Table of Contents

ToggleAnother Monday. Another “digital transformation” initiative. Your inbox? Overflowing. Your teams? Stretched thin. The promise of “efficiency” often feels like a cruel joke, more like “endless meetings” and “spreadsheet fatigue.”

You’ve seen it all before: the next big thing, the silver bullet. But this time, it’s different. This isn’t just another buzzword. This is about AI agents, think of them as your new co-pilots: autonomous, goal-driven, designed to cut through the noise, streamline operations, enhance customer experiences, and uncover insights that actually drive growth.

The skepticism you feel is valid. Past tech initiatives often promised the moon but delivered a rock. AI agents, however, are the definitive solution.

They tackle the very disruptions that caused fatigue, offering a path to smarter, more effective change, tangible results, and less human friction.

They address the core pain points that have plagued large-scale tech adoptions for years, and there’s a bigger shift happening.

The industry is changing fast. Traditional time-and-materials (T&M) billing is fading, and outcome-based pricing is taking over. Why? AI is boosting productivity. If an AI tool can slash a coding task from eight hours to two, clients will question paying for effort; they want results.

This forces GSIs to rethink everything: revenue models, service delivery. AI agents aren’t just internal tools, they’re enablers for outcome-based services. GSIs must embrace them not just for cost savings, but to fundamentally reshape client relationships and revenue.

Positioning AI agents as a strategic lever can pave the way for a more profitable, value-driven future. This article serves as a roadmap: a clear path to building a profitable AI agent practice, one that truly delivers, not just promises.

The Shifting Sands of GSI: Why AI Agents Are Your Next Frontier

Global Systems Integrators operate in a fast-evolving environment: rapid AI adoption, multi-cloud and hybrid infrastructures, vast data volumes, and constant cybersecurity threats.

GSIs are indispensable partners, specializing in the design, implementation, and management of complex IT systems for major enterprises and governments, bringing disparate systems together and making them work.

Leading GSIs

- Accenture

- IBM

- TCS

- Capgemini

- Deloitte

Core strengths: global reach, deep technical expertise, and large-scale transformation execution.

Market Opportunity and Evolution

The role of GSIs has expanded from purely technical implementation to strategic enablement:

- Guiding clients through digital transformation

- Driving outcome-based engagements instead of traditional time-and-materials (T&M) billing

- Leveraging AI to improve productivity and reduce delivery time (e.g., an eight-hour coding task now takes two hours)

Outcome-based pricing is no longer optional, it’s a survival imperative.

Revenue Growth Projection

| Metric | 2024 | 2034 | Notes |

|---|---|---|---|

| Global GSI market size | $400B | $2.2T | Massive growth over 10 years |

| Global AI agents market | $5.4B | $47.1B | CAGR 45.8% (2025-2030) |

| Agentic AI opportunity for GSIs | — | ~$1T | Based on enterprise adoption of agentic AI |

Strategic Imperatives for GSIs

- Internal AI adoption as proof

- Successful internal implementations become a differentiator.

- Demonstrates real-world proficiency to clients.

- Addresses client skepticism and builds credibility.

- Shift to outcome-based models

- Clients demand results, not effort.

- Lagging on AI adoption risks losing market share.

- Revenue models and service delivery must be re-evaluated.

- Integrating AI agents into service portfolios

- Move from traditional system integration → agentic ecosystem integration

- Requires deep understanding of:

- AI agent architectures

- Orchestration frameworks

- Governance models

Sector Opportunities for AI Agents

| Sector | Estimated Market (USD) |

|---|---|

| Tech/Telecom/Media/Entertainment/Gaming (TMEG) | $125B–$175B |

| Retail & CPG | $150B–$200B |

| Financial Services & Insurance | $125B–$175B |

| Automotive & Industrial | $200B–$250B |

Regional Highlights

- U.S.: Largest market share at 40.1%

- Asia Pacific: Fastest-growing region, highest CAGR 2025–2030

Investor Activity

- AI agent start-ups raised $3.8B in 2024 (≈3× prior year)

- ~85% of enterprises expected to implement AI agents by end of 2025

Key Takeaways

- AI agents are more than efficiency tools, they re-architect enterprise IT.

