TL;DR

- Skip the 180 hours of repetitive investor Q&A. Build an AI agent that answers questions 24/7 while you focus on closing deals.

- What you’re building: Agent Sam – handles 80%+ of pre-due diligence questions automatically.

- Time investment: 1-2 weeks to launch | No coding required

- Proven approach: Lyzr raised $15M Series A this way (30+ investors, 90% time saved)

- You stay in control: Agent handles FAQs. You handle strategy, relationships, and negotiations.

Choose Your Path:

Is this for me? → Read the Executive Summary

Quick overview of the problem, solution, and why this works. Decide if Agent Sam is worth your time.

Where to start? → Jump to Phase 1

Map your investor questions, build your FAQ bible, prepare your knowledge base.

I’m convinced. Let me build Agent Sam now. → Building with Lyzr Studio

Skip the theory. Jump straight into configuration, setup, and deployment. Get Agent Sam live today.

How does the AI work? → Knowledge Base Architecture

Understand the three-layer system and how Agent Sam makes decisions.

Ready to scale beyond one agent? → Expanding Beyond Agent Sam

Build a multi-agent ecosystem: Research Agent, Data Room Agent, Engagement Tracking.

Watch Agent Sam interview our co-founder → 5-Minute Demo Video

See how it asks questions, processes answers, and maintains professional conversation flow.

Executive Summary

Fundraising is brutal. Founders spend 40-60% of their time answering the same questions repeatedly: “What’s your current MRR? Who are your competitors? What are your unit economics?”

Meanwhile, the real work: building relationships, delivering compelling pitches, and closing deals, gets squeezed into whatever time remains.

The math is painful: 10-15 hours every week for 2-3 months = 120-180 hours of repetitive work.

But…

What if an AI agent could handle all these repetitive conversations for you?

Imagine this: It’s 2 AM in Tokyo. An investor just read your deck and has questions. Instead of waiting 12 hours for you to wake up in San Francisco, they get answers immediately.

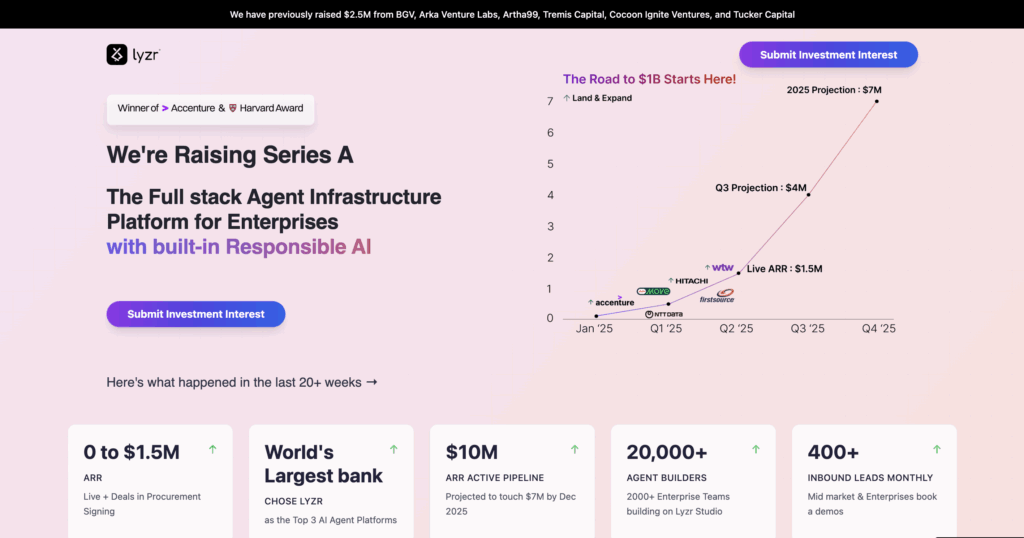

This isn’t theory. Lyzr used this exact approach to build “Agent Sam” while raising our $15M Series A.

The results:

- 30+ qualified investors engaged through the agent

- 10 investors reached due diligence stage

- 90% reduction in time spent on repetitive Q&A (from 120+ hours to 40 hours total)

- Founders focused on high-value relationships instead of answering the same questions 50 times

What This Playbook Delivers

A proven, step-by-step framework for building your own fundraising agent system that:

- 24/7 investor Q&A automation – Answer questions even while you sleep

- Consistent, accurate information – Every investor gets the same quality response

- Scale beyond human limits – Handle 50+ conversations simultaneously

- 20+ hours saved per week – Focus on relationships, not repetitive questions

- Complete strategic control – You stay in charge of all critical decisions

The Approach: Crawl, Walk, Run

- CRAWL Build Agent Sam – Your Investor Q&A Agent (Week 1-2) Start with the proven, lower-risk use case. Get 80%+ of pre-due diligence questions handled automatically. Save 10-15 hours per week. Investors get instant answers. All interactions logged and tracked.

Step-by-step implementation of Agent Sam based on Lyzr’s real experience. Battle-tested and proven.

- WALK & RUN Expand Your Agent Ecosystem (Month 2-3): Build specialized agents that work together as an integrated system. Complete pipeline visibility. Proactive insights. Superhuman fundraising capabilities.

Architecture and examples for expanding to multiple agents. The roadmap for what’s possible.

Why this works: Start with one agent, prove it works, then expand. You’re augmenting your judgment, not replacing it. If Agent Sam doesn’t work, you’ve invested 40 hours, not 200 hours building a complex system.

