Table of Contents

ToggleHow many hours does your team spend every week reviewing applications, chasing documents, or double-checking reports that should’ve been automated?

If the answer feels uncomfortable, you’re not alone. Across the finance world, teams are losing hundreds of hours each month to repeatable, manual work. And it’s costing more than just time, it’s slowing down decisions, frustrating customers, and dragging margins.

That’s exactly why AI agents for finance are gaining ground.

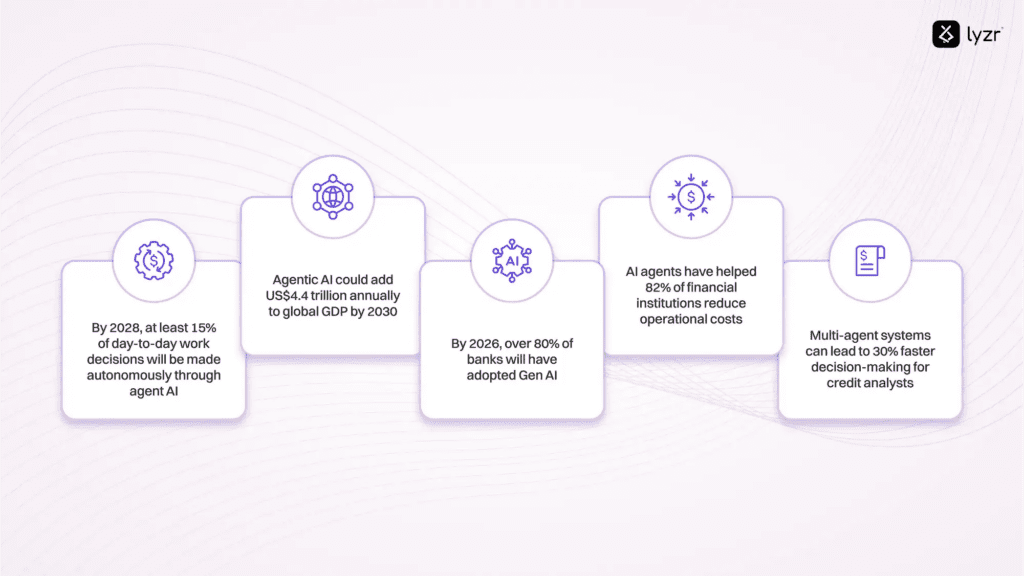

In 2024, the AI agent market in finance is already valued at $38.36 billion. By 2030, it’s projected to reach $190.33 billion. And McKinsey estimates that AI could unlock up to $1 trillion in annual productivity gains across the sector.

In this blog, we’ll break down how AI agents are being used in finance today, what problems they solve, and why early adopters are already seeing results.

Historical Context and the Digital Shift in Finance

Before AI agents, finance was a different world, one filled with manual processes and inefficiencies. Tracking expenses, revenues, and profits took time and effort, pulling focus away from strategic decisions.

Human error was a constant risk, leading to inaccurate reports and misinformed choices. Real-time insights were scarce, making it hard to react to market shifts quickly. And for many businesses, hiring dedicated financial staff was a costly challenge.

Technology helped digitize some of these processes, but AI agents for finance are taking things further.

From automating workflows to analyzing risks in real time, AI is making financial services faster, smarter, and more adaptive. AI agents enable financial institutions to improve decision-making and service offerings.

Growing role of AI Agents for Finance

The rapid adoption of AI agents for finance isn’t happening in a vacuum. It’s a direct response to specific, measurable pain points that have plagued the industry for years. The following breakdown highlights four critical challenges, using hard data to show their impact and how AI agents are providing a direct solution.

1) Tackling the 24% Inefficiency Drag on Finance Teams

A significant portion of finance teams are slowed down by manual work. This is where AI agents provide a direct solution, automating routine tasks to free up skilled professionals. The table below highlights the core issues they address:

| Challenge | Solution |

|---|---|

| 24% of finance teams struggle with inefficiencies | AI agents automate routine tasks and improve customer service interactions |

| 27% lack key skills impacting productivity | Enables teams to focus on strategic work |

| Manual processes slow operations | Faster, more accurate task completion |

2) Slashing the $160 Customer Acquisition Cost

The cost to acquire new customers is a major drain on resources and marketing ROI. AI agents for finance address this by using predictive analytics to target high-value prospects and personalize outreach. This approach directly counters these expensive industry benchmarks:

| Challenge | Solution |

|---|---|

| Financial leads cost $160 on average | AI agents identify high-value prospects |

| High marketing spend with uncertain ROI | Predictive analytics improve targeting |

| Generic outreach lowers conversions | Leveraging customer data for personalized engagement boosts success |

