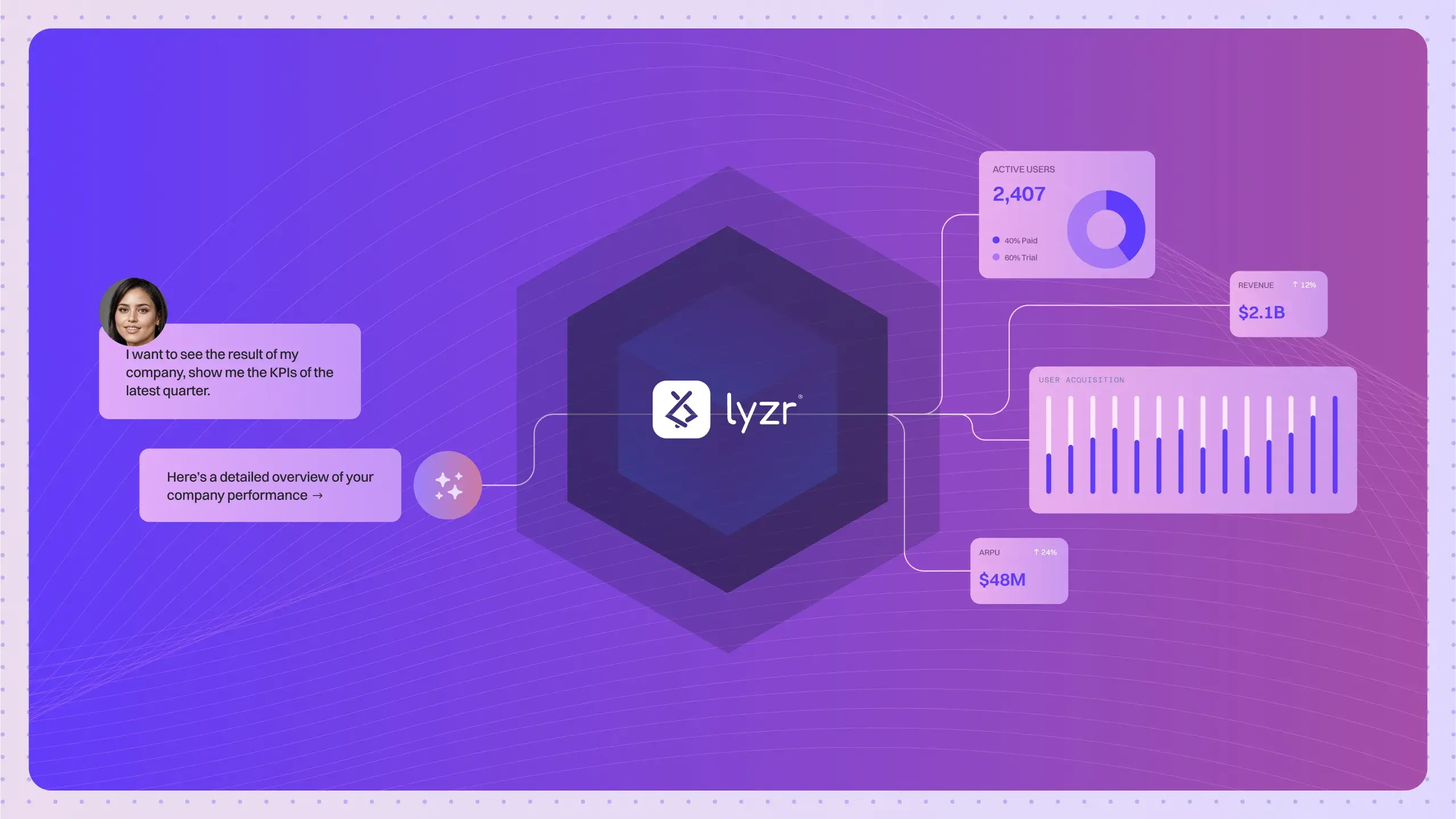

Discover Generative AI in Insurance for Enhanced Accuracy and Savings

Lyzr’s Generative AI in insurance solutions address industry-specific challenges, from claims processing to fraud detection and risk assessment.

Enterprises who trust us

Why is Generative AI for Operational Efficiency Needed?

Generative AI in insurance enhances efficiency, provides data-driven insights, and optimizes customer experiences.

Achieve Success with Generative AI-Driven Solutions in Insurance

Improve accuracy in risk evaluations using Generative AI in risk assessment to predict claims and set premiums accurately.

Cut time and costs by automating claims review and approvals through Generative AI for claims processing.

Deliver tailored policy options by analyzing customer data with Generative AI for policy underwriting.

Identify and prevent fraud with AI-driven pattern recognition and anomaly detection tools.

Reimagine Your Insurance Operations with Lyzr's AI Solutions

GoML achieved a

73% increase in qualified

leads with AI solutions

- 73% increase in qualified leads

- 10x cost savings compared to traditional methods

- Significant boost in sales efficiency

- Streamlined sales process for better results

Download Our Top 100+ AI Use Cases Template

Learn More About AI Agents

What our customers have to say ?

Co-Founder & CEO, Taascom Inc

Founder, CEO, Sure People

Partner, Founder, VantagePoint,

Stay updated

with the latest in Generative

AI in insurance

and other innovations

FAQs about Generative AI in Insurance

Generative AI in insurance supports adjusters, claims processors, and risk analysts by automating tasks, improving data accuracy, and enhancing decision-making.

The implementation of Generative AI in insurance varies, typically ranging from weeks for basic setups to months for custom solutions.

Our Generative AI solutions comply with GDPR and HIPAA, ensuring data privacy with encryption, secure storage, and access controls.

Our Generative AI for insurance integrates with CRM, ERP, claims management, and analytics platforms for seamless workflows.

Yes, our Generative AI in insurance solutions are customizable to meet your specific needs, from underwriting to claims processing.

Generative AI enables personalized policy recommendations, custom communication, and tailored risk assessments, enhancing client satisfaction.