Table of Contents

ToggleTL;DR

AI is transforming insurance customer service by automating policy queries, handling multilingual conversations, and providing faster, more personalized support. This blog explores why traditional methods fall short, how multi-agent systems work, and how Lyzr’s pre-built AI agents help insurers deploy compliant, scalable customer service solutions in days.

Real-world examples span life, health, motor, general, and group insurance.

Explore how you can build and deploy your first insurance support agent using Lyzr Agent Studio.

Disrupting Insurance Support: From Legacy Challenges to AI Transformation

Insurance support operations have long struggled with inefficiencies; fragmented communication, high manual effort, long resolution times, and inconsistent compliance. Traditional call centers and ticketing systems simply can’t keep up with the volume and complexity of modern customer demands.

AI addresses these gaps with precision. Using intelligent agents, insurers can offer always-on, multilingual support that understands user context, fetches the right policy data, and automates resolution. AI agents don’t replace humans; they complement them by handling repetitive tasks, routing complex ones appropriately, and ensuring compliance along the way.

McKinsey reports that up to 60% of customer service tasks in insurance can be automated with AI, reducing costs and improving customer experience at scale source.

Core Benefits of AI-Powered Customer Support

AI-powered support agents don’t just speed up responses; they completely rewire the service model:

- 24/7 Availability: AI agents don’t clock out. They manage tier-1 and tier-2 queries across time zones and languages.

- Hyper-Personalization: Responses are tailored to the user’s policy, history, and intent.

- Compliance-Ready: Every step is logged, auditable, and aligned with regulations like IRDAI, HIPAA, or GDPR.

- Multilingual + Multichannel: Customers can communicate through WhatsApp, chat, email, or voice; in their preferred language.

- Cost-Efficient Scalability: AI agents scale without increasing headcount, ideal during seasonal surges or crises.

Full-Stack Architecture: Multi-Agent Customer Support in Insurance:

Lyzr’s customer support agent stack follows a seamless, modular flow that mirrors the natural path of customer service.

When a query comes in; whether through chat, voice, email, or WhatsApp; it is first processed by an Ingestion Agent, which captures the message and pulls any related customer context from CRM tools like Salesforce or Freshdesk. This query is then passed to a Retrieval Agent, which uses retrieval-augmented generation (RAG) to fetch relevant policy documents, FAQs, or prior claims information from vector databases.

Next, a Response Generation Agent uses LLMs to create a context-aware reply grounded in the retrieved data. A Sentiment Analysis Agent simultaneously evaluates the tone of the customer to detect urgency or frustration. If needed, the Escalation Agent steps in, routing the ticket to the right internal department; underwriting, legal, or fraud; based on priority or intent. Every step in the process is captured by a Logging and Audit Agent, ensuring compliance and traceability for future reviews.

Together, these agents form a cohesive support engine that operates in real time, is customizable per product line, and adheres to regional compliance norms.

P.S: Here are 50+ use cases that we automate for Enterprises

Real-World Use Cases Across Insurance Lines”:

Life Insurance: Lyzr agents help customers update nominees, understand premium due dates, and navigate the process of claim settlement. By accessing user history and policy documents, the agent provides personalized advice while triggering alerts for sensitive requests like policy cancellations or deaths.

Health Insurance: Customers frequently ask about cashless hospitals, coverage limitations, or reimbursement processes. AI agents answer these in seconds. When a user uploads a bill or discharge summary, the agent uses OCR and policy logic to verify admissibility; freeing up TPA teams for actual medical claim reviews.

Motor Insurance: Post-accident, customers can upload photos via WhatsApp. AI agents guide them through the damage documentation, schedule garage visits, and estimate coverage eligibility. In fraud-prone scenarios, sentiment and image detection agents can flag inconsistencies before claim processing begins.

Property & General Insurance: During natural calamities like floods, agents answer queries about what’s covered, offer nearest emergency contacts, and process requests in multiple languages. Customers receive location-based support dynamically tuned to regional regulations and coverage clauses.

Group/Corporate Insurance: HR teams of client organizations interact with AI agents to resolve TPA queries, claim escalations, and onboarding support. Rather than sending emails or making calls, HRs use a self-service portal connected to the agent, reducing TAT from days to minutes.

Why Enterprises Choose Lyzr for AI Support Agents

What sets Lyzr apart is the ability to orchestrate multiple specialized agents to work in sync. Instead of relying on a monolithic chatbot, each agent handles a distinct function; retrieval, generation, escalation, audit logging; resulting in higher accuracy, compliance, and customer satisfaction.

Key Capabilities:

- Composable Multi-Agent Design: Tailor workflows per product line or region.

- Secure Deployment Options: Host on-prem, VPC, or hybrid with full data control.

- Drag-and-Drop Agent Builder: Launch agents in Lyzr Agent Studio without writing a single line of code.

- RAG-Enabled Personalization: Ground responses in real documents using vector indexing and retrieval logic.

- Safe & Responsible AI: Includes approval workflows, fallback rules, and human-in-the-loop escalation.

Key Tradeoffs and Deployment Considerations

| Challenge | Description | Mitigation via Lyzr |

| Model Hallucination | AI might fabricate responses | Grounding via RAG + human review |

| Multi-System Integration | CRMs, ticketing tools, emails need sync | Lyzr supports 20+ enterprise connectors |

| Compliance Complexity | Must follow IRDAI, HIPAA, GDPR | Built-in audit logging + safe response agents |

| Cultural Sensitivity | Regional languages, sentiments differ | Sentiment + language detection agents enable localization |

FAQs: AI in Insurance Customer Support

1. What platforms can I use to build AI insurance support agents?

Lyzr, Google Dialogflow, AWS Lex, and Microsoft Copilot are commonly used. Lyzr offers multi-agent architecture and insurance-specific templates.

