Table of Contents

ToggleOver 300 billion business emails are exchanged annually, and a significant portion flows into customer service teams. For insurance providers, this creates a critical challenge: ensuring each email is acknowledged, classified, and resolved without delay.

Manual handling slows down response times, increases workload, and often leaves customers waiting.

The Global insurer faced a similar challenge in managing its high volume of service emails. The need was clear, faster classification, accurate case tracking, and timely customer acknowledgment.

To address this, Lyzr introduced an agentic email triage and case management system that automated the entire process from inbox to resolution.

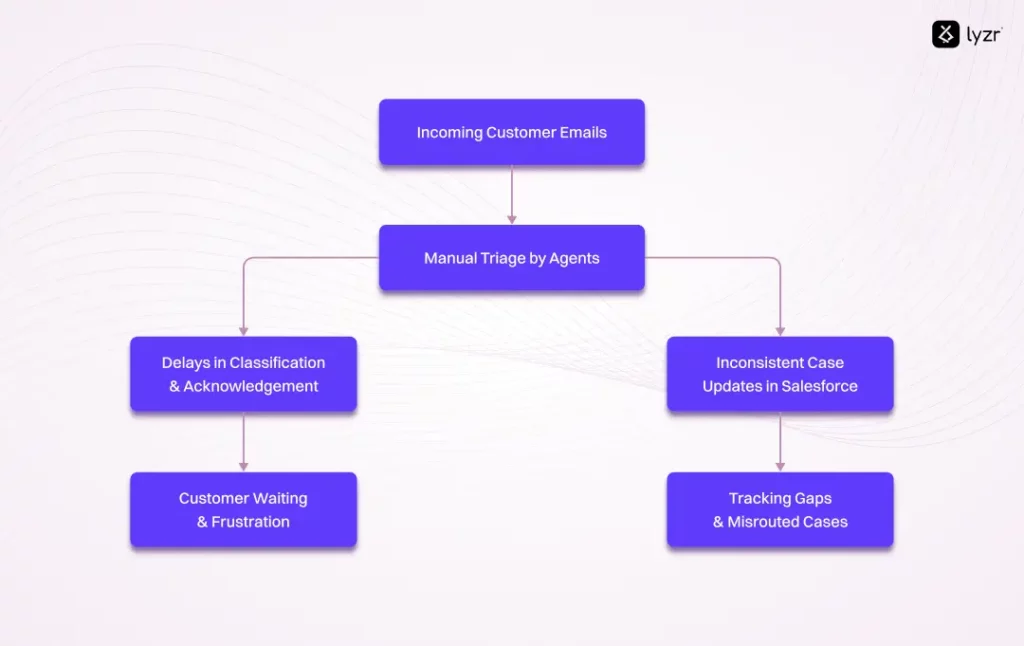

The Challenges Faced

Customer service operations were under increasing pressure from the rising volume of emails.

Three key challenges stood out:

- Manual email triage consumed significant time: Service agents had to open, read, and classify each email manually. This slowed down workflows and left customers waiting for acknowledgment.

- Delayed responses impacted customer experience: Customers did not receive immediate confirmation or updates, creating uncertainty and reducing trust in the service process.

- Inconsistent case tracking in Salesforce: Cases were not always created or updated accurately, leading to gaps in tracking and occasional delays in routing issues to the right teams.

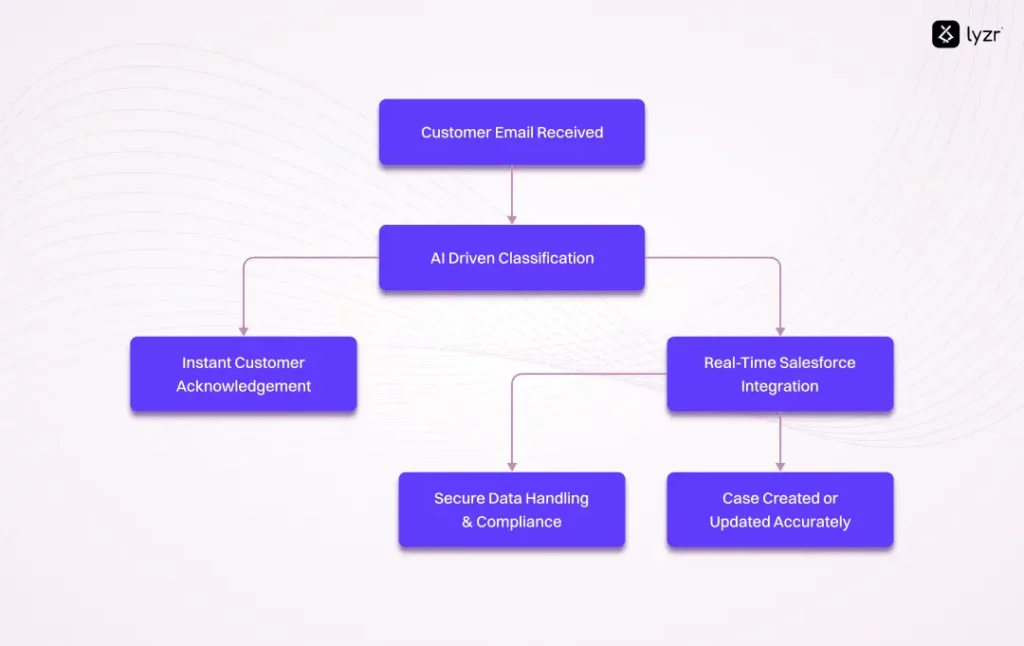

What the Ideal Solution Needed

The solution had to go beyond manual fixes and rethinking workflows. At its core, it needed to ensure that every email, no matter how complex, could be received and classified automatically.

The process had to connect directly with Salesforce so that cases were created or updated in real time, eliminating the gaps caused by human delays.

Equally important was the customer experience. Each inquiry had to be acknowledged instantly with a clear confirmation and timeline for resolution, building trust from the very first interaction.

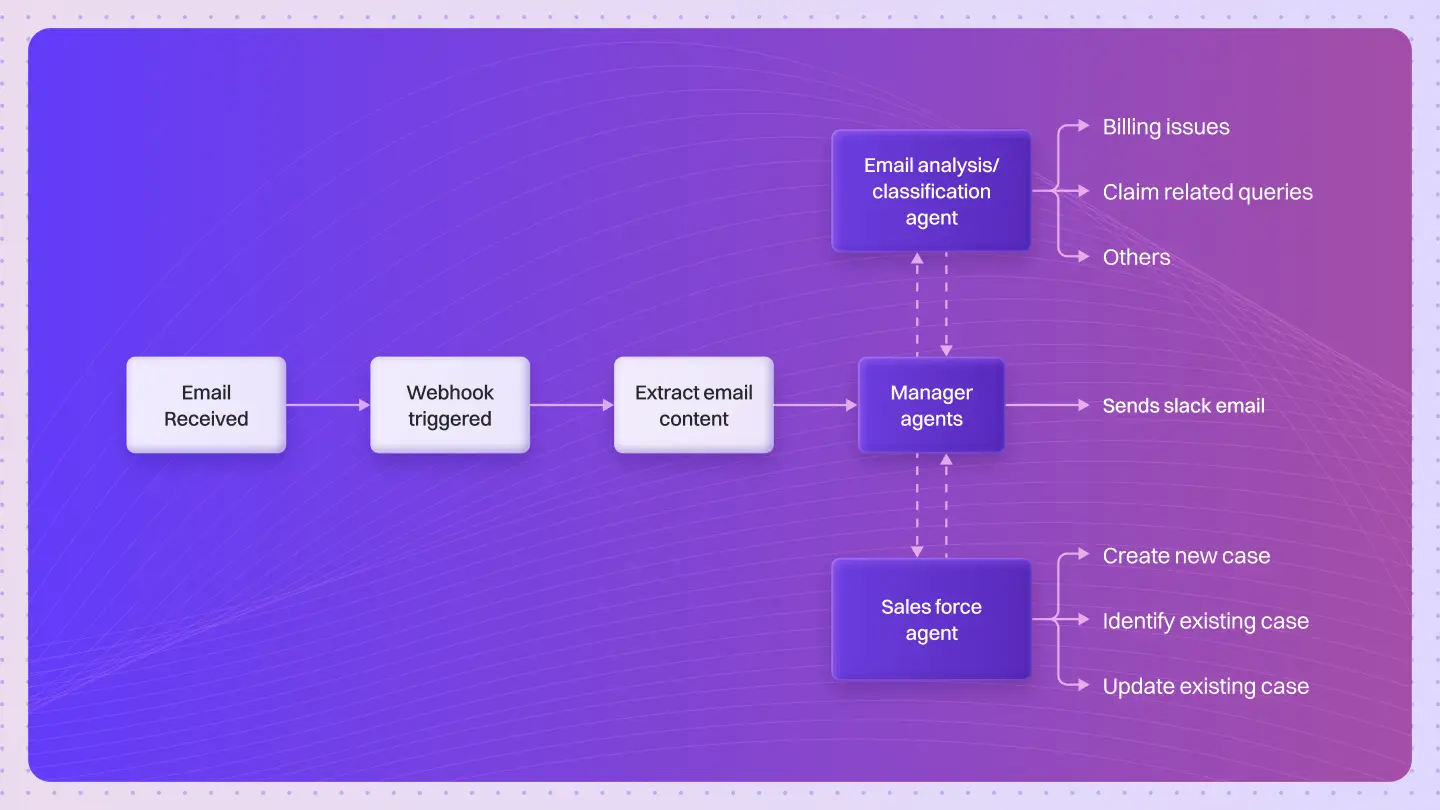

And because the insurance sector deals with highly sensitive data, the system had to embed security at every step, from policy details to billing information, ensuring compliance and safe handling across all interactions.

How Lyzr Solved It

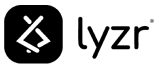

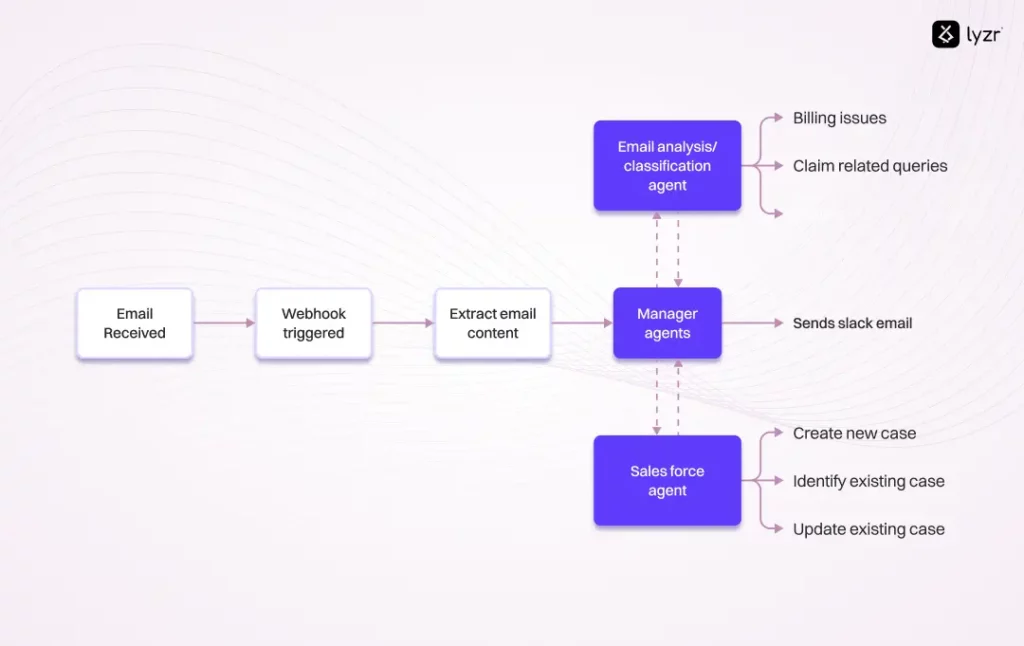

Lyzr built an agentic email triage and case management system that automated customer service workflow from inbox to resolution. Instead of relying on manual intervention, the system orchestrated multiple specialized agents, each responsible for a critical step in the process.

1. Manager Agent

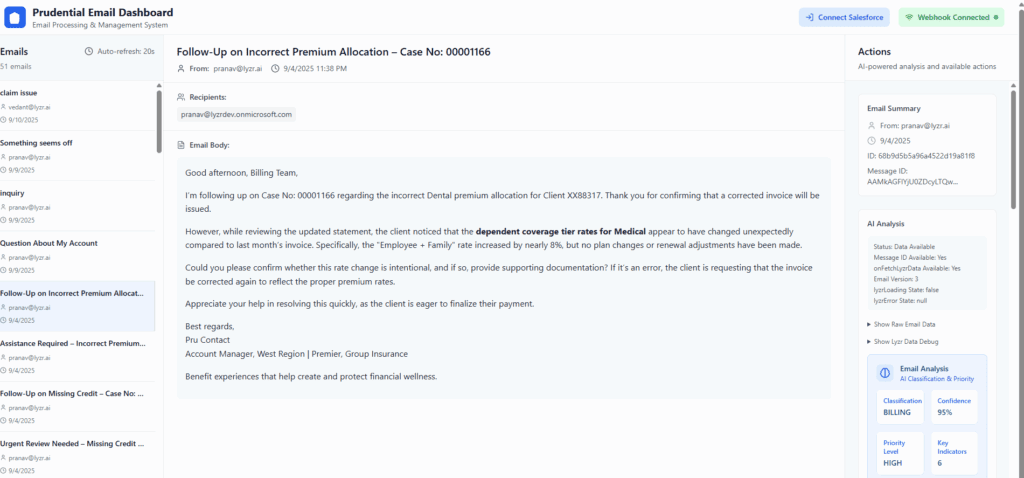

The process begins when a customer email arrives in the Outlook inbox. A webhook immediately triggers the workflow, extracting subject lines, body content, attachments, and metadata. From there, the Manager Agent takes charge, sending an instant acknowledgment to the customer while passing the extracted content to the next specialized agents.

2. Email Classification Agent

The Email Classification Agent analyzes the inquiry using AI. Emails are categorized into areas such as billing issues, claims, or general queries. Alongside classification, the agent assigns urgency levels, confidence scores, and extracts identifiers like policy numbers or invoice references.

3. Salesforce Agent

Once classified, the Salesforce Agent ensures seamless case management. It checks if a case already exists, updating it with new details when available, or creates a new one when required. Integration with Salesforce is secured through token-based authentication, ensuring sensitive data like billing and policy details remain protected.

4. Customer Communication and Internal Routing

After Salesforce actions, the system ensures customers remain informed. Automated acknowledgment templates are sent, providing confirmation of receipt, estimated timelines, and next steps. Simultaneously, the workflow handles internal routing, assigning cases to the appropriate specialist teams such as Billing or Claims, and setting follow-up timelines for resolution.

Results and Impact

With Lyzr’s agentic email triage and case management system in place, the insurer transformed its customer service operations. The improvements were clear across efficiency, accuracy, and customer experience.

| Area | Before Lyzr | After Lyzr |

|---|---|---|

| Response Times | Manual triage delayed acknowledgments | Instant acknowledgments sent automatically |

| Manual Effort | Agents spent hours reading, classifying, and routing emails | AI handled triage, freeing agents for higher-value tasks |

| Case Accuracy | Inconsistent case creation and updates in Salesforce | Real-time, secure creation and updates with no gaps |

| Customer Experience | Customers waited without clarity or timelines | Customers received confirmations and clear next steps |

Wrapping Up

This leading global insurer successfully shifted from a manual, time-consuming email management process to an automated, agent-driven workflow. Lyzr’s system not only improved efficiency and accuracy but also elevated the customer experience with instant acknowledgments, precise case tracking, and secure handling of sensitive information.

By implementing this agentic email triage and case management system, the insurer strengthened operational reliability, reduced workloads for service agents, and ensured that no customer inquiry went unresolved.

Book a demo to explore how Lyzr can simplify email and case management workflows for enterprises.

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here