Table of Contents

ToggleDiscovering and evaluating startups is often slow and resource-heavy. Analysts typically spend weeks reviewing hundreds of companies, yet critical insights can still be missed.

Our team set out to build the world’s first agentic CVC platform, an AI-powered system that combines a knowledge graph with specialized AI agents to research, evaluate, and monitor startups in minutes.

The platform handles tens of thousands of startups, applies an 88-point evaluation framework, and generates instant reports and dashboards for smarter investment decisions.

The result is a secure, enterprise-ready system that reduces research cycles from weeks to minutes, improves deal accuracy, and provides transparent, score-based insights, giving corporate venture teams the speed and clarity they need to act confidently.

The Startup Discovery Challenge for Corporate Venture Teams

Corporate venture teams face a growing volume of startups, over 40,000 new companies annually across multiple sectors. Traditional tools, such as market databases and research platforms, provide static data and generic insights.

Analysts often spend weeks manually compiling reports, yet critical trends and competitive signals can still be missed.

| Challenge | Impact on Venture Teams | Typical Scale / Numbers |

|---|---|---|

| Fragmented Data | Analysts spend hours gathering information from multiple sources | 5–10 databases per research cycle |

| Slow Evaluation Cycles | Each startup can take weeks to research and score | 2–4 weeks per startup |

| Limited Reasoning | Tools provide data but no actionable insights or explainable recommendations | Hundreds of hours spent on interpretation |

| Competitive Blind Spots | Hard to track competitors’ moves, market shifts, or emerging technologies | 40,000+ startups in scope annually |

These limitations make it difficult for corporate venture teams to identify high-potential startups quickly, improve investment accuracy, and maintain a strategic advantage in a fast-moving market.

Challenges Faced by a Leading Corporate Venture Team

A leading corporate venture team faced several critical challenges that slowed decision-making and limited scalability:

| Challenge | Impact |

|---|---|

| High-volume startup research | Weeks-long evaluation cycles for hundreds of startups |

| Complex evaluation framework | Manual 88-parameter scoring caused delays and inconsistencies |

| Slow market & competitor monitoring | Strategic signals often missed, limiting proactive decisions |

| Inefficient reporting | Analysts spend 30–40% of time on decks and reports instead of insights |

| Limited explainability | Hard to justify investment recommendations to stakeholders |

These challenges made it difficult for the team to scale evaluations, act quickly, and maintain strategic oversight across thousands of startups.

