Table of Contents

ToggleKnow Your Customer (KYC) verification is a cornerstone of modern financial compliance, essential for preventing fraud, money laundering, and identity theft. However, the process is often manual, time-consuming, and error-prone. Enter AI agents for KYC verification an emerging paradigm that combines automation, intelligence, and modular agent-based design to revolutionize the way organizations manage customer onboarding and regulatory compliance.

What Is a KYC Agent?

A KYC Agent is an AI-powered software module that automates the processing of KYC documents, checks them against internal regulatory standards, and evaluates their validity. These agents handle:

- Document ingestion and validation

- Biometric verification (e.g., selfie-to-ID match)

- Address verification using trusted APIs

- Sanctions screening and AML compliance checks

Watch an Example KYC Agent in Action: YouTube – KYC Agent Demo

Problem Statements in Traditional KYC Systems

Financial institutions and fintech platforms face several key challenges when using traditional KYC systems:

Financial institutions and fintech platforms face several pain points:

- Fragmented Workflows: Identity checks, document upload, and compliance are handled by separate tools.

- Operational Bottlenecks: Human review delays slow down onboarding.

- Fraud & Compliance Risks: Legacy systems lack advanced liveness detection and continuous monitoring.

- Lack of Explainability: Decision logs are often unstructured, making audits difficult.

- Limited Integration with Trusted Data Providers: Many systems rely on outdated or internal databases instead of industry-standard APIs.

The agentic architecture solves these with:

- Autonomous task agents

- Orchestration via a compliance engine

- Human-in-the-loop oversight

- Explainable logs and retraining workflows

Overview: Full-Stack KYC Agent Blueprint

This KYC Agent blueprint outlines a full-stack verification system powered by specialized AI agents. From OCR-based document ingestion to address checks, biometric validation, sanctions screening, and AML reporting;each step is handled independently yet orchestrated centrally through a compliance engine.

The image below showcases the full KYC Agent Workflow designed with modular, explainable agents integrated into trusted API ecosystems:

The system integrates trusted APIs like:

- Onfido (identity verification)

- LexisNexis (AML data)

- USPS (address validation)

- Trulioo (global KYC data)

The result? A secure, fast, and auditable onboarding experience.

Tools & Platforms to Build KYC Agents

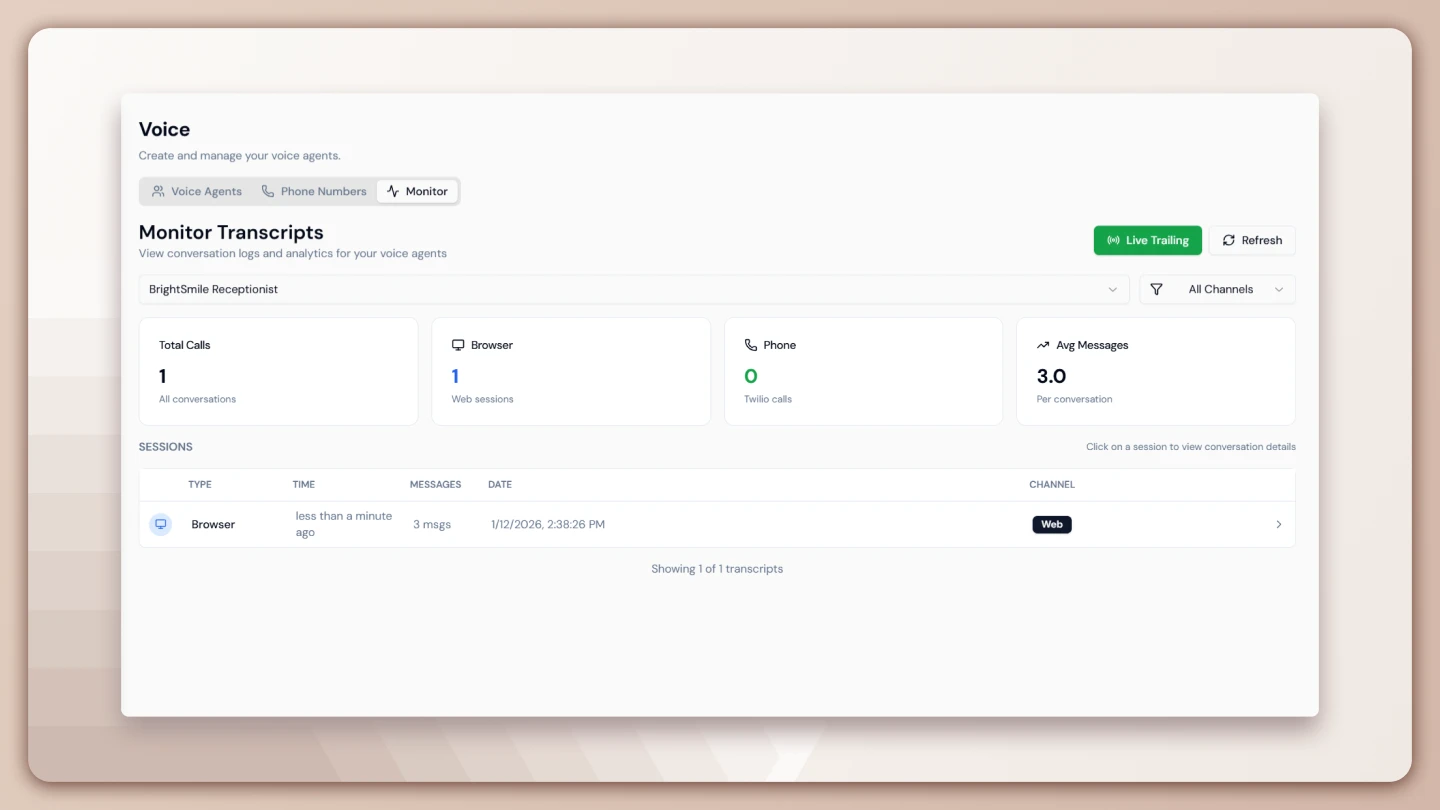

- Lyzr Agent Studio – Build & deploy secure, multi-agent systems with no code

- AWS Comprehend + Textract – For NLP and OCR tasks

- LangGraph + Vector DBs – For contextual orchestration

- Hugging Face Transformers – Custom model fine-tuning

- ComplyAdvantage API – AML screening integrations

Explore how to start building your first agent in our courses and tap into the Lyzr community for support.

