Table of Contents

ToggleTL;DR

AI is revolutionizing financial forecasting by combining real-time data ingestion with predictive modeling across agents. CFOs now gain access to autonomous agents for revenue prediction, cost modeling, and cash flow orchestration; all with auditable logic and embedded controls. Platforms like Lyzr Agent Studio accelerate time-to-value by offering prebuilt forecasting agents for enterprises.

What is AI in Financial Forecasting?

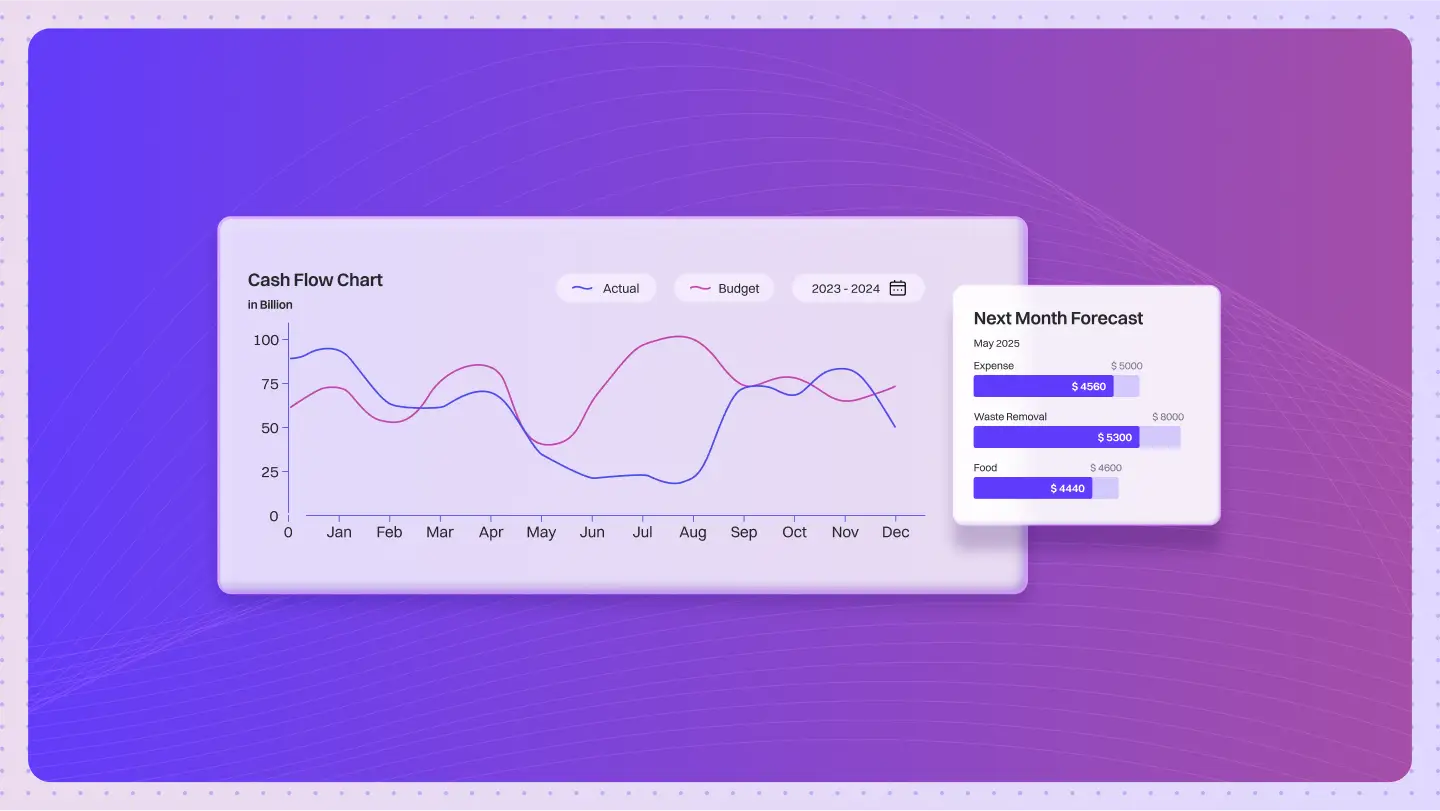

AI in financial forecasting refers to the use of machine learning models, large language models (LLMs), and multi-agent systems to predict revenue, expenses, cash flow, and other financial metrics. Unlike static statistical models, AI-powered forecasts adapt to real-time signals; market trends, customer behaviors, and macroeconomic shifts; delivering dynamic, scenario-based insights for decision-making.