3) Automating 1000s of Tasks to Mitigate Hiring Costs

Building and maintaining large operational teams is a significant and ongoing expense. By automating repetitive work and improving accuracy, AI agents help control these costs and reduce the reliance on extensive manual oversight. The key financial pressures they alleviate include:

| Challenge | Solution |

|---|---|

| Hiring and training are expensive | AI automates repetitive tasks |

| Large teams needed for operations | Reduces manual workload |

| Errors in finance processes | Improves accuracy and efficiency |

4) 57% of Investors Want Human Interaction, AI Agents Make It Smarter

While customers value a human touch, they also expect speed and accuracy. Instead of replacing people, AI agents act as co-pilots, empowering human teams with instant data and insights to create smarter, faster customer experiences. This hybrid approach solves these key challenges:

| Challenge | Solution |

|---|---|

| 57% of investors prefer live agents | AI enhances human-agent interactions |

| Delayed response times | AI provides instant data insights |

| Generic customer interactions | Personalization improves experience |

Key areas where AI Agents for finance are making an impact?

From back-office automation to front-line analytics, AI agents for finance are transforming core business functions. Let’s break down some of the most critical use cases where they are making an impact right now:

1. Financial Forecasting and Budgeting

AI agents have reshaped financial forecasting and budgeting by analyzing financial data, historical data, market trends, and economic indicators to generate accurate projections. They can:

- Develop comprehensive cash flow forecasts

- Provide precise revenue and expense predictions

- Detect financial risks and highlight growth opportunities

- Support scenario planning and sensitivity analysis for better decision-making

2. Automating Routine Financial Tasks

AI agents simplify financial processes by handling repetitive tasks with speed and accuracy. In accounts payable and receivable, they can:

- Process invoices and match them with purchase orders automatically

- Verify payment details and initiate transactions without manual input

- Reconcile financial records in real-time, reducing discrepancies

See It in Action: Automating Customer Onboarding

Talk is one thing, but seeing AI handle a complex financial workflow is another. The demo below shows how a multi-agent system automates the entire customer onboarding process for a bank. Watch how it seamlessly handles everything from initial data collection and credit checks to compliance verification, all without manual intervention. This is a real-world example of how AI agents are eliminating repetitive tasks and improving accuracy in finance today.

3. Fraud Detection

Digital transactions have made payments more convenient, but also more vulnerable to fraud in the financial sector. AI agents act as always-on security analysts, scanning massive amounts of data in real time to detect suspicious activity.

Unlike traditional fraud detection methods that rely on manual reviews, AI can catch anomalies instantly and prevent fraudulent transactions before they happen.

Here’s how AI-powered fraud detection is making a difference:

- Real-Time Monitoring: AI analyzes up to 5,000 transaction data points in milliseconds, while human analysts can process only 20-30.

- Pattern Recognition: Identifies unusual spending behavior, such as a sudden high-value purchase in a foreign country.

- Automated Alerts: Sends instant notifications when potential fraud is detected, like those “Did you make this purchase?” texts from banks.

4. Credit Scoring

Traditional credit scoring methods rely on limited data, often overlooking individuals with little to no credit history. AI agents are reshaping this process by analyzing a wider range of factors, providing a more accurate and inclusive assessment of creditworthiness.

Here’s how AI is improving credit scoring:

- Expanded Data Analysis: Considers spending habits, bill payment history, and even digital footprints beyond just credit reports.

- Financial Inclusion: Helps extend credit to underserved populations who may not have traditional credit histories.

- Real-Time Risk Assessment: Continuously updates credit profiles based on new financial behavior.

These applications demonstrate the power of AI agents for finance in specific tasks. But their impact can be seen on a much broader scale across the entire industry. This is where we see two types of applications emerge: Vertical and Horizontal.

Vertical & Horizontal Use Cases

Now that we’ve seen what AI agents for finance can do on a task-by-task basis, let’s look at how these capabilities are applied at a macro level. Their use cases generally fall into two main categories: Vertical (deeply integrated into a specific industry sector) and Horizontal (applied across common business functions).

