Table of Contents

ToggleFor decades, getting a loan has felt like a slow, painful crawl. It’s a world of endless paperwork, where human analysts have the tough job of manually sifting through credit scores, bank statements, and employment histories, all while trying to spot potential red flags. The trouble is, this old-school approach is not just slow; it can be inconsistent and simply can’t keep pace with the speed of our digital world.

This is where AI agents for loan approval are changing the game entirely.

Imagine how AI agents for loan approval create intelligent, automated workflows designed to accelerate credit decisions with incredible accuracy, ensuring every choice is fair, compliant with regulations, and able to adapt to changes in real-time.

Let’s Explore in Depth. So What is a Loan AI Agent?

What is a Loan AI Agent and How Does It Enable Automated Loan Approval?

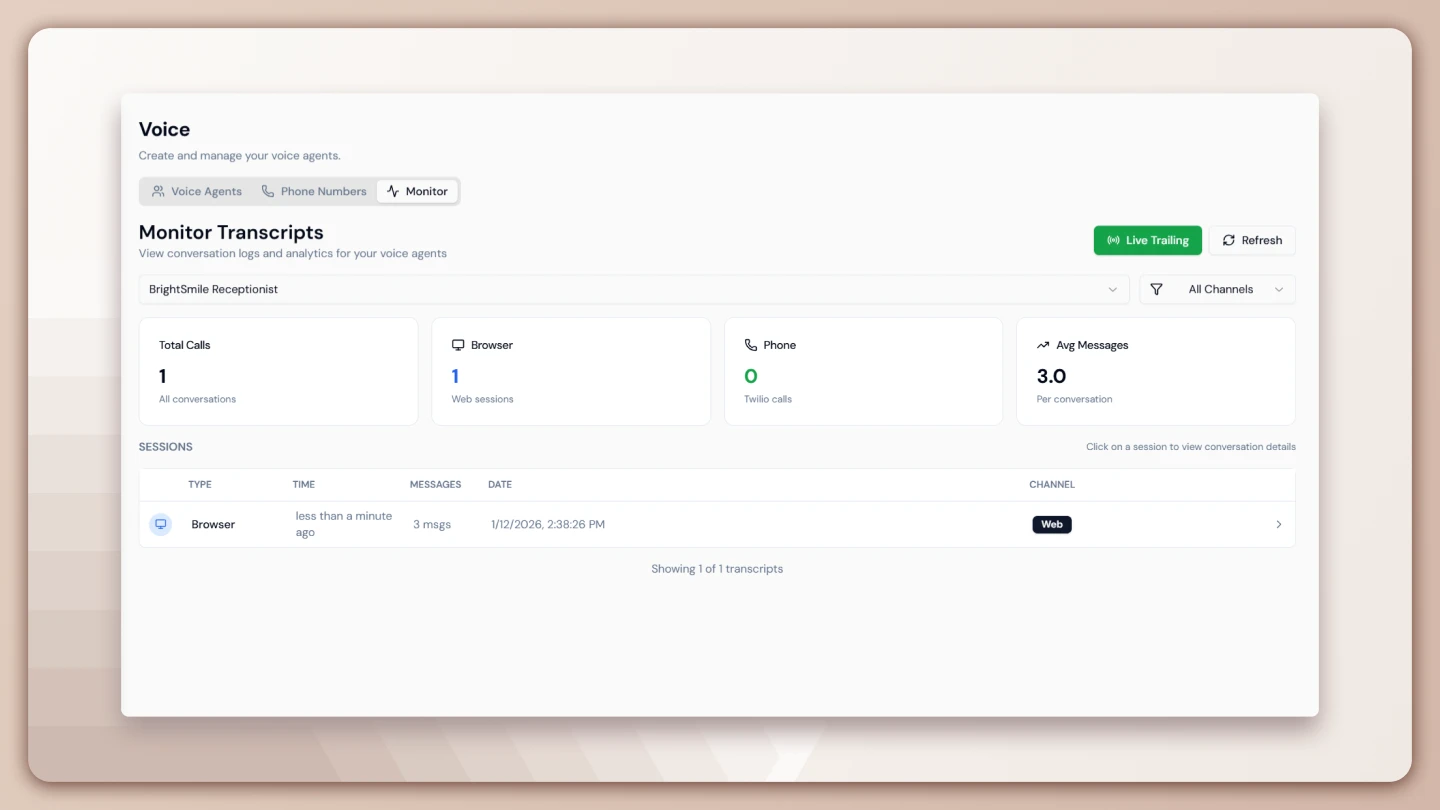

A Loan Approval Agent is an AI-powered software entity that autonomously evaluates loan applications. It extracts and validates financial documents, checks credit scores and repayment histories, verifies employment and income data, runs fraud and identity checks, and calculates eligibility based on risk models. These agents interact with APIs, internal datasets, and other agents to make decisions that are auditable, explainable, and customizable.

