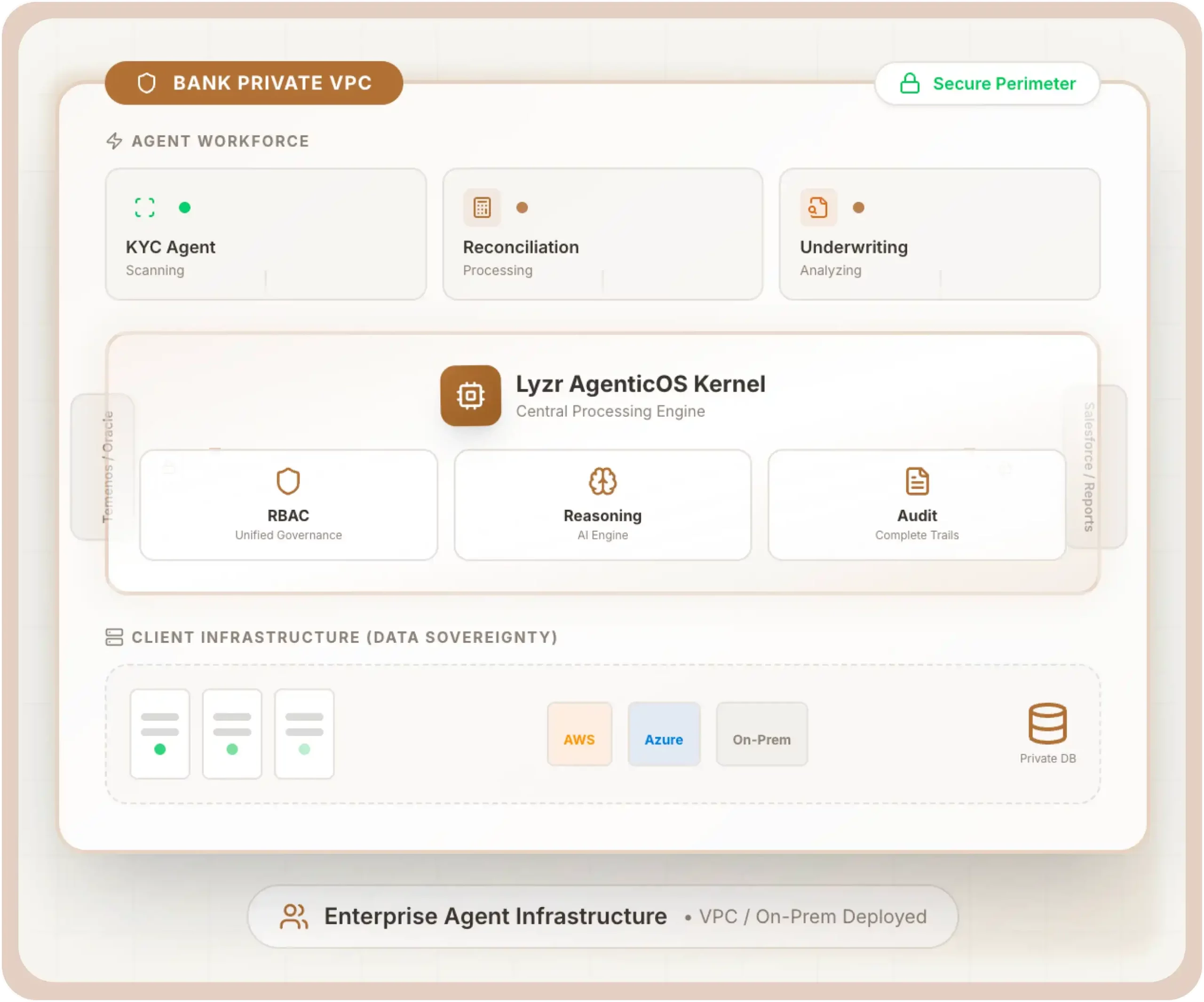

Build the Agentic OS for Banking.

Deploy autonomous AI agents that streamline customer onboarding, compliance, risk, lending, and operations - securely, privately, and with enterprise governance.

Customers who trust us

Meet your Banking Agent Suite

Autonomous, audit-ready AI agents that orchestrate the entire source-to-pay cycle sourcing and RFx, autonomous negotiations, touchless P2P, spend analytics, and 24/7 risk and compliance to turn procurement into a strategic value engine.

Trusted Infrastructure. Certified Security. Native Integration.

Stop AI Sprawl. Install an Operating System.

Unified Governance

Centralize control over all AI agents. Define who can access what data and enforce policy checks before any model output reaches the user.

LLM Independence

Switch between models (GPT-4, Claude, Llama 3) without breaking your applications. The OS acts as an abstraction layer for model inference.

Disaster Recovery

Ensure business continuity with automated failover for agent states and memory snapshots. Recover agent context instantly after outages.

- Scale Your Revenue

Engineered for the Zero -Trust Era.