Vertical Use Cases

| Industry / Sector | AI Use Cases | Example Impact |

|---|---|---|

| Banking & Credit Unions (Retail, Commercial, Investment Banking) | Credit scoring, Fraud/money-laundering detection, Customer churn | Global bank boosted profitability by 6% with AI-driven credit scoring models. |

| Investment & Wealth Management (Asset & Wealth Management, Brokerage Services, Alternative Investments) | Portfolio optimization, Market prediction, Risk assessment, Deal sourcing, Due diligence, Performance forecasting | Investment platform increased client portfolio returns by 3.7% annually by optimizing asset allocation. |

| Insurance & Payment Services (Life & Health, Property & Casualty, Reinsurance, Payment Processors, Credit Cards, Money Transfers) | Claims processing, Underwriting, Fraud detection, Fraud prevention, Transaction monitoring, Cross-border optimization | Insurer cut underwriting time by 65% while improving accuracy by 12% with agentic workflow. |

| Capital Markets & Fintech (Stock Exchanges, M&A, Private Equity, Venture Capital, Hedge Funds, Blockchain, Cryptocurrency) | Algorithmic trading, Market sentiment analysis, Regulatory compliance, Customer spending profiling, KYC/AML compliance, Robo-advisory | Cryptocurrency exchange reduced fraudulent transactions by 76% via AI-powered behavioral analysis. |

| Financial Services & Regulatory Bodies (Accounting, Tax Advisory, Credit Rating Agencies, Market Infrastructure) | Automated reporting, Tax optimization, Client risk profiling, Real-time clearing, Cybersecurity, Data analytics | Tax advisory firm boosted client refunds by an average of 8.5% using AI to identify overlooked deductions. |

For a deeper dive into how AI agents are transforming banking operations from compliance to customer service, explore our comprehensive Banking Playbook.

Horizontal Use Cases

| Category | AI Use Cases | Example Impact |

|---|---|---|

| Search | Connect your sources, Create a knowledge base, Find information | Fortune 100 improved information flow by 45% after implementing AI-powered semantic search. |

| Understand | Analyze data, Summarize sources, Create reports & documentation | Industry giant reduced decision-making errors by 8% using AI to analyze historical data. |

| Automate | Orchestrate workflows, Automate tasks, Notification automation | Enterprise decreased process downtime by 180% with AI-automated workflow segments. |

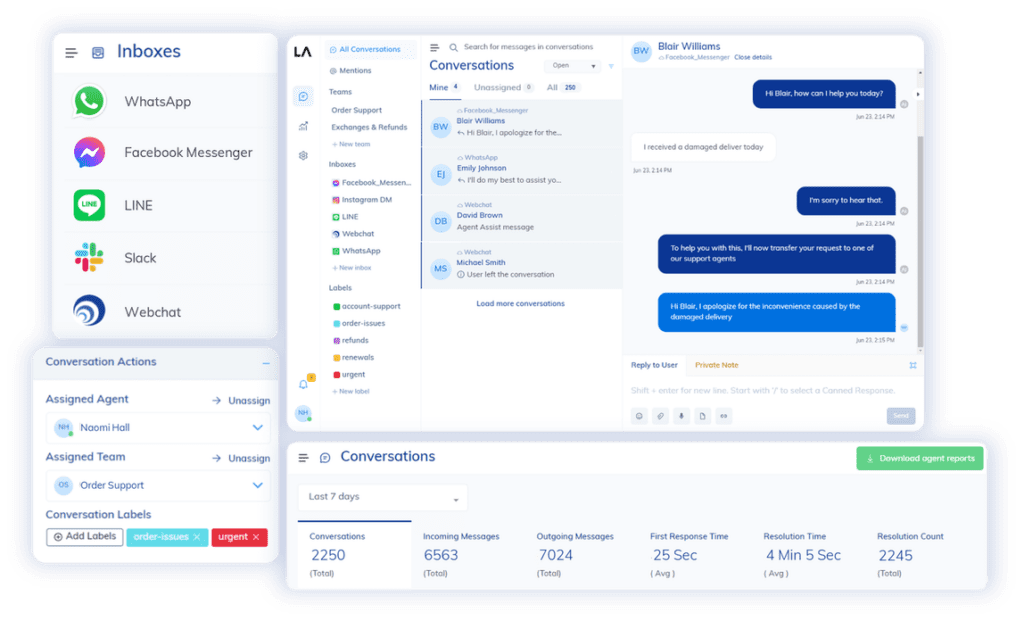

| Talk | Customer support, Natural language interfaces, Personalized assistants | In the financial services industry, 50% decreased customer support workload and improved customer satisfaction by 24/7 chatbot support. |