Building the Agentic CVC Platform with Lyzr

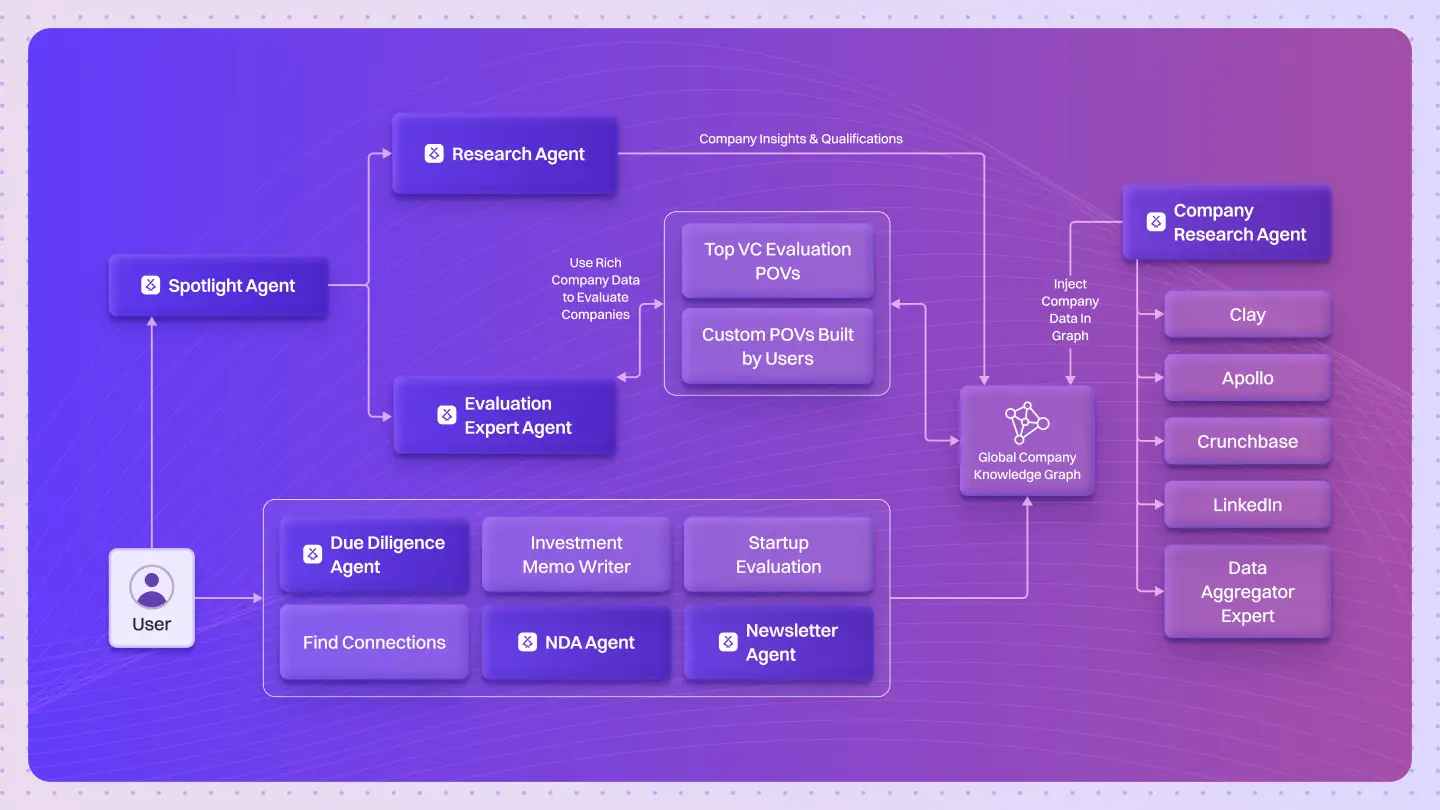

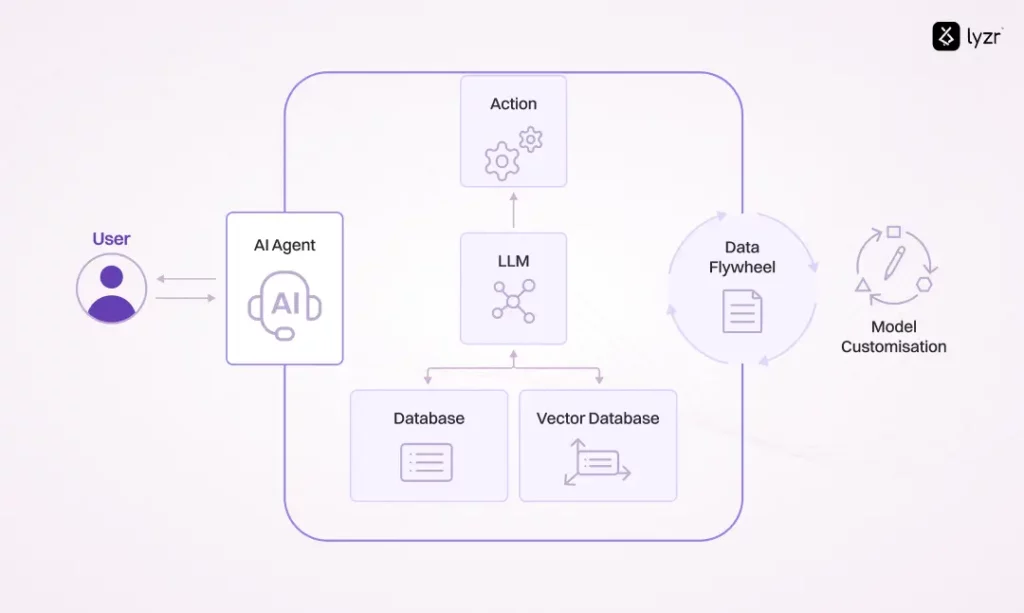

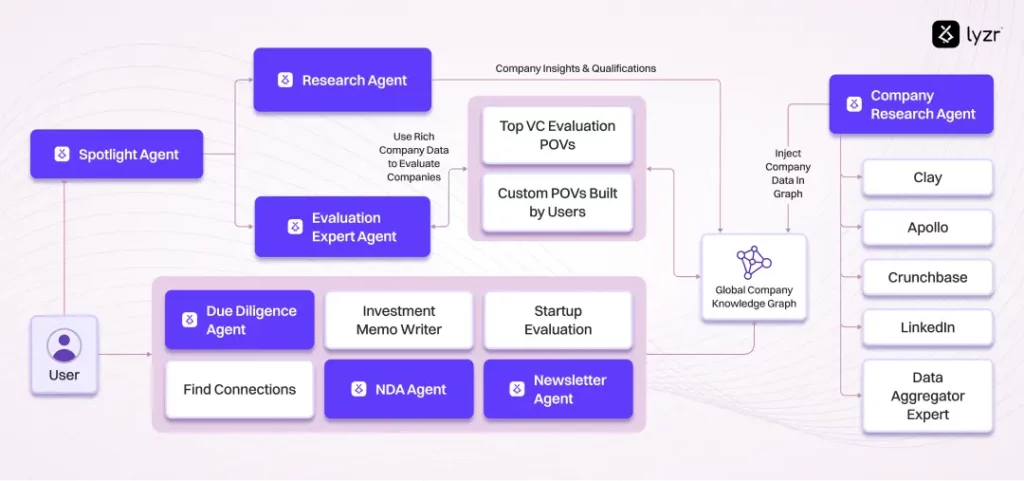

To address these challenges, our team leveraged Lyzr’s AI capabilities to design and implement the world’s first agentic Corporate Venture Capital (CVC) platform for a leading corporate venture team. The platform combines a dynamic knowledge graph with specialized AI agents to automate research, evaluation, and monitoring of startups at scale.

Key capabilities include:

- Rapid Research: AI agents can analyze hundreds of startups in minutes, replacing weeks of manual effort.

- Custom Evaluation: The platform applies an 88-point scoring framework with transparent, explainable results.

- Competitive Intelligence: Agents track market trends, competitor moves, and emerging technologies in real time.

- Automated Reporting: Generate investor-ready decks, SWOT analyses, and dashboards instantly.

