Table of Contents

ToggleClaims AI agents are intelligent software systems that automate the entire insurance claims lifecycle.

Powered by large language models (LLMs), retrieval-augmented generation (RAG), and OCR, these agents streamline automated claims processing in insurance, from travel insurance claim OCR to car accident data capture, fraud detection, and claims adjudication.

By replacing manual tasks with AI-driven workflows, insurers can reduce processing time, cut costs, and deliver faster, more accurate settlements.

Why Insurers Are Adopting AI Agents Now??

Rising claim volumes from climate events and policy expansion, combined with growing fraud sophistication, have accelerated the adoption of AI claims solutions.

Insurers are under pressure to cut operational costs while delivering better customer experiences. Advances in OCR, NLP, and LLMs now make it possible to deploy AI claims solutions that processes travel, auto, health, and property claims in real time.

At the same time, regulators demand transparency and auditability, features built into modern AI agent frameworks.

Full-Stack Architecture for Insurance Claims Automation

Lyzr’s multi-agent blueprint for claims automation is modular, secure, and customizable. In the data ingestion layer, the Data Ingestion Agent is responsible for extracting structured and unstructured data from FNOL forms, emails, and PDFs using OCR tools such as Google Vision or AWS Textract.

It parses invoices, prescriptions, and policy documents while connecting seamlessly to CRM platforms like Salesforce and cloud data systems such as Snowflake.

The assessment layer is powered by the Damage Assessment Agent, which evaluates visual and sensor data from sources such as telematics, drones, and third-party image recognition APIs like Tractable. The agent uses LLM-based reasoning for context-aware analysis, improving judgment and claim accuracy.

In the violation and fraud detection layer, the Fraud Detection Agent scans for anomalies, checks against blacklisted vendors, and flags duplicate or suspicious claims. It leverages external fraud databases like NIPR and government watchlists to detect risks in real-time.

The decisioning and adjudication layer is driven by the Claims Adjudication Agent, which interprets the terms of the insurance policy, including exclusions, deductibles, and sub-limits. When a claim is complex or high-value, the agent escalates it to a human-in-the-loop process, ensuring compliance and trust.

Finally, the orchestration and communication layer is managed by the Customer Communication Agent. This agent provides real-time updates to claimants via email, SMS, or chatbot integrations. It works with tools like Gmail and call-center APIs while maintaining logs for audit and compliance, aligned with ISO/IEC 27001.

Explore 50+ other blueprints across BFSI, Sales & Marketing built by Lyzr

Benefits of AI Agents in Insurance Claims

- Speed: Claims that take weeks can be processed in hours.

- Accuracy: Reduced manual errors with OCR + structured extraction.

- Scalability: Handle surges in FNOLs during peak seasons.

- Fraud Detection: Enhanced with anomaly detection and external datasets.

- Customer Experience: Real-time status updates and quicker settlements.

- Compliance: Audit trails with every agent action, critical for regulators.

Tabular Breakdown: AI Agents vs Traditional Claims Processing

| Feature | Traditional Workflow | AI Agent-Based Workflow |

| Claim Triage | Manual Queueing | Automated Prioritization |

| Document Extraction | Human Entry or RPA | OCR + NLP Agents |

| Fraud Detection | Periodic Audits | Real-Time Signal Matching |

| Decisioning | Rule Engines | LLM + Policy Rule Reasoning |

| Customer Updates | IVR or Email Delays | Real-Time Chat + Notifications |

Expanded Real-World Use Cases:

- Automobiles: In the auto insurance sector, a mid-size provider has adopted Lyzr agents to evaluate repair shop estimates and compare them against telematics data from the insured vehicles. Low-risk claims are now processed and approved within six minutes. The system is integrated with Tractable for image recognition and Salesforce for CRM synchronization.

- Health: In the health insurance domain, a leading provider uses Lyzr agents to manage thousands of claims weekly. These agents validate prescriptions, detect invoice markup anomalies, and assess eligibility against plan coverage. The agents are fine-tuned with medical coding systems like ICD-10 and CPT for precision in interpretation and compliance.

- Real Estate: Property and disaster insurers have deployed Lyzr agents to assist in real-time damage evaluation post-floods or hurricanes. Agents process drone images, cross-verify data with APIs from organizations such as NOAA, and match claim details to policy clauses, speeding up disbursement while maintaining compliance.

- Travel: In travel insurance, agents handle delayed flights, missed connections, and lost luggage claims by parsing customer emails and retrieving data from airline APIs. The decisions are contextualized using policy specifics and automatically communicated to claimants.

Explore more sector-specific cases at Lyzr Case Studies.