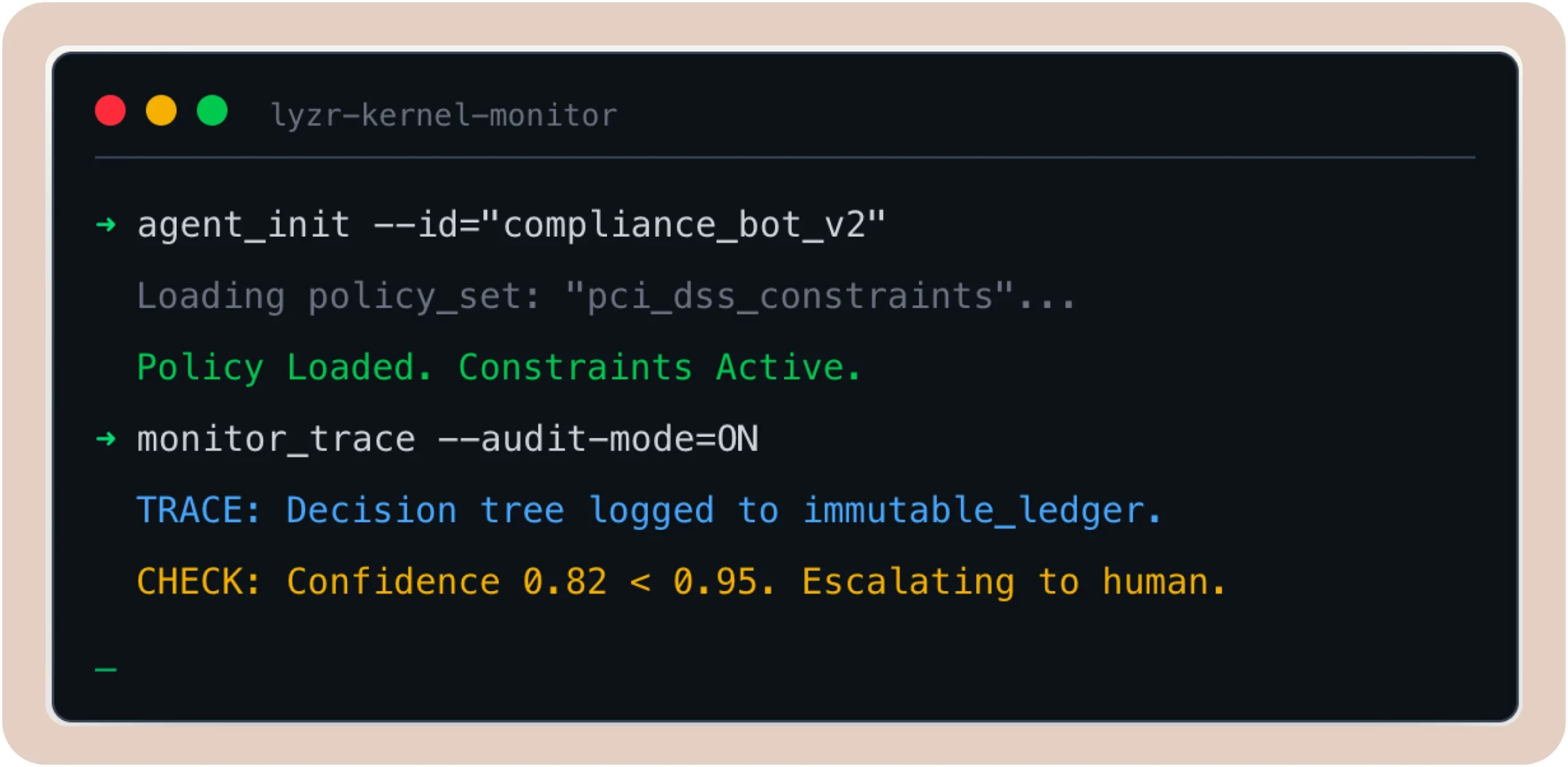

Tiered Autonomy ensures agents do real work, safely.

The Permission Layer (RBAC)

Granular access control for agents, defining exactly which APIs and data subsets they can touch.

Regulatory Explainability & Traceability

Complete audit trails of agent "thought processes." Replay exactly why an agent made a decision.

The 'Kill Switch' & Human Override

Instant suspension capabilities and mandatory human sign-off checkpoints \for high-stakes actions.

Pre-Built Agent Architectures for Banking.

- Risk & Compliance

KYC/AML Analyst

Automated screening & watchlist verification

Fraud Detector

Real-time transaction monitoring

Risk Assessor

Credit & operational risk scoring

Regulatory Reporter

Automated compliance reporting

- Lending & Credit

Underwriter Assistant

Financial statement analysis & spreads

Document Processor

Loan document extraction & validation

Portfolio Analyst

Loan portfolio health monitoring

Collections Agent

Intelligent payment follow-up

- Operations & Treasury

Reconciliation Bot

Ledger matching & exception handling

Payment Processor

Cross-border payment orchestration

Customer Onboarding

End-to-end account opening

System Monitor

Core banking health checks

Enhance Your Core.

The AgenticOS acts as the intelligent middleware fabric. It reads from your systems of record, reasons about the data using secure LLMs, and writes refined decisions to your systems of action - preserving your single source of truth.

Two-way sync with core banking ledgers

Native connectors for Snowflake and Oracle

API-first architecture for custom legacy tools

Typical Deployment Path (4 Weeks)

This isn’t a research project. Most teams start seeing tangible operational impact within weeks.

Week 1

- Architecture Review

Security audit, VPC peering setup, and access control definition.

Week 2

- Agent Configuration

Connecting data sources, defining prompts, and setting guardrails.

Week 3

- UAT & Red Teaming

Adversarial testing, user acceptance, and compliance sign-off.

Week 4

- Go-Live

Phased rollout to production with real-time monitoring active.

Built for High-Stakes Environments

CTO

Tier-1 Global Bank

Zero

Data Exfiltration Incidents