Who This Playbook Is For

✓ Founders raising Seed, Series A, or Series B rounds

✓ Teams who want to scale fundraising without losing the human touch

✓ Anyone drowning in repetitive investor questions

What You Don’t Need

✗ Deep technical expertise (we’ll walk you through it)

✗ Massive budget

✗ Months of development time (get Agent Sam live in 1-2 weeks)

Critical Principle: Agents augment, never replace. You stay in complete control of all strategic decisions, relationship building, and deal closing. This playbook shows you how to build an AI Chief of Staff, not an autopilot.

Let’s build your fundraising advantage.

CRAWL – Build Agent Sam

Phase 1: Think Like a Product Manager First

Timeline: Week 1 (Days 1-5)

Here’s where most people mess up, they rush to build the agent. DON’T.

This week is about thinking like a product manager, understanding what investors actually ask before due diligence so your agent can handle those questions confidently.

Step 1: Map the Question Landscape

Work with your CFO/Financial lead to dig into past conversations: emails, recorded calls, meeting notes. Categorize questions by theme:

- Financials (ARR, MRR, burn rate, runway)

- Market & Competition (TAM, competitive landscape, differentiation)

- Operations & Team (org structure, key hires, culture)

- Product & Sales (product roadmap, customer acquisition, retention)

- Vision & Strategy (long-term goals, exit strategy)

If you’re fundraising for the first time: Start simple. Use YC’s standard investor question list, talk to a few founders who’ve recently raised, and anticipate questions from your pitch deck. Aim for 20–30 FAQs to start, expand as new ones come in.

Step 2: Build Your FAQ Bible

Each FAQ should do four things:

- Answer the question clearly – provide the exact number or fact.

- Add context – explain the why behind the answer.

- Show proof – include data, charts, or benchmarks.

- Set guardrails – define what the agent can or can’t disclose and how it should handle off-limits queries.

Example:

Question: What is your current MRR and growth rate?

Answer: $125K as of Q2 2025, growing 35% month-over-month.

Context: Growth driven by enterprise expansion (60%) and product-led growth in mid-market (40%).

Proof: MRR grew from $75K in Q1 to $125K in Q2; projected $180K in Q3.

Guardrail: If asked for customer-level data, respond: “I can share aggregate figures, but contract details are confidential. Our CEO can discuss specifics with qualified investors.”

The goal: anticipate the follow-up questions.

When an investor asks, “What’s your MRR?”, they’ll likely follow with “What’s driving that growth?” or “Which segments are growing fastest?” Write your FAQ so Agent Sam can cover all those layers in one go.

Step 3: Build Your Knowledge Foundation

Required Documents Checklist:

- Pitch deck (latest version)

- Financial model (3-year projection)

- Customer case studies

- Product roadmap

- Competitive analysis

- Team bios and org chart

- Cap table (anonymized version for initial sharing)

- Existing investor information

- Press coverage and testimonials

- Technical architecture documentation

Phase 2: Building with Lyzr Studio

Now we get to the fun part!

All that prep work you just did? we’re putting it into action.

→ Start Building in Lyzr Studio

Think of Lyzr Studio as your agent-building toolkit with built-in safety rails. You don’t need to be a coding expert – it handles the complex stuff so you can focus on what your agent should actually do.

Step 1: Agent Configuration

Setting Up Your Agent’s Identity

Agent Identity:

- Name: Agent Sam (or your chosen name)

- Role: Specialized investment agent

- Goal: “Provide accurate, contextual responses to pre-due diligence inquiries while maintaining professional tone and ensuring data security”

- Instructions: Define how your agent behaves, what tone it uses, when to escalate to humans, and what information to share (or not share).

Step 2: LLM Selection and Optimization

Picking the Right Brain for Your Agent

We tested a bunch of AI models for Agent Sam. Here’s why Claude Won for Agent Sam:

- Financial Accuracy: Better precision with complex metrics and ratios

- Contextual Awareness: Excellent at maintaining context across multi-part questions

- Risk-Aware Responses: More conservative about information certainty – crucial for investment discussions

- Professional Tone: Naturally maintains formal, precise tone investors expect

→ Try Different Models in Studio

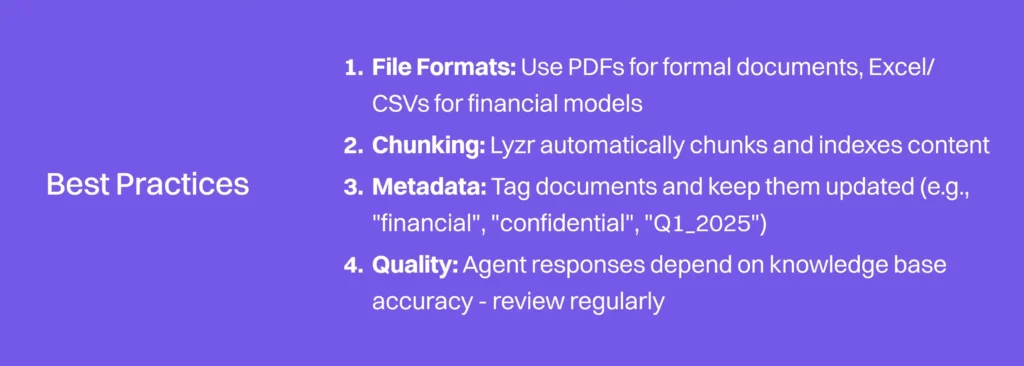

Step 3: Knowledge Base Architecture

Building Your Agent’s Brain – The Three-Layer System

Your agent pulls information from three sources. Each serves a different purpose:

Three-Layer Information Architecture:

1. Core Instructions (Always Active)

What: Rules and identity built into your agent’s prompt

Used for: Agent role, tone, boundaries, escalation rules

Example: “You are Agent Sam. Be professional. Escalate pricing negotiations to founders.”