Leading Vendors in AI Agents for the Financial Services Industry

Several companies are driving innovation for AI agents for finance. Among the top vendors are:

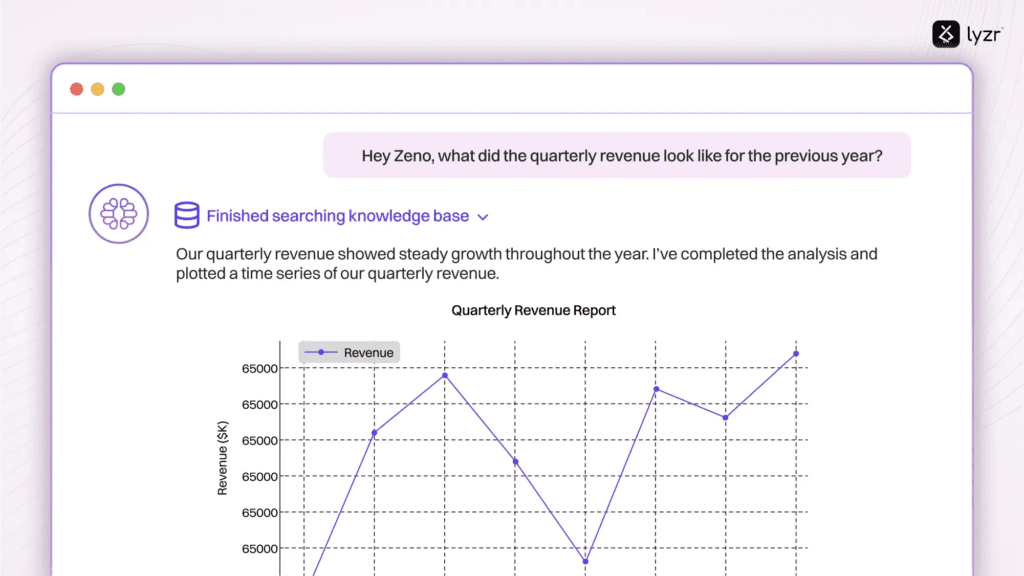

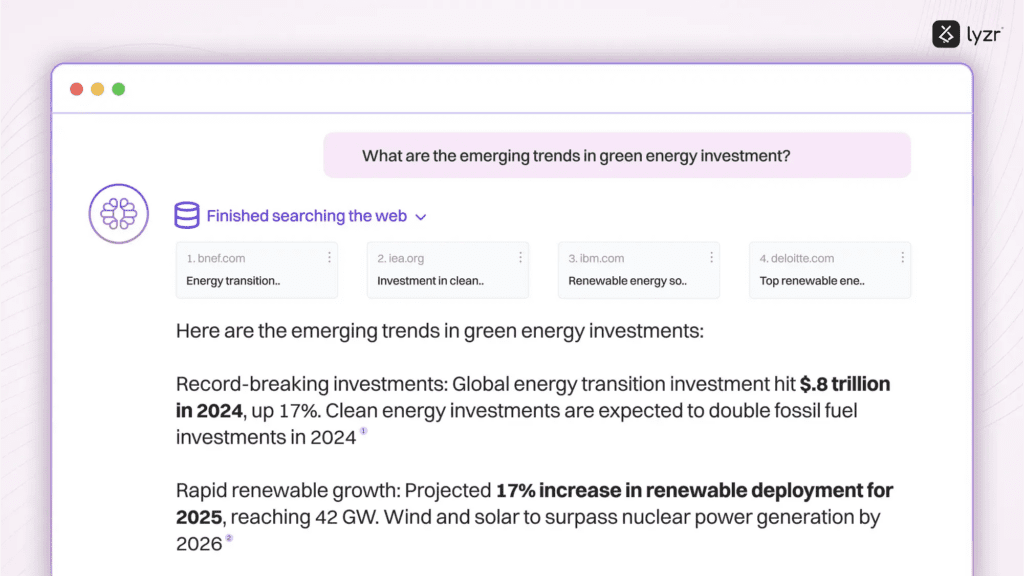

1. Lyzr.ai

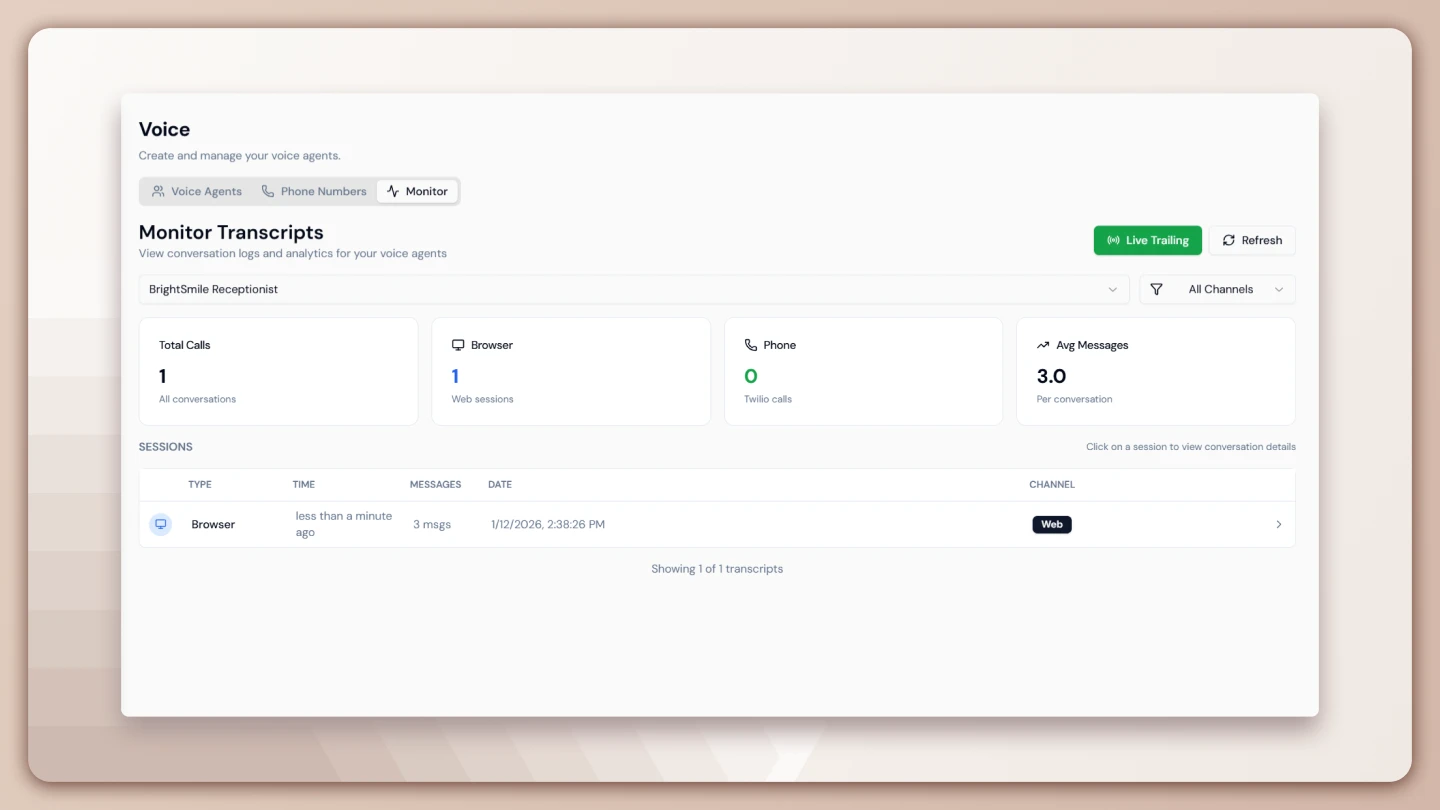

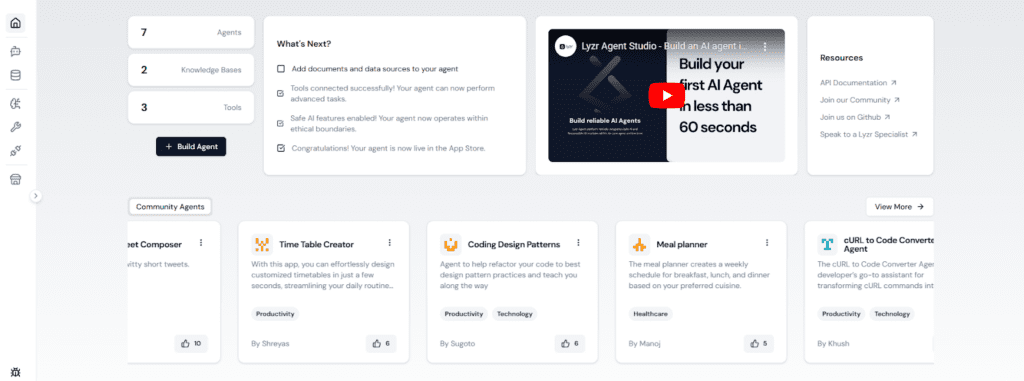