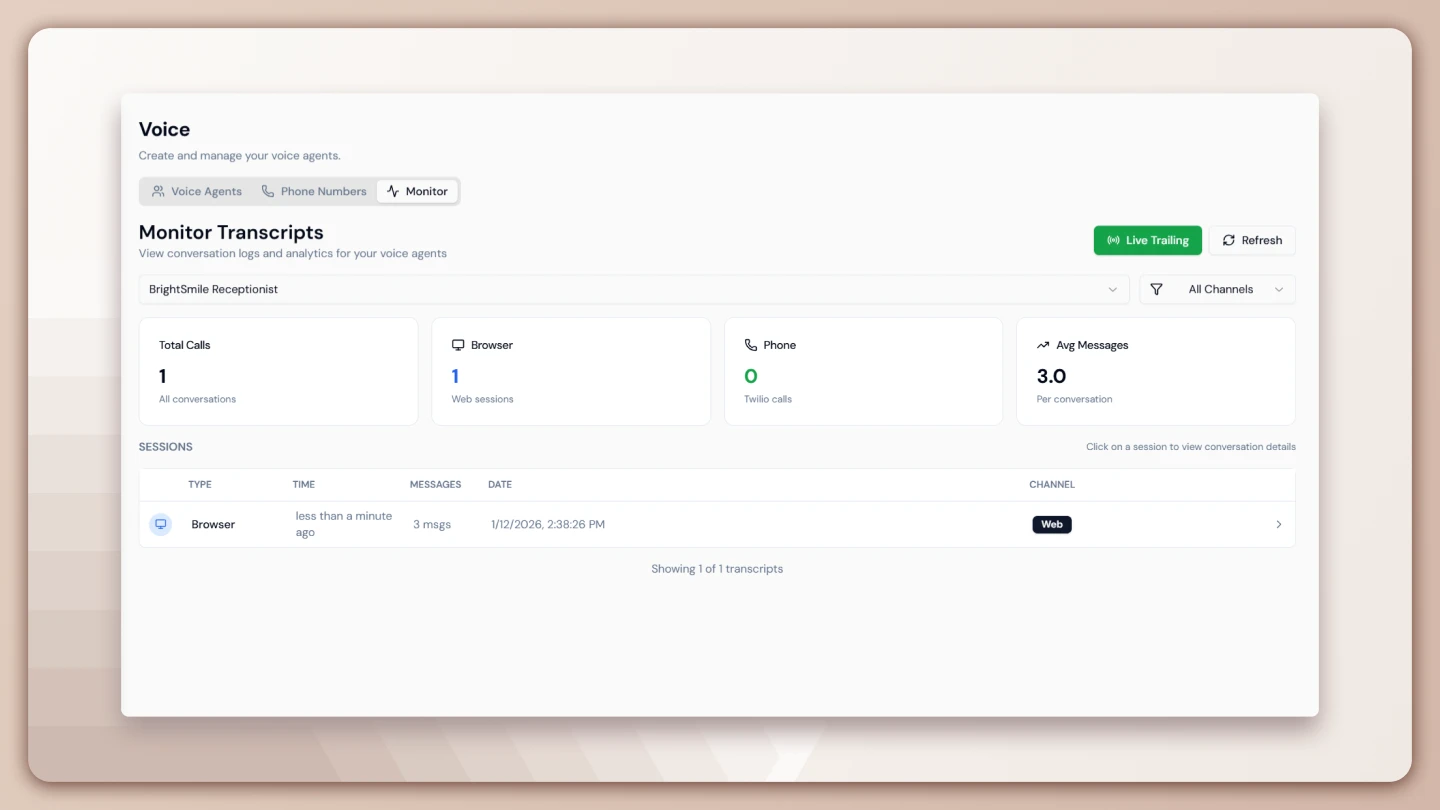

- Conversational Interface: Analysts interact via text or voice, making insights easy to access and act on.

How It Was Built: Approach & Methodology with Lyzr

To address the challenges faced by a leading corporate venture team, the team partnered with Lyzr to design a multi-phase, AI-driven approach for building the agentic CVC platform. The platform was designed to combine speed, accuracy, and explainability across every stage of startup evaluation.

Phased Approach

| Phase | Focus | Key Deliverables |

|---|---|---|

| Foundation | Platform architecture, core AI agents, initial dataset ingestion | Knowledge graph setup, Research Agent, Evaluation Expert Agent, conversational UI |

| Market Entry | Beta rollout and analyst onboarding | Refined agent outputs, real-time dashboards, automated reporting |

| Market Expansion | Multi-industry coverage | Additional agents, enhanced scoring models, extended dataset integration |

| Ecosystem Development | Partner integrations and API access | API marketplace, third-party data connectors, scalability enhancements |

