Table of Contents

ToggleInsurance agencies in the past were infamous for giving you the runaround. But now, it’s easier to get responses within minutes. You log onto a website, converse with a chatbot or receive a survey or form to fill out and it’s done. Simple, fast, efficient.

That’s the power of implementing Generative AI in Insurance companies.

Generative AI is an artificial intelligence operator that produces content or automates workflows without human interaction. And it’s changing the way insurers operate. Generative AI in Insurance can be used to generate policy documents, ascertain claim history, automate claim filing, and increase overall productivity within the workplace.

The insurance industry,like all others, has a vast amount of data, endless paperwork, and technical jargon that’s not easily understood! These factors make the insurance industry a hotbed for implementation of GenAI tools like chatbots, search agents, data analyzers, and content generators.

In this article, we’ll take a 360-degree view of Generative AI in insurance, the companies already employing agents and, and how you can benefit from creating private and secure genAI apps without so much as a line of code!

Insurance Companies Using Gen AI

Many Insurance companies worldwide have implemented generative AI to help with work operations and customer service experiences. A report by Sprout.ai found that 59% of businesses have already used generative AI systems. Let’s look at how Generative AI use cases within the insurance industry and helped many worldwide businesses:

Allianz Commercial: Analyzing Databases

Allianz Commercial uses an AI chatbot, which improves customer service and operational tasks. The company is known for using AI assistants to help customers with underwriting and risk appetite queries. Gen AI is used here to expose clients to content databases and ensure the bots are available 24/7 on various channels.

New York Life Insurance: Answering Customer Questions

New York Life Insurance, one of the third-most prominent life insurance companies in the United States, is developing a Gen AI tool. This tool will help the company’s representatives answer customers’ problematic questions. Alex Cook, head of Strategic capabilities at New York Life Insurance, states that AI in insurance will become “focused on ensuring the client or agent is holistic and on becoming more forward-thinking in developing the right experiences”. As Gen AI advances, many worldwide insurance companies move towards AI to work well with customers, improve client satisfaction and offer solutions to customer inquiries.

Anthem Inc: Gen AI Medical Data Research

Anthem Inc., a world-leading health insurance company, is currently working with Google Cloud to analyse customer data, detect risks/fraud, and offer personalised experiences for customers. This involves using AI agents and bots to research and retrieve information regarding healthcare claims and clients’ medical histories. The AI bots are currently being trained to research databases, address client concerns, and gather personal information.

AI in insurance is advancing. Anthem Inc. is developing AI agents that can offer personalized customer care and even possible medical interventions.

Helvetia: Improving Digital Communication and Customer Inquiries

Helvetia, a worldwide insurance company, became the first in the insurance industry to use Gen AI through customer service. A seven-month trial was conducted, and the company used a chatbot called Clara. The chatbot is powered by GPT-4 and handles customer questions in multiple languages. The success of this trial was since customer inquiries regarding their claims regarding insurance and pensions were answered faster, which improved digital communication within the company.

MetLife: Reducing and Resolving Insurance Problems

Another study by MetLife Insurance Company found that using an AI chatbot helped increase interactions between customers and clients where the chatbots could detect customer emotions during the calls. It was found that there was a 3.5% improvement in the company resolving first-call issues from the chatbots with a 50% reduction in call time. MetLife Japan also developed an AI solution that helped detect claims and large amounts of data.

These examples show that Generative AI use cases and chatbots have helped many insurance companies worldwide increase their workload, answer customer insurance questions, and produce the correct data for insurers to observe. The advancing technology of chatbots will benefit many insurance businesses and ensure customers are satisfied with the services.

AI Use-Cases Powered by Lyzr for the Insurance Biz

GenAI Agents, as they are called, are simple AI-generated tools that can automate several tasks. For instance, a Gen AI-powered chatbot created solely for an insurance client can answer customer queries, help fill out claim-related forms, and even send follow-up messages for pending payments.

Listed below are similar examples of Gen AI in insurance use cases that Lyzr can develop for your organization:

Insurance Quote Generator

One of the most important tasks of an insurance agent is selling a policy! However, these days, you can’t just sell any policy to anyone—it needs to be personalized. That’s where a GenAI agent comes into play. It’s a tool that analyzes a customer’s responses, understands the profile, suggests suitable add-ons, and shares a policy that’s closest to the customer’s actual requirements.

Claims History Search Agent

When making an insurance claim, companies must analyze central databases to help and give rise to your claim. This involves intense research, history analysis, and an investigation of the actual incident. AI in insurance would allow databases to be quickly anaylsed, including evidence, analysis, and research of the insurance policy. Due to the advancement of technology, creative AI agents have a chance to speed up the claiming process and ensure clients’ claims are quickly resolved.

Customer Satisfaction Analyst

Within a business worldwide, client feedback is vital to ensure customer inquiries are answered and customer satisfaction is evaluated. A Customer Satisfaction Analyst operates by analyzing complaints, feedback, and providing surveys. Think back to when you ordered an item online or spoke to someone on the phone regarding your insurance claim and received an email for an online survey. That survey, which is filled out, is then analysed by the customer satisfaction analyst regarding the customer service and company.