- Traditional “systems integrator” roles evolve to orchestrating human-AI ecosystems.

- Internal adoption, speed, and scale of AI agents correlate directly with market competitiveness.

- GSIs must proactively embrace AI agents to secure relevance, profitability, and growth.

Quantified.

Table 1: Global AI Agent & AI Market Valuation

| Metric/Category | Value/Projection |

|---|---|

| Global AI Agent Market Valuation (2024) | $5.4 billion |

| Global AI Agent Market Valuation (2025) | $7.6 billion |

| Global AI Agent Market Valuation (2030) | $47.1 billion |

| Global AI Market Size (2025) | $371.71 billion |

| Global AI Market Size (2032) | $2,407.02 billion |

| AI Agents Market CAGR (2025-2030) | 45.8% |

| AI Market CAGR (2025-2032) | 30.6% |

Table 2: Systems Integrator (SI) Services Opportunity

| Metric/Category | Value/Projection |

|---|---|

| Projected SI Services Opportunity from Agentic AI (Total) | ~$1 trillion |

| SI Services Opportunity: Tech/TMEG Sector | $125B–$175B |

| SI Services Opportunity: Retail/CPG Sector | $150B–$200B |

| SI Services Opportunity: Financial Services/Insurance Sector | $125B–$175B |

| SI Services Opportunity: Healthcare/Life Sciences Sector | $100B–$150B |

| SI Services Opportunity: Automotive/Industrial Sector | $200B–$250B |

Table 3: Adoption, Investment & Regional Insights

| Metric/Category | Value/Projection |

|---|---|

| Enterprise Adoption Rate (Expected by end of 2025) | 85% |

| Enterprises Interested in Deploying Agentic AI (Next 3 Years) | >90% |

| Investment in AI Agent Startups (2024) | $3.8 billion (nearly 3× previous year) |

| Regional Market Dominance | U.S. (40.1% revenue share) |

| Fastest Growing Regional Market | Asia Pacific (highest CAGR 2025–2030) |

A Centralized Repository of Market Data

The numbers speak clearly: the scale is immense, the urgency undeniable. GSIs can’t afford to wait. A $1 trillion opportunity in systems integration, broken down by industry sector, shows where growth is most attainable. This is more than data, it’s actionable intelligence, guiding practice development, sales focus, and resource allocation.

Why This Matters

- High enterprise adoption rates signal mainstream momentum.

- Surging startup investments highlight accelerating innovation.

- Competitors are already moving, raising the stakes.

- Delay means falling behind in a market reshaping at speed.

