Table of Contents

ToggleTL;DR

Credit risk assessment is being transformed by AI agents that automate document parsing, fraud detection, policy matching, and scoring. This reduces turnaround time from weeks to minutes while increasing compliance and accuracy.

Enterprises are moving toward agentic credit workflows to scale risk operations, ensure auditable decisions, and integrate with CRMs and regulatory APIs in real-time. Lyzr offers prebuilt credit risk agents that plug into your core banking stack in days.

What is AI in Credit Risk Assessment?

AI in credit risk assessment refers to the use of intelligent software agents; powered by machine learning, LLMs, and advanced analytics, to evaluate the likelihood of a borrower defaulting on a loan. In modern enterprise setups, this goes beyond simple scoring.

AI agents now ingest structured and unstructured data, perform document verification, orchestrate API calls (e.g., CIBIL, Experian), compute eligibility, detect anomalies, and dynamically retrain models for ongoing credit portfolio health.

Unlike traditional monolithic systems, agent-based assessment is modular, explainable, and adaptive; making it ideal for financial institutions operating across diverse products and jurisdictions.

Why Traditional Credit Risk Assessment Falls Short

Traditional credit scoring systems rely on static rules, manual reviews, and siloed data sources. Risk officers often juggle between PDFs, CRM systems, third-party APIs, and internal rules engines; slowing down decision cycles and increasing the risk of bias or error.

Meanwhile, regulators are tightening scrutiny over explainability, compliance, and fairness in lending. Enterprises are under pressure to move toward dynamic, real-time, and transparent decisioning systems.

AI agents offer a compelling shift. They can pre-process documents, extract entities, perform cross-verification, and explain their logic; while handing off edge cases to human reviewers. The result: reduced NPAs, improved onboarding speed, and lower operational costs.

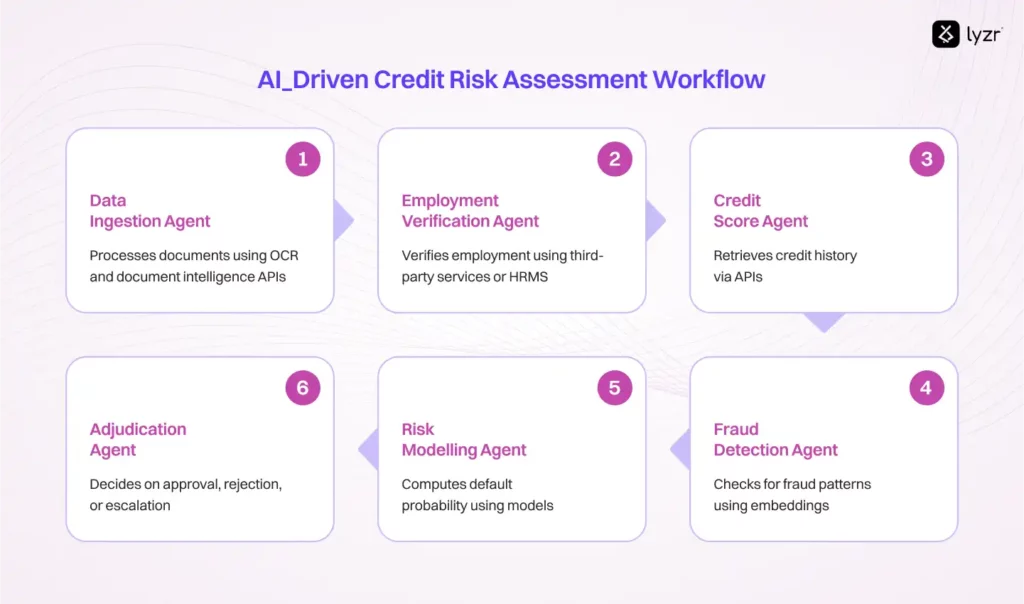

How Agent-Based Credit Risk Assessment Works

In a modern AI-first credit workflow, agents operate across a pipeline; each specialized for a task. Let’s break this down:

It begins with a Data Ingestion Agent that processes bank statements, KYC documents, and payslips using OCR and document intelligence APIs like AWS Textract or Google Document AI. The extracted fields are passed to an Employment Verification Agent, which triggers third-party services like Truework or verifies with internal HRMS records.

Simultaneously, a Credit Score Agent retrieves credit history via Experian, Equifax, or CIBIL APIs. Then, a Fraud Detection Agent checks for synthetic identity patterns or blacklist hits using embeddings and vector search.

