- Lyzr Marketplace

- Insurance

- Claims Processing Agent

Claims Processing Agent

Manual claims processing is slow and costly. This agent automates the entire lifecycle for faster, more accurate, and cost-effective resolutions.

- VPs of Claims

- Chief Operating Officers

- Heads of Claims Transformation

Trusted by leaders: Real-world AI impact.

The problems we hear from leaders like you

The pressure to reduce costs while improving customer experience is immense. These are the challenges that legacy claims systems create.

Manual overload

Adjusters spend up to 30% of their time on low-value administrative tasks, increasing costs and the risk of burnout.

Siloed data

Fragmented information across legacy systems prevents a complete view of a claim, causing delays and duplicated efforts.

Rising costs

High Loss Adjustment Expenses (LAE) and claims leakage eat into profitability and create significant financial exposure.

Poor CX

Slow, opaque processes lead to customer frustration, eroding trust and loyalty at the most critical touchpoint.

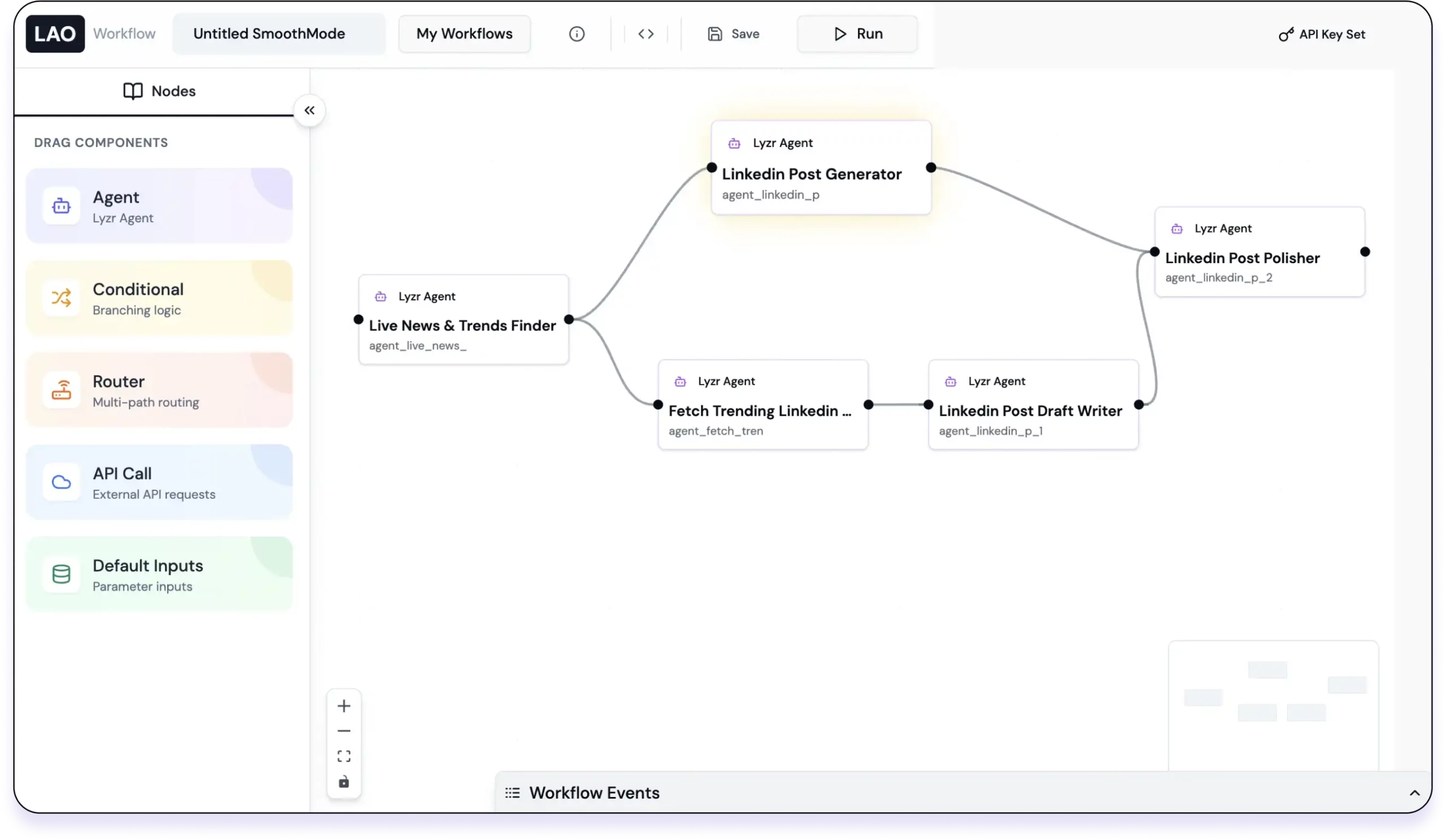

Agent workflow for regulatory monitoring

Quantifiable value for your operations

Your investment in AI should not be a leap of faith. It should deliver a clear, measurable impact on your most important KPIs.

- 45%

reduction in average claims cycle times, leading to faster resolutions.

- 40%

increase in adjuster productivity, allowing teams to handle more volume.

- 35%

decrease in overall claims processing costs.

- 30%

reduction in claims leakage by identifying liability exceptions automatically.

Outcomes you can expect

By deploying our agent, you will fundamentally transform your claims operation from a cost center into a strategic advantage. Here’s what to expect.

Intelligent intake

Automate First Notice of Loss (FNOL) with 24/7 availability, ensuring accurate, complete data capture from the start.

Automated triage

Instantly categorize claims by complexity, enabling straight-through processing for simple cases and routing complex ones to experts.

Accelerated assessment

Use computer vision to analyze photos and videos, providing accurate damage estimates in seconds without a physical inspection.

Proactive fraud detection

Leverage machine learning to analyze patterns and flag suspicious claims with high accuracy, preventing financial loss.

How to start building from here

The journey from a promising pilot to a deployed solution can be a challenge. We are your partner in implementation, sharing the risk and ensuring your AI agents make it to production. We don't just provide a platform; we provide a clear pathway to success.

Dedicated AI expertise

We invest in a Forward Deployment AI Engineer (FDE) to work directly with you. Our FDE acts as a hands-on AI startup CTO for your project.