2. Vector Database (Retrieved on Demand)

What: Documents the agent searches when needed

Used for: Pitch decks, case studies, product docs, FAQs, market research

How it works:

Investor asks: “Tell me about your customers”

→ Agent searches pitch deck, case studies, testimonials

→ Combines relevant sections into answer

Technology: Qdrant

3. Structured Data (Live Queries)

What: Real-time API connections to your business systems

Used for: Stripe (MRR/ARR), HubSpot (pipeline), Carta (cap table), analytics (metrics)

How it works:

Investor asks: “What’s your current MRR?”

→ Agent queries Stripe API right now

→ Returns today’s number: “$125K”

How These Work Together

When an investor asks: “How’s your revenue trending and who are your customers?”

The agent automatically:

- Checks instructions: Is revenue data shareable? ✓

- Queries Stripe API: Current MRR = $125K, last month = $92K

- Searches vector DB: Customer logos and case studies

- Synthesizes answer: “Our MRR is $125K, up 35% from last month. Key customers include Accenture, AWS, and AirAsia. Here’s a case study…”

Lyzr Studio handles this orchestration automatically – you just configure what goes where.

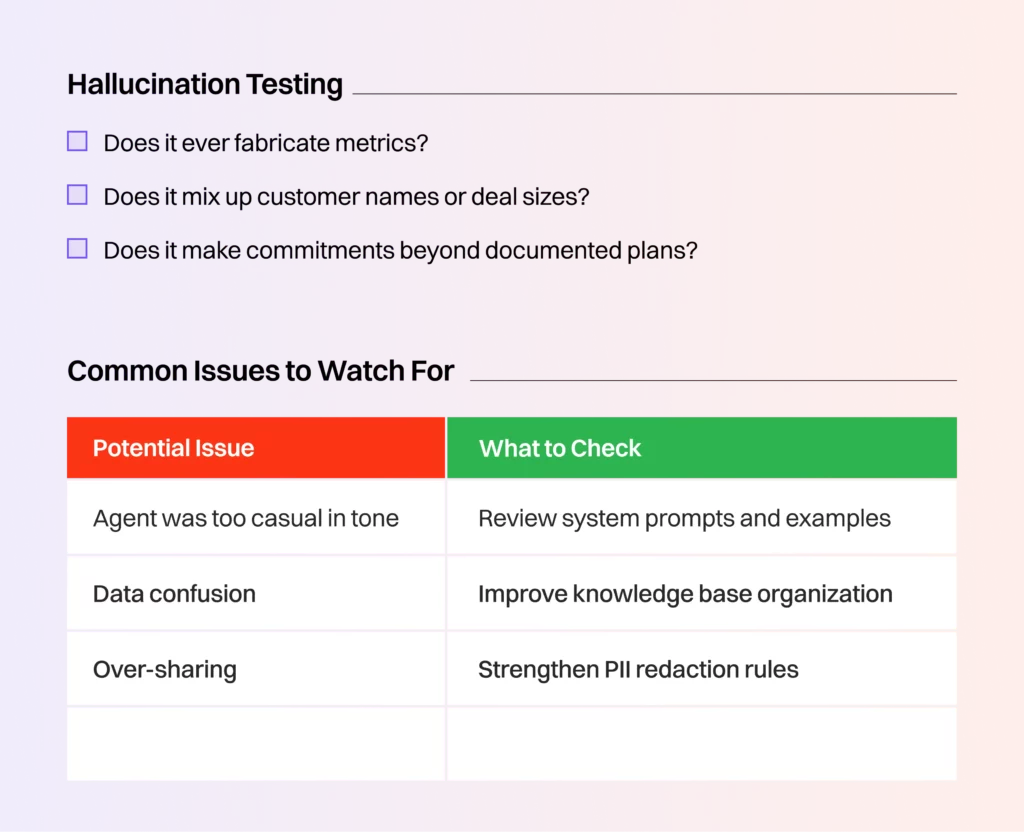

Step 4: Responsible AI & Safety Features

Making Sure Your Agent Doesn’t Embarrass You

Lyzr includes built-in safety features: hallucination detection, groundedness checking, PII redaction, bias monitoring, toxicity filtering, and human-in-loop escalation.

Enable them all. Seriously. It’s like wearing a seatbelt – you hope you don’t need it, but you’ll be glad it’s there.

