- Lyzr Marketplace

- Legal

- Real Estate Title Review Agent

Real Estate Title Review Agent

Title reviews often involve tedious document checks, cross-verifications, and risk assessments across multiple sources. The Real Estate Title Review Agent accelerates this workflow by analyzing ownership history, flags, encumbrances, and document inconsistencies with high accuracy.

- Title Operations Managers

- Real Estate Compliance Heads

- Mortgage Underwriting Leaders

Trusted by leaders: Real-world AI impact.

The problems we hear from leaders like you

Title examination teams face information overload, fragmented records, and rising accuracy demands — slowing down approvals and increasing operational risk.

Manual review overload

Teams spend hours combing through deeds, liens, tax records, and legal documents manually, increasing turnaround time and cost.

High risk of missed red flags

With scattered data sources and heavy workloads, critical issues such as undisclosed liens, ownership gaps, or conflicting records may get overlooked.

Inconsistent reporting standards

Different examiners follow different review styles, making reports inconsistent and harder to audit or validate, especially across high-volume operations.

Slow borrower and realtor response cycles

Delays in title clearance stall entire real estate transactions, causing friction and increasing pressure on underwriting and closing teams.

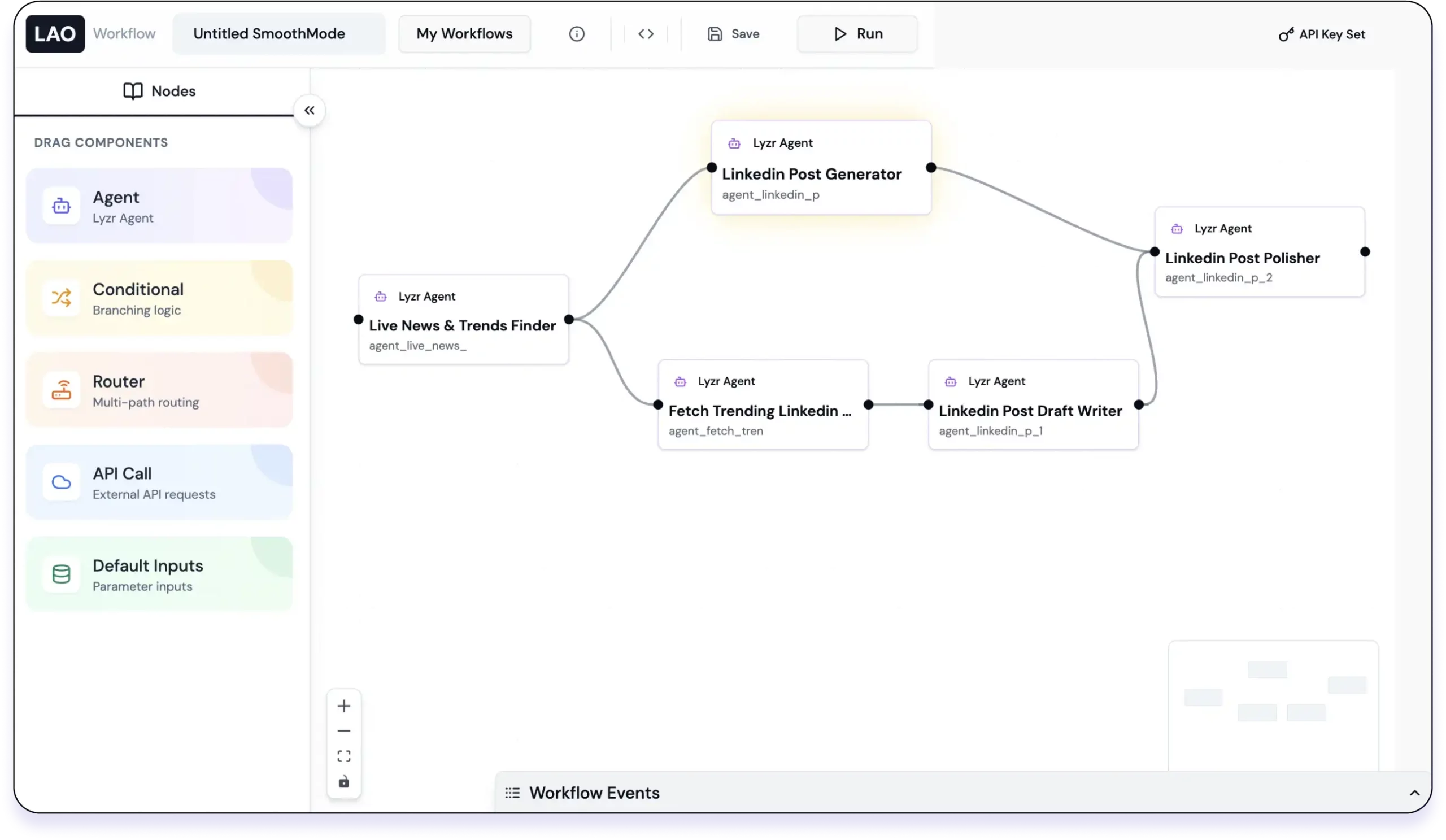

Agent workflow for regulatory monitoring

Why Leading

Organizations Choose Lyzr?