Watch a Loan Approval Agent in Action: YouTube : Lyzr Loan Agent Demo

The Problem with Traditional Loan Processing

Financial institutions often struggle with slow turnaround times, as manual reviews can take days or even weeks. There’s also a high risk of human error and bias, leading to inconsistent underwriting decisions. Operational costs are significant due to the need for large underwriting teams. Moreover, there’s increased regulatory risk and gaps in fraud detection stemming from outdated risk scoring systems.

AI agents help solve these problems by enabling autonomous document ingestion, implementing rule-based and ML-driven scoring systems, incorporating human-in-the-loop workflows for edge cases, and using Retrieval-Augmented Generation (RAG) to dynamically update rules in real time.

Solving these challenges requires more than just a single tool; it demands a complete re-imagining of the credit decision stack. The key lies in creating an intelligent, multi-layered system where specialized agents work together to automate each step of the process. Let’s look at the blueprint for how such a full-stack loan approval agent is architected.

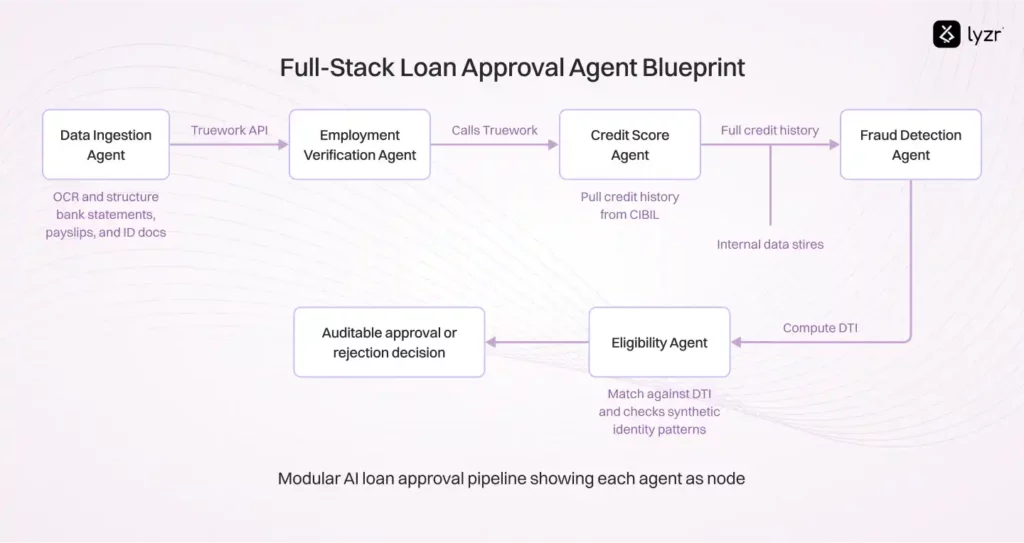

Architecture: Full-Stack Loan Approval Agent Blueprint

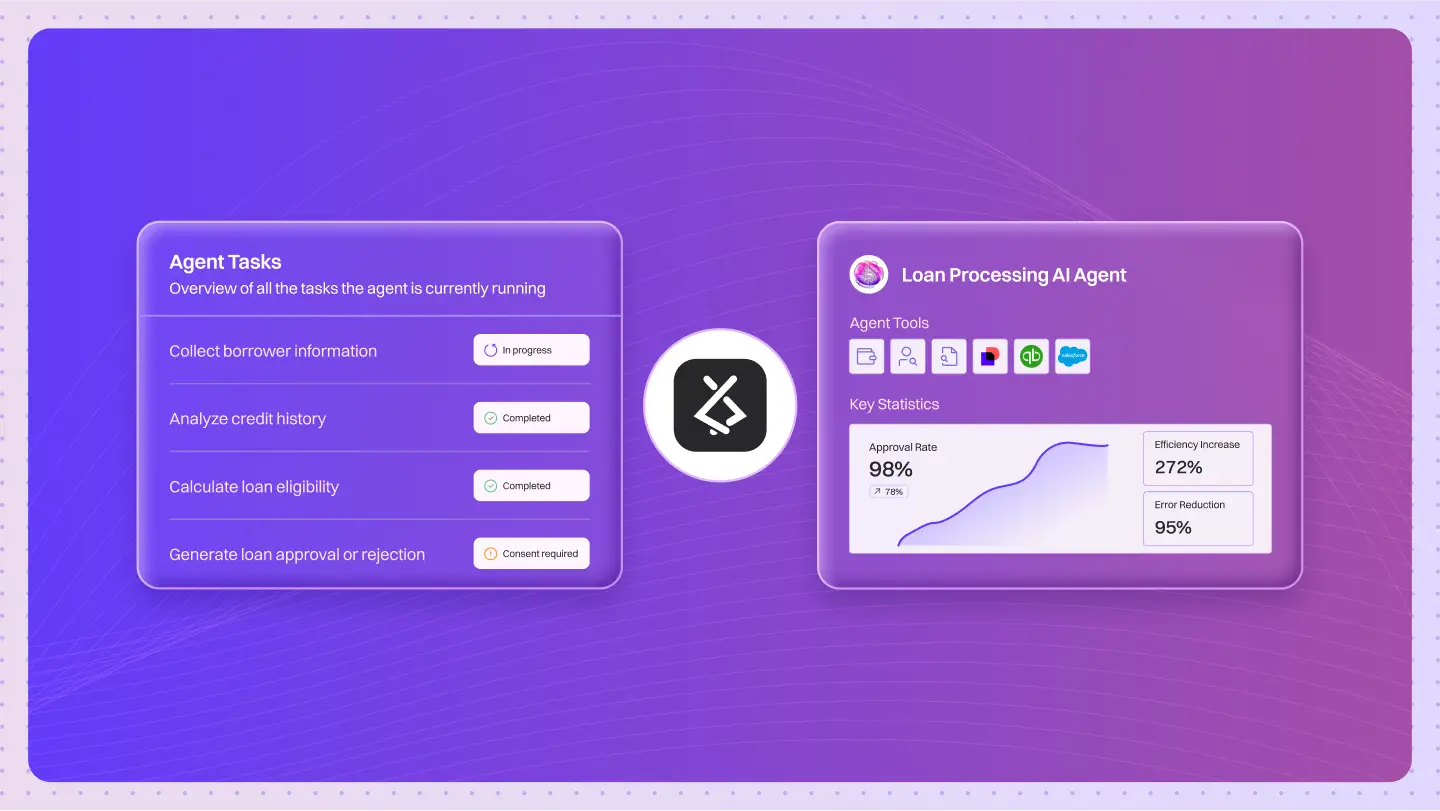

Lyzr’s multi-agent system can deploy the entire credit decision stack:

- Data Ingestion Agent: OCR and structure bank statements, payslips, and ID docs

- Employment Verification Agent: Call external employment verification APIs (e.g., Truework)

- Credit Score Agent: Pull credit history from CIBIL, Experian, or Equifax

- Fraud Detection Agent: Match against blacklists and check synthetic identity patterns

- Eligibility Agent: Compute DTI (Debt-to-Income) and approve or flag applications

To see a complete multi-agent system like this in action, watch our full demo on how AI-powered agents automate the entire customer onboarding process for banks.

Transforming Traditional Loan Underwriting with AI Agents

At its core, this automated system redefines the role of a loan underwriting AI agent. Instead of relying on manual checks and subjective analysis, the AI agent serves as the central brain, processing vast datasets to assess risk more accurately. It evaluates an applicant’s creditworthiness based on a holistic view of their financial health, moving beyond simple credit scores to deliver nuanced, data-backed underwriting decisions that are both fast and fair.

