Table of Contents

ToggleCompliance is no longer just a checkbox activity ;it’s a strategic imperative. In today’s volatile regulatory climate, organizations across finance, healthcare, insurance, and even tech are under constant pressure to comply with evolving frameworks like GDPR, HIPAA, SOX, PCI-DSS, and industry-specific mandates.

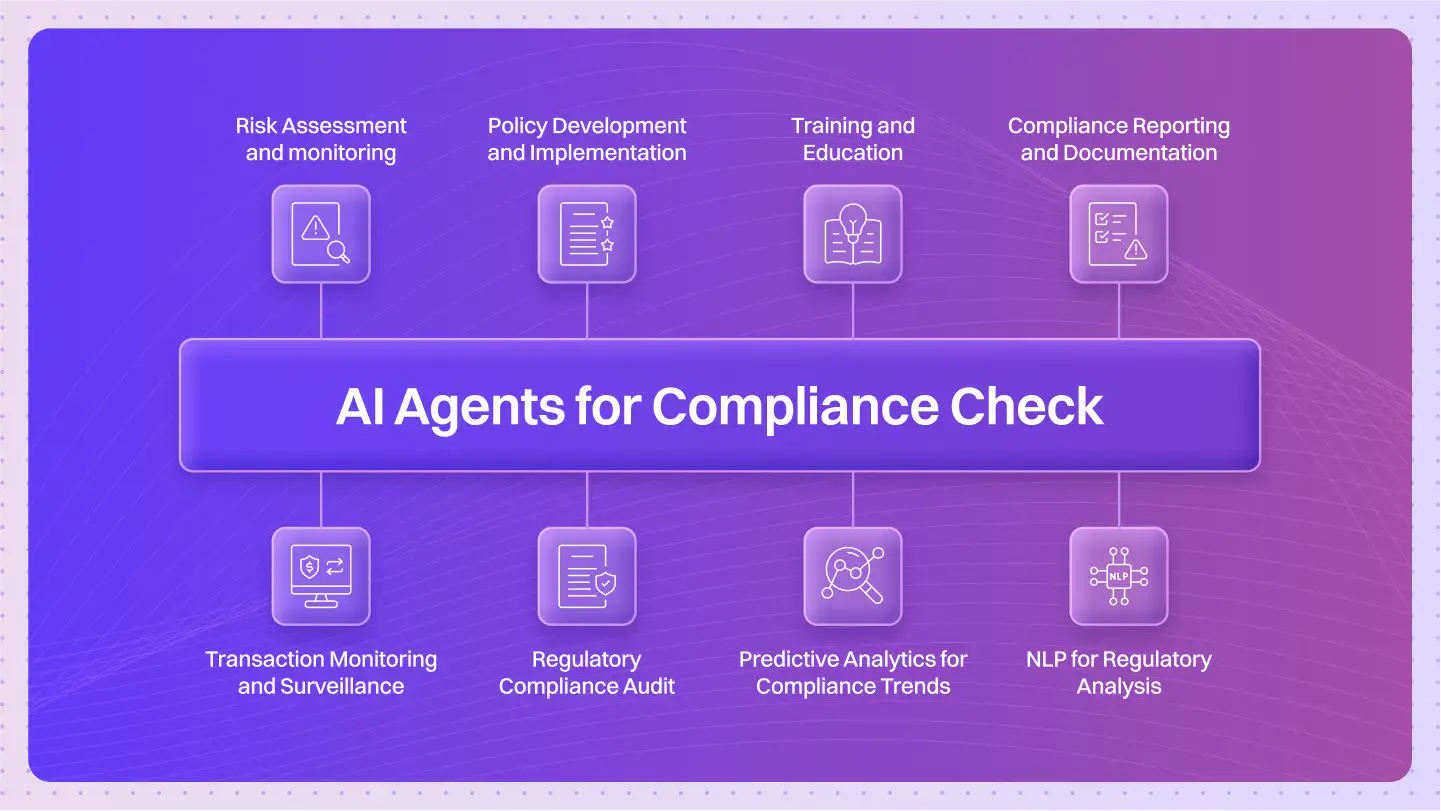

Yet, traditional compliance methods are manual, fragmented, and reactive. Enter AI agents for compliance checks ;modular, intelligent systems that autonomously scan, monitor, and enforce compliance policies at scale.

