- Customer Onboarding Agent

Customer Onboarding Agent for Banks

Automate end-to-end onboarding, from digitizing handwritten forms to generating credit reports and account setup documents. Built for accuracy, speed, and compliance at scale.

Who is it for?

Operations Teams:

Looking to replace manual data entry and speed up onboarding.

Risk & Compliance Officers

Needing reliable AML, sanctions, and credit checks.

IT & Transformation Leads

Seeking easy integration without overhauling existing systems.

How does Lyzr solve it?

Manual Workflows

Replaces handwritten forms and manual entry with digitized, agent-driven processing.

Compliance Gaps

Automates credit evaluations and AML checks with multi-database support.

Scalability Issues

Supports batch uploads and large-scale onboarding without added headcount.

Major Benefits

Faster Onboarding

Cuts turnaround from days to minutes using multi-agent automation.

High Accuracy:

Combines outputs from three OCR agents for precise data capture

Built for Scale

Handles thousands of profiles via batch mode with optional human review.

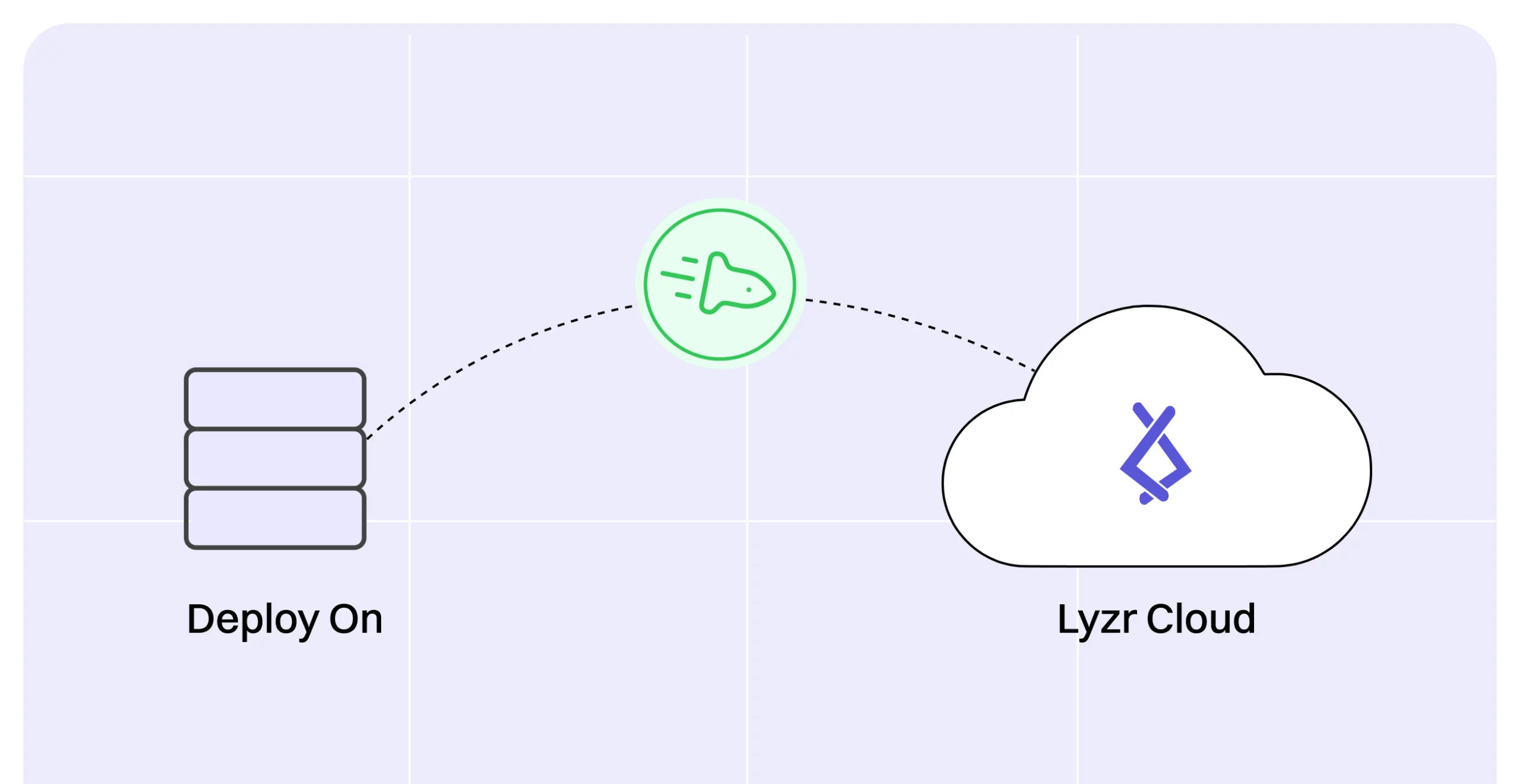

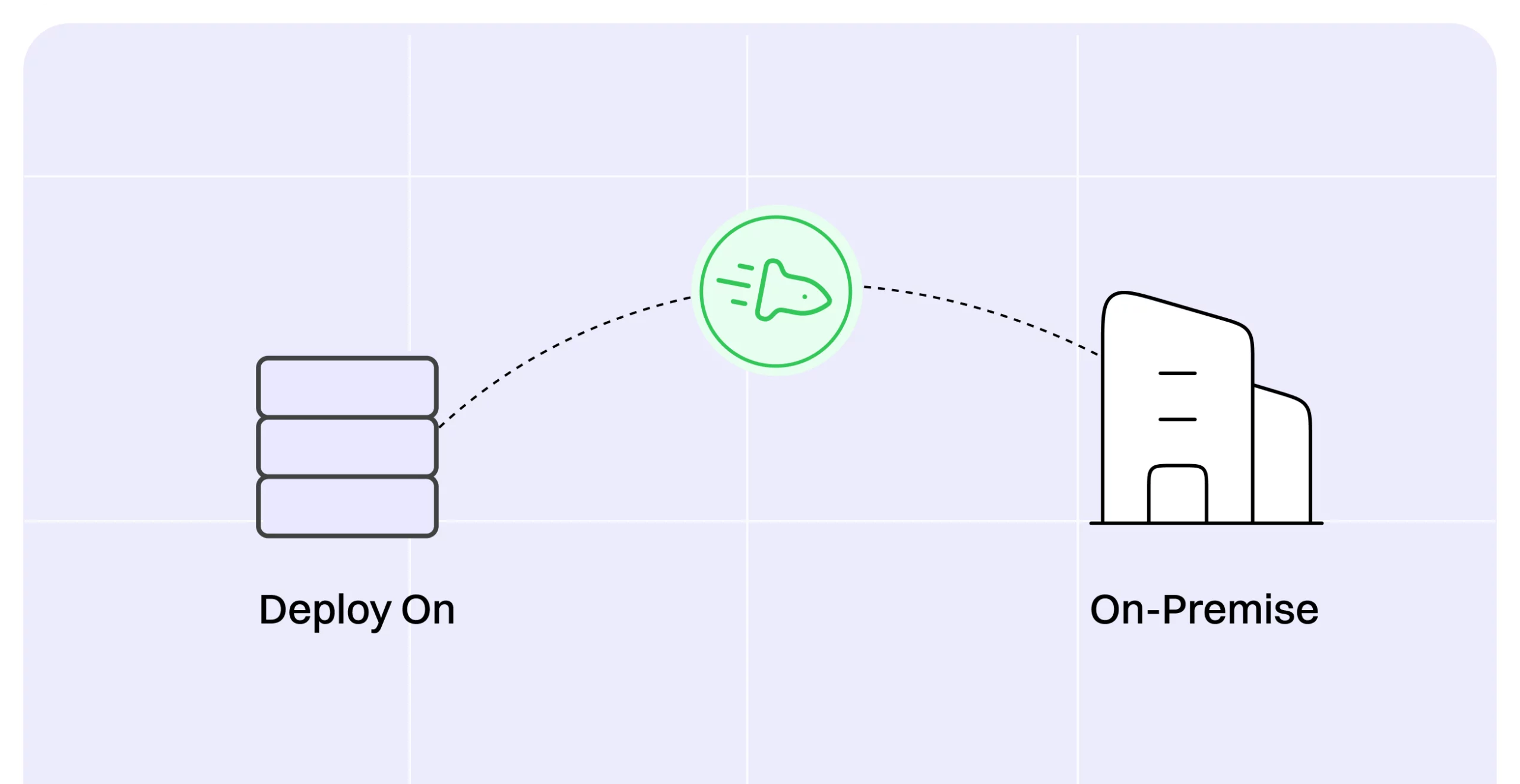

Choose how you build and deploy

With Lyzr, you have the flexibility to use agents through our SaaS platform or host within your own infrastructure.

Deploy on Lyzr Cloud

- Instant setup with no infrastructure management.

- Automatic updates.

- Pay-as-you-go pricing.

- 24/7 monitoring and enterprise-grade security.

Deploy On-Premise

- Complete control over infrastructure and data.

- Custom deployment.

- Enhanced security with your protocols.

- Dedicated support and implementation assistance.

Industry-grade

security and compliance

Lyzr Agent Studio is the only platform you need to create, business. Build smarter, faster, and scalable AI solutions in just a few clicks.

Frequently asked questions ?

Uses a three-agent OCR system (Mistral, Gemini, Azure) for cross-verified accuracy.

Yes. The agent supports internal databases and custom scoring models.

Absolutely. Upload and process thousands of customers at once.

No. It connects through APIs and MCP—no need to replace current tools.