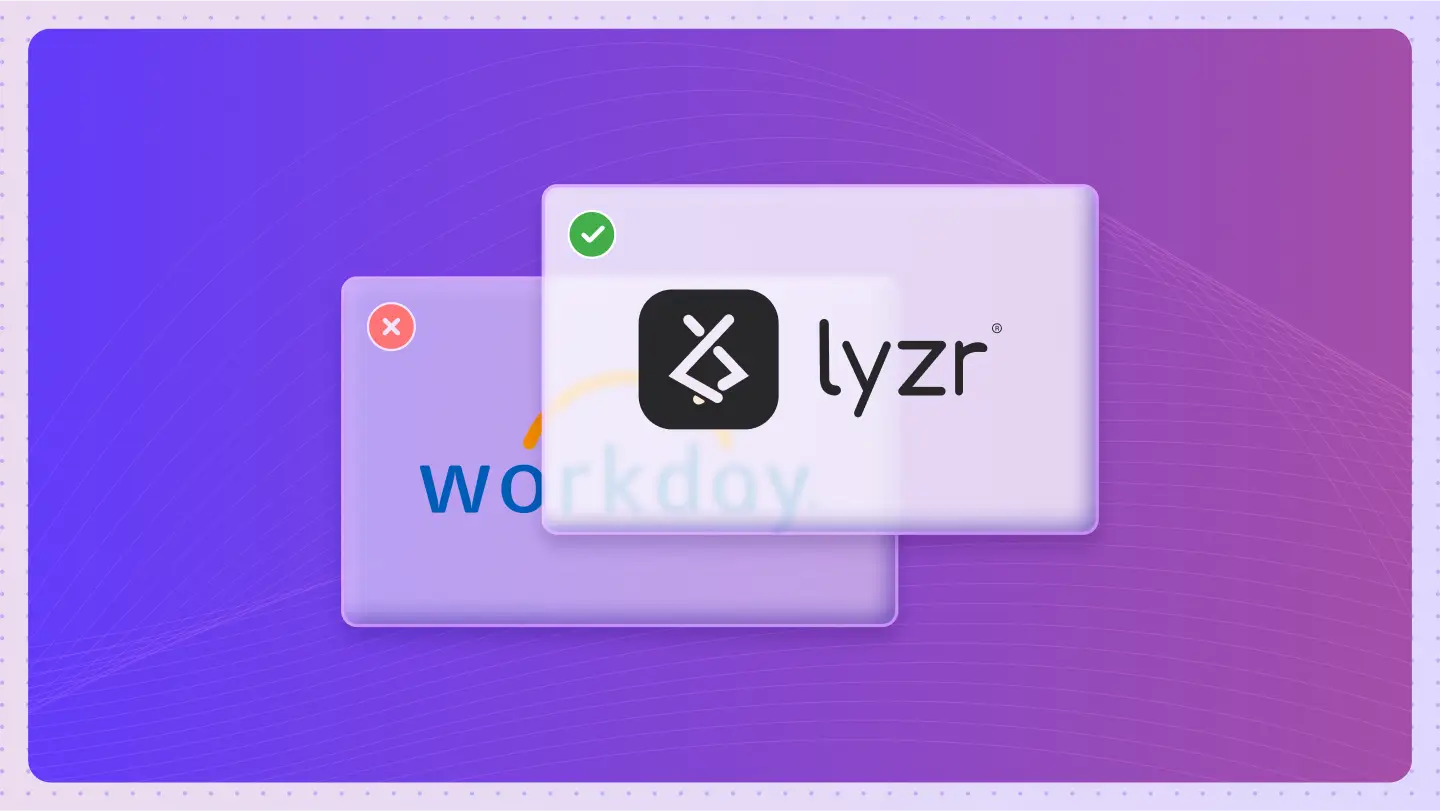

In sectors like banking, pharma, energy, and insurance, regulatory reporting is a constant, high-stakes responsibility. Whether it’s MiFID II in the EU, HIPAA in healthcare, or ESG disclosures globally, enterprises face a triple challenge:

- High Data Complexity: Reports often require pulling data from dozens of systems.