What Is a Compliance Check Agent?

A Compliance Check Agent is an AI-powered software module that autonomously monitors enterprise systems, processes, and data against a predefined set of regulatory rules. These agents can:

- Extract data from logs, emails, and documents

- Flag policy violations or anomalies in real-time

- Connect with external regulation APIs for live updates

- Generate explainable audit reports

- Orchestrate remediation tasks or trigger alerts

These agents work in tandem to ensure continuous compliance and audit readiness.

Example of a Regulatory Monitoring Agent

The Problem with Traditional Compliance Management

Legacy compliance management relies heavily on manual oversight, siloed teams, and inflexible tools:

- Static Policies: Rulebooks are hardcoded and rarely updated in real time.

- Audit Fatigue: Manual audits lead to missed issues and inconsistent enforcement.

- Data Deluge: Growing data volumes overwhelm traditional GRC platforms.

- Siloed Monitoring: Risk signals spread across systems (email, CRM, file stores) go undetected.

- Slow Remediation: Most tools lack autonomous or proactive action capabilities.

Architecture: Full-Stack Compliance Agent Blueprint

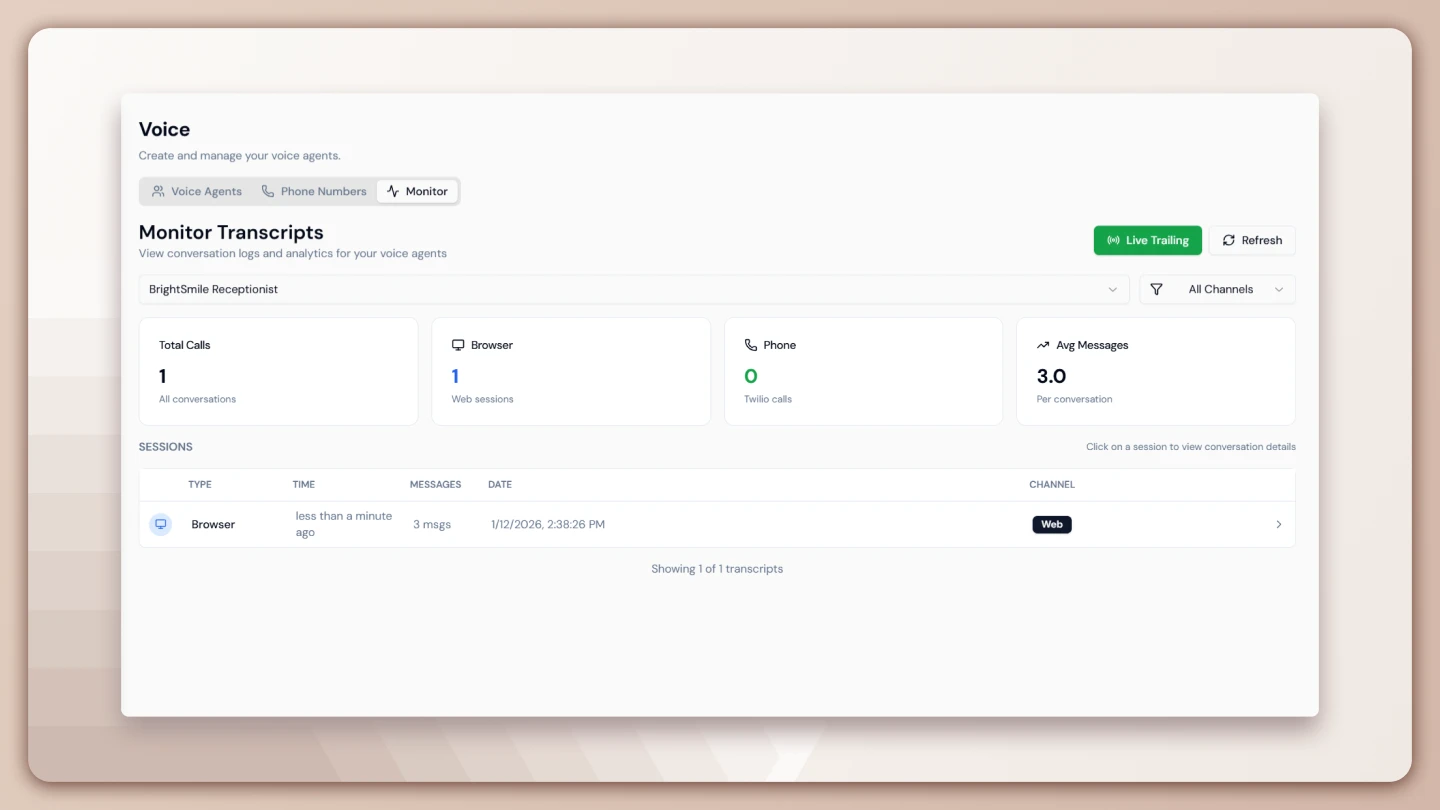

Lyzr’s full-stack compliance agent system is built as a modular, intelligent pipeline where each agent performs a specialized task but operates as part of a cohesive orchestration layer. The system begins with a Data Extraction Agent, which ingests structured and unstructured data from logs, documents, email systems, and internal tools like Salesforce or SharePoint.

This data is then passed to a Policy Inference Agent, which maps it against current compliance requirements using Retrieval-Augmented Generation (RAG) and LLM-based interpretation. Once mapped, the Violation Detection Agent scans for anomalies, breaches, or rule violations ;like unauthorized file access or unapproved contract language.

These findings are then routed to an Audit Trail Agent, which logs every decision, input, and output with full explainability. Finally, an Alert & Action Agent takes over, escalating the issue to legal, IT, or compliance teams or triggering auto-remediation workflows when appropriate.