A Risk Modeling Agent then uses a fine-tuned LLM or XGBoost model to compute default probability. Lastly, an Adjudication Agent packages the outcome; either auto-approving, rejecting, or flagging for human escalation; with detailed rationales logged for audits.

Each agent logs its operations, complies with role-based access, and supports human-in-the-loop intervention.

Here are 50+ Agentic use cases across BFSI, Sales, Marketing & Others.

Real-World Use Cases Across Financial Services

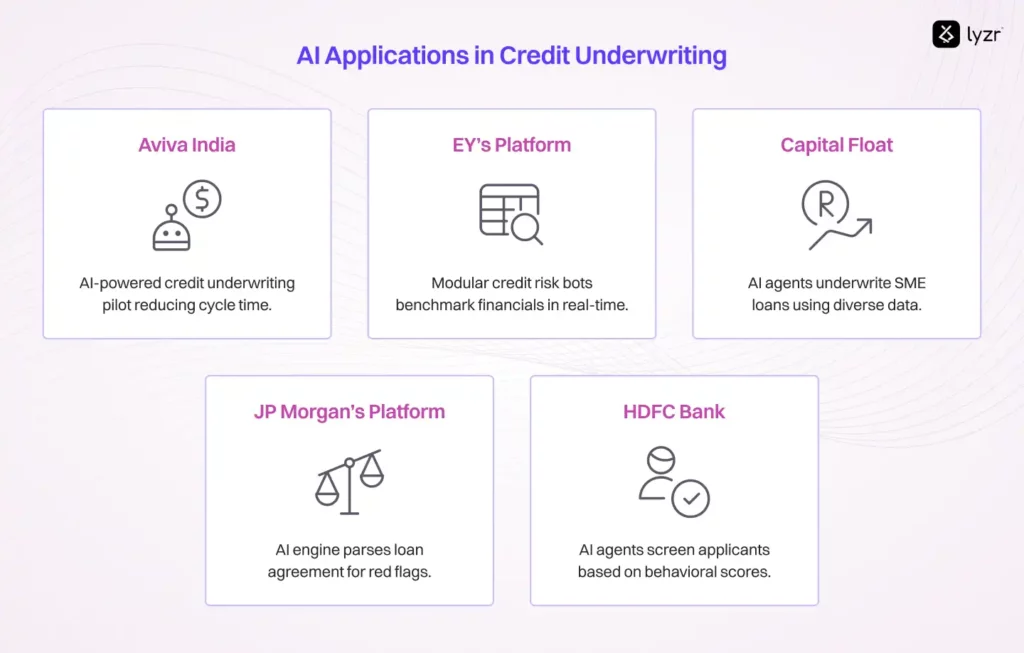

1. Aviva India

Launched an AI-powered credit underwriting pilot for life insurance premium financing. Their system used income data, vectorized customer interactions, and risk pattern detection agents; reducing underwriting cycle time by 60%.

2. EY’s Credit Intelligence Platform

EY deployed modular credit risk bots across multiple banking clients in APAC. These bots extracted ratios from financials, benchmarked them via industry datasets, and highlighted covenant breaches in real time.

3. Capital Float

India’s leading digital NBFC uses AI agents to underwrite SME loans. Agents extract GST data, bank transactions, and social sentiment to determine creditworthiness, delivering results in under 30 minutes.

4. JP Morgan’s COiN Platform

Their AI-powered legal review engine was extended into credit workflows, where document agents parse loan agreements for red flags; mitigating contract risks before disbursement.

5. HDFC Bank

The bank’s digital lending unit uses AI agents to screen applicants based on behavioral scores, previous repayments, and image-recognition-based verification; flagging high-risk profiles automatically.

Need a playbook for implementing Agents in Banking? check out the playbook.

How Are Enterprises Deploying AI in Credit Risk Today?

