Table of Contents

ToggleRefunds might look simple from the outside, but behind every request is a tangle of checks, approvals, system lookups, and back-and-forth communication.

Whether it’s a returned item, a billing error, or a subscription cancellation, each refund triggers a mini workflow, and in high-volume businesses like e-commerce, SaaS, or travel, that workflow repeats hundreds or thousands of times a month.

Manual handling slows things down. AI agents can automate these tasks, leading to improved efficiency. Emails pile up.

Tickets bounce between support and finance. Customers wait, often in the dark.

The result? Delays, errors, rising costs, and unhappy users. AI agents can analyze return data to improve product performance and decision-making.

And while refund processes vary from one business to another, the pain points stay the same: inconsistent decisions, missed SLAs, and strained teams.

What if we have a common solution to all these pain points? Let’s have a look

Where It Breaks Down Today?

Let’s break down a typical refund process and where things start to fall apart:

| Step | Average Time | Manual Effort | Tools Involved |

|---|---|---|---|

| Triage & categorization of crucial tasks | 5–10 mins | Yes | Helpdesk, CRM |

| Data gathering | 8–12 mins | Yes | CRM, ERP, order system |

| Approval & routing | 24–48 hrs (delays) | Yes | Email, finance tool |

| Customer communication | Repeated follow-ups | Yes | Chat, ticketing system |

1. Rigid Rules, No Context

Most workflows treat every refund the same—whether it’s a loyal customer asking for a one-time return or a suspicious, repeated request.

- No intelligent decision making for edge cases or exceptions, where AI agents can make smarter decisions

- No ability to weigh customer history or product type

- Refunds get blocked or delayed for the wrong reasons

AI agents can enhance customer satisfaction by providing timely and accurate decisions, improving the efficiency and effectiveness of the returns and refund processes.

Impact: Increased churn, support escalations, and brand damage for high-value customers.

2. Disconnected Systems

Support uses a helpdesk, finance uses ERP, and customer data sits in a CRM, presenting significant challenges in data integration. None of these tools speak to each other.

- Agents manually gather order details and payment data

- Finance teams verify refund eligibility through emails or spreadsheets

- Context is lost between steps

AI agents can ensure seamless integration of these systems, enhancing operational efficiency and improving customer satisfaction.

Impact: Average of 8–12 minutes spent per refund gathering data across 3–5 systems.

3. Human Bottlenecks Everywhere

Approvals happen over email, but automating repetitive tasks with AI agents can streamline these approvals. Notes are buried in support tickets. SLA clocks tick while people wait on responses.

- Refunds often involve 3+ handoffs before resolution

- Approvals get delayed by 24–48 hours on average

- Support teams field follow-up queries in the meantime, but AI agents can reduce the need for manual intervention by instantly verifying requests and sorting them efficiently

Impact: Slow turnarounds, missed SLAs, and rising support volumes.