Lyzr Agent Studio helps financial institutions to build AI agents for fraud detection, customer support, automated workflows, and real-time decision-making, all without complex coding.

Key features:

1. Agentic AI at its Core: Create and deploy AI agents that think, adapt, and scale effortlessly to meet your business demands.

2. HybridFlow Precision: Blend the power of LLMs and ML models to deliver intelligent, accurate, and dependable outputs.

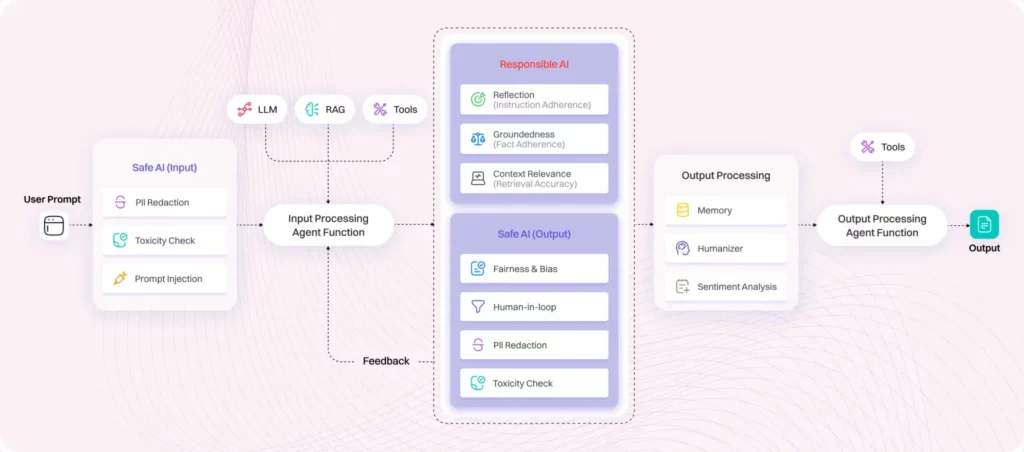

3. Secure and Responsible AI: Built with security and fairness at the forefront, ensuring ethical AI practices and compliance.

4. Customization: Easily customize workflows and design agents tailored to your business needs, no advanced coding required.