These features ensure your agent:

- Only shares verified information from your knowledge base

- Never fabricates metrics or makes up data

- Automatically redacts sensitive personal information

- Flags sensitive questions for human review before responding

- Maintains professional, unbiased communication

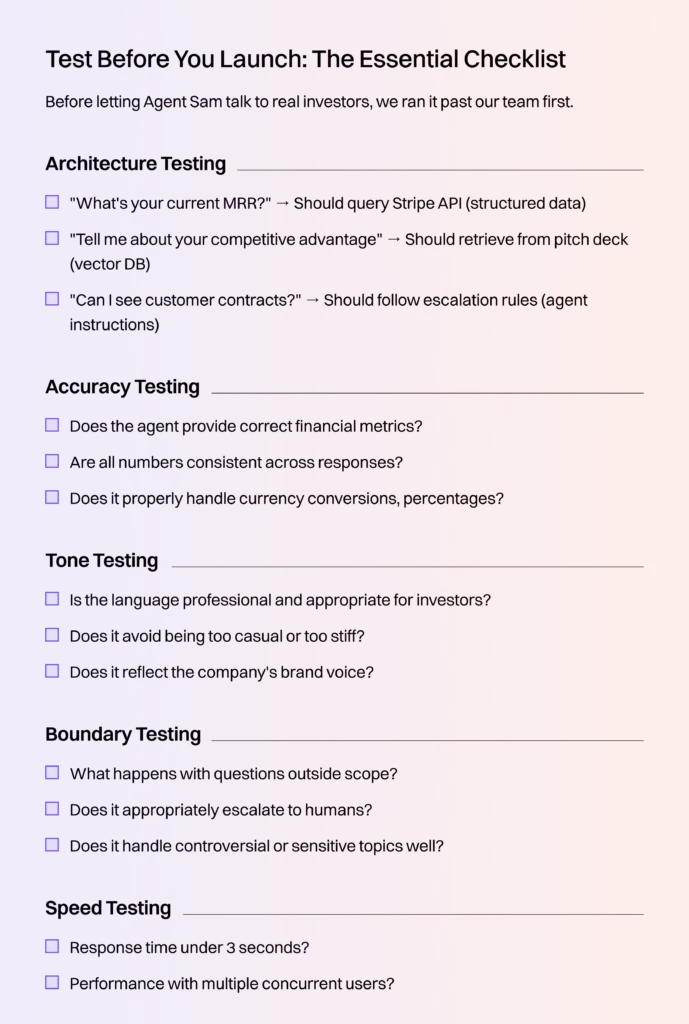

Step 5: Deploy and Monitor

Launch It and Watch What Happens

Deploy: Hit launch in Lyzr Studio. It automatically creates a chat interface you can share right away – send the link to your team first, then to investors.

Want a custom look? Use Lyzr’s API (we’ll cover that in Phase 3).

Monitor: Track agent performance in Lyzr Studio’s observability dashboard:

- Usage metrics – Total conversations and activity

- Real-time monitoring – Live performance tracking

- Filtering – View by user, agent, or time period

- Analytics – Understand engagement patterns

Why Monitoring Matters:

- See patterns → If everyone asks about pricing, beef up that section

- Catch problems → Agent running slow? Fix it before investors notice

- Learn what matters → What investors focus on tells you what they care about

This data is gold for refining your pitch and your agent.

Want to see all this in action first? Explore pre-built agent templates in Lyzr Studio → Browse Agent Marketplace

Phase 3: Making It Look Like Yours (Custom Frontend)

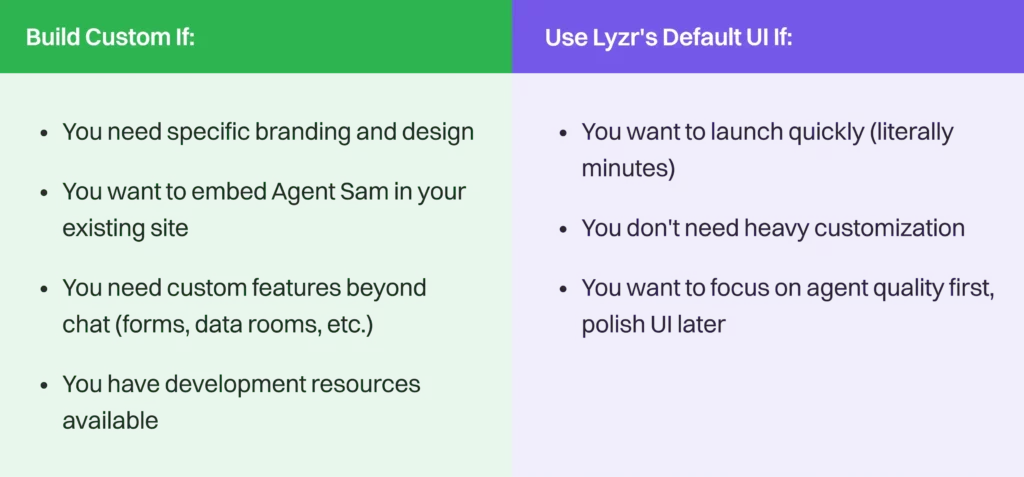

Agent Sam works perfectly with Lyzr’s auto-generated UI. But if you want a branded experience, you can build a custom frontend.