Key Components of a Compliance AI Agent Stack

| Component | Description | Example Tools/APIs |

| NLP + RAG Models | Interpret unstructured policy documents | OpenAI GPT-4, LangChain, LangGraph |

| Log & Email Ingestion | Extract data from enterprise systems | AWS Kinesis, Google Vault, Microsoft Graph |

| Violation Detection | Flag suspicious access, file misuse, etc. | Splunk, Snyk, Datadog, Snowflake Alerts |

| Orchestration & Escalation | Route cases to legal, IT, or HR as needed | Lyzr Studio, ServiceNow, Zapier |

| Continuous Learning | Update rulebooks via live regulation feeds | RegTech APIs (ClauseMatch, Ascent) |

Why Enterprises Are Moving to AI-Powered Compliance Checks

According to a McKinsey study, organizations spend 15–20% of operational budgets on compliance-related activities. AI agents can reduce this by over 40%, while increasing regulatory coverage and speed.

Benefits:

- Real-Time Enforcement: Monitor 24/7 without waiting for audits

- Scalability: Cover more jurisdictions, more systems, without scaling headcount

- Explainability: Every action has a traceable decision log

- Security-first: Deployed on private cloud or within enterprise firewalls

- Adaptive: Integrate retrieval-based updates as laws evolve

Real-World Use Cases

- Banking & Fintech

Large financial institutions use compliance agents to enforce anti-money laundering (AML) policies and audit customer communication. For example, an agent might monitor trading desk Slack messages and alert compliance teams if insider trading keywords are detected. Agents can also track suspicious transaction flows and auto-flag them for Suspicious Activity Reports (SARs). - Healthcare & Hospitals (HIPAA)

Compliance agents in hospitals track access logs to Protected Health Information (PHI). If an employee accesses more records than required by their role, a violation detection agent automatically logs the event and notifies the Privacy Officer. Another agent could scan outgoing faxes and emails for PHI breaches and prevent the transmission. - Insurance & Claims Audits