When deployed with an agentic architecture, these forecasts become modular, explainable, and auditable; tailored to enterprise-grade financial planning and analysis (FP&A).

Platforms like Lyzr make this deployment seamless with plug-and-play agents.

How Are Enterprises Deploying AI in Financial Forecasting Today?

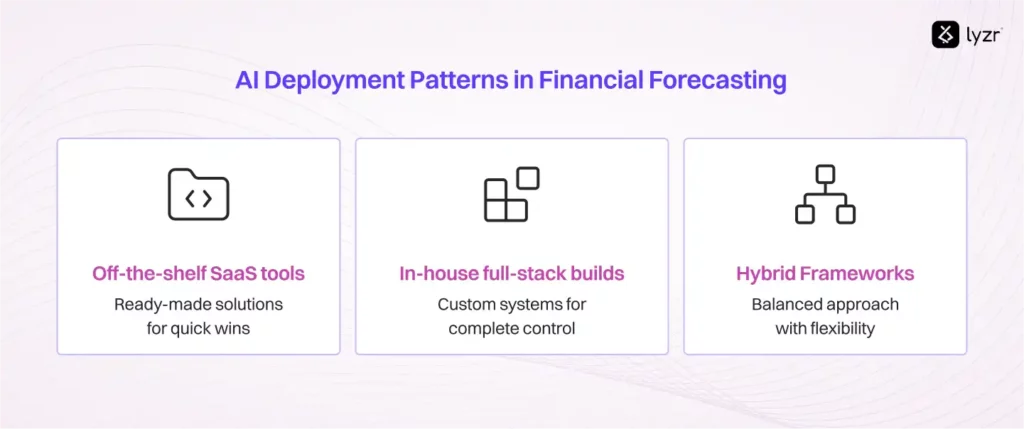

Enterprise adoption of AI in financial forecasting is evolving across three primary deployment patterns:

- Off-the-shelf SaaS tools: Solutions like Workday Adaptive Planning, Anaplan, and Planful provide ready-made forecasting modules that integrate with ERP and BI platforms. These tools offer quick wins through automated P&L projections, rolling forecasts, and dashboard visualizations. However, they often function as closed systems, limiting the ability to embed proprietary logic, real-time signals, or granular scenario modeling required by complex enterprises.

- In-house full-stack builds: Enterprises like Amazon, Goldman Sachs, and Tata Group are building custom forecasting engines using orchestration frameworks like Databricks Workflows, AWS Step Functions, or Airflow. These pipelines include connectors to internal data lakes (e.g., Snowflake), custom-built ML models hosted on SageMaker or Azure ML, and business rule engines for scenario planning. While these systems offer complete control and high fidelity, they demand significant time, cross-functional collaboration, and ongoing maintenance across data, modeling, and compliance functions.

- Hybrid frameworks with customizable agent templates: A growing number of mid-to-large enterprises are adopting hybrid platforms like Lyzr to balance speed and control. These systems offer prebuilt financial forecasting agents such as revenue prediction, workforce planning, or cash flow modeling agents that can be orchestrated with internal APIs, custom Excel logic, or regulatory constraints. This modular approach reduces time-to-value dramatically while allowing CFOs to retain enterprise-grade flexibility, control, and auditability.