From Studio to Production: Agent Sam’s Journey

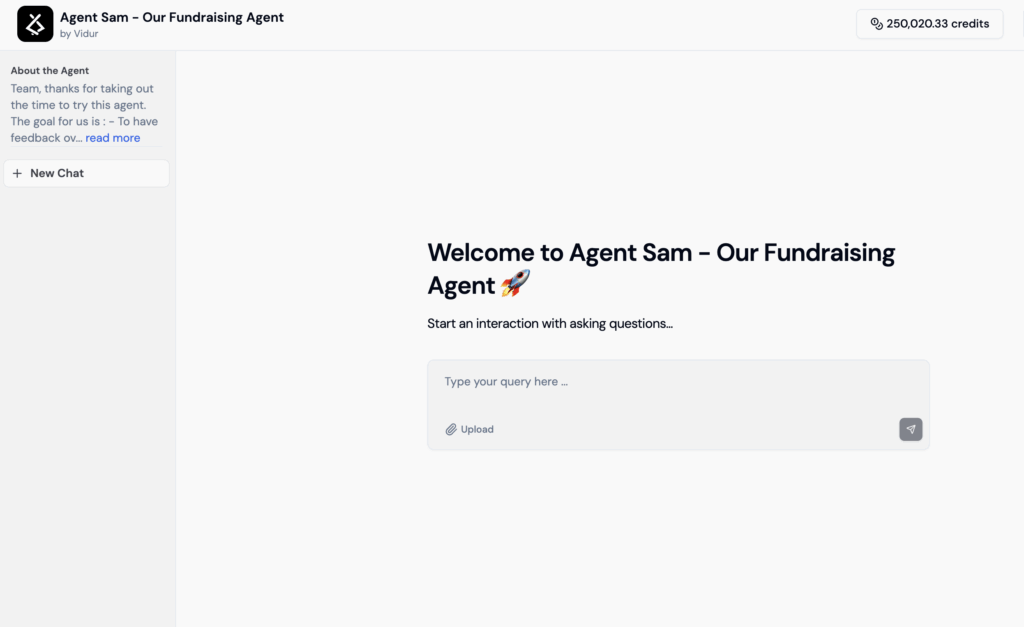

Step 1: We built Agent Sam in Lyzr Studio

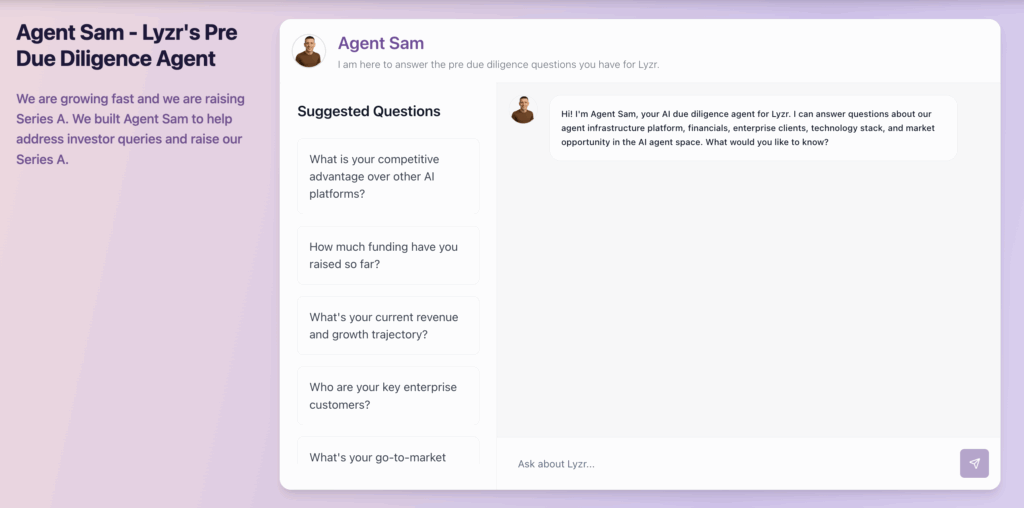

This is what it looked like right out of the box:

Clean, functional, and perfect for testing. Investors could ask questions and get accurate answers immediately. But it looked like a tool, not our brand.

Step 2: We integrated it into our custom investor site

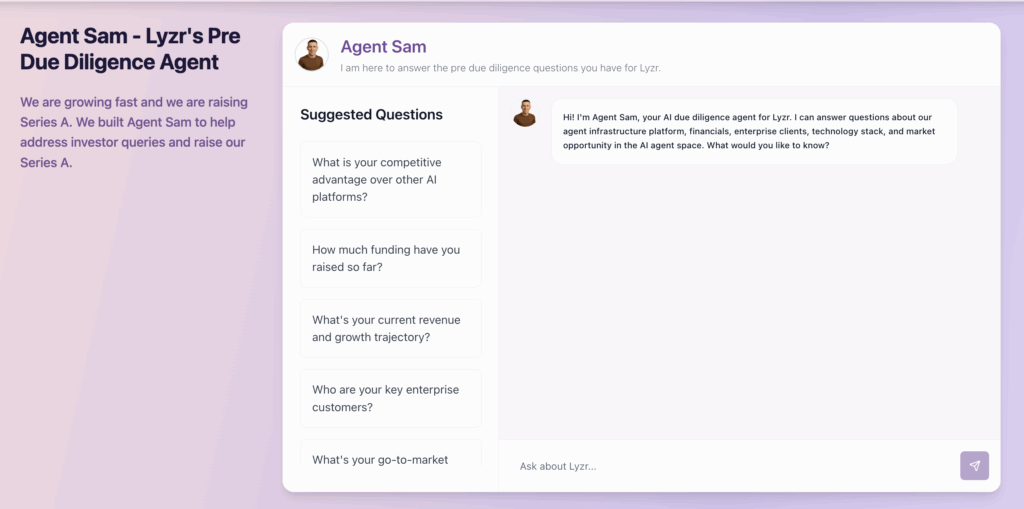

Image : What Lovable (an AI frontend builder) + Lyzr’s Agent API looks like

Same agent, same intelligence, but wrapped in a branded experience:

What Changed?

- Branded landing page with company overview

- Custom chat interface integrated with Agent Sam

- Investor application flow with gated data room

- Live deal tracker showing recent partnerships

- Embedded founder interview video

What stayed the same?