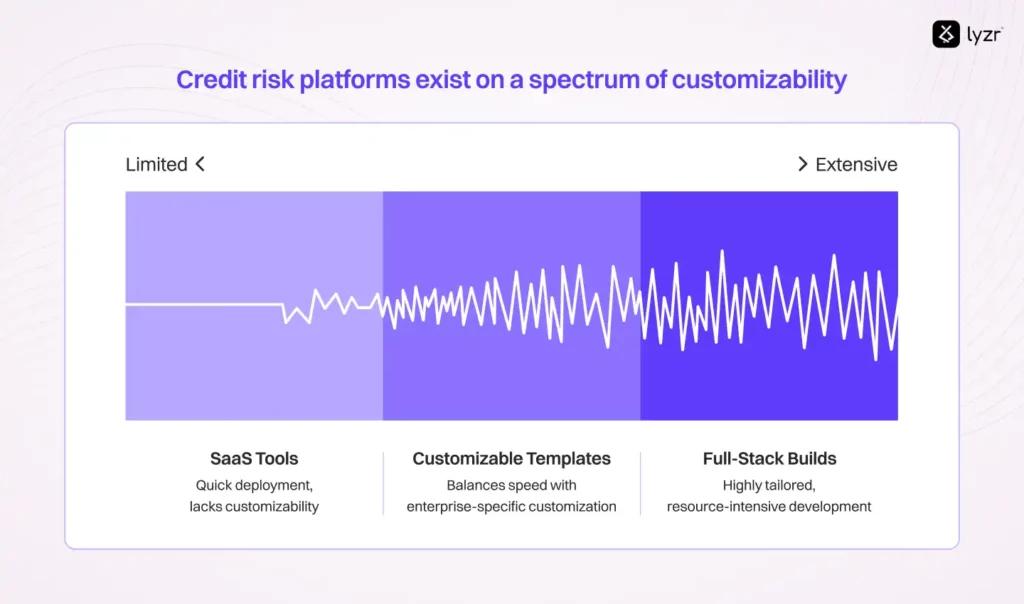

Enterprises are adopting AI in credit risk assessment through three dominant deployment patterns:

1. Off-the-shelf SaaS tools: Platforms like Zest AI, Upstart, and Experian PowerCurve offer prebuilt credit scoring and decisioning solutions. These are quick to implement and come with built-in integrations for bureaus and compliance reporting. However, they often lack the flexibility to incorporate custom eligibility criteria, domain-specific scoring models, or internal risk signals, making them less ideal for nuanced lending strategies.

2. In-house full-stack builds: Large banks and fintechs; such as JPMorgan Chase, HDFC, or Capital One; are building end-to-end credit risk pipelines using orchestration frameworks like AWS Step Functions, LangChain, or Databricks Workflows.

These systems typically include document processing layers, credit bureau connectors, fraud detection modules, and proprietary ML models hosted on Sagemaker or Vertex AI. While highly tailored, these builds are resource-intensive, requiring dedicated data science, engineering, and compliance teams.

3. Hybrid frameworks with customizable templates: Mid- to large-sized financial institutions are increasingly turning to platforms like Lyzr to accelerate deployment. These frameworks offer prebuilt credit agent templates; such as document ingestion, credit check, and risk modeling agents; which can be combined with enterprise-specific APIs, scoring models, and regulatory policies. This modular approach offers the best of both worlds: the speed of off-the-shelf tools with the control of in-house systems, enabling faster time-to-value without compromising on customization or compliance.