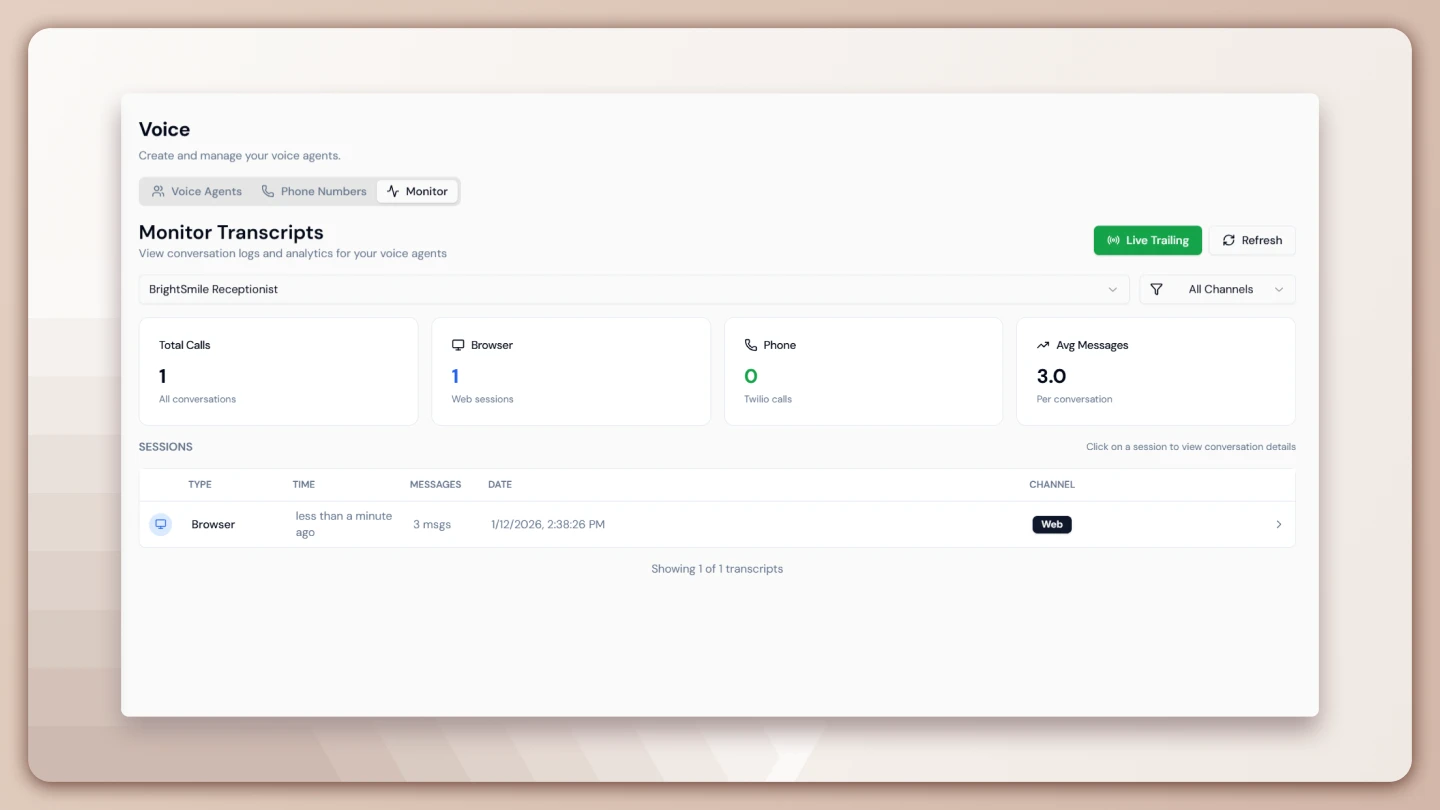

How Lyzr Enables Insurance Claims Agents

Lyzr’s low-code Agent Studio helps insurers go live with AI agents quickly and securely. With prompt or RAG-based workflows, you can customize agents for every stage of the claims process.

Lyzr also supports full-stack BFSI deployments through a library of modular agents and governance tools, ensuring scalability and regulatory alignment.

Want to know how you can get started? Book a demo today

The Future of AI in Claims Adjudication

AI in claims adjudication is moving beyond simple automation. Next-generation AI agents can interpret complex policy clauses, exclusions, and sub-limits, something traditional systems cannot manage without human review.

The future of claims adjudication will rely on multi-agent architectures where specialized AI agents handle different parts of the process:

- Data ingestion agents: Extract structured and unstructured claim details.

- Fraud detection agents: Compare claims against external fraud databases and anomaly signals.

- Decisioning agents: Apply LLM-based reasoning to policy rules for accurate outcomes.

- Communication agents: Deliver real-time adjudication updates to claimants.

With AI agent orchestration frameworks like Lyzr, insurers can scale adjudication securely, integrate with legacy CRMs, and maintain full auditability.

Frequently Asked Questions

1. What is a claims AI agent?

A claims AI agent is an autonomous system that automates parts of the insurance claims process, including document ingestion, fraud detection, and adjudication. Unlike traditional automation, claims AI agents reason over data, integrate with external systems, and provide real-time communication with claimants.

2. How are AI agents used in automated insurance claims processing?

AI agents streamline automated insurance claims processing by handling document OCR, policy interpretation, fraud detection, and customer communication. They cut claim resolution times from weeks to hours while maintaining compliance through audit-ready workflows.

3. What are AI claims solutions, and how do they benefit insurers?

AI claims solutions include specialized agents for intake, assessment, fraud detection, and adjudication. Benefits for insurers include faster processing, reduced operational costs, fewer false fraud alerts, and improved customer experience with real-time updates.

4. How does Lyzr enable AI agents for insurance claims?

Lyzr Agent Studio allows insurers to build and deploy AI agents for insurance claims processing and adjudication securely. Insurers can use prebuilt templates for auto, health, property, travel, and warranty claims, and customize them with OCR, NLP, and fraud-detection workflows, all with audit trails for compliance.

5. Can AI agents be used for travel insurance claims with OCR?

Yes. Travel insurance claim agents leverage OCR (Optical Character Recognition) to process tickets, boarding passes, and delay confirmations. They verify details against airline APIs and policy terms to approve or reject claims quickly.

6. What role does AI play in claims adjudication?

AI in claims adjudication ensures faster, more accurate decisions by interpreting complex policy clauses, exclusions, and sub-limits. AI agents escalate high-value or ambiguous claims to human adjusters while automating routine ones, reducing backlog and errors.

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here