- Constantly Changing Rules: Jurisdictions update regulations frequently, requiring agile adaptation.

- Heavy Audit Burden: Enterprises must retain full traceability, version history, and compliance evidence.

AI agents are uniquely suited to solve these challenges:

- Extract data from structured (databases) and unstructured (emails, PDFs) sources.

- Apply real-time rule logic across jurisdictions.

- Flag anomalies, omissions, or overdue filings.

- Generate regulatory reports with embedded audit trails.

Lyzr’s Agent Architecture for Regulatory Reporting

Lyzr enables enterprises to deploy regulatory agents using a 5-layer modular architecture. Here’s how the pipeline flows across the compliance lifecycle:

The process begins with the Ingestion Layer, where AI agents pull data from ERP systems, CRMs, databases, email inboxes, and third-party platforms like Snowflake or Salesforce. This structured and unstructured data is cleaned, parsed, and prepared for compliance analysis.

Next, the Policy Mapping Layer kicks in. Here, agents map the incoming data to regulatory rules based on jurisdiction and industry. For example, transactions may be mapped against SOX, MiFID II, or RBI guidelines, with logic derived from a template repository hosted on studio.lyzr.ai.

As soon as data is mapped, the Violation Detection Layer runs checks to identify missing fields, inconsistencies, reporting delays, or threshold breaches. These agents often call internal ML models or APIs to evaluate risk scores or detect anomalies.

If any flags are triggered, the Audit & Logging Layer ensures all decisions made by the agents are documented with full context;what data was used, what rule was applied, and why the flag was raised. This information feeds internal auditors and satisfies external regulatory bodies.

Finally, the Action Orchestration Layer takes over. Agents automatically file reports, escalate incidents, or assign follow-up tasks in tools like Jira, Notion, or email, ensuring that every step is traceable and actionable.

Industry-Specific Use Cases

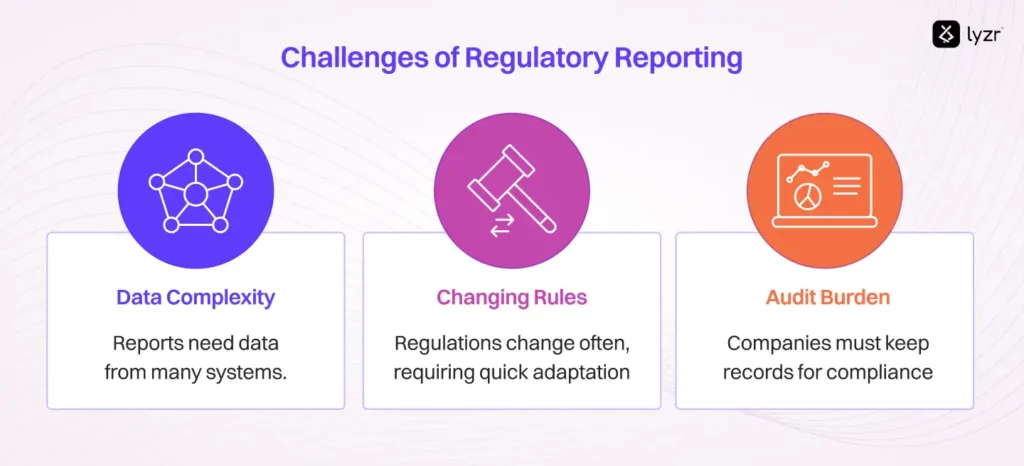

Banking

In global banking, daily compliance with capital requirements, KYC checks, and transaction limits is non-negotiable. AI agents help banks automate liquidity reports, cross-border transaction reviews, and suspicious activity reports. They monitor data in real time and prepare pre-filled templates for regulators like the RBI, ECB, or SEC, reducing compliance risk and saving hundreds of hours.

Insurance

For insurance providers, regulatory reporting often involves validating policy issuance, reinsurance contracts, premium collections, and solvency margins. AI agents can track policy-level data across platforms and flag inconsistencies or gaps in reporting. They also prepare quarterly and annual IRDAI filings, complete with embedded audit trails and contextual justification for each compliance decision.