Modular AI Agent Stack for Credit Risk

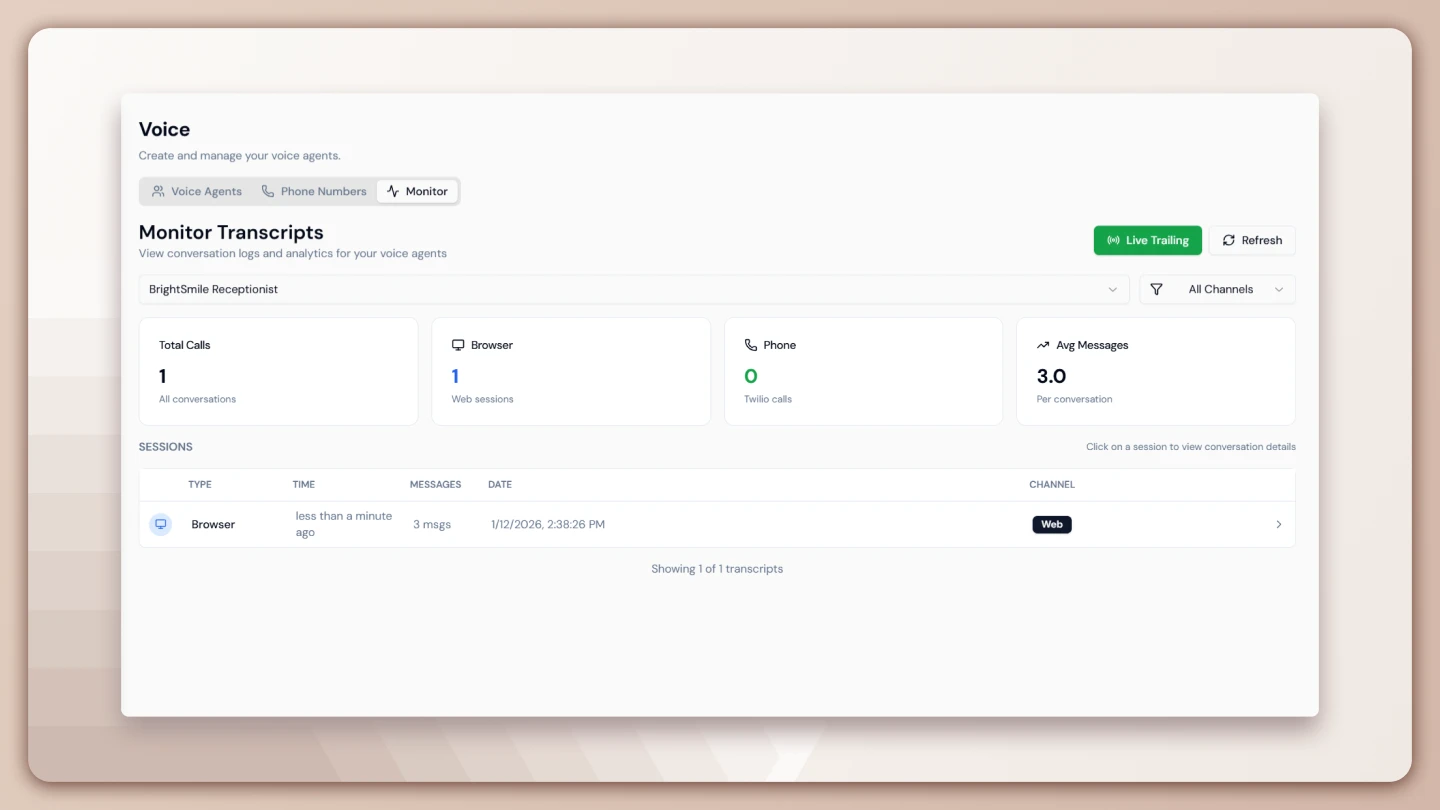

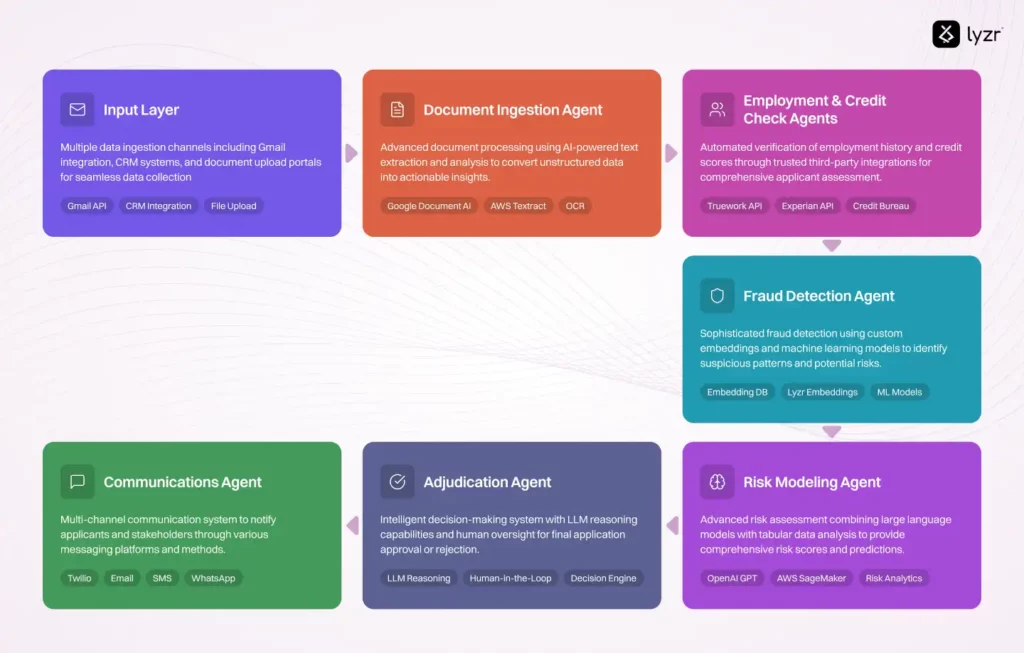

In a modular, left-to-right AI agent stack for credit risk assessment, the process begins at the input layer, where data is collected from sources such as Gmail, CRM systems, and document uploads.

This data is first processed by the Document Ingestion Agent, which uses tools like Google Document AI and AWS Textract to extract structured information. Next, Employment & Credit Check Agents call external APIs like Truework and Experian to validate employment details and retrieve credit scores.

