Table of Contents

ToggleTL;DR

AI is transforming payroll systems by automating calculations, validations, compliance checks, and real-time salary disbursement. This article breaks down how agent-based architectures enable scalable, modular payroll processing. We explore real-world deployments by large enterprises and how Lyzr’s agent stack accelerates rollout.

If you manage global payroll, audits, or multi-location operations, this is your blueprint for next-gen automation.

What is AI in Payroll Systems?

AI in payroll systems refers to the use of intelligent software agents that automate payroll processing, tax compliance, employee classification, salary disbursements, and audit reporting. These systems rely on large language models (LLMs), rule-based engines, and vector databases to minimize errors, handle multi-country operations, and deliver real-time payroll intelligence at scale.

Agentic payroll platforms are modular, adaptive, and context-aware; allowing HR and finance teams to run compliant, zero-error payroll systems with minimal manual effort.

Why Payroll Needs an AI Upgrade?

Payroll is deceptively complex. What looks like a routine monthly operation often involves:

- Ever-changing tax laws across jurisdictions

- Fringe benefits, bonuses, and phantom stock compensation

- Hourly workers, freelancers, and hybrid workforces

- Error-prone calculations leading to regulatory fines

- Manual interventions during audits or leaves

Enterprises handling 1,000+ employees across geographies face mounting costs just to “not get payroll wrong.” Traditional systems are brittle;reliant on pre-coded logic, static rules, and reactive updates. AI agents offer a better way: proactive, adaptive, and audit-ready automation at scale.

AI Payroll Architecture: Modular and Orchestrated

Modern AI payroll workflows use modular agents, each responsible for a critical function in the pipeline.

First, a Timesheet Ingestion Agent scans timesheets, biometric records, and log data;structured or unstructured;using OCR and natural language understanding.

Next, a Classification Agent verifies employee roles, contractor status, and location-dependent compliance obligations. It cross-references contracts, HR databases, and regulatory APIs (e.g., IRS, EPFO).

A Compensation Agent computes net pay after deductions, perks, tax liabilities, and reimbursements, tailored to local laws and company policy.

Before disbursement, a Compliance Agent flags anomalies like excessive deductions, misclassified workers, or outdated KYC data. It can also enforce ESG or DEI thresholds if configured.

Finally, a Disbursement Agent connects to banking APIs (RazorpayX, JPMorgan, Stripe) to execute bulk payouts. Simultaneously, a Communication Agent sends payslips, anomaly alerts, and tax advice via Slack, WhatsApp, or email.

All agents log decisions in an Audit Trail Module, ensuring transparency and rollback if needed. This orchestration is handled through frameworks like LangChain, Lyzr Agent API, or Autogen.

Need a playbook for implementing Agents in Banking? check out the playbook.

Real-World Use Cases Across Enterprises

1. EY (Ernst & Young): EY uses AI-driven payroll audit agents to review 500,000+ pay cycles across global clients. Their intelligent agents detect outliers, run statistical validations, and cross-check tax bands in real time.

2. ADP: A pioneer in HR automation, ADP integrates AI for tax calculation, wage garnishment logic, and compliance alerts. Their solution uses predictive agents to flag upcoming changes in employment law.

3. Infosys:Infosys automated its internal payroll across 65,000+ employees using an agent-led orchestration system that reduced payroll closure from 5 days to under 24 hours. OCR agents processed scanned attendance logs, while disbursement agents routed payments across global accounts.

4. Walmart: Walmart deployed AI payroll agents to manage hourly wage earners. These agents compute real-time earnings, trigger early wage access features, and validate scheduling compliance.

5. Netflix (Global Contractor Payroll): To manage hundreds of international freelancers and creators, Netflix uses a modular payroll AI stack that classifies contractors, handles tax reporting, and automates crypto-to-fiat conversion where required.

Here are 50+ Agentic use cases across BFSI, Sales, Marketing & Others.

How Lyzr Accelerates Payroll Agent Deployment

Lyzr offers a full-stack agent platform designed for modular deployment across HR and finance operations:

- Pre-built Payroll Agents: Timesheet, classification, tax, disbursement, and audit agents ready to deploy

- Plug-and-Play Orchestration: Bring your own CRM, HRMS (e.g., SAP SuccessFactors, Zoho, Darwinbox)

- Built-in Compliance: Localized logic pre-mapped for India (EPFO, TDS), US (IRS, 401K), UK (NI, PAYE)

