Table of Contents

ToggleOver 300,000 NDAs are signed daily across global enterprises, making them one of the most common legal documents in business.

Yet, what should be a quick formality often becomes a bottleneck. Even a simple NDA typically takes 3–7 days to finalize due to back-and-forth reviews, version tracking, and delayed responses.

For large banks and financial institutions, the scale magnifies this problem.

Hundreds of NDAs flow through their systems each quarter, tying up legal teams in repetitive reviews and slowing partnership development. The costs extend beyond wasted hours to delayed deal execution and strained internal resources.

When a leading Australian bank faced this challenge, Lyzr demonstrated how specialized AI agents could handle NDA negotiations end-to-end—faster, compliant, and without overwhelming human teams.

A Leading Australian Bank’s Challenge

For one of Australia’s largest banks, NDA negotiations had become a persistent bottleneck in forming new partnerships. Every engagement, whether with a fintech, a technology vendor, or a strategic partner, began with an NDA. With hundreds of agreements processed each quarter, the cycle consumed excessive time and resources.

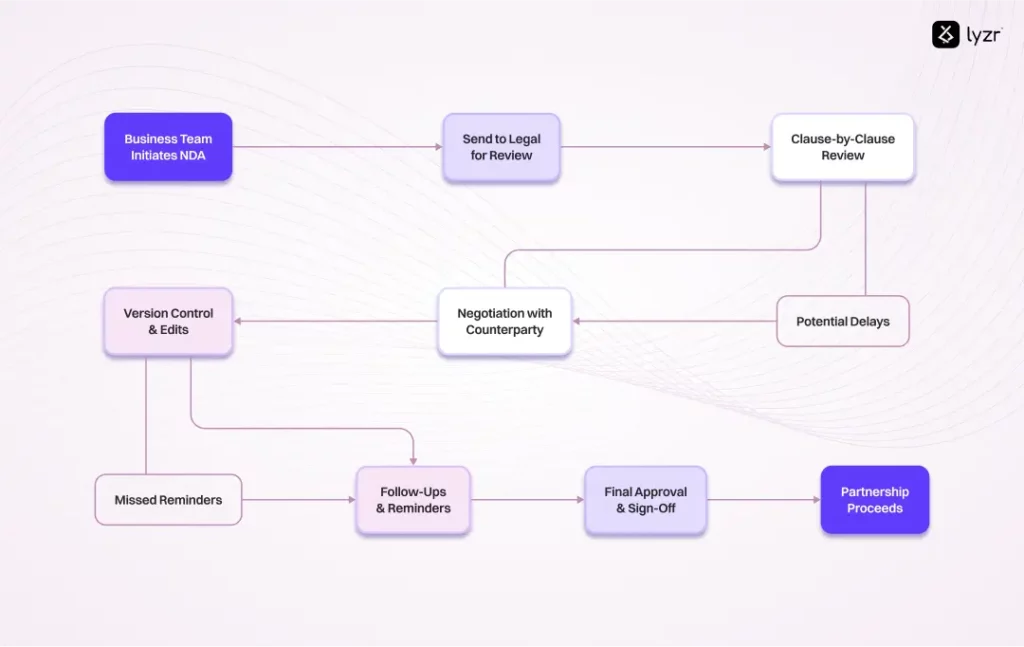

The legal team spent dozens of hours each week on repetitive reviews. Standard clauses were checked repeatedly, version control added friction, and delays stretched a days-long task into weeks.

Manual NDA Negotiation Cycle

Key challenges:

- Slow deal initiation – Partnerships stalled at the NDA stage.

- Overextended legal resources – Teams focused on low-value, repetitive work.

- Operational inefficiency – Business teams struggled to move opportunities forward.