The pipeline then moves to the Fraud Detection Agent, which leverages an embedding database and Lyzr’s custom embeddings to flag anomalies or synthetic identities. The refined data is passed to the Risk Modeling Agent, which combines OpenAI’s language models with tabular models hosted on AWS Sagemaker to compute default probability.

Based on this, the Adjudication Agent determines whether to approve, reject, or escalate the application, incorporating LLM reasoning and human-in-the-loop safeguards. Finally, the Comms Agent ensures real-time, multi-channel updates via Twilio, email, SMS, or WhatsApp.

All orchestrated securely via Lyzr’s Agent Studio with enterprise controls.

How Lyzr Accelerates Credit Risk Deployment

With Lyzr, you don’t have to build this stack from scratch. Our prebuilt credit agents come integrated with workflows for:

- Document parsing (OCR + Entity Recognition)

- API-based verification (KYC, Credit Bureaus)

- Custom LLM-based scoring models

- Fraud detection via vector DB + embeddings

- Modular orchestration and fallback logic

You can deploy these agents as standalone APIs or within a secure multi-agent framework. Lyzr also ensures:

- Enterprise-grade controls (audit trails, RBAC, PII redaction)

- LLM flexibility (OpenAI, Claude, Perplexity, Nova Models)

- Fast deployment (go live in 1–2 weeks)

- Domain extensibility (retail loans, SME credit, insurance financing)

Explore our Banking Use Cases or launch agents directly via Agent Studio.

AI in Credit Risk Decisioning: Build vs Buy vs Hybrid

Deciding how to modernize credit risk assessment comes down to three choices: build in-house, buy off-the-shelf, or adopt a hybrid modular model. Here’s how they compare:

| Feature/Decision Area | Build In-House | Buy Off-the-Shelf | Lyzr Hybrid Model |

| Customization | High, but time-consuming | Low to moderate | High, with prebuilt templates |

| Time to Deployment | 6–12 months | 2–3 months | 1–2 weeks |

| Cost Efficiency | High engineering + infra cost | Licensing-heavy | Flat pricing, usage-based if scaled |

| Compliance & Explainability | Depends on dev team | Often opaque | Built-in audit logging + human review |

| Integration Support | Requires dev bandwidth | Limited to vendors | Plug-and-play with CRMs, APIs, DBs |

Wrapping Up

AI in credit risk assessment is already transforming how enterprises onboard, underwrite, and manage portfolios. Companies adopting modular, real-time AI credit decisioning are reducing risk exposure, improving compliance, and scaling faster than competitors.

The future of credit workflows is modular, explainable, and auditable, and it’s here today.

Ready to see how prebuilt AI Agents can fit into your Banking stack? → Book a demo with Lyzr.

Frequently Asked Questions (FAQs)

1. What is AI in credit risk assessment?

AI in credit risk assessment refers to the use of machine learning, large language models (LLMs), and intelligent agents to evaluate borrower risk. Unlike traditional systems, AI credit risk models analyze both structured and unstructured data, perform document verification, and support real-time decisioning.

2. How is AI used for real-time credit risk assessments?

AI credit risk agents process documents, verify identity, connect to bureau APIs, detect fraud, and compute risk scores instantly. This enables banks and NBFCs to make faster, auditable, and compliant lending decisions in real time.

3. Which companies lead in modular credit risk assessment during onboarding?

Enterprises like HDFC, Capital Float, and Aviva India have adopted modular AI in credit risk management. Platforms such as Lyzr are also recognized as leaders for onboarding with prebuilt, customizable agents that can be deployed in weeks.

4. What are the benefits of AI in credit risk management?

AI in credit risk management improves compliance, reduces NPAs, accelerates loan approvals, and ensures fairness in decisioning. By replacing manual checks with modular AI agents, enterprises gain both speed and accuracy.

5. What is AI credit decisioning and why does it matter?

AI credit decisioning is the process where AI agents automatically analyze applications, check eligibility, and generate approval or rejection decisions. It matters because it helps enterprises reduce risk, improve transparency, and scale lending operations efficiently.

6. How does Lyzr help in modular credit risk assessment?

Lyzr offers prebuilt modular agents for document parsing, fraud detection, and credit decisioning. This enables banks and NBFCs to deploy AI in credit risk assessment within weeks instead of months, while ensuring compliance and explainability.

7. Why choose Lyzr over other AI credit risk platforms?

Unlike off-the-shelf SaaS or full in-house builds, Lyzr provides a hybrid approach, prebuilt templates plus customization. This makes it faster to launch, easier to integrate, and fully auditable for regulatory compliance.

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here