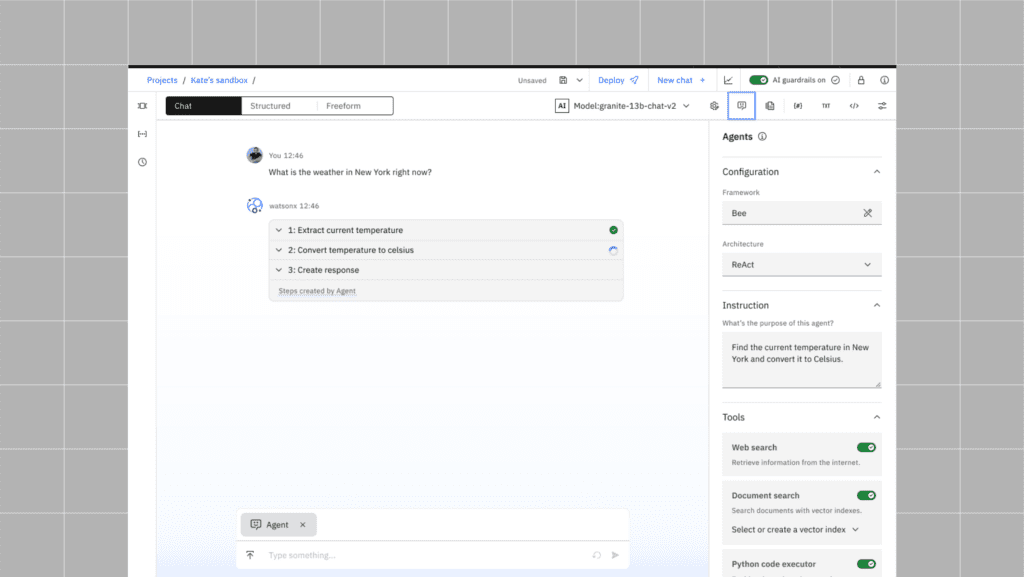

2. IBM

IBM’s Watson platform is a well-established AI ecosystem, delivering solutions for fraud detection, customer service, and AI-driven insights tailored to financial services.

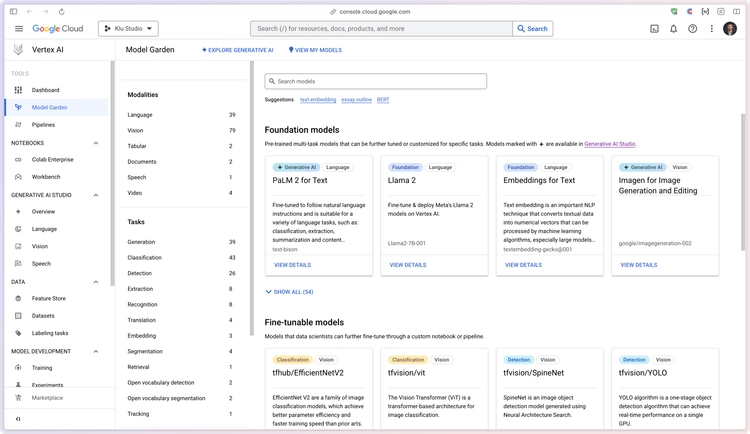

3. Google Cloud

Google’s Vertex AI provides advanced tools for building custom AI models, enabling financial institutions to manage risk, ensure regulatory compliance, and optimize decision-making.

4. Microsoft Azure

Azure AI helps banks and financial institutions automate operations, enhance decision-making, and create more personalized customer experiences.

5. Cognigy

Cognigy specializes in AI-driven conversational agents, offering a no-code platform that allows financial institutions to build intelligent chatbots and virtual assistants with ease.

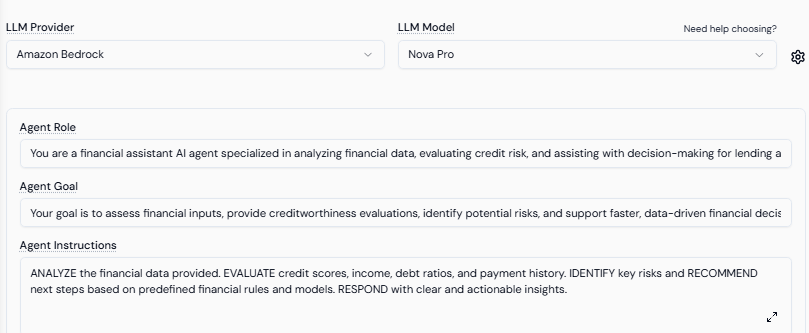

A Closer Look: How to Build an AI Agent for finance with Lyzr Studio

Lyzr Agent Studio makes building secure, reliable AI agents seamless which you can integrate into your workflows, automate tasks, and customize them to fit your business goals. When using generative AI in a finance agency, it is crucial to protect sensitive information to prevent accidental data leaks.

1: Define Your Agent: Give your agent a name and purpose. Choose your preferred LLM provider and model, then outline the instructions or idea to get started.

2. Easy integrations: Run your agent, ask questions, and evaluate its responses. Refine the prompts as needed for perfection.

3. Rapid Development and Testing: Launch your agent as an app on Lyzr’s app store and let others discover, access, and benefit from your creation.

Conclusion: The Future of Finance is Efficient and Intelligent

The evidence is clear: the era of manual inefficiency in finance is coming to an end. From tackling fraud and automating routine tasks to providing deep, predictive insights, AI agents for finance are not just a futuristic concept, they are a practical solution delivering real-world results today.

As McKinsey’s projection of a $1 trillion productivity gain suggests, the institutions that embrace these tools will not only save time and money but will also build a smarter, more adaptive foundation for the future.

Ready to get started? Try out our platform now or have a unique need? Book a demo

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here