Key Components of an AI-Powered KYC Agent Stack

An effective KYC agent combines various technologies and tools:

| Component | Description | Example Tools |

| OCR (Optical Character Recognition) | Extracts data from ID documents | Google Vision, AWS Textract |

| Facial Recognition | Matches selfie with ID photo | Azure Face API, Face++ |

| Document Verification | Validates passport, license formats | Onfido, IDNow |

| AML Screening | Checks against watchlists | ComplyAdvantage, World-Check |

| LLMs + RAG | Enables contextual Q&A & decision-making | OpenAI GPT-4, LangGraph + RAG |

Why Are Enterprises Moving Toward AI-Powered KYC?

According to a McKinsey report, traditional KYC processes can cost financial institutions $60M–$500M annually. AI agents reduce this cost dramatically while improving speed and accuracy.

Benefits of AI agents in KYC include:

- Faster onboarding: Automates verification in real time

- Accuracy & consistency: Eliminates manual entry errors

- Scalability: Handles high volumes without hiring

- Compliance-ready: Tracks audit trails, updates with regulation changes

- Cost-effective: Lowers the cost per verification through automation

Real-World Use Cases

Enterprises across financial services, fintech, insurance, and gig economy platforms are rapidly shifting to agent-powered KYC systems. These systems automate document verification, biometric checks, AML screenings, and compliance reporting, enabling them to onboard users in real-time with minimal friction and maximum auditability.

For example, a fintech company using Lyzr.ai can deploy a set of agents that parse uploaded documents, verify identities through facial recognition, connect to AML watchlists, and generate SAR filings;all within seconds.

1. Banking & Fintech

Banks use multi-agent systems built on platforms like Lyzr.ai to automate end-to-end onboarding. A customer uploads documents, and AI agents parse data, check legitimacy, verify biometrics, and run sanctions screening; all in under 2 minutes.

2. Cryptocurrency Exchanges

KYC is mandatory to comply with global AML standards. AI agents validate customer identity and ensure compliance at scale, even during high-volume trading spikes.

3. Insurance

KYC agents help verify identity before issuing policies and prevent fraudulent claims by cross-referencing identity data.

4. Gig Economy Platforms

Driver or host onboarding involves background verification. AI agents integrate criminal records databases and perform identity verification in seconds.

Why Lyzr Wins: Modular, Multi-Agent Systems for Enterprise-Ready KYC

At Lyzr, we believe that KYC verification shouldn’t be handled by a monolithic tool. Instead, composable AI agents make the system:

- Customizable: Swap components (e.g., OCR provider)

- Secure: Deploy privately on cloud/VPC

- Auditable: Log every step for compliance

- Context-aware: Use retrieval-augmented agents with access to evolving regulation datasets

Explore real-world KYC implementations in our case studies and use cases section on lyzr.ai/usecases.

Challenges & Trade-Offs in Moving Toward AI Agents

While AI agents solve many traditional KYC issues, they also introduce a new set of implementation trade-offs that enterprises must consider:

| Challenge | Description | Mitigation Strategy |

| Biased Models | Inaccurate face match for certain ethnicities | Use diverse training datasets & model audits |

| Data Privacy | Sensitive ID data processing | On-premise deployment via Studio.Lyzr.ai |

| Regulation Drift | KYC rules change across regions | Retrieval-augmented agents with live compliance updates |

| Over-reliance on Automation | No human in loop | Deploy agents with escalation protocols & audit trails |

Key FAQs

1. Can I deploy KYC agents on my own infrastructure?

Yes. With Lyzr Agent Studio, enterprises can deploy agents in their VPC or private cloud for complete control and data security.

2. What tools are best for building AI agents for KYC?

Platforms like Lyzr, OpenAI for LLMs, AWS Textract, and third-party compliance APIs like ComplyAdvantage are commonly used.

3. How do KYC agents handle changes in regulation?

Retrieval-augmented agents can be connected to real-time regulation databases, allowing them to adapt and provide context-aware validation.

4. Are AI KYC agents prone to bias?

Like any AI system, they can be biased if not trained on diverse datasets. Regular audits and human-in-the-loop design help mitigate this.

5. What are the trade-offs in adopting AI agents for KYC?

Trade-offs include upfront integration effort, model transparency issues, and potential over-automation if human review is skipped.

6. How do I get started with Lyzr for KYC agents?

Start by exploring our use cases, building your first agent in Agent Studio, or contacting our team at lyzr.ai to schedule a demo.

AI agents are reshaping KYC from a tedious compliance task into a fast, intelligent, and adaptive process. Platforms like Lyzr make it possible to build secure, compliant, and enterprise-grade KYC solutions that evolve with regulation and scale with demand.

Ready to automate your KYC? Visit Lyzr.ai to learn more.

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here