This holistic capability is a core strength of modern AI agents for loan approval.

To see exactly how an AI agent can generate a detailed underwriting report from just a few inputs, watch this tutorial on building a loan underwriting expert.

Key Components of a Loan Approval AI Stack

| Component | Description | Example Tools/APIs |

| OCR + NLP | Parse bank statements and documents | AWS Textract, Google Vision |

| Credit Scoring | Fetch and analyze credit data | Experian, Equifax, CIBIL |

| Employment Verification | Confirm employment & salary | Truework, Plaid Income |

| Risk Modeling | Predict repayment probability | Scikit-learn, Hugging Face |

| Fraud Detection | Identity, behavioral anomaly checks | Sift, Socure, LexisNexis |

| Orchestration Layer | Multi-agent control and logic | Lyzr Studio, LangGraph |

Why Enterprises Are Adopting AI Agents for Loan Approvals

The business case for adopting AI agents for loan approval is compelling. According to a BCG report, digitizing loan origination can reduce costs by 30-50% and improve approval times by 70%.

Benefits include:

- Instant Decisions: From weeks to seconds

- Explainability: Every step logged and auditable

- Consistency: Objective decision-making across all applications

- Scalability: Easily handle seasonal spikes or new product launches

- Customization: Adjust risk models and rules per geography or product

For a deeper dive into how AI agents are revolutionizing the financial sector, download our Banking Playbook to discover strategies for reducing workloads and delivering consistent, scalable results.

Real-World Use Cases for Loan Application AI Agents

AI agents for loan approval are transforming operations across the financial landscape, from digital-first neo-banks to traditional mortgage lenders. Here are a few key examples:

Digital Banks & Neo-banks

These institutions can deploy agents built on Lyzr to automate unsecured personal loan approvals. The agents handle document parsing, real-time credit score retrieval, and fraud checks, significantly reducing processing time and human effort.