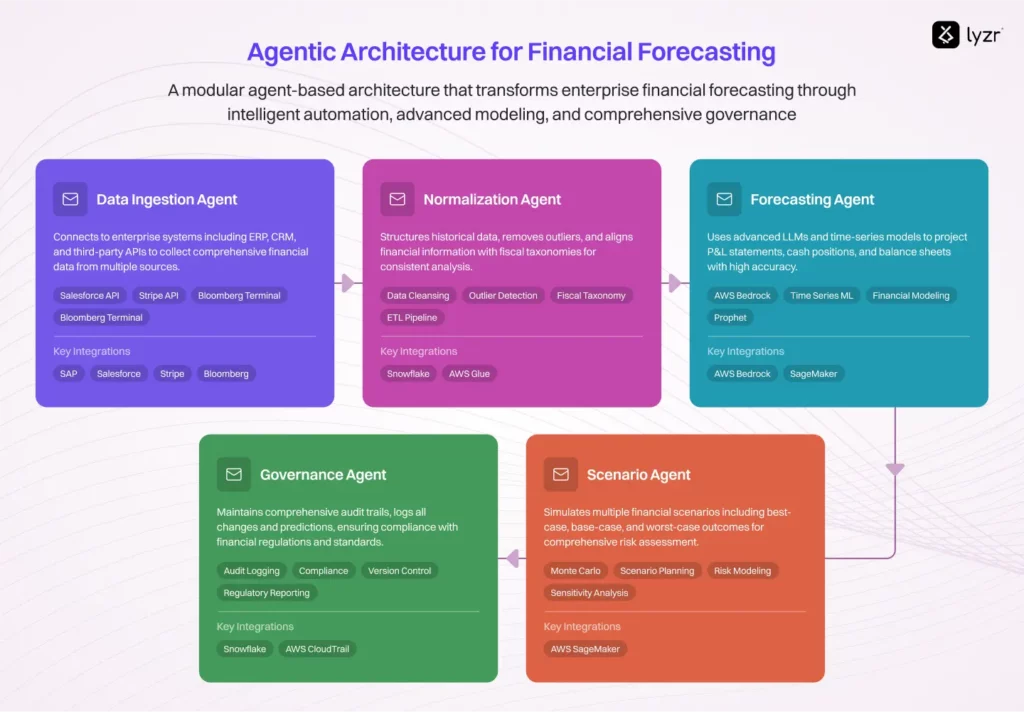

Agentic Architecture for Financial Forecasting

A modular agent-based architecture transforms how enterprises handle financial forecasting. The process starts with a Data Ingestion Agent, which connects to ERP, CRM, and third-party APIs (e.g., Salesforce, Stripe, Bloomberg). This is followed by a Normalization Agent that structures historicals, removes outliers, and aligns with fiscal taxonomies.

A Forecasting Agent uses LLMs and time-series models to project P&L statements, cash positions, and balance sheets. A Scenario Agent simulates best-case, base-case, and worst-case outcomes, while a Narrative Agent generates board-ready summaries. Finally, a Governance Agent logs all changes and predictions, supporting audit trails and compliance.

Diagram suggestion: A left-to-right modular pipeline showing five agents; Data Ingestion → Normalization → Forecasting → Scenario Simulation → Governance. Connectors to SAP, Salesforce, AWS Bedrock, and Snowflake should be embedded.

Need a playbook for implementing Agents in Banking? check out the playbook.