Sector Breakdown of SI Opportunity

| Sector | Opportunity (USD) |

|---|---|

| Tech/Telecom/Media/Entertainment/Gaming (TMEG) | $125B–$175B |

| Retail & CPG | $150B–$200B |

| Financial Services & Insurance | $125B–$175B |

| Healthcare & Life Sciences | $100B–$150B |

| Automotive & Industrial | $200B–$250B |

| Total Potential | ~$1 trillion |

Beyond Automation: The Transformative Power of AI Agents for GSIs

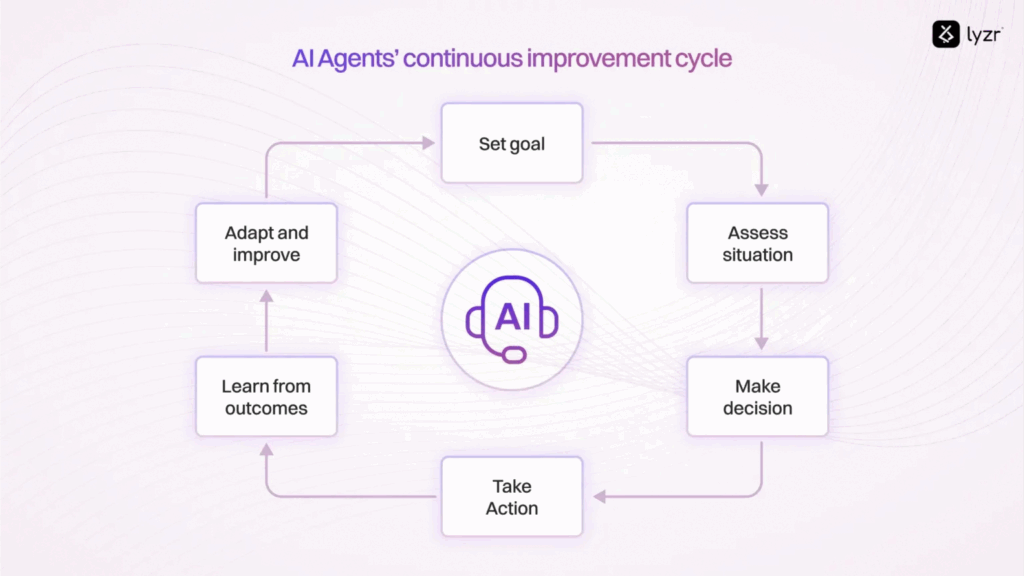

AI agents mark a significant leap beyond traditional automation. Unlike simple “if-then” workflows, they autonomously manage tasks, make real-time decisions, and adapt to evolving environments.

Their capabilities span autonomous decision-making, continuous learning, predictive analytics, and seamless integration with enterprise systems, interacting with APIs, databases, and even other models to execute multi-step processes and handle exceptions without constant oversight.

With natural language direction, even non-technical employees can encode complex workflows, broadening access and accelerating adoption across the enterprise.