Lyzr’s Approach

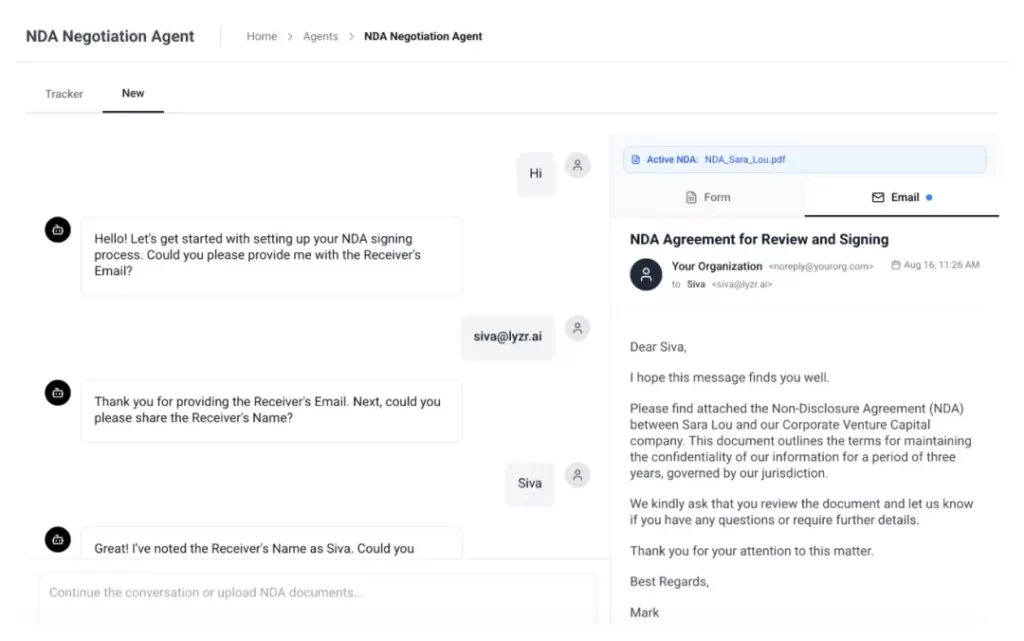

To address the bank’s NDA bottleneck, Lyzr built a specialized AI negotiation agent designed to manage the process end-to-end while upholding strict compliance standards. The objective was clear: reduce turnaround time, minimize repetitive legal effort, and preserve trust with responsible AI guardrails.

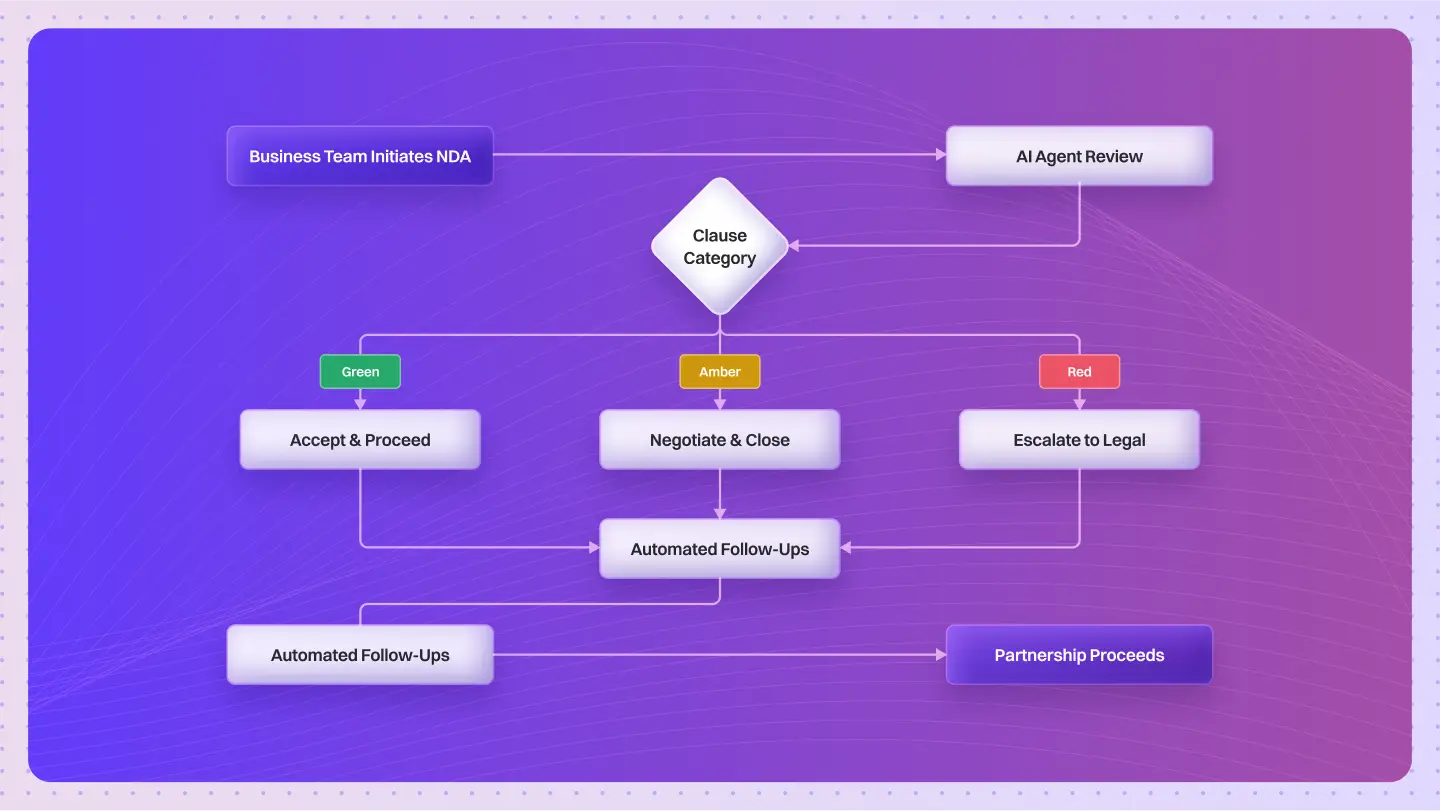

1. Negotiation Logic Adapted to Clause-Level Nuance

The agent applied structured decision-making to every clause, ensuring agreements moved forward smoothly without unnecessary escalation.