With AI in Insurance‘s help, AI agents can analyse data and customer surveys clients complete online. The AI agents can also provide databases offering customer feedback and even work with clients to help resolve any complaints.

Legal Case Search Agent

When insurance companies work with worldwide clients, they must analyze data, research possible changing laws, and retrieve information concerning legal cases. A legal case search agent in AI insurance would use AI agents to understand the different algorithms, retrieve legal data, and use natural learning processes (NLP).

Gen AI in Insurance will retrieve information through case types, language, keywords, and data information. Legal Case Search Agents are an essential asset to the insurance industry, enabling legal professionals to retrieve information, research, and save time to produce an efficient legal case.

Marketing Content Generator

Imagine no social media, newsletters, email marketing, or search engine marketing. Many of us wouldn’t know about the different companies worldwide and what services they offer. This is where marketing in insurance companies comes into play. With the power of marketing, SEO, and content creation, insurance companies can reach their target audiences and offer their insurance services.

Generative AI in Insurance can be used in Marketing to help produce campaigns and content to reach different target audiences. A marketing content generator can provide SEO content to reach insurers, optimize content creation, and enhance brand identity. AI in insurance companies will quickly provide content for websites, social media, newsletters and emails, and email marketing sent to the company and its services.

Claims Trend Analysis

Claims trends are an essential feature for underwriters and the future of a business’s financial performance. Generative AI in insurance can help with crucial tasks regarding claims management, such as data analysis, risk assessments and summarizing long-term documentation.

Gen AI in Insurance will help with underwriting by ensuring that the paperwork and policy terms are produced for the insurance company. Gen AI can also detect errors or bugs in statistical models, providing the software can enhance programming work. LangChain models help translate documentation quickly and effectively, ensuring customers understand each piece of information and reducing possible risks for insurance claims and AI agents’ data analysis to save time.

Customer Service Agents

Due to chatbots’ success, a report by Sprout.ai found that 43% of customers had a faster onboarding experience, which helped improve customer service in the company. Insurance companies can use Generative AI to offer personalized services and products to customers.

An example of this would be a company called Chatbot, which could use Gen AI to discuss customer inquiries and answer any claims questions. Gen AI can also be trained on insurance policies and history to ensure customers receive the correct information regarding specific product recommendations.

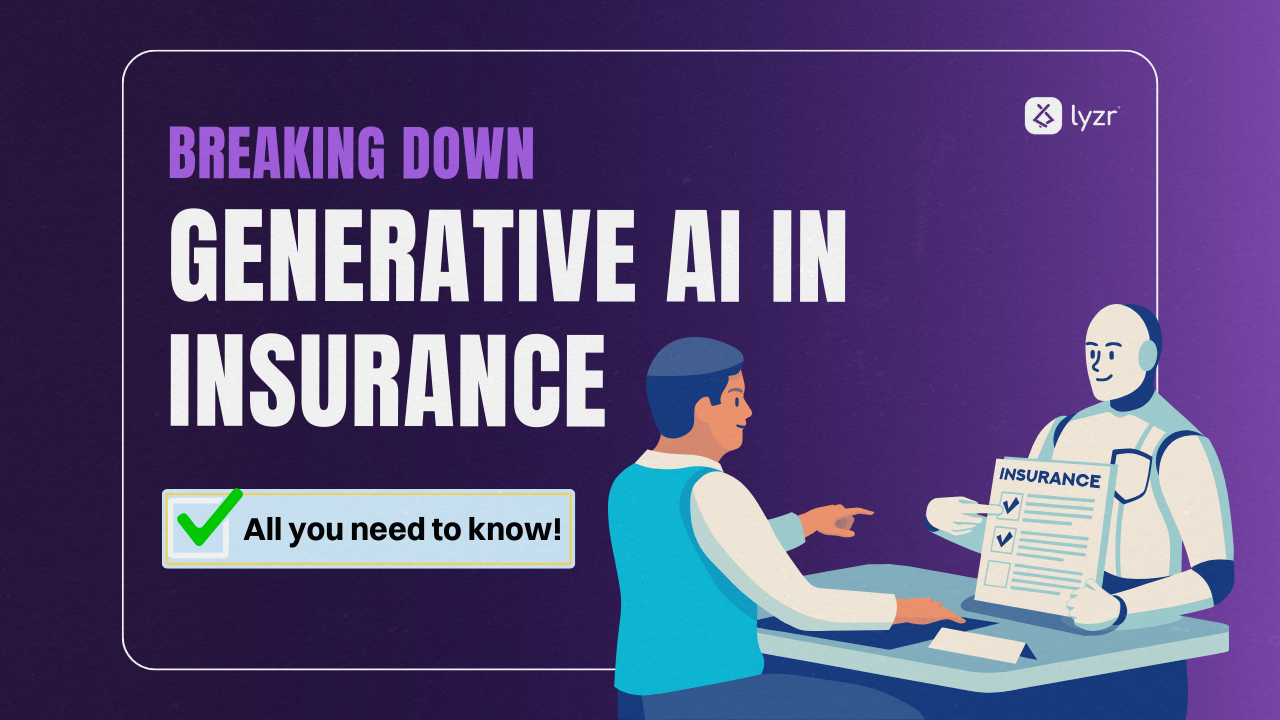

Executive Decision Support Analyst

Insurance companies can use Generative AI to focus on data sets and business insights. Gen AI can organize, analyze, and collect data for many insurance companies, ensuring that their sales are tracked. With the support of an Executive Decision Support Analyst, analysing data across the business will help impact decision-making and long-term planning for the company.

