Table of Contents

ToggleRaising funding is brutal. Between pitch decks, financial models, and endless investor meetings, founders often find themselves drowning in questions from potential investors.

That’s when we realized we needed Agent Sam, an AI-powered investment agent that could handle pre-due diligence queries. What started as a simple automation project became the key to raising our $15M Series A round.

Here’s the complete journey of how we built Agent Sam using Lyzr’s no-code agent building platform called Lyzr Studio for building, deploying, and managing secure AI agents and Lovable to create the frontend through natural language.

Phase 1: Understanding the Problem Space (Product Manager Mode)

Before writing a single line of code or configuring any agent, I switched into product manager mode. The goal was clear: understand exactly what investors ask during pre-due diligence and ensure our agent could handle these queries flawlessly.

Working with Our CFO: Mapping the Question Landscape

Our CFO (Aditya) became my primary stakeholder. Together, we spent weeks analyzing past investor conversations, mapping out the most common pre-due diligence questions regarding Financials, Market & Competition, Operations & Team, Product & Sales etc.

Creating the Knowledge Foundation

The key insight was that investors don’t just want data, they want context based human like responses. A simple “Our MRR is $X” isn’t enough. They want to understand growth trends, customers, and how the numbers relates to our overall strategy.

We compiled comprehensive FAQs that included:

- Primary answers with specific metrics

- Contextual information explaining trends and rationale

- Supporting data with charts and comparative analysis

- Guardrails for handling edge cases and out-of-scope questions

This became our knowledge base foundation and not just a Q&A document, but a structured repository of institutional knowledge that would power Agent Sam’s responses.

Phase 2: Building and Testing Agent Sam with Lyzr Studio

With our requirements clear, it was time to build. Lyzr Studio’s visual builder made it possible to get up and running in under a minute, but building a production-ready investment agent required careful attention to every component.

Setting Up the Agent Architecture

Creating an agent in Lyzr Studio follows a systematic approach:

Step 1: Agent Role, Goals and Instructions : We named our agent “Sam” and defined its purpose: “A specialized investment agent that provides accurate, contextual responses to pre-due diligence inquiries while maintaining professional tone and ensuring data security.”

If you are interested in building an Investment agent, Do check out our banking playbook.

Step 2: LLM Selection and Optimization This was where patience, testing and iteration became crucial. We tested multiple language models:

| Language Model (LLM) | Our Findings & Feedback | Verdict |

| GPT-4o | Great general performance but had occasional hallucinations with financial data, often mixing up different metrics. | Not Suitable |

| Gemini 2.5 | Fast and cost-effective, but we found the tone and language to be too casual, even after multiple instructions. | Not Suitable |

| Claude 3.7 Sonnet | Showed superior reasoning with financial data, excellent contextual awareness for multi-part questions, and a consistently professional tone. | The Winner |

Why Claude worked best for Agent Sam:

- Superior reasoning with financial data: Claude demonstrated better accuracy when working with complex financial metrics and ratios

- Contextual awareness: Excellent at maintaining context across multi-part financial questions

- Risk-aware responses: Claude was more conservative about providing information it wasn’t certain about, crucial for investment discussions

- Professional tone consistency: Better at maintaining the formal, precise tone investors expect.

With Claude selected as our core engine, we moved on to the final step of the agent’s setup: refining its core instructions.

Step 3: Prompt Engineering and Role Definition We spent considerable time crafting Agent Sam’s core instructions, again testing and iterating based on what this agent lacks every time we test it, really helped.

Building the Knowledge Base: The Heart of Agent Sam

Lyzr Studio’s Knowledge Base feature allows creation of persistent repositories for Retrieval-Augmented Generation (RAG). This became Agent Sam’s brain.

Knowledge Base Architecture:

- Name: “Investment Intelligence KB”

- Vector Database: We chose Qdrant for its performance with financial document retrieval, this was suggested by default by Lyzr so I went ahead with that.

- Embedding Model: Again, I trusted Lyzr for suggesting me the most relevant embedding model which never caused a problem to me.

Content Ingestion Process: We uploaded multiple documents such as Financial statements and projections, FAQ documents that we had created and more.

Lyzr automatically selected appropriate parsers based on file type and broke content into chunks with proper indexing.

Advanced Features and Guardrails

Memory Configuration:

- Short-term memory: Enabled to maintain context within investor conversations

- Long-term memory: Configured to remember key themes in case investors really love talking to our agent :p and keep talking until we exhaust the context length.

Safety and Responsible AI: Lyzr’s proprietary Safe and Responsible AI features are integrated within the agent inferencing flow, ensuring:

- No hallucination of financial metrics

- Appropriate handling of confidential information

- Consistent professional responses

- Compliance with investor communication standards

Stress Testing Within the Company

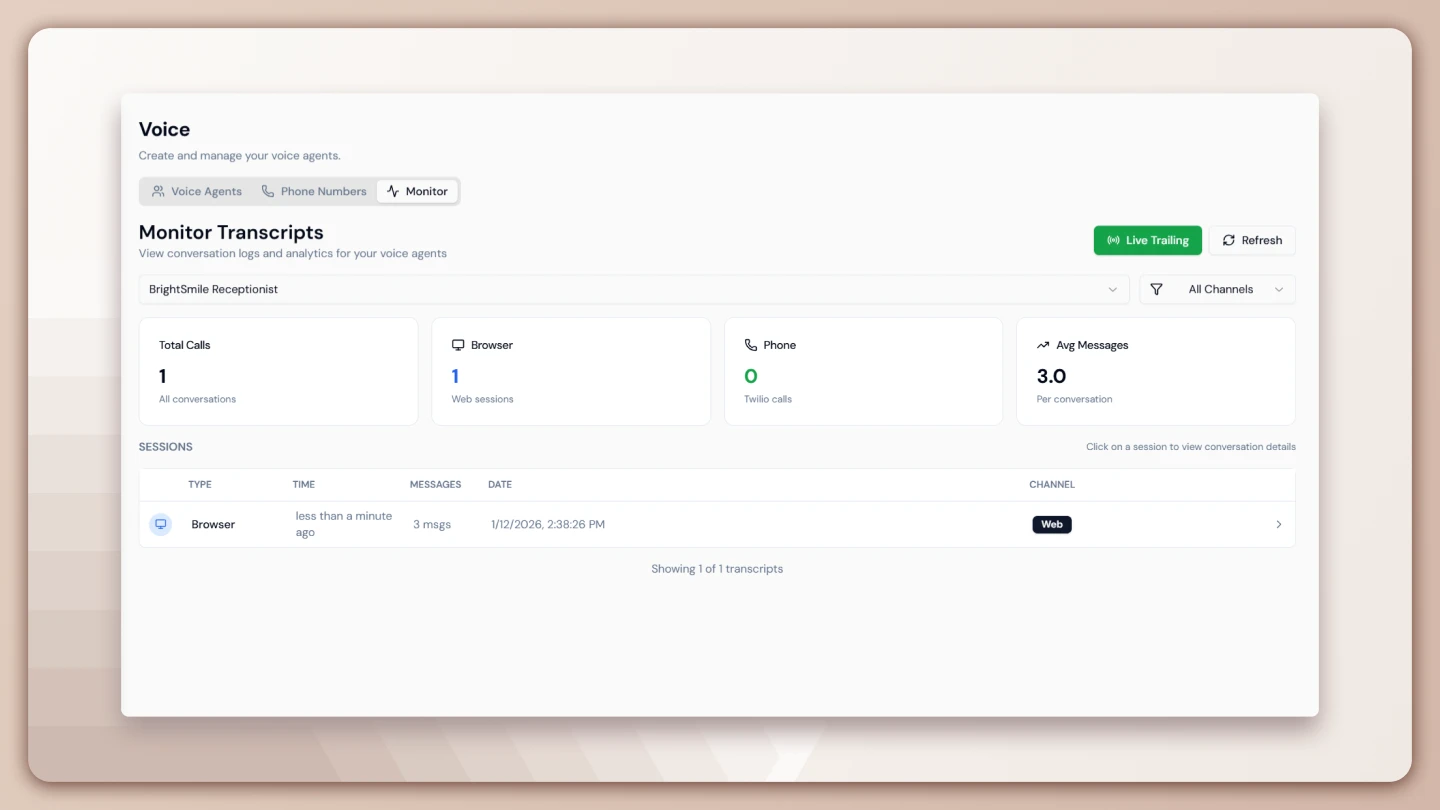

Before any external exposure, we put Agent Sam through rigorous internal testing. Once I launched the agent on Lyzr Studio. It automatically gave me a beautiful UI that I could share internally for business leaders to test out.

Phase 3: Building the Frontend with Lovable

With Agent Sam performing excellently in Lyzr Studio, we needed a professional interface that investors would actually want to use. This is where Lovable’s capabilities shined.

Designing the User Experience

Lovable’s prompt-based system makes app creation simple through detailed natural language descriptions. However, building an investment-grade interface required thoughtful UX planning.

Our Initial Lovable Prompt:

Create a professional investment agent interface with the following requirements.

Layout:

– Clean, institutional design with subtle black/purple color scheme following lyzr’s brand colors

– Header with company logo and “Agent Sam – Investment Intelligence” branding

– Main chat interface with message history

– Sidebar with quick access to common investor questionsFeatures:

– Real-time chat interface with typing indicators

– Message history with timestamps

– Export conversation feature for investor records

– Quick question buttons for common queries (MRR, burn rate, competitive landscape)

– Professional typography suitable for investor communicationsTechnical:

– Responsive design for desktop and mobile

– Fast loading times

– Clean message formatting with support for financial tables

– Security-focused with no data persistence in browser storage

Integrating Agent Sam with the Frontend

The critical technical challenge was connecting our Lyzr-built Agent Sam with the Lovable frontend. This required using Lyzr’s Agent API Inference to integrate agents into existing systems.

Integration Architecture:

Frontend (Lovable) ↔ Agent API ↔ Agent Sam (Lyzr Studio)

Directly copied the agent inference and asked Lovable agent to call Lyzr’s API to get response for Agent Sam. That’s it! Yes it was as simple as that.

Conclusion: The Future of Vibe Coding

Building Agent Sam taught us that successful AI implementation isn’t just about the technology, it’s about understanding the business problem, crafting the right solution, and executing with attention to detail.

Key Takeaways for Building AI Agents:

- Start with the problem, not the technology: Understand exactly what your users need before building anything

- Choose the right tools for your use case: Lyzr’s easy to use studio and focus on Safe and Responsible AI made it ideal for handling sensitive financial data and build the backend of Agent Sam, while Lovable’s natural language interface made frontend development accessible

- Invest in knowledge base quality: Your agent is only as good as the information it has access to

- Test extensively before deployment: Internal stress testing revealed critical improvements that made Agent Sam investor-ready

- Design for your specific user base: Investors have different expectations than general consumers, the interface and interactions must reflect that.

The Bigger Picture: Agent Sam represents more than just a successful fundraising tool, it’s a glimpse into the future of business development. As AI agents become more sophisticated and accessible through platforms like Lyzr and Lovable, we’ll see a fundamental shift in how companies interact with stakeholders.

Want to build your own investment agent? Check out Lyzr Studio for AI agent development and Lovable for rapid frontend creation. Both platforms offer the enterprise-grade capabilities needed for professional applications.

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here