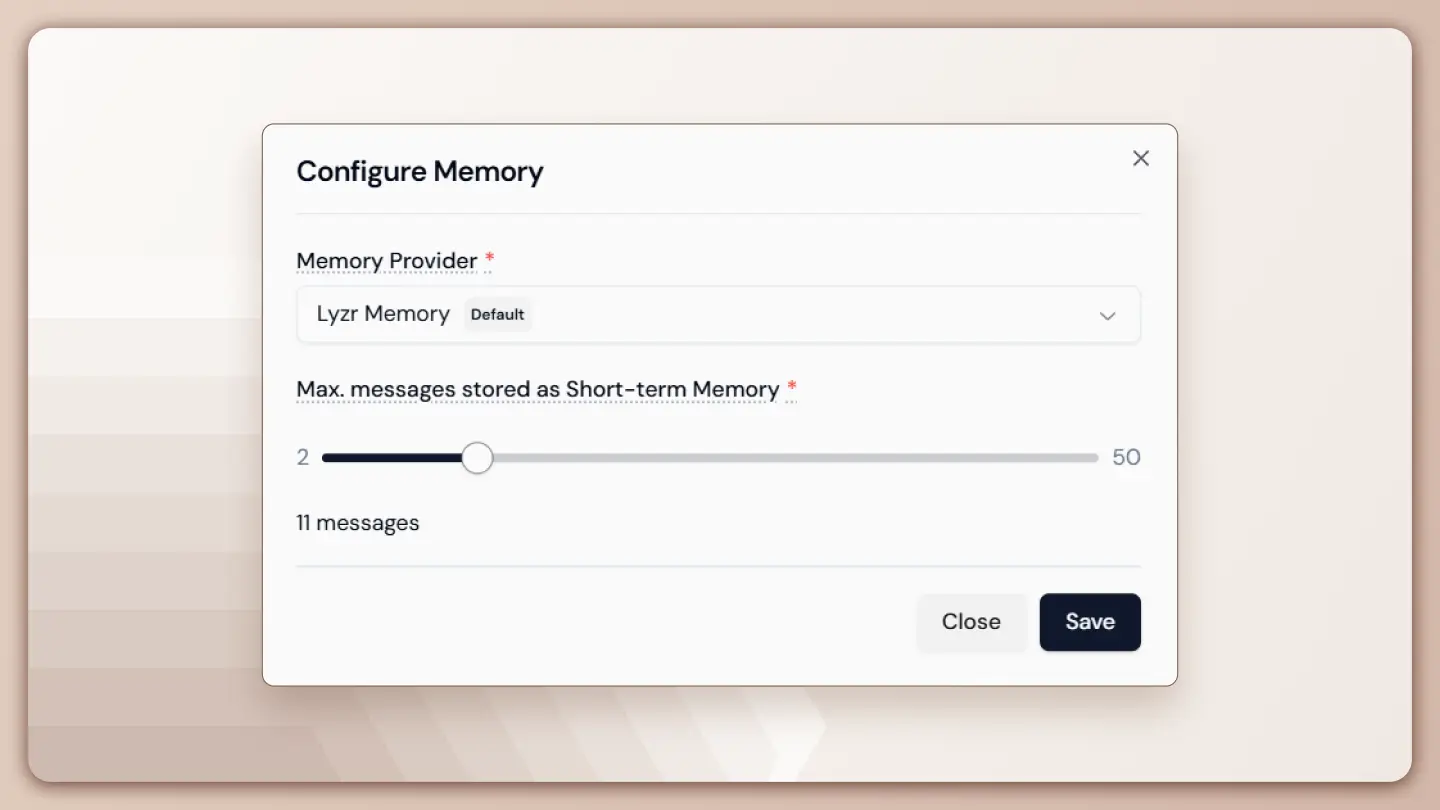

- Secure and Transparent: Audit logging, role-based access, human-in-the-loop overrides

- Rapid Time to Value: Go from prototype to pilot in under 2 weeks

Unlike black-box payroll SaaS tools, Lyzr lets enterprises own and customize every part of the agent lifecycle while meeting their data privacy mandates.

Tradeoff Table: Build vs Buy vs Lyzr Hybrid

| Feature / Approach | Build In-House | Buy SaaS Payroll Tool | Lyzr Hybrid Agent Platform |

| Customization | Full control | Limited templates | Full control with pre-built modules |

| Time to Deployment | 1–3 months | 1–2 weeks | 1–3 weeks |

| Cost Efficiency | High upfront dev cost | Subscription + per employee charges | Flat fee per agent or workflow |

| Regulatory Agility | Manual updates | Reactive compliance | Agents adapt via real-time policy API |

AI Payroll Orchestration Flow

In an AI-powered payroll automation workflow, the process begins with the Timesheet Ingestion Agent, which integrates seamlessly with platforms like Darwinbox, ADP, and Workday to collect employee attendance and work-hour data.

This is followed by the Employee Classification Agent, which leverages LLMs and contract parsers to determine employee types, roles, and eligibility criteria. The Compensation Computation Agent then calculates salaries by connecting to tax APIs, applying LLM-driven logic, and integrating with SAP payroll modules.