- Agent Sam’s intelligence (same prompts, same knowledge base)

- 24/7 availability and instant responses

- All the Lyzr Studio features (memory, safety checks, tools)

Result: Professional, branded experience while Agent Sam handled all investor Q&A

Professional brand experience + AI efficiency = investor confidence.

When to Build Custom vs. Use Default

Lyzr’s Lesson: We built custom for branding, but the agent API integration took minimal time. Focus on agent quality first, polish UI later.

The Investor Experience

1. Discovery

Investors find Agent Sam through our landing page (shared via email, LinkedIn, warm intros)

2. Landing Page

- Company overview and key metrics (Live ARR: $1.5M, projecting $7M by year-end)

- Customer logos (Accenture, AWS, AirAsia, etc.)

- “Submit Investment Interest” CTA

3. Video Interview

12-minute founder interview where Agent Sam asks CEO about Lyzr’s vision, traction, and funding use.

Why This Works:

- Investor hears directly from founder (authenticity)

- Pre-recorded = time-efficient for founder

- On-demand = convenient for investor

- Consistent message to all investors

4. Interactive Q&A

Investors chat with Agent Sam, who answers questions using the knowledge base in real-time

Suggested Questions Displayed:

- “What is your competitive advantage over other AI platforms?”

- “How much funding have you raised so far?”

- “What’s your current revenue and growth trajectory?”

- “Who are your key enterprise customers?”

- “What’s your go-to-market strategy?”

- “What are the main use cases for Lyzr?”

Investor Interaction Example:

Agent Sam Capabilities:

- Real-time responses – Answers investor questions immediately

- Source citations – References specific documents from knowledge base

- Contextual conversations – Remembers earlier questions using short-term memory

- Strategic escalation – Hands off complex discussions to founders (handled 60-70% of process, escalated final 30% to humans)

5. Application & Qualification

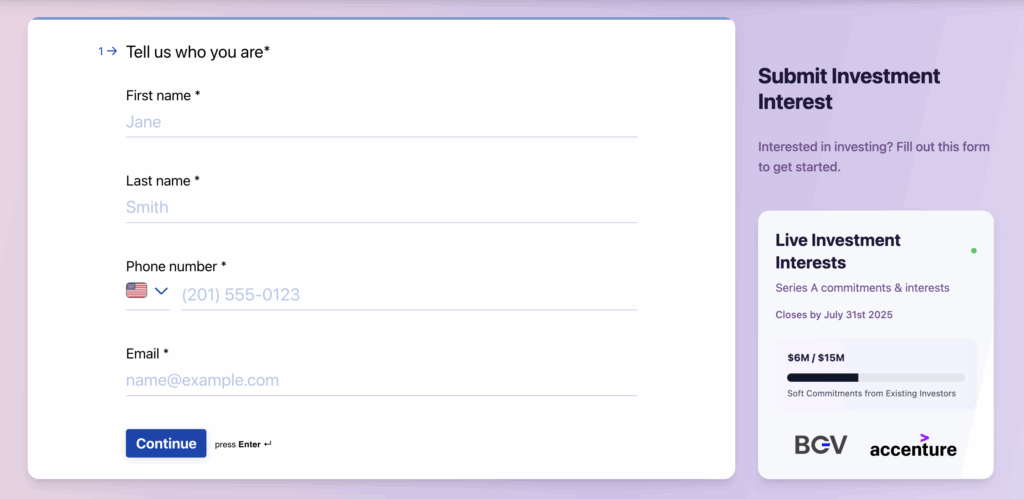

Investment Interest Form Investors submit contact information and investment details through a multi-step form.

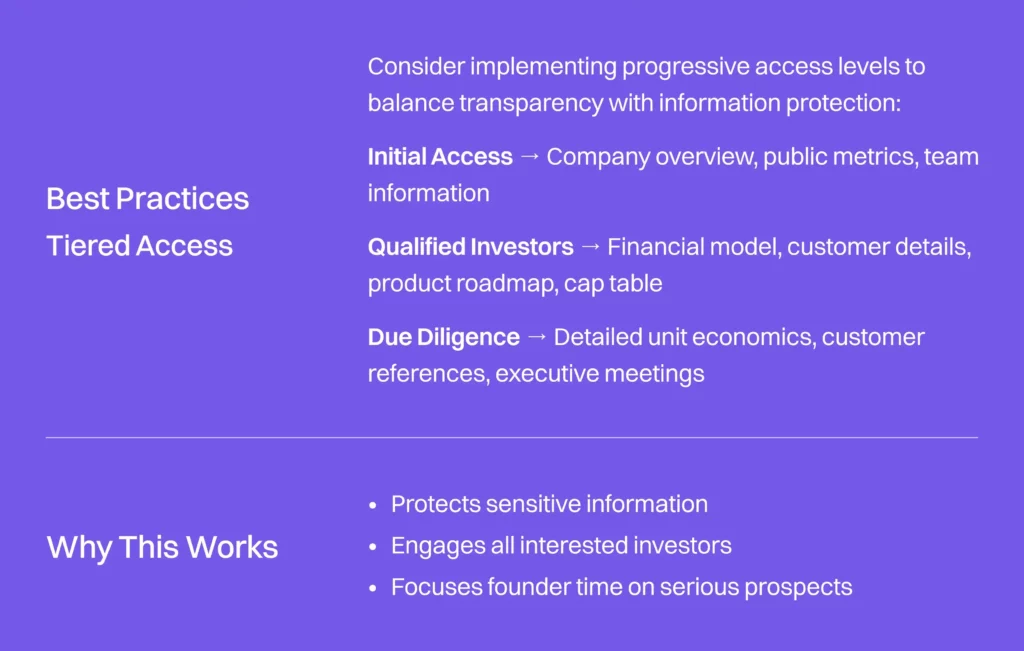

Post-Submission:

- Tiered access to automated data room

- Lyzr team receives notification for review

6. Data Room Strategy

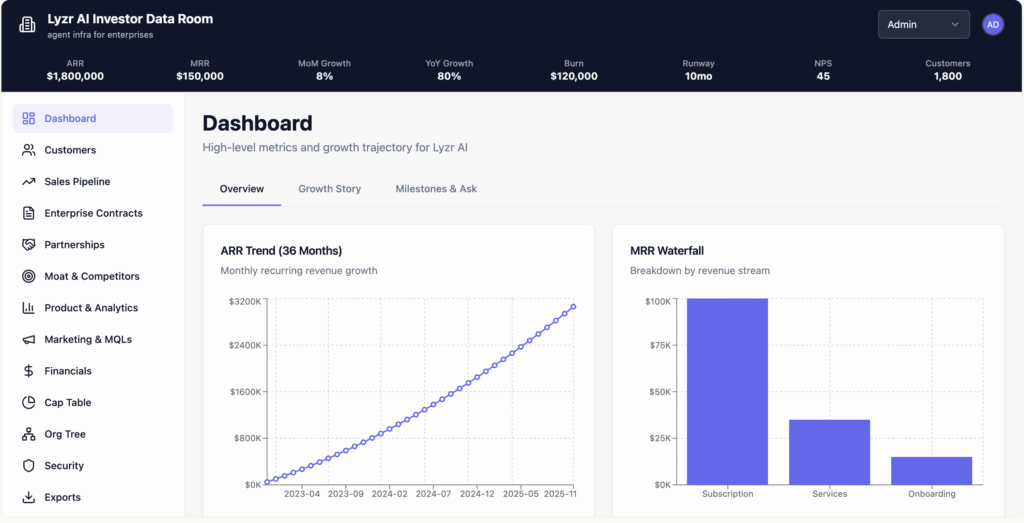

What Lyzr Did:

Provided investors with an automated data room containing key business metrics; ARR and growth data, customer pipeline, product analytics, cap table, and financial projections. Access was gated based on application and qualification status.

Rather than building from scratch, we’ve created something to help.

The Lovable Data Room Prompt Builder generates a complete, production-ready data room interface based on your specifications:

Image: Sample data room dashboard built with Lovable Prompt Builder

How it works:

- Describe your data room requirements (company info, document categories, access tiers)

- The agent generates a detailed one-shot Lovable prompt

- Use that prompt in Lovable to build your complete data room interface

- Connect it to your Data Room Agent via Lyzr’s API

→ Generate Your Data Room Prompt

What Agent Sam Can’t Do (And Shouldn’t Try)

1. Replace You

Investors invest in people. Agent Sam handles facts, but it can’t show:

- Personal motivation and conviction

- Resilience and adaptability

- Authentic human connection

- Strategic judgment under pressure

Our Reality Check: Agent Sam handled 60-70% of investor interactions: answering questions, sharing data, and qualifying prospects. But the final 30% required human connection.

As Anirudh, Lyzr’s co-founder stated: “No one is writing a US$2 million check without talking to the founder.”

2. Answer the Hard “What If” Questions

When investors ask stuff like:

- “What if your main market collapses?”

- “What happens if Google copies you tomorrow?”

- “Explain the IP behind your tech”

These need your strategic brain, not just data lookup. Agent Sam knows when to say “Let me connect you with the founder.”

3. Build Real Relationships

Fundraising is personal. Investors want to know if you listen, if you can build a team, if you stay calm under fire. An AI can’t show them that – only you can.

4. Negotiate Terms

Agent Sam doesn’t (and shouldn’t) negotiate:

- Valuation

- Board seats

- Liquidation preferences

- Pro-rata rights

- Founder vesting

These are sensitive, high-stakes discussions requiring founder judgment.

Watch Out For These Risks

- Accuracy Issues: We fixed this with groundedness checks, live data from Stripe/Carta, and audit trails on every conversation.

- Over-Reliance: Review your agent’s conversation logs weekly. You’ll spot patterns in what investors care about – use that to sharpen your pitch.

- Sounding Generic: Good news: great founders still stand out. The agent saves time; your vision and conviction are what close deals.

Bottom Line: Use AI to create more time for meaningful conversations with investors, not to avoid them.

WALK & RUN – Expanding Beyond Agent Sam

Timeline: Months 2-3 (After Agent Sam Proves Itself)

Okay, Agent Sam is crushing it with investors. Now let’s talk about expanding.

But Before You Expand: Are You Ready?

Only expand if:

- Agent Sam has been live for at least 2 weeks

- You’ve handled 20+ investor conversations through the agent

- You’ve identified gaps or manual tasks that agents could automate

- You have a functional investor data room

- You actually have time to build and maintain more agents

If you haven’t built Agent Sam yet, start there first, it only takes about 20 minutes → Build Agent Sam in Studio

The Vision: Your Fundraising Agent Ecosystem

Agent Sam proved AI can handle investor Q&A at scale. But fundraising has tons of other time-sucks:

- Investor research: 30 min per investor, all manual

- Data room management: 5-10 hours/week organizing files and permissions

- Engagement tracking: Daily spreadsheet updates (ugh)

- Follow-ups: Remembering who to ping and when

Each one is a chance to build a specialized agent. Together? They cut your fundraising busywork by 80-90%.