2. Is it secure to use AI for customer-facing insurance interactions?

Yes. Platforms like Lyzr support deployment in Virtual Private Clouds (VPCs), ensuring that sensitive customer data never leaves the enterprise perimeter.

3. How long does it take to deploy AI support in an insurance firm?

Lyzr can deploy a prototype in 7 days. Full deployment with CRM integration and compliance workflows typically takes 3–6 weeks.

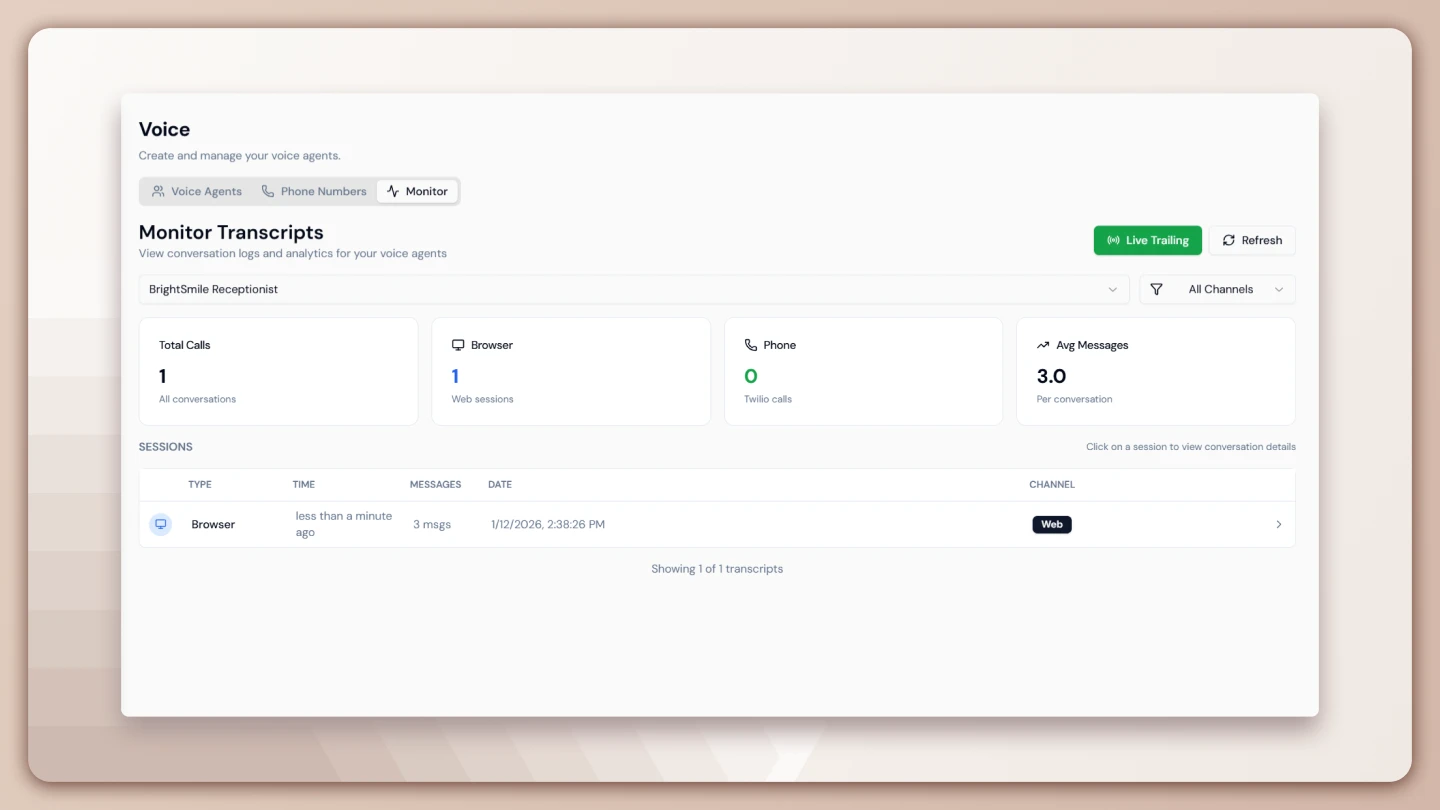

4. Do you build voice agents and integrate with insurance tools?

Yes, we do. Lyzr supports the creation of voice agents that can handle inbound and outbound calls using integrations with providers like Twilio and IVR systems. These agents can also connect with insurance tools such as PolicyBazaar CRM, ClaimVantage, Guidewire, and Duck Creek for end-to-end automation. All of this can be done directly on Lyzr Agent Studio.

5. How do AI agents handle changing policies or regulations?

Using Retrieval-Augmented Generation (RAG), agents stay updated by connecting to live databases and knowledge bases that reflect new rules and policy changes.

6. Are there any risks in automating customer support with AI?

Yes; like hallucinations or escalation delays. These are mitigated by Lyzr’s modular agents, which separate tasks and include audit trails, fallback routes, and manual approvals.

7. Can AI agents personalize answers for each policyholder?

Yes. Lyzr agents retrieve exact policy details using vector search and tailor responses based on customer history and current context.

8. Is this only for large insurers or can mid-size firms use it too?

Lyzr works with insurers of all sizes. Mid-size firms benefit from pre-built templates and low-code deployment via studio.lyzr.ai.

If you’re looking to modernize your customer support experience across policy types, languages, and channels; without compromising compliance; Lyzr’s AI agent stack is built for you.

Looking to bring AI agents into your company? Book a demo.

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here