- Lyzr Marketplace

- Finance

- A/P Fraud Risk Reduction Agent

A/P Fraud Risk Reduction Agent

Accounts Payable fraud drains millions every year through false invoices, duplicate payments, and policy breaches. The A/P Fraud Risk Reduction Agent continuously monitors transactions, flags anomalies, and ensures every payment aligns with verified data and compliance rules.

- Chief Financial Officers

- Heads of Accounts Payable

- Compliance and Risk Leaders

Trusted by leaders: Real-world AI impact.

The problems we hear from leaders like you

A/P fraud detection is often reactive and manual, leaving gaps in oversight and increasing exposure to financial and reputational risk.

Limited visibility into suspicious activity

Manual reviews miss early warning signs, allowing fraudulent invoices and duplicate payments to go unnoticed until after disbursement.

Reactive fraud detection

Traditional systems detect fraud post-payment, making recovery difficult and increasing losses over time.

Complex vendor ecosystems

With hundreds of vendors, verifying every transaction and payment manually leads to delays and inconsistency in fraud controls.

High compliance burden

Continuous monitoring for fraud, errors, and policy breaches adds significant workload to finance and audit teams.

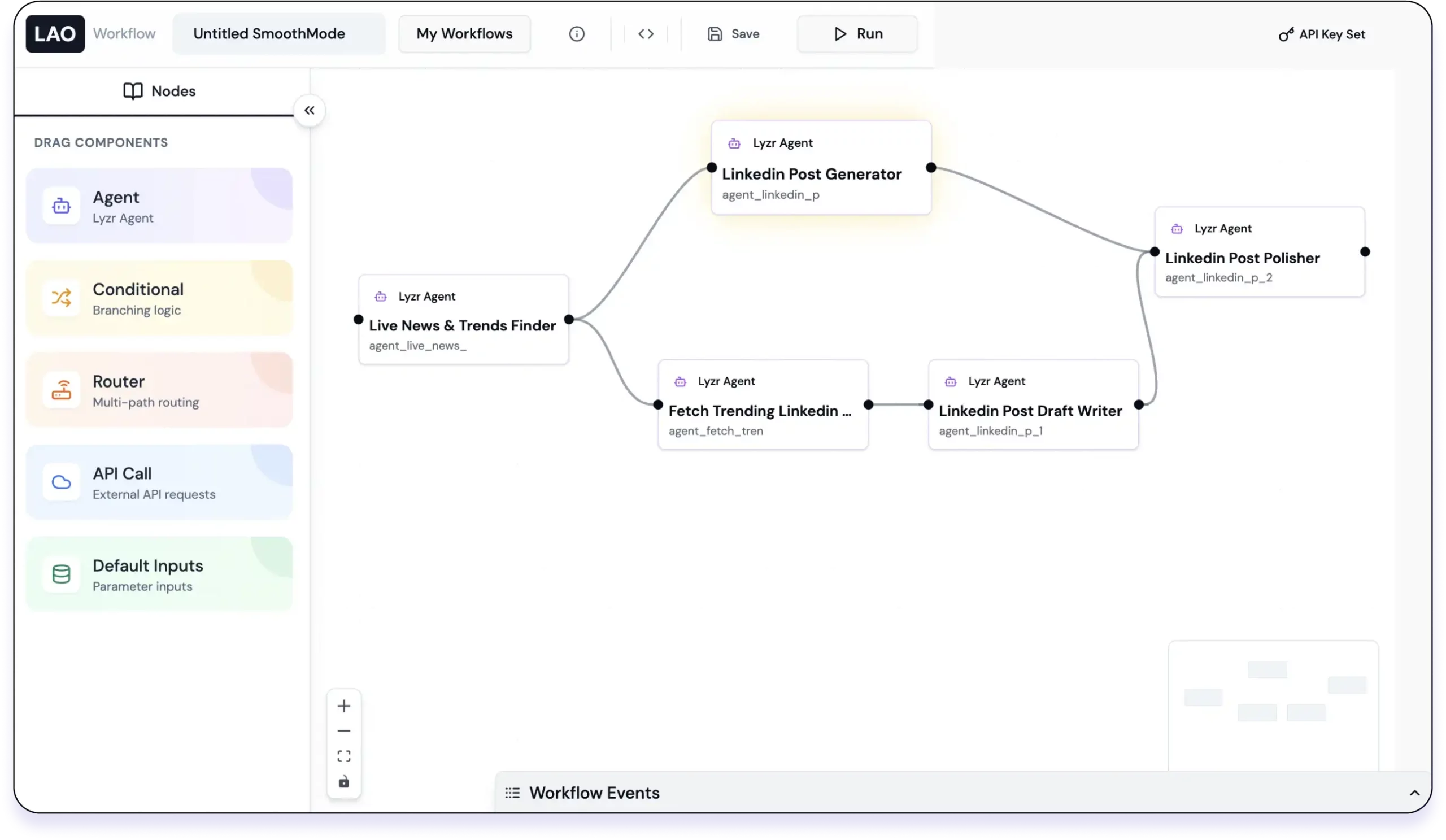

Agent workflow for regulatory monitoring

Why Leading

Organizations Choose Lyzr?

Lyzr provides the full-stack platform to transform your business functions into a unified Agentic Operating System, guaranteed.

Data Privacy & IP Ownership

Agents run in your cloud/on-prem.

We

guarantee zero access to your data, ensuring

100% privacy that your AI workforce is

always your unquestionable IP.

Full Flexibility,

Zero Vendor Lock-In

Integrate Lyzr as a plug-and-play solution within your existing ecosystem. No forced migration, no vendor dependency, just pure value.

Scalability & Real-Time

Customization

Start with one agent and build toward an Agentic OS for the entire function. Full control lets you customize and deploy changes in real-time.

Agentic Operating System

for your org

Unify your agents on a central knowledge graph to unlock the next-level enterprise intelligence: OGI.

Quantifiable value for your institution

Automating fraud detection and compliance monitoring leads to measurable financial and operational benefits.

- 70%

reduction in fraudulent transactions, through real-time anomaly detection

- 50%

faster fraud resolution, by prioritizing high-risk alerts for investigation

- 45%

decrease in compliance effort, with automated validation and reporting

- 35%

savings in financial losses, due to early detection and prevention mechanisms

Outcomes you can expect

The A/P Fraud Risk Reduction Agent strengthens financial control, minimizes exposure, and restores confidence in every payment made.

Continuous fraud monitoring

Automate real-time surveillance across invoices, vendors, and payment systems to catch red flags before they turn into losses.

Early detection and prevention

Identify unusual patterns and duplicate invoices using machine learning and rules-based analysis, ensuring timely intervention.

Strengthened compliance

Ensure every transaction adheres to policy, approval hierarchy, and vendor verification standards, reducing audit risks.

Smarter investigations

Provide finance and risk teams with prioritized alerts, detailed audit trails, and investigation-ready reports for faster closure.

How to start building from here

The journey from a promising pilot to a deployed solution can be a challenge. We are your partner in implementation, sharing the risk and ensuring your AI agents make it to production. We don't just provide a platform; we provide a clear pathway to success.

Dedicated AI expertise

We invest in a Forward Deployment AI Engineer (FDE) to work directly with you. Our FDE acts as a hands-on AI startup CTO for your project.

A partner in risk management

We take on the risk of ensuring your agent goes from concept to a fully functional, production-ready solution. We'll work with you every step of the way to get you live.

Strategic guidance & workshops

Our dedicated team will provide strategic guidance and training sessions, empowering your internal teams to own and scale your AI capabilities once your first use case is live.

Project management oversight

We assign a project manager to oversee your agent's journey, providing a clear roadmap and ensuring a smooth, frictionless path to production.

Agents used for this use case.

The Regulatory Monitoring Agent is often built on a combination of specialized agents. Here are some you can use to enhance this use case on the Lyzr platform:

- KYC Processing Agent

- Fraud Detection Agent

- AML Agent

- Legal Document Drafting Agent

- Compliance Agent

Frequently asked questions

It continuously monitors Accounts Payable data, detects potential fraud patterns, and flags suspicious activity before payments are processed. This helps organizations proactively prevent financial losses.

The agent analyzes invoice, vendor, and payment data in real time using rules and machine learning models to detect anomalies — such as duplicate invoices, altered amounts, or mismatched vendor details.

Yes. It integrates seamlessly with major ERP and accounting platforms to access transaction data, apply checks, and return verified results.

No. It’s scalable for mid-sized and enterprise-level finance teams — adapting to transaction volumes, vendor counts, and fraud risk levels.

By automating checks for vendor authenticity, invoice consistency, and policy adherence, the agent eliminates repetitive manual reviews and creates audit-ready records automatically.

Yes. It monitors transactions across multiple layers — from internal approvals and duplicate payments to external vendor anomalies — providing comprehensive protection.

The agent continuously learns from feedback and transaction history, improving its accuracy and reducing false positives over time.

Yes. It includes customizable dashboards that visualize trends, high-risk vendors, and fraud exposure across business units or regions.

Absolutely. It maintains a detailed audit trail for every flagged transaction, allowing risk and finance teams to trace anomalies and close investigations faster.

Yes. The agent adheres to enterprise-grade compliance standards and helps maintain adherence to SOX, PCI-DSS, and other regulatory frameworks.

Organizations typically see reduced fraud-related losses, faster investigation timelines, lower compliance costs, and stronger vendor trust within months of deployment.

Build your first AI workflow today.

Start with a blueprint. Launch it. Customize it. Deploy it. All inside Lyzr.