Lyzr provides the full-stack platform to transform your business functions into a unified Agentic Operating System, guaranteed.

Data Privacy & IP Ownership

Agents run in your cloud/on-prem.

We

guarantee zero access to your data, ensuring

100% privacy that your AI workforce is

always your unquestionable IP.

Full Flexibility,

Zero Vendor Lock-In

Integrate Lyzr as a plug-and-play solution within your existing ecosystem. No forced migration, no vendor dependency, just pure value.

Scalability & Real-Time

Customization

Start with one agent and build toward an Agentic OS for the entire function. Full control lets you customize and deploy changes in real-time.

Agentic Operating System

for your org

Unify your agents on a central knowledge graph to unlock the next-level enterprise intelligence: OGI.

Quantifiable value for your institution

Automated document review and structured analysis help institutions cut delays and improve accuracy in title operations.

- 65%

faster title examination, reducing manual review efforts

- 50%

fewer missed discrepancies through structured, AI-driven checks

- 40%

lower operational overhead, especially in high-volume workflows

- 30%

decrease in closing delays, improving turnaround across the transaction cycle

Outcomes you can expect

The Real Estate Title Review Agent brings speed, reliability, and structure to title review workflows.

Faster and more reliable title checks

Automates extraction, cross-checking, and anomaly detection across deeds, lien records, and ownership documents.

Consistent examiner-ready summaries

Produces standardized, clear, and audit-friendly reports, reducing discrepancies between examiners.

Reduced risk exposure

Highlights ownership gaps, pending litigation, lien issues, and conflicting information before they escalate.

Smoother loan and property closing cycles

Accelerates clearance steps so borrower, lender, and realtor timelines stay aligned without last-minute blockers.

How to start building from here

The journey from a promising pilot to a deployed solution can be a challenge. We are your partner in implementation, sharing the risk and ensuring your AI agents make it to production. We don't just provide a platform; we provide a clear pathway to success.

Dedicated AI expertise

We invest in a Forward Deployment AI Engineer (FDE) to work directly with you. Our FDE acts as a hands-on AI startup CTO for your project.

A partner in risk management

We take on the risk of ensuring your agent goes from concept to a fully functional, production-ready solution. We'll work with you every step of the way to get you live.

Strategic guidance & workshops

Our dedicated team will provide strategic guidance and training sessions, empowering your internal teams to own and scale your AI capabilities once your first use case is live.

Project management oversight

We assign a project manager to oversee your agent's journey, providing a clear roadmap and ensuring a smooth, frictionless path to production.

Agents used for this use case.

The Regulatory Monitoring Agent is often built on a combination of specialized agents. Here are some you can use to enhance this use case on the Lyzr platform:

- KYC Processing Agent

- Fraud Detection Agent

- AML Agent

- Legal Document Drafting Agent

- Compliance Agent

Frequently asked questions

It analyzes property records, deeds, ownership history, liens, encumbrances, and legal documents to produce a structured title review summary. It flags potential issues early so teams can validate and take action quickly.

It automates data extraction from uploaded documents and third-party property record sources. This eliminates manual scanning and lets examiners focus on the validation of findings instead of searching for information.

Yes. The agent checks for gaps in ownership history, inconsistent legal descriptions, missing signatures, unrecorded liens, and mismatched property identifiers.

It can connect with internal systems and external APIs depending on the institution's setup, allowing access to tax records, lien databases, and property registries where supported.

By following a standardized review approach across all files, it reduces variability across examiners and ensures every file undergoes the same level of scrutiny.

Yes. Faster identification of title issues shortens the time borrowers and realtors wait for clearance, reducing delays in loan processing and closing.

No. It acts as an intelligent assistant that handles the heavy research and document analysis workload, while examiners make the final decision.

Absolutely. Any organization that handles title reviews, property risk checks, or closing workflows can use the agent to increase speed and consistency.

It flags suspicious discrepancies such as conflicting seller information, forged documents, or irregular patterns that warrant deeper examination by experts.

Accuracy improves through structured document parsing and rule-based checks. Human reviewers still validate critical findings, ensuring reliability without losing control.

Build your first AI workflow today.

Start with a blueprint. Launch it. Customize it. Deploy it. All inside Lyzr.