Building block companies like LangChain and Hugging Face offer significant features but could be better when producing fast production rates and Gen AI applications. As competitors move forward with different advancing technologies, speed is essential in determining insurance companies’ productivity and making reliable decisions that will affect the business’s long-term plans.

Lyzr is a Generative AI tool offering rapid AI development. It allows customers to build their own AI system that works for their company. Lyzr offers an SDK package where customers can customise their chatbot to have a data analysis agent, answering bot, and knowledge base. Make sure to check out our demo.

Why Build Private AI Agents?

Owning a business requires ample work; using systems like chatbots or other AI tools is a beneficial way to help customers and ensure the productivity of your company’s workflow increases. Having a chance to build your own AI agent will ensure the AI tool works for you and your business, especially in the insurance industry.

Generative AI in Insurance will offer designated solutions for businesses to expand and ensure company requirements are met. However, using third-party platforms runs the risk of unsecured data, latency issues as well as lack of timely support.

Here’s how building your private GenAI agent using a solution like Lyzr’s SDKs could resolve all these issues for you.

- Complete control over the tool: Lyzr offers the framework in the form of an SDK (software development kit) for building your own AI Agent. Think of this as the skeleton that the final form will be built on. The primary structure is ready, and can be further customized to provide the necessary service or operations the organization needs, and can be adapted to suit the enterprise requirements.

- 100% secure data: Since the final product is a private AI agent built for a specific organization, the data is hosted on the company’s secure cloud, instead of an external one. This mitigates the risk of a data breach, or downtime, and sensitive customer data is not under threat of exposure.

- Fully integrated AI agent: Each SDK is developed into a fully-functional, fully integrated AI Agent for every unique operation at individual organizations. It is integrated with the existing infrastructure of the company, and does not require hosting on a separate platform.

- Privately run: Many AI softwares are run on third-party platforms which can become costly as the company grows in size, can experience latency issues, and could also struggle with data storage limitations. A privately run AI agent is under the management of the organization and thus these problems can be tackled without external intervention.

- Easy implementation without a dedicated AI/ML team: Think of the Lyzr SDKs as a ready-to-build IKEA set. All the pieces and parts are in place, with the proper documentation provided to you. With only a few lines of code the AI agent can be customized, set up and begin functioning without the need to hire dedicated AI experts. Plus, Lyzr offers 24/7 customer support when you purchase a plan with us.

Why is Lyzr the Solution?

Let’s imagine you’re craving a pizza but know that making it from scratch will take too much time. That’s how one can think of custom-creation of GenAI agents, without the use of frameworks like Lyzr. Building an AI application from scratch requires technical expertise in AI/ML and coding skills, as well as lots of funds and resources.

Now imagine a frozen pizza – these are ready-made, and only require heating to provide a fast solution to your pizza craving. Like a frozen pizza, Lyzr offers fast and straightforward Gen AI framework for companies to deploy their GenAI agents, using a pre-built SDK.

Lyzr stands out in the market as the simplest agent framework to help customers build and launch Generative AI apps faster. With Lyzr’s Agent SDK, the company can focus on deploying AI agents with a focus on privacy and safeguarding data. Lyzr is committed to excellence and offers insurance companies the chance to increase customer engagement with AI agents.

Lyzr offers its customers 2 product types:

- Pre-built agents for proven use cases – Chat, Search, RAG, Data Analysis, Text-to-SQL

- Multi-Agent Automation to automate complex workflows

Additionally, Lyzr also offers an AI Management System to manage all Agents, Agent analytics, and Agent operations under one roof.

A Bright Future for Gen AI in Insurance

As Gen AI develops, insurance companies explore using AI agents for risk assessments, customer service/support, underwriting processes, and claiming proceedings. With this knowledge, Insurance executives can embrace new technologies and ensure they become successful insurance companies.

Generative AI in insurance will offer many solutions for worldwide businesses and ensure increased productivity. Here are some cases where gen AI will be used in insurance businesses:

- Policy Research

- Claim Filing

- Insurance Quote Generation

- Customer Interaction

- Legal Case Search

- Market Intelligence Analysis

- Marketing Content Creation

As we can see, Gen AI agents can and will be used in different parts of insurance businesses to generate higher customer satisfaction and ensure that insurance claims are processed. Gen AI will benefit the insurance industry and work with other sectors such as healthcare, HR, retail, and automation to ensure all businesses succeed in the future of Gen AI.

Want to build private and custom AI agents in your insurance organization? Book a demo with Lyzr to try our product offerings suited to your enterprise needs here.

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here