A partner in risk management

We take on the risk of ensuring your agent goes from concept to a fully functional, production-ready solution. We'll work with you every step of the way to get you live.

Strategic guidance & workshops

Our dedicated team will provide strategic guidance and training sessions, empowering your internal teams to own and scale your AI capabilities once your first use case is live.

Project management oversight

We assign a project manager to oversee your agent's journey, providing a clear roadmap and ensuring a smooth, frictionless path to production.

Agents used for this use case.

The Regulatory Monitoring Agent is often built on a combination of specialized agents. Here are some you can use to enhance this use case on the Lyzr platform:

- KYC Processing Agent

- Fraud Detection Agent

- AML Agent

- Legal Document Drafting Agent

- Compliance Agent

Frequently asked questions

An AI-powered system that automates the claims lifecycle, from initial submission and triage to damage assessment, fraud detection, and settlement.

No. The agent augments your team by handling repetitive, manual tasks, freeing adjusters to focus on complex cases and customer communication.

It uses machine learning to analyze claim data, documents, and historical patterns to flag suspicious activity for human review.

By automating manual tasks, enabling straight-through processing, and reducing claims leakage, it lowers Loss Adjustment Expenses (LAE).

A fully automated process where simple, low-risk claims are processed from submission to payment with zero human intervention, drastically cutting costs.

Yes, our agents are designed to act as an intelligent layer on top of your existing legacy systems, preventing costly rip-and-replace projects.

Policyholders submit photos of damage, and the AI agent analyzes them to provide an accurate repair estimate in seconds, often eliminating the need for an adjuster.

By speeding up resolutions and providing proactive communication, the agent creates a faster, more transparent experience that builds loyalty.

Its intelligent triage system automatically categorizes claims by complexity, routing simple ones for automation and complex ones to specialized adjusters.

We prioritize enterprise-grade security and data privacy. The platform is designed to handle sensitive information with the highest standards of security.

A PoC is a small-scale project that demonstrates the agent's value within your organization's specific context, showing tangible results quickly.

The time to implement depends on the complexity of your use case, but our roadmap provides a clear path to get a Proof of Concept up and running quickly.

Build your first AI workflow today.

Start with a blueprint. Launch it. Customize it. Deploy it. All inside Lyzr.