Key AI Agents Developed with Lyzr

| Agent | Function |

|---|---|

| Research Agent | Conducts deep company research, populating the knowledge graph |

| Evaluation Expert Agent | Applies the 88-point scoring framework with explainable reasoning |

| Scouting Report Agent | Generates SWOT analyses and market maps instantly |

| Competitive Sentinel Agent | Monitors competitor moves and strategic signals in real time |

| Founder Interview Agent | Produces dynamic Q&A scripts for analyst calls |

| Deck Generator | Auto-creates investor-ready presentations and reports |

How the Platform Operates

The agentic CVC platform is designed to streamline startup discovery, evaluation, and monitoring by combining specialized AI agents with a central knowledge graph. The workflow ensures that analysts receive fast, actionable, and explainable insights.

High-Level Workflow

- User Interaction: Analysts access the platform through a Tactical Agent via text or voice.

- Task Delegation: The Tactical Agent assigns tasks to specialized AI agents:

- Research Agent: Gathers company data and populates the knowledge graph.

- Evaluation Expert Agent: Applies the 88-point scoring framework with explainable reasoning.

- Other Agents: Scouting Report, Competitive Sentinel, Founder Interview, Deck Generator.

- Data Storage: All structured information is stored in the knowledge graph, ensuring a unified source of truth.

- Output Delivery: Analysts receive insights through:

- Conversational UI (text/voice)

- Automated decks and reports (PPT, PDF)

- Alerts, dashboards, and notifications

High-Level Architecture

- Frontend:

- React-based agentic UI supporting text and voice interactions.

- Provides conversational access to insights, dashboards, and reports.

- Backend:

- Lyzr multi-agent orchestration manages AI agents for research, evaluation, monitoring, and reporting.

- Handles task delegation, execution, and data consolidation.

- Data Layer:

- Knowledge Graph (AWS Neptune / OpenSearch): Central repository connecting startups, people, funding, patents, and news, over 5 billion relationships.

- Supports real-time updates and advanced querying for analytics.

- Integrations:

- Internal datasets and proprietary evaluation frameworks.

- External sources such as Crunchbase, Pitchbook, and research APIs.

- Enables continuous enrichment of startup profiles and market insights.

Key Architectural Features

| Feature | Purpose |

|---|---|

| Knowledge Graph | Centralized, structured storage of startups and relationships |

| Multi-Agent Orchestration | AI agents handle specialized tasks efficiently |

| Explainable Scoring | Transparent application of the 88-point evaluation framework |

| Automated Reporting | Generates decks, SWOTs, and dashboards instantly |

| Secure & Enterprise-Ready | Meets enterprise compliance and data protection requirements |

Roadmap & Future Outlook

The platform was developed in a multi-phase roadmap to ensure rapid delivery, scalability, and continuous enhancement. Each phase focuses on specific capabilities and measurable outcomes for the corporate venture team.

Development Phases

| Phase | Timeline | Key Deliverables |

|---|---|---|

| Foundation | 12 weeks | Knowledge graph setup, core AI agents (Research, Evaluation, Scouting, Competitive Sentinel), conversational UI, initial dataset ingestion |

| Market Entry | Post-foundation | Beta release, analyst onboarding, real-time dashboards, automated reporting |

| Market Expansion | TBD | Multi-industry coverage, additional agents, enhanced scoring models |

| Ecosystem Development | TBD | Partner integrations, API marketplace, extended analytics capabilities |

Wrapping Up

The agentic CVC platform demonstrates how AI-driven automation and knowledge graphs can transform corporate venture operations.

By combining specialized AI agents, an 88-point evaluation framework, and real-time data, a leading corporate venture team can now analyze hundreds of startups in minutes, generate explainable insights, and maintain strategic visibility across thousands of opportunities.

The platform not only reduces manual effort and cycle times but also empowers teams to make more informed, transparent, and timely investment decisions.

Looking ahead, its scalable architecture and modular design position it to expand across industries, integrate with partners, and continuously enhance predictive capabilities, setting a new benchmark for corporate venture intelligence.

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here