- Lyzr Marketplace

- Banking

- KYC Compliance Agent

KYC Compliance Agent

Manual KYC is costly, slow, and risky. This agent automates the entire lifecycle, from onboarding to continuous monitoring, ensuring perpetual compliance.

- Chief Compliance Officers

- VPs of Risk Management

- Heads of Financial Crime Compliance

Trusted by leaders: Real-world AI impact.

The problems we hear from leaders like you

The tension between robust compliance and operational efficiency creates daily challenges that expose your institution to financial and reputational risk.

Manual overload

Analysts are drowning in repetitive data entry and swivel-chair workflows between fragmented systems, slowing down the entire process.

Alert fatigue

High false positive rates from legacy systems overwhelm analysts, burying genuine threats under a mountain of unnecessary manual reviews.

Onboarding Friction

Lengthy, paper-based onboarding procedures create a poor customer experience, leading to high abandonment rates and lost business.

Data Fragmentation

Critical customer data is siloed across disconnected systems, leading to inconsistencies, duplicated effort, and security risks.

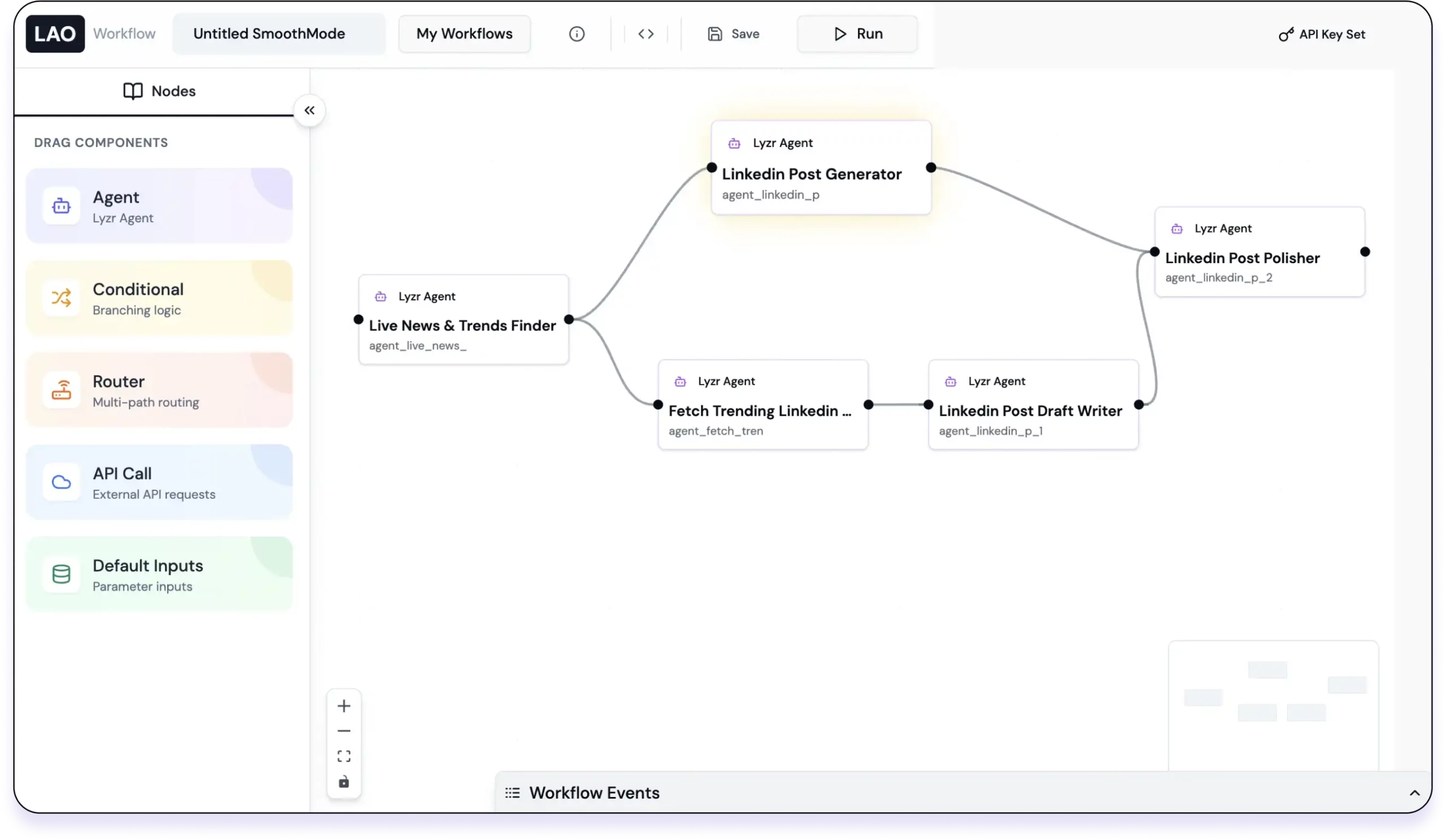

Agent workflow for regulatory monitoring

Quantifiable value for your institution

Moving to an AI-driven compliance model delivers a clear and compelling return on investment across efficiency, risk, and customer experience.

- 90%

increase in KYC process efficiency, freeing up analyst time.

- 60%

reduction in false positives, allowing teams to focus on real threats.

- 50%

cost savings on high-volume compliance and reporting processes.

- 20%

fewer staff required to process the same volume of due diligence files.

Outcomes you can expect

Implementing this agent transforms your compliance function from a reactive cost center into a proactive, strategic asset that protects and grows your business.

Autonomous investigations

Automate entire Level-1 investigations, from ID verification and sanctions screening to risk assessment, freeing up experts.

Perpetual monitoring

Shift from periodic reviews to real-time, continuous monitoring that instantly detects changes in customer risk profiles.

Augmented expertise

Empower your analysts by eliminating mundane tasks. The agent handles data gathering while humans focus on critical judgment calls.

Seamless onboarding

Reduce customer verification from days to minutes, eliminating friction and drastically cutting down on applicant abandonment.

How to start building from here

The journey from a promising pilot to a deployed solution can be a challenge. We are your partner in implementation, sharing the risk and ensuring your AI agents make it to production. We don't just provide a platform; we provide a clear pathway to success.

Dedicated AI expertise

We invest in a Forward Deployment AI Engineer (FDE) to work directly with you. Our FDE acts as a hands-on AI startup CTO for your project.