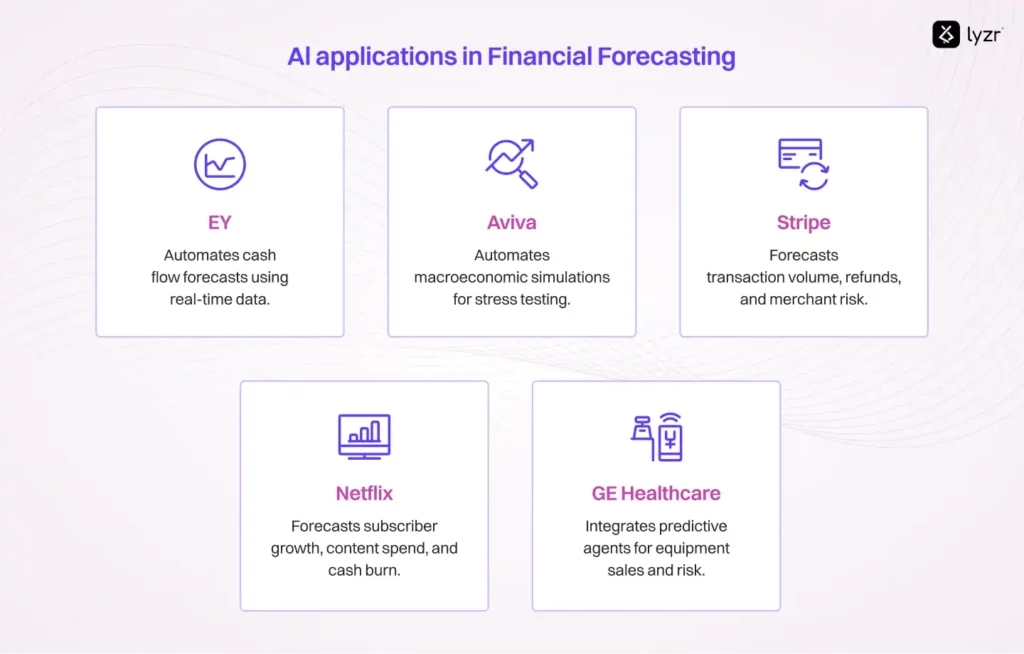

Real-World Use Cases

EY (Ernst & Young) uses AI agents to automate cash flow forecasts across their global clients. These agents ingest real-time banking data, accounts receivable, and payable histories to generate rolling forecasts.

Aviva deployed AI-powered scenario planning for regulatory stress testing. Lyzr-style agentic workflows helped automate worst-case macroeconomic simulations, reducing analysis time by 70%.

Stripe utilizes ML models to forecast transaction volume growth, refunds, and merchant risk exposure, making it one of the leading payment processors for fast, reliable, and scalable global payments.

Netflix leverages agent-based modeling to forecast regional subscriber growth, content spend, and cash burn; enabling dynamic budget adjustments across departments.

GE Healthcare integrates predictive agents for equipment sales, operational costs, and procurement risk, optimizing working capital and enhancing supply chain decisions.

Explore additional applications in the AI Agents for Banking Use Cases hub.

Why Lyzr: The Agentic Advantage

Lyzr provides a full-stack platform to deploy financial forecasting agents in days; not months. Enterprises get access to:

- Prebuilt forecasting agents for revenue, expense, cash flow, and workforce planning

- Orchestration engine that allows chaining agents (e.g., ingest → normalize → forecast → narrate)

- Compliance-ready with SOC 2, GDPR, and HIPAA-safe modules (see Lyzr Academy)

- Plug-and-play integrations with Snowflake, SAP, NetSuite, Salesforce, and more

- Enterprise guardrails: human-in-the-loop, audit trails, approval workflows

Whether you’re building forecasts for FP&A, board reporting, or strategic planning, Lyzr’s platform delivers speed, control, and modularity. Check out our Case Studies to see enterprise deployments in action.

Build vs Buy vs Lyzr Hybrid

| Criteria | Build In-House | Buy SaaS Tool | Lyzr Hybrid Platform |

| Customization | High but slow | Limited to vendor features | Modular agent SDK + customization |

| Time to Deploy | 6–12 months | 2–3 months | 1–2 weeks with prebuilt agents |

| Cost | High (engineering + infra) | Medium | Flat pricing, scalable |

| Control & Compliance | Full (but complex to maintain) | Vendor-managed | Enterprise-grade controls |

FAQs

1. Can I swap LLMs in Lyzr’s financial forecasting agents?

Yes. Lyzr supports pluggable LLMs like OpenAI, Anthropic, and even private models via AWS Bedrock.

2. Can these agents integrate with our CRM and ERP?

Absolutely. Lyzr supports Salesforce, NetSuite, SAP, and Snowflake via native and custom connectors.

3. How do you ensure compliance and audit readiness?

All agent activities are logged. You get governance dashboards, approval chains, and audit logs by default.

4. Is human-in-the-loop supported?

Yes. You can configure thresholds where forecasts are routed to finance teams for review before submission.

5. Can I reuse forecasting agents across business units?

Yes. Agents are modular and reusable across geographies, SBUs, or departments with parameter tuning.

6. What’s the typical pilot to production timeline?

1 week for a pilot. 4–6 weeks to scale to production with historical data, access provisioning, and reviews.

7. What if we want to build forecasting logic ourselves?

Lyzr supports a hybrid model. Use our orchestration + governance layer and bring your own forecasting agent.

8. How does Lyzr mitigate hallucinations or model drift?

Lyzr includes model monitoring, external validation agents, and statistical confidence thresholds to flag anomalies.

Looking to bring AI agents into your company? Book a demo to see them in action.

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here