Pharma

Pharmaceutical companies must comply with documentation-heavy regulations like the FDA’s 21 CFR Part 11 or EMA’s clinical trial directives. AI agents help automate reporting around adverse events, trial registration updates, and electronic records. These agents can ingest lab notes, PDFs, and trial results to ensure timely, traceable, and complete submissions.

Energy

In the energy sector, regulatory reporting now includes sustainability metrics such as carbon emissions, water usage, and renewable sourcing. AI agents collect this data from IoT devices, plant logs, and environmental systems. They then align the information to GRI, SASB, or CDP standards, enabling companies to publish verifiable ESG reports with minimal manual intervention.

Explore use cases across industries

RPA vs AI Agents for Regulatory Automation

| Feature | Traditional RPA | AI Agents via Lyzr |

| Data Handling | Structured only | Structured + Unstructured |

| Flexibility | Rigid scripts | Dynamic prompting + API chaining |

| Compliance Rule Updates | Manual script changes | Rule-layer abstraction |

| Scalability | Per bot | Multi-agent collaboration |

| Auditability | Limited logs | Full contextual trace |

| Setup Time | 3–6 months | 2–4 weeks with prebuilt agents |

How Lyzr Speeds Up Deployment

Lyzr’s Agent Studio empowers enterprises to build and launch compliance agents in days, not months. Here’s how:

Pre-Built Agents for Regulatory Workflows: Lyzr offers domain-specific agents across banking, insurance, sales, marketing, and pharma;all with enterprise-grade logic pre-mapped to industry rules and standards.

- No-Code Builder: Easily configure triggers, inputs, tools, and outputs for each agent without writing code.

- Safe & Responsible AI Modules: Agents come with built-in features like four-eyes approval, human-in-the-loop, role-based access, and audit logs to meet even the strictest compliance needs.

- Plug-and-Play Integrations: Connect to Salesforce, Snowflake, Outlook, internal APIs, and databases instantly, accelerating agent onboarding.

“Interested in the Generative AI playbook for banking? Explore the full guide here

Strategic Benefits of Using AI Agents for Regulatory Automation

AI agents not only cut costs;they future-proof compliance workflows. Enterprises that deploy Lyzr-powered agents gain:

- Faster Time-to-Compliance: Regulatory filings that took weeks can now be completed in hours through automation, reducing last-minute rushes and human error.

- Lower Operational Risk: With automated checks and real-time monitoring, enterprises significantly reduce the chances of missed deadlines, reporting gaps, or non-compliance penalties.

- Cross-Jurisdictional Scalability: Agents can dynamically switch logic depending on location, regulator, or policy;ideal for global teams.

- Transparency and Trust: Every decision made by an agent is logged, justified, and reproducible;building trust with internal stakeholders and external regulators alike.

- Compliance as a Continuous Process: Based on all the info so far, can you give me an article/blog article for AI agents for lead qualification? Instead of being a quarterly scramble, compliance becomes a living, breathing process running 24/7 in the background.

FAQs

1. What is the best tool for deploying regulatory reporting agents?

Lyzr’s Agent Studio is purpose-built for enterprise-ready regulatory agents, offering prebuilt agents, secure integrations, and full auditability out of the box.

2. What’s the difference between AI agents and RPA bots in compliance?

RPA bots are limited to static workflows. AI agents are context-aware, dynamic, and capable of handling evolving rules, unstructured data, and multi-step collaboration.

3. Can AI agents be used across multiple jurisdictions?

Yes. Lyzr’s framework supports rule-layer customization, enabling one agent to adapt reporting logic per jurisdiction (e.g., SEC, RBI, IRDAI, or MiFID II).

4. What are the security concerns with AI in regulatory workflows?

Lyzr ensures agents are deployed in sandboxed environments with RBAC, encrypted data handling, and traceable decision logs to meet enterprise security standards.

5. How long does it take to deploy a compliance agent using Lyzr?

Enterprises can go from idea to working prototype in under a week, and scale deployment in 2–4 weeks depending on complexity.

6. How do agents stay updated with regulation changes?

Lyzr allows compliance teams to upload new rule sets or update policies via the Agent Studio. These are version-controlled and instantly reflected in all relevant agents.

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here