A partner in risk management

We take on the risk of ensuring your agent goes from concept to a fully functional, production-ready solution. We'll work with you every step of the way to get you live.

Strategic guidance & workshops

Our dedicated team will provide strategic guidance and training sessions, empowering your internal teams to own and scale your AI capabilities once your first use case is live.

Project management oversight

We assign a project manager to oversee your agent's journey, providing a clear roadmap and ensuring a smooth, frictionless path to production.

Agents used for this use case.

The Regulatory Monitoring Agent is often built on a combination of specialized agents. Here are some you can use to enhance this use case on the Lyzr platform:

- KYC Processing Agent

- Fraud Detection Agent

- AML Agent

- Legal Document Drafting Agent

- Compliance Agent

Frequently asked questions

It's an AI system that automates the end-to-end Know Your Customer process, from identity verification and due diligence to continuous risk monitoring and reporting.

It uses advanced machine learning to analyze complex patterns, moving beyond rigid, rules-based systems that incorrectly flag legitimate activity.

Yes, it can be configured to automatically trigger and perform deeper investigations for high-risk customers, gathering and summarizing additional data.

It’s a shift from periodic reviews to continuous, real-time monitoring of customer risk, ensuring your data is never a stale "snapshot in time."

Every action and decision made by the agent is logged with a clear explanation, providing the transparency required for regulatory audits.

No, it augments them. The agent handles high-volume, repetitive tasks, freeing up your human experts to focus on complex cases requiring judgment.

It can reduce onboarding and verification time from several days to just a few minutes, dramatically improving the customer experience.

The agent cross-references customer data against global sanctions lists, Politically Exposed Persons (PEPs) databases, and adverse media sources in real-time.

Yes, it can use generative AI to summarize investigation findings and auto-draft narratives for Suspicious Activity Reports (SARs), accelerating the reporting process.

OCR just extracts text. The agent orchestrates the entire workflow: extracting data, verifying it, screening it, assessing risk, and monitoring it continuously.

Yes, the platform is built with enterprise-grade security protocols to ensure that all sensitive customer information is handled with the highest standards of data privacy.

Absolutely. The agent is designed to integrate with your existing systems, acting as an intelligent layer that orchestrates data and workflows across your tech stack.

Build your first AI workflow today.

Start with a blueprint. Launch it. Customize it. Deploy it. All inside Lyzr.