To ensure regulatory compliance, the Compliance Agent monitors statutory limits and triggers alerts when thresholds are breached. Once validated, the Disbursement Agent initiates salary transfers through RazorpayX, Plaid, or ACH systems.

Finally, the Audit and Communication Agent logs every step and sends updates via Slack, email, HRMS platforms, and Salesforce ensuring transparency, traceability, and seamless cross-functional communication.

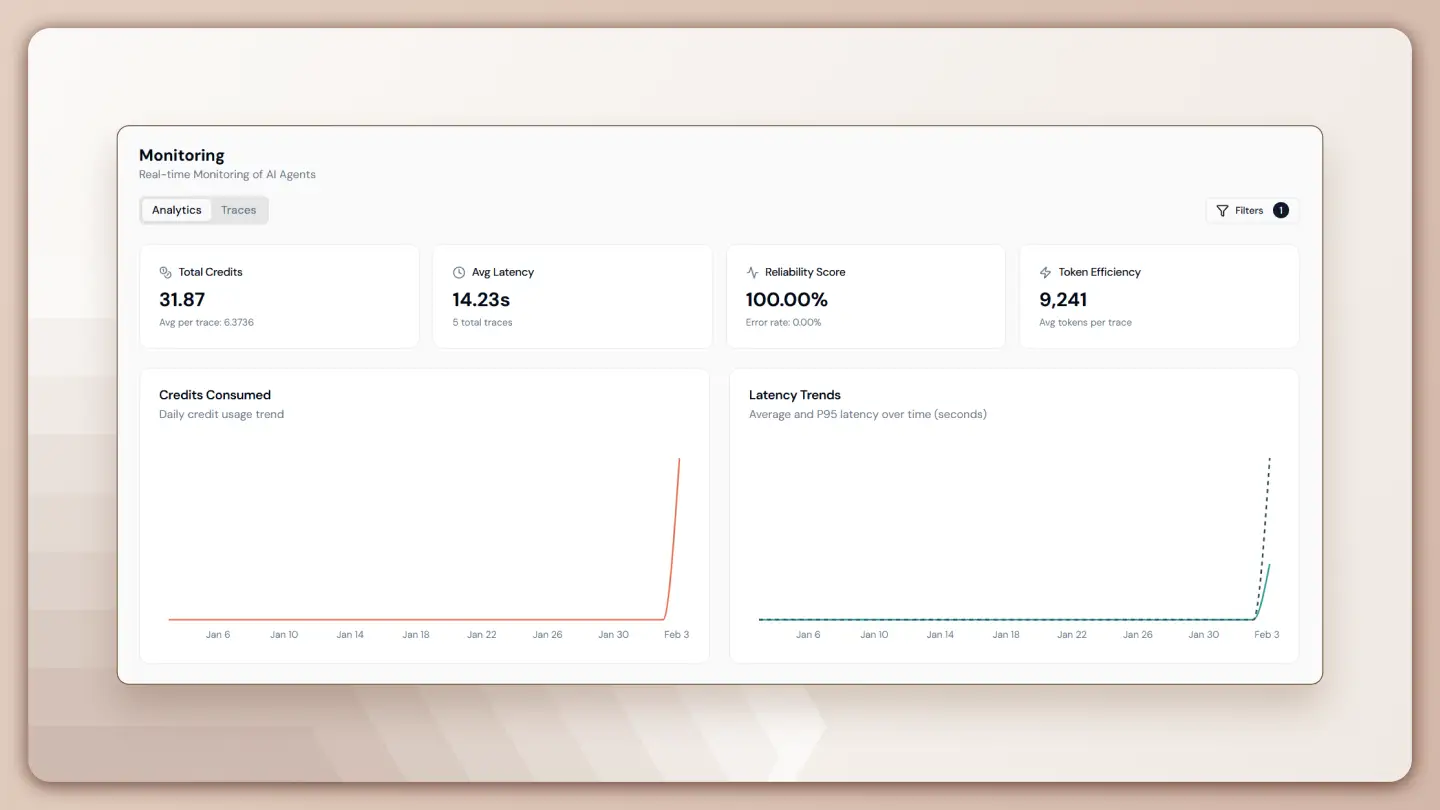

Each agent connects via Lyzr’s Agent API with a centralized control plane for orchestration, monitoring, and exception handling.

Frequently Asked Questions (FAQs)

1. Can we use our existing payroll system with Lyzr agents?

Yes. Lyzr integrates with leading platforms like SAP, Zoho Payroll, Darwinbox, and ADP. Agents act as an overlay or co-pilot, not a replacement.

2. Is Lyzr compliant with GDPR and data residency laws?

Absolutely. Lyzr supports on-prem, VPC, or region-specific deployments to meet GDPR, HIPAA, and Indian DPDP mandates.