Insurance providers deploy agents to cross-reference claims against policy terms and regulatory disclosures. For example, if an insurance agent modifies claim settlement amounts outside allowed thresholds without manager approval, a compliance agent flags this as a potential violation and initiates internal investigation workflows. - Retail & eCommerce (CCPA/GDPR)

AI agents scan marketing emails and checkout processes to ensure they comply with opt-in consent rules. If a regional variation in GDPR enforcement (e.g., requiring double opt-in in Germany) is missed, the agent alerts the marketing ops team with specific recommendations. In this compliance-focused context, exploring OneTrust alternatives allows organizations to evaluate flexible consent management solutions that better align with regional regulations and evolving privacy requirements. - Energy, Telecom & Infrastructure (SOX)

Agents ensure that financial reports, board meeting minutes, and material disclosures are in sync and follow Sarbanes-Oxley (SOX) protocols. They can even verify digital signatures on board resolutions and escalate missing compliance documents.

Need a definitive guide to go Agentic in Banking? Download this guide.

Why Lyzr Wins: Agent Ecosystem Built for Compliance at Scale

Unlike point-solution GRC platforms, Lyzr delivers:

- Composable Agents: Easily integrate with policy engines, audit logs, and data lakes

- Private Deployments: Full control via on-prem/VPC agent hosting

- No-Code Workflows: Drag-and-drop policy enforcement pipelines

- Real-Time Rule Updates: RAG-connected agents that ingest changes from external policy APIs

- Safe AI: With human-in-the-loop decision paths and 4-eyes approval flows

Explore lyzr.ai/usecases to learn how other enterprises are using Lyzr for regulatory assurance.

Challenges and Trade-Offs in Adopting AI Compliance Agents

| Challenge | Description | Mitigation |

| Model Drift | Policies evolve quickly | Use retrieval-augmented agents tied to rule APIs |

| False Positives | Over-triggering alerts without full context | Layer human review agents and feedback loops |

| Data Privacy | Handling sensitive internal documents | Deploy on-prem via studio.lyzr.ai |

| Explainability | Interpreting ML-based violation flags | Use agent logs, decision chains, and summaries |

| Integration Effort | Onboarding across multiple data sources | Start modular with Lyzr’s no-code Agent Studio |

Common FAQs for Compliance Agents

1. Are AI compliance agents compliant with frameworks like GDPR and SOC 2?

Yes. Lyzr agents can be deployed in environments that meet SOC 2 Type II and GDPR standards. The system is built with privacy-by-design principles and supports access controls, audit trails, and encryption across all layers.

2. Can these agents integrate with live regulatory updates?

Absolutely. Using Retrieval-Augmented Generation (RAG), the Policy Inference Agent can connect to regulation APIs like Ascent or ClauseMatch and dynamically update policies as rules change across geographies.

3. Are compliance agents safe and responsible?

Yes. Lyzr ensures all agents are equipped with human-in-the-loop capabilities, escalation flows, and explainable logs. You can configure fallback protocols and approval gates for any sensitive decision, ensuring safe AI usage in regulated environments.

4. Can I deploy these agents in a private or hybrid environment?

Definitely. Using studio.lyzr.ai, compliance agents can be deployed fully within your Virtual Private Cloud (VPC) or on-prem setup, ensuring complete control over sensitive compliance data.

5. How do compliance agents detect violations in real-time?

Violation Detection Agents continuously scan for anomalies in behavior, document language, and system logs using predefined rules and ML models. They operate 24/7 and can trigger alerts immediately upon breach detection.

6. What enterprise tools can I integrate with compliance agents?

You can connect Lyzr agents with tools like Salesforce, Workday, Jira, Microsoft Teams, Zoom, Splunk, and enterprise data warehouses. Compliance workflows can run across email servers, CRM platforms, file storage systems, and HR tech stacks.

AI agents are redefining compliance from a reactive burden to a proactive, intelligent safety net. With Lyzr, you can orchestrate compliance workflows that evolve with regulation, adapt in real time, and remain enterprise-grade.

Explore the future of compliance at lyzr: book a demo.

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here