But Let’s Be Clear: These Are Admin Tasks, Not Strategy

The Rule: Human-in-Loop

Agents do the work that doesn’t need judgment (gathering data, organizing files, sending reminders). You make the calls that do need judgment (which investors matter, what terms work, how to position yourself, when to share sensitive info). Always keep yourself in the loop.

Start with the agent that solves your biggest headache, validate it, then expand gradually.

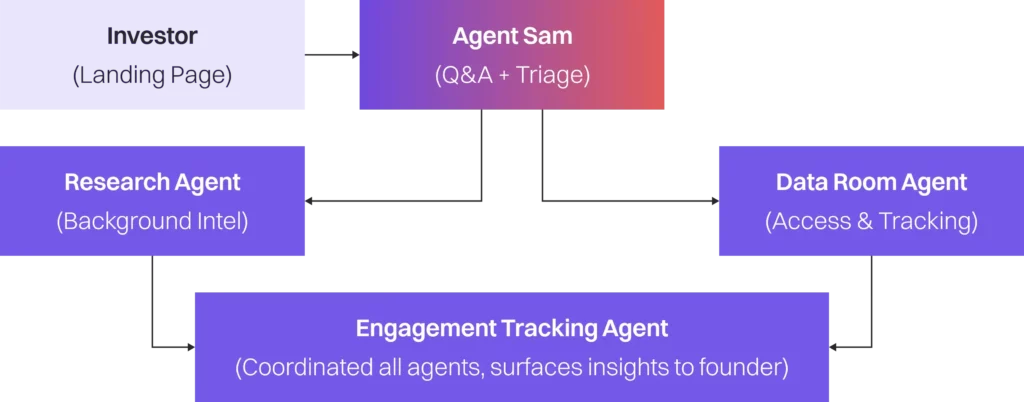

The Three Agent Types for Expansion

1. Investor Research Agent: Finds and analyzes investors automatically. It scrapes websites, LinkedIn, portfolios, and interviews to generate one-page briefings, saving roughly 30 minutes per investor.

2. Data Room Agent: Sorts and manages your documents, grants tiered access, and tracks investor activity, saving 5–10 hours a week during active fundraising.

3. Engagement Tracking Agent: Monitors every interaction (Agent Sam, email, calls), scores investors based on engagement, and recommends next steps saving 2–3 hours a week.

How Agents Work Together (RUN Phase)

When you’re ready to orchestrate multiple agents, they work as a coordinated system.

Example: “New Investor Inquiry” Workflow

- Agent Sam engages with investor, answers initial questions

- Investor Research Agent automatically researches the fund in background

- Data Room Agent grants appropriate access level based on conversation

- Engagement Tracking Agent scores the lead and creates CRM entry

- If high-value investor → system alerts founder with AI-generated briefing

- After founder call → Follow-up Agent sends thank you and next steps

Outcome: You get superhuman fundraising support that runs while you sleep. You stay the conductor, not the worker.

Multi-Agent Orchestration in Lyzr Studio

Agents communicate via webhooks, share a common knowledge base, and pass context between them. The visual workflow builder lets you define triggers and logic like:

- If investor score >80 → trigger hot lead workflow

- Every Monday at 9 AM → run pipeline report

A central Manager Agent coordinates everything and delivers daily insights straight to you.

Beyond Fundraising: Investor Relations Agent

Once the round closes, you’ve got a new job: keeping investors updated every month. The Investor Relations Agent pulls live data from tools like Stripe or QuickBooks, drafts consistent updates, and sends them automatically, saving 4–6 hours a month and ensuring no updates are missed.

This is especially useful post-Series A when you’ve got board members and stakeholders expecting regular communication. And here’s the bonus – all the infrastructure you built for fundraising? You just repurpose it.

What You’ll Have by Month 3

If you build even 2-3 agents beyond Agent Sam:

- 80-90% less admin work

- Professional investor experience everywhere

- Zero dropped leads or forgotten follow-ups

- Real-time view of your pipeline

- You focus on relationships and closing, not spreadsheets

You go from drowning in busywork to having an AI team that handles operations while you do what only you can do: build relationships and close deals.

You’ve Reached the End, Now It’s Time to Build

You now have everything you need to build Agent Sam and automate 80-90% of your fundraising busywork.

Your Unfair Advantage

While other founders drown in repetitive questions and scramble to track 50+ investor conversations, you’ll have Agent Sam handling Q&A 24/7, perfect records of every interaction, and real-time visibility into your pipeline.

You’re building. They’re stuck in spreadsheets.

Final Thoughts from Lyzr’s Co-Founder

“At the end of the day, you still have to show up. The agent opens doors, but the founder closes deals. What we’ve done is eliminate the 80% of work that doesn’t require founder genius, so founders can focus on the 20% that does.”

– Anirudh Narayan, Co Founder, CGO

Now go build.

Ready to Start? Here’s Your Next 30 Minutes

1. Start Building Immediately (Recommended)

Jump into Lyzr Studio and build Agent Sam using this playbook as your guide.

Start here → Explore Lyzr Studio

2. See It First

Not ready to build yet, but curious? → Book a Demo

3. Go Deeper

Want to understand the technical details before building? → Lyzr Documentation

The founders who act fast, win fast. While other founders are still drafting spreadsheets, you could have Agent Sam live by Friday.