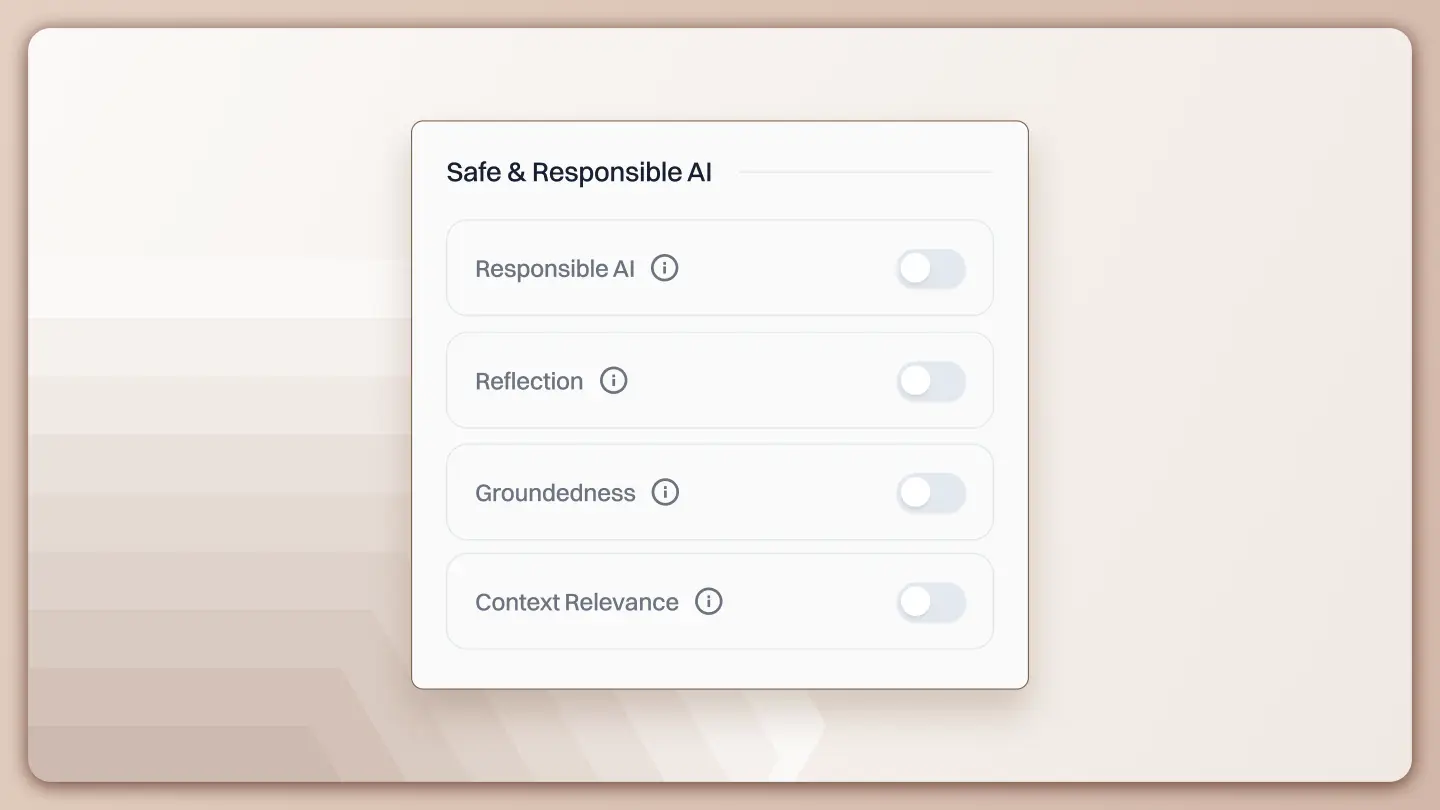

3. How are hallucinations prevented in Lyzr agents?

Each agent uses constrained prompting, retrieval-augmented generation (RAG), and validation layers. No AI response goes live without policy checks.

4. What’s the timeline to deploy a pilot payroll agent?

Most enterprises go live with a working pilot in 10–14 days using pre-built templates. Full-scale deployment takes 4–6 weeks based on integrations.

5. Can these agents work across multiple countries or legal entities?

Yes. Lyzr agents can be scoped to region-specific logic with switchable prompts, vector stores, and rule APIs.

6. What level of human control is supported?

Every Lyzr deployment includes human-in-the-loop review, override options, and complete audit trails.

7. What skillsets do we need to build agents in-house?

You need basic Python and API skills. However, Lyzr’s low-code platform enables HR or finance analysts to configure agents with minimal coding.

8. Can these agents be reused across HR functions?

Yes. The same architecture powers leave management, onboarding, compliance reporting, and even exit formalities, ensuring ROI across functions.

Looking to bring AI agents into your company? Book a demo to see them in action.

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here