- Lyzr Marketplace

- Banking

- Fraud Detection Agent

Fraud Detection Agent

Fraud risk is rising across banking, payments, and digital commerce. Traditional rule-based systems generate too many false positives and often miss sophisticated schemes. The Fraud Detection Agent applies AI and machine learning to identify unusual patterns in real time, reducing fraud losses while improving the customer experience. It helps institutions safeguard transactions, accounts, and reputations.

- Chief Risk Officers

- Fraud Prevention & Security Teams

- Digital Banking & Payments Leaders

Trusted by leaders: Real-world AI impact.

The problems we hear from leaders like you

Fraud is becoming more complex, but existing defenses struggle to keep pace.

High false positives

Legacy systems overwhelm teams with alerts that turn out to be legitimate activity.

Evolving fraud tactics

Fraudsters use advanced methods that bypass static, rule-based detection.

Slow response times

Delayed fraud detection allows suspicious activity to escalate into major losses.

Customer friction

Overly aggressive monitoring disrupts genuine transactions, eroding trust and satisfaction.

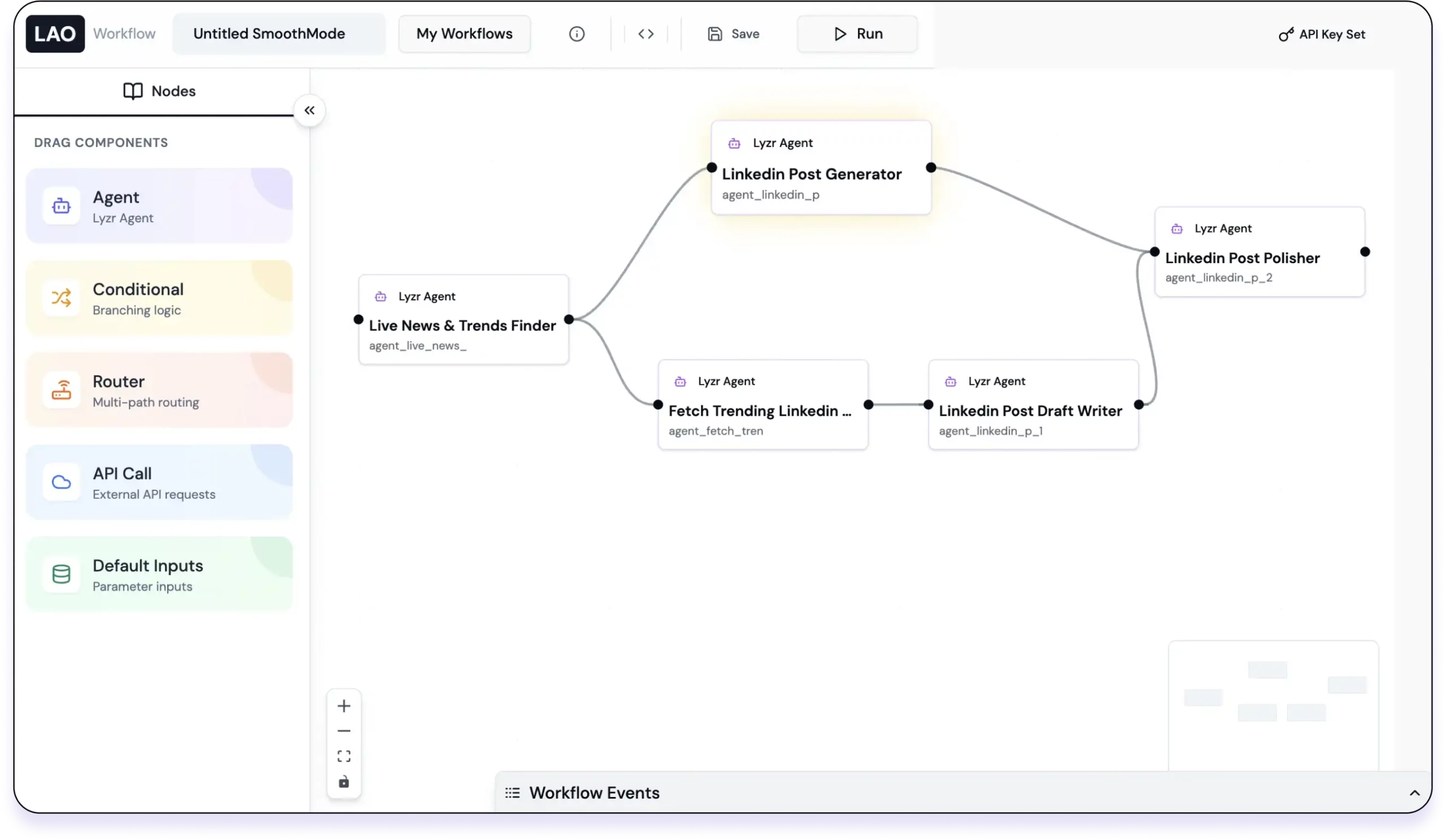

Agent workflow for regulatory monitoring

Quantifiable value for your institution

The Fraud Detection Agent improves fraud prevention accuracy, reduces losses, and lowers operational costs.

- 75%

reduction in false positives, improving efficiency and customer trust

- 60%

faster fraud detection, enabling real-time intervention

- 45%

decrease in fraud-related losses, through proactive monitoring

- 90%

automation of fraud checks, reducing manual workload

Outcomes you can expect

This agent delivers proactive, intelligent, and customer-friendly fraud defense.

Real-time fraud monitoring

Analyzes every transaction instantly to stop fraud before it occurs.

Adaptive AI models

Continuously learns from new fraud patterns to stay ahead of threats.

Customer-friendly security

Balances fraud protection with smooth transaction experiences.

Centralized fraud management

Consolidates alerts, case management, and reporting in one system.

How to start building from here