2. Human-in-the-Loop Control

Legal teams remained engaged only where critical judgment was required, freeing them from repetitive reviews.

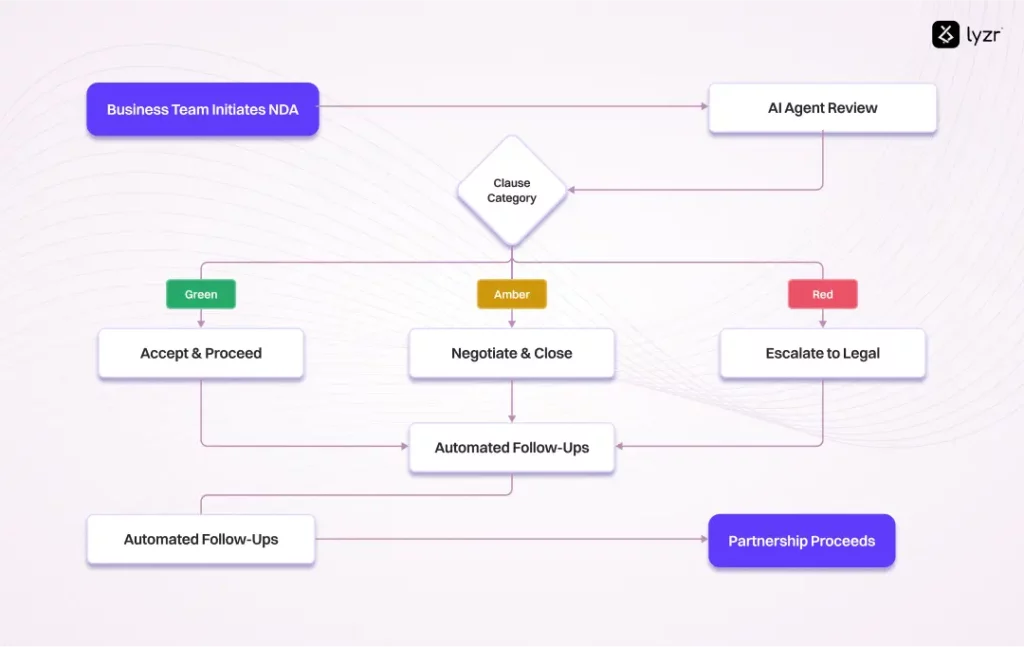

3. Traffic Light Negotiation Framework

- Green – Acceptable clauses processed as-is.

- Amber – Clauses flagged for bargaining and closure.

- Red – Escalated directly to the legal team for judgment.

4. Responsible AI by Design

Hallucination checks, bias detection, audit trails, and permission layers ensured reliability, compliance, and transparency throughout the process.

By embedding these principles, the AI agent not only automated the workflow but also mirrored the discipline of legal review, creating a trusted system that the bank’s compliance teams could confidently adopt.

Results & Impact

The introduction of Lyzr’s NDA negotiation agent delivered measurable improvements across speed, efficiency, and resource utilization.

Key Outcomes

- 5× faster turnaround – NDAs completed in days, not weeks.

- 80% human hours saved – Legal teams redirected capacity to higher-value work.

- 0 missed follow-ups – Automated reminders ensured every NDA moved forward.

Before vs After

| Metric | Manual Process | AI Agent Process | Impact |

|---|---|---|---|

| Average Turnaround Time | 5–7 business days | 1–2 business days | 5× faster execution |

| Human Hours per NDA | ~3–4 hours | <1 hour (20% oversight) | 80% hours saved |

| Follow-Up Compliance | Frequent delays/missed | 100% automated & timely | 0 missed follow-ups |

| Legal Team Involvement | Every agreement, end-to-end | Only “Red” clauses | Focused on critical decisions ⚖️ |

By automating the repetitive cycles while keeping oversight intact, the bank accelerated deal initiation and freed its legal resources for strategic work.

Wrapping Up

The NDA negotiation agent built on Lyzr demonstrated how AI can address one of the most persistent bottlenecks in enterprise partnerships. By combining structured negotiation logic with human oversight and responsible AI guardrails, the solution accelerated NDA cycles without compromising compliance.

For the Australian bank, the outcome was clear, faster deal execution, reduced legal workload, and greater operational efficiency.

More importantly, the framework established a repeatable model for handling high-volume, low-variation agreements across the enterprise.

As banks and large organizations continue to seek efficiency in compliance-heavy workflows, this case illustrates the role of AI agents in reshaping document negotiation from a bottleneck into a competitive advantage.

Have a use case in mind? Book a demo with our team

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here