How AI Agents Automate BNPL Decisions

To enable instant checkout financing, BNPL services use embedded AI agents that assess creditworthiness in under a second. These agents pull income data, assess historical repayment patterns, and flag potential fraud in real-time.

Housing Finance Companies

Mortgage lenders use multi-agent setups to validate employment records, analyze bank statements, and determine loan-to-value ratios. These AI agents for loan approval speed up loan origination and reduce risk through layered verification.

SME Lending

Small business lenders leverage agents to process GST data, check business registration status, and assess cash flow. This helps them underwrite loans quickly while maintaining compliance with regional SME lending norms.

Why a Modular Approach is Leading in Real-Time Credit Decisioning

- No-Code Agent Studio: Build agents using visual workflows

- On-Premise Ready: Deploy inside your own VPC/cloud

- Composable & Secure: Swap tools (e.g., Experian for Equifax), secure all data

- Smart Orchestration: LangGraph-style routing based on loan type or geography

- Dynamic Learning: Use RAG to adapt to regulation or credit scoring changes

Challenges & Trade-Offs in Moving to AI Agents

While the benefits are clear, a successful transition to AI agents for loan approval requires addressing potential challenges.

| Challenge | Description | Mitigation Strategy |

| Model Bias | Bias in training data leads to unfair rejections | Audit data & use fairness constraints |

| Data Privacy | Financial & identity data is highly sensitive | Deploy on private cloud via Lyzr |

| Explainability | Complex ML models hard to interpret | Use traceable agent workflows |

| Regulatory Drift | Lending laws change across regions | Integrate RAG for live rule updates |

| Automation Overload | Risk of skipping human review | Include human-in-loop fallback workflows |

Conclusion

The days of slow, paperwork-heavy loan approvals are officially behind us. The future of lending is powered by intelligent AI agents for loan approval that deliver instant, accurate, and scalable credit decisions. This critical shift transforms a costly operational bottleneck into a significant competitive advantage, improving both internal efficiency and the end-customer experience. Building this future is more accessible than you might think with a modular, no-code framework designed for security and customization. See for yourself how you can deploy a powerful loan underwriting agent tailored to your institution’s needs.

Schedule your personalized demo of Lyzr today and start your automation journey.

Frequently Asked Questions

1. What exactly is a personal credit application AI agent?

A personal credit application AI agent is a specialized piece of software designed to autonomously handle and evaluate a loan application from start to finish. It mimics the decision-making process of a human analyst by performing tasks like reading financial documents, verifying income and employment through external services, checking credit scores from bureaus, and running fraud detection checks. The end goal is to produce a fast, accurate, and consistent eligibility decision without manual intervention.

2. How does a loan underwriting AI agent differ from traditional methods?

A loan underwriting AI agent transforms the process from a slow, manual review into a dynamic, data-driven workflow. Unlike traditional methods that rely on static checklists and human interpretation, an AI agent can analyze thousands of data points in seconds, identify complex patterns, and calculate risk with greater precision. This not only accelerates turnaround times from weeks to minutes but also reduces the potential for human error and bias, leading to fairer and more consistent underwriting decisions across all applications.

3. Can these AI agents automate BNPL (Buy Now, Pay Later) decisions at checkout?

Absolutely. Automating BNPL decisions is a prime use case for AI agents, as they are built for the kind of instant, real-time credit assessment required at a point of sale. When a customer chooses a BNPL option, an embedded AI agent can immediately pull relevant financial data, assess repayment history, and check for fraud indicators to approve or decline the transaction in under a second. This seamless process is crucial for providing a smooth customer experience at checkout while effectively managing risk for the lender.

4. When evaluating AI lending platforms, what indicates a leader in real-time credit decisioning?

A leading platform for real-time credit decisioning is defined by its modularity and adaptability, allowing financial institutions to build and customize their own workflows without being locked into a single rigid system. True industry leaders provide a framework where you can easily swap data sources, integrate various verification APIs, and fine-tune risk models to fit specific products or regional regulations. This composable, secure, and often no-code approach is critical for creating scalable and future-proof lending operations that can evolve with the market.

5. How can I determine if an agentic workflow is the right solution for my institution?

The best way to evaluate an agentic workflow is to see how easily it can be adapted to your existing processes and specific needs, such as handling unique document types or integrating with your current compliance rules. A key consideration should be whether the platform allows for rapid prototyping and deployment, as this reduces the initial risk and resource commitment. For instance, building a proof-of-concept with a flexible AI agent framework like Lyzr can quickly demonstrate the potential ROI in cost reduction and decision speed, helping you make an informed decision without a massive upfront investment.

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here