The journey from a promising pilot to a deployed solution can be a challenge. We are your partner in implementation, sharing the risk and ensuring your AI agents make it to production. We don't just provide a platform; we provide a clear pathway to success.

Dedicated AI expertise

We invest in a Forward Deployment AI Engineer (FDE) to work directly with you. Our FDE acts as a hands-on AI startup CTO for your project.

A partner in risk management

We take on the risk of ensuring your agent goes from concept to a fully functional, production-ready solution. We'll work with you every step of the way to get you live.

Strategic guidance & workshops

Our dedicated team will provide strategic guidance and training sessions, empowering your internal teams to own and scale your AI capabilities once your first use case is live.

Project management oversight

We assign a project manager to oversee your agent's journey, providing a clear roadmap and ensuring a smooth, frictionless path to production.

Agents used for this use case.

The Regulatory Monitoring Agent is often built on a combination of specialized agents. Here are some you can use to enhance this use case on the Lyzr platform:

- KYC Processing Agent

- Fraud Detection Agent

- AML Agent

- Legal Document Drafting Agent

- Compliance Agent

Frequently asked questions

It monitors transactions in real time to detect and prevent fraudulent activity.

By applying AI to differentiate legitimate transactions from fraud-like behavior.

Yes, it enhances and coexists with legacy fraud management platforms.

Yes, it monitors employee activity as well as customer transactions.

Banks, fintechs, payment providers, and e-commerce companies.

AI models continuously learn from new data and update detection rules.

Yes, it tracks domestic and international transactions with equal accuracy.

It uses enterprise-grade encryption, access controls, and compliance standards.

Yes, it provides audit-ready fraud detection and resolution records.

Typically within seconds, enabling real-time response.

Lower fraud losses, reduced operational costs, and higher customer satisfaction.

Build your first AI workflow today.

Start with a blueprint. Launch it. Customize it. Deploy it. All inside Lyzr.