- Lyzr Marketplace

- Finance

- Cash Application Agent

Cash Application Agent

The Cash Application Agent automates one of the most time-consuming finance processes , matching incoming payments to open invoices. It accelerates reconciliation, improves accuracy, and gives finance teams real-time visibility into receivables.

- CFOs and Finance Controllers

- Accounts Receivable Managers

- Treasury and Cash Flow Leaders

Trusted by leaders: Real-world AI impact.

The problems we hear from leaders like you

Cash application teams spend hours reconciling payments, navigating multiple systems, and resolving mismatched entries , slowing cash flow and customer experience.

Manual reconciliation workload

Teams spend excessive time matching payments to invoices, remittance data, and bank statements, leading to inefficiencies and errors.

Delayed cash visibility

Fragmented systems and manual updates delay visibility into available cash, making forecasting and liquidity planning difficult.

High exception rates

Unstructured remittance data or missing references cause frequent mismatches that require manual intervention, delaying closure.

Poor customer experience

Misapplied or delayed payments frustrate customers, increase support tickets, and can even strain vendor relationships.

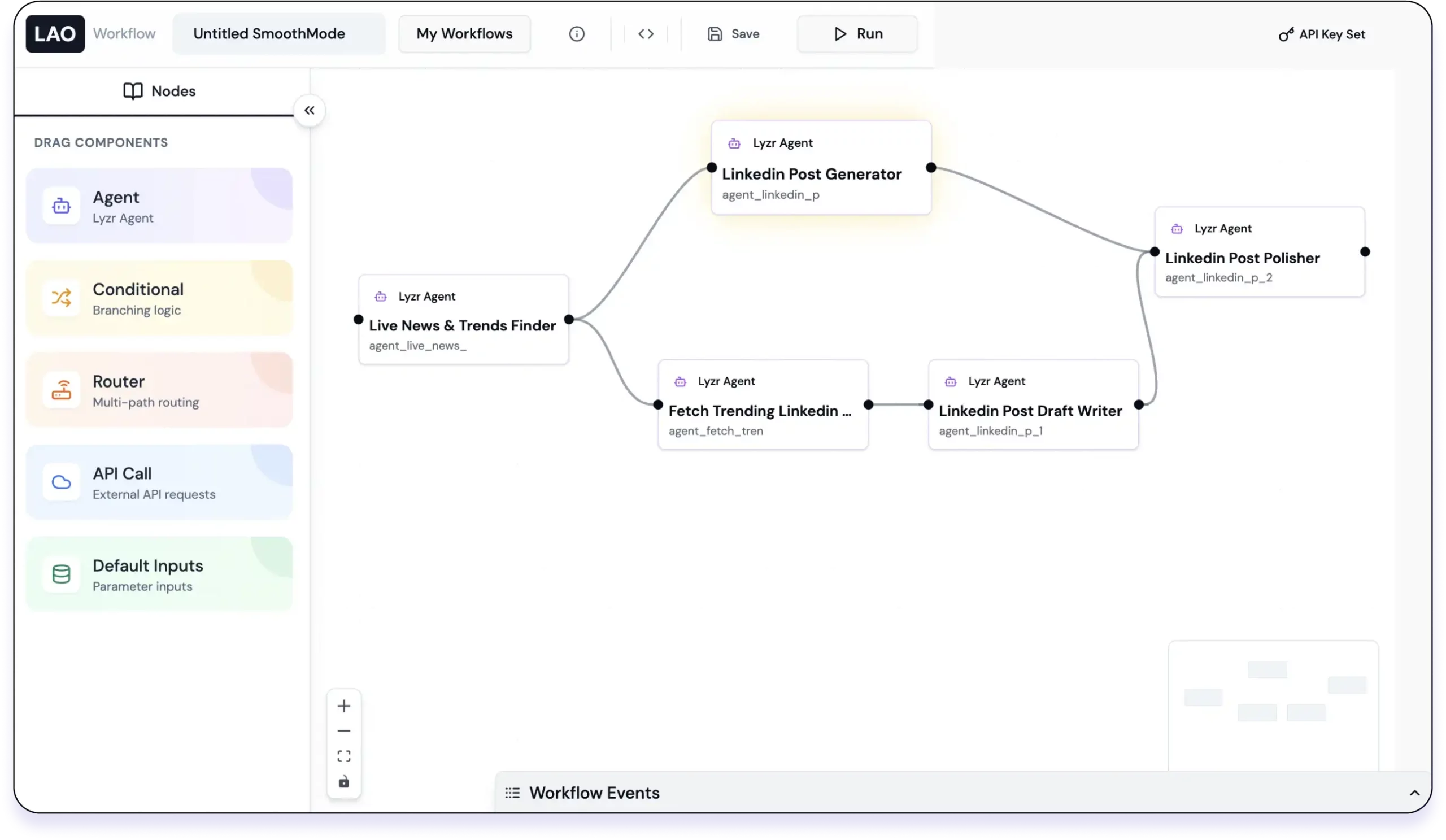

Agent workflow for regulatory monitoring

Why Leading

Organizations Choose Lyzr?

Lyzr provides the full-stack platform to transform your business functions into a unified Agentic Operating System, guaranteed.

Data Privacy & IP Ownership

Agents run in your cloud/on-prem.

We

guarantee zero access to your data, ensuring

100% privacy that your AI workforce is

always your unquestionable IP.

Full Flexibility,

Zero Vendor Lock-In

Integrate Lyzr as a plug-and-play solution within your existing ecosystem. No forced migration, no vendor dependency, just pure value.

Scalability & Real-Time

Customization

Start with one agent and build toward an Agentic OS for the entire function. Full control lets you customize and deploy changes in real-time.

Agentic Operating System

for your org

Unify your agents on a central knowledge graph to unlock the next-level enterprise intelligence: OGI.

Quantifiable value for your institution

Automation in cash application drives measurable financial impact, accelerating cash flow and improving accuracy.

- 75%

reduction in manual reconciliation time, enabling faster invoice closure

- 60%

improvement in cash flow visibility, supporting real-time liquidity management

- 50%

fewer exceptions, with automated remittance capture and intelligent matching

- 30%

decrease in customer payment disputes, driven by accurate and timely allocations

Outcomes you can expect

With the Cash Application Agent, finance teams can close faster, manage liquidity better, and deliver smoother customer experiences.

Automated reconciliation

Match payments to invoices automatically by analyzing bank feeds, remittance advice, and ERP data in real time.

Real-time cash insights

Access dashboards that display updated cash positions, enabling proactive treasury and working capital management.

Reduced exceptions

Leverage AI-driven matching that learns from patterns to minimize manual reviews and exceptions over time.

Enhanced customer confidence

Ensure timely and accurate application of customer payments, reducing disputes and improving relationships.

How to start building from here

The journey from a promising pilot to a deployed solution can be a challenge. We are your partner in implementation, sharing the risk and ensuring your AI agents make it to production. We don't just provide a platform; we provide a clear pathway to success.

Dedicated AI expertise

We invest in a Forward Deployment AI Engineer (FDE) to work directly with you. Our FDE acts as a hands-on AI startup CTO for your project.

A partner in risk management

We take on the risk of ensuring your agent goes from concept to a fully functional, production-ready solution. We'll work with you every step of the way to get you live.

Strategic guidance & workshops

Our dedicated team will provide strategic guidance and training sessions, empowering your internal teams to own and scale your AI capabilities once your first use case is live.

Project management oversight

We assign a project manager to oversee your agent's journey, providing a clear roadmap and ensuring a smooth, frictionless path to production.

Agents used for this use case.

The Regulatory Monitoring Agent is often built on a combination of specialized agents. Here are some you can use to enhance this use case on the Lyzr platform:

- KYC Processing Agent

- Fraud Detection Agent

- AML Agent

- Legal Document Drafting Agent

- Compliance Agent

Frequently asked questions

The agent extracts remittance details from emails, PDFs, portals, and bank statements, using AI to interpret and link them to the correct customer accounts and invoices.

Yes. It connects with popular ERP platforms like SAP, Oracle, NetSuite, and Microsoft Dynamics, ensuring seamless data synchronization.

The agent provides real-time dashboards showing applied and unapplied cash, enabling finance teams to forecast and plan liquidity with precision.

Absolutely. It processes ACH, wire transfers, checks, and even digital wallet payments, recognizing patterns across formats and geographies.

Using AI-based matching logic, the agent learns from past reconciliations to automatically handle complex scenarios, minimizing manual intervention.

Yes. It flags and categorizes such payments, applying them intelligently or routing them for quick manual review with all contextual data ready.

Faster cash application means quicker visibility into receivables and improved forecasting accuracy, helping treasury teams make better liquidity decisions.

Yes. It uses enterprise-grade encryption, secure API integrations, and role-based access controls to ensure all transaction data is protected.

Definitely. The agent is built to handle large-scale, high-frequency payments across multiple business units or regions without performance drops.

Organizations typically achieve faster month-end closing, reduced DSO (Days Sales Outstanding), and stronger cash flow management , resulting in direct financial gains.

Build your first AI workflow today.

Start with a blueprint. Launch it. Customize it. Deploy it. All inside Lyzr.