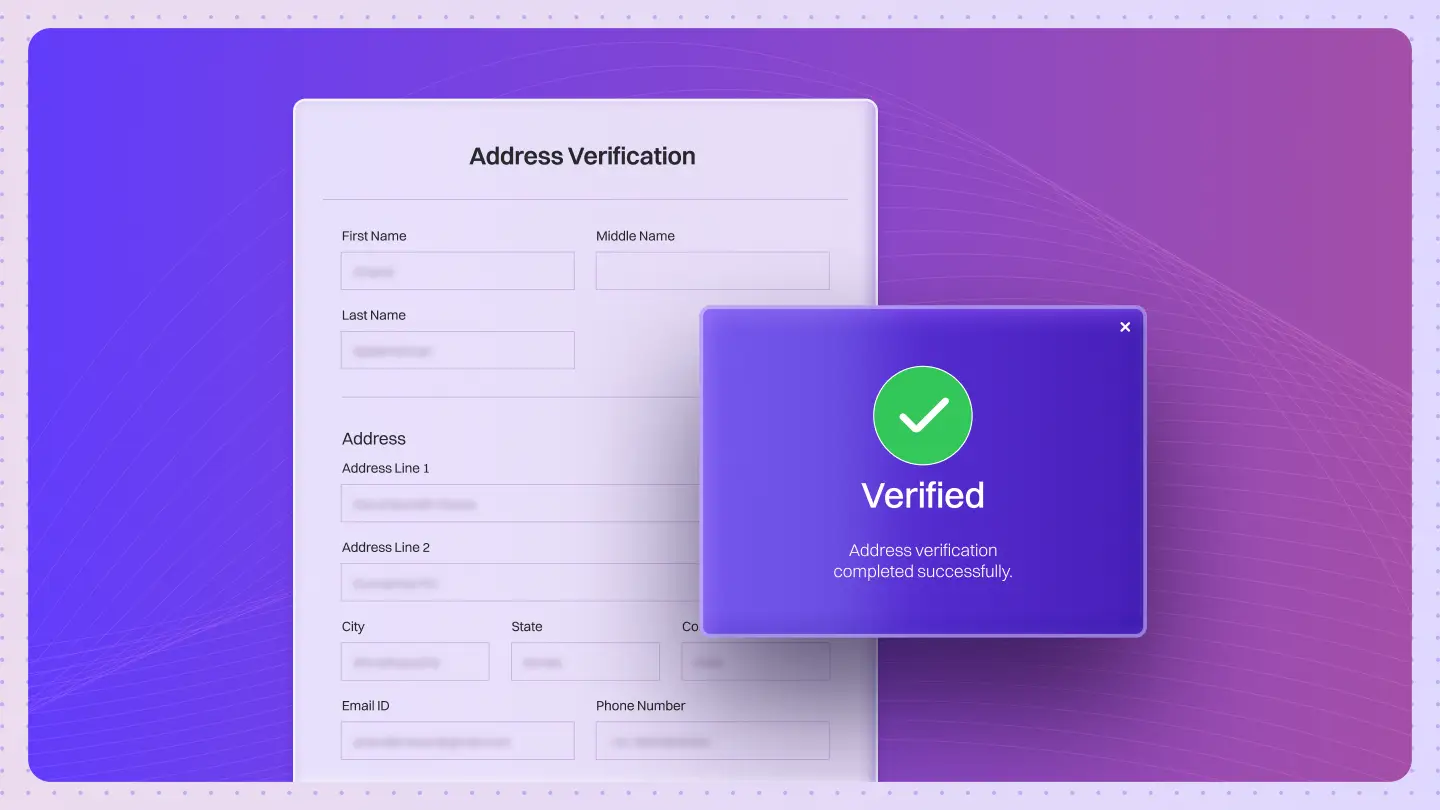

For GSIs, this shift extends far beyond optimizing human-driven processes. The consulting mandate now includes designing, implementing, and governing hybrid human-AI workflows, ensuring seamless collaboration between humans and agents.

Success will require deep expertise in AI-human teaming: rethinking roles, interfaces, and processes so that agents augment judgment, creativity, and strategic thinking rather than simply automating tasks. This creates new opportunities in change management, governance frameworks, and internal “AI agent academies” to empower business users while safeguarding security, scalability, and compliance.

Yet widespread deployment of AI agents faces a practical constraint: infrastructure. The surging demand for compute, power, and resilient networks creates an “AI bottleneck.” Here, GSIs’ traditional strengths in IT infrastructure design and management become a unique advantage.

By optimizing data centers, integrating specialized hardware, and building energy-efficient architectures, GSIs can address these constraints while connecting core competencies to the AI agent opportunity. A truly comprehensive practice must deliver not only software and workflows but also scalable, robust infrastructure—ensuring long-term viability and performance for enterprise AI adoption.

Across diverse sectors.

AI Agent Capabilities & Strategic GSI Use Cases

- Customer Service: Personalized experiences. Understanding needs. Answering questions. Resolving issues. Recommending products. Across web, mobile, voice, video. Best Buy’s GenAI virtual assistant. Developed with Accenture and Google. Offers self-service. Equips human agents with real-time recommendations. Capital One’s Chat Concierge. 24/7 access for tasks like comparing vehicles. Scheduling test drives.

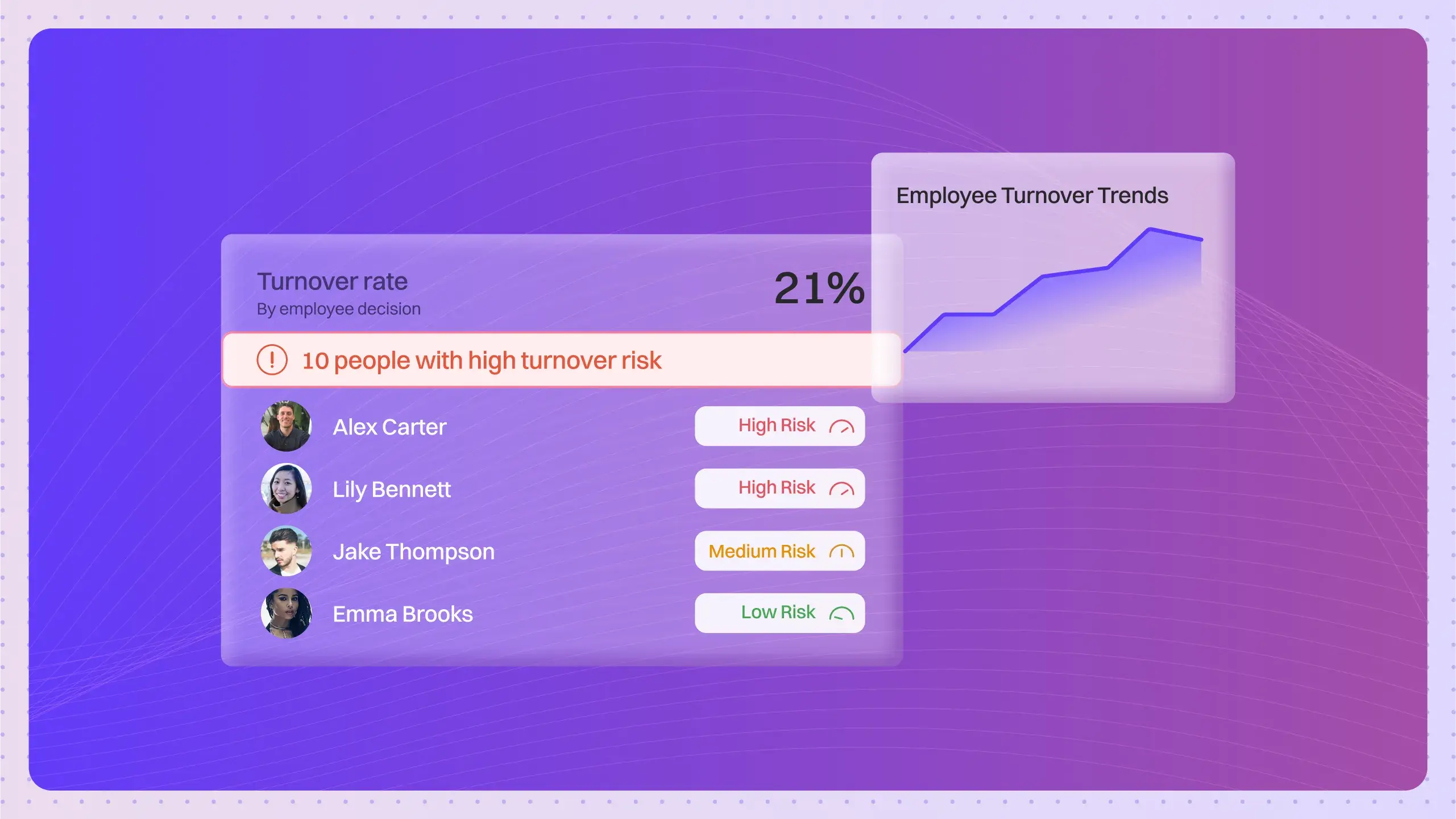

- Employee Support: Boost productivity. Streamline internal processes. Manage repetitive tasks. Answer employee questions. Assist with content editing. And translation. IBM offers pre-built watsonx agents. For HR (automating support, recruiting, onboarding). Sales (automating sales tasks). Procurement (cutting costs, improving supplier management).

- Finance: Transforming financial services. Algorithmic trading. Fraud detection. Risk management. Personalized financial advice. Revolutionizing revenue cycle operations. Verifying insurance eligibility. Navigating prior authorizations. Inspecting coding. Scrubbing claims. Managing denials. Reconciling payments. Near-perfect accuracy. Deloitte highlights AI agents for continuous KYC. Credit underwriting. Treasury management.

- Manufacturing: AI-powered robots. Perform repetitive tasks with precision. Other agents optimize production schedules. Predict equipment failures (predictive maintenance). Manage inventory. Walmart deploys AI agents. To forecast demand. Sync store-level stock. Trigger autonomous shelf-scanning robots.

- Healthcare: Diagnostic tools. Analyze medical images. Remotely monitor patient health. Assist with robotic surgeries. Automate revenue cycle management. Care coordination.

- Supply Chain & Logistics: Optimize inventory management. Predict demand. Improve delivery times. Assist with route and warehouse management.

- Sales & Marketing: Lead qualification. Sales forecasting. Identifying potential customers. Personalizing sales interactions. Generating content faster. Optimizing campaigns.

- Code Generation/Development: Accelerate software development. AI-enabled code generation. Coding assistance. Enhanced code testing. GitHub Copilot. 40% time savings during code-migration.

- Security: Strengthen security posture. Mitigating attacks. Increasing investigation speed. Across various surfaces. And stages of the security lifecycle.

| AI Agent Type/Capability | GSI Service Offering/Internal Operation | Specific Use Cases/Examples | Direct GSI Pain Point Addressed |

| Autonomous Decision-Making, Continuous Learning | IT Support Automation, Financial Process Optimization | Automated email categorization & response 12, Predictive maintenance scheduling 2, Real-time fraud detection 2, Automated healthcare claims processing 23 | Operational Scaling Limitations 13, Inefficient Manual Processes 27, High Time-and-Materials Costs 3 |

| Natural Language Processing (NLP), Predictive Analytics | Customer Service Transformation, Sales & Marketing Automation | Personalized marketing campaigns 2, AI-assisted customer support (e.g., Best Buy’s virtual assistant) 20, Lead qualification & sales forecasting 2 | Lack of Business Agility 26, Inconsistent Customer Experience 29, High Operational Costs 27 |

| Multi-Agent Systems, Tool Integration | Strategic Consulting, Supply Chain Management, HR Automation | Multi-agent KYC workflows 24, Complex logistics optimization 2, Employee onboarding & support (e.g., IBM watsonx HR agents) 22 | Complexity of Integrated Systems 6, Talent Acquisition & Retention Challenges 30, Siloed Operations 6 |

| Natural Language Interface, Tool Integration | Code Generation & Development, Business Process Optimization | AI-assisted code testing (e.g., Diffblue) 25, Workflow automation by non-technical users 5, Automated documentation 31 | Talent Shortages (technical) 28, Inefficient Development Cycles 25, Lack of Business Agility 26 |

Conclusion: From Promise to Proof

The story of AI in enterprise has always been about potential. But with AI agents, the narrative shifts from promises to proof. These aren’t abstract tools, they are tangible co-pilots, capable of transforming how GSIs deliver value, compete, and grow.

By moving beyond incremental efficiency to re-architecting workflows, enabling outcome-based pricing, and reshaping client relationships, AI agents redefine what it means to be a systems integrator in the next decade.

The data is clear: trillion-dollar opportunities, double-digit adoption rates, surging investments, and sector-specific demand too large to ignore. The risks are equally real—lagging adoption means ceding ground to faster, more agile competitors.

The winners will be those who not only advise on AI but live it internally, building credibility through their own transformations while delivering scalable, outcome-driven solutions to clients.

GSIs now stand at an inflection point. Embracing AI agents is no longer about chasing efficiency, it’s about future-proofing relevance. The firms that act with urgency, scale with intelligence, and integrate AI into every layer of their operations will define the next era of global transformation. The choice is stark: lead the change, or risk being left behind.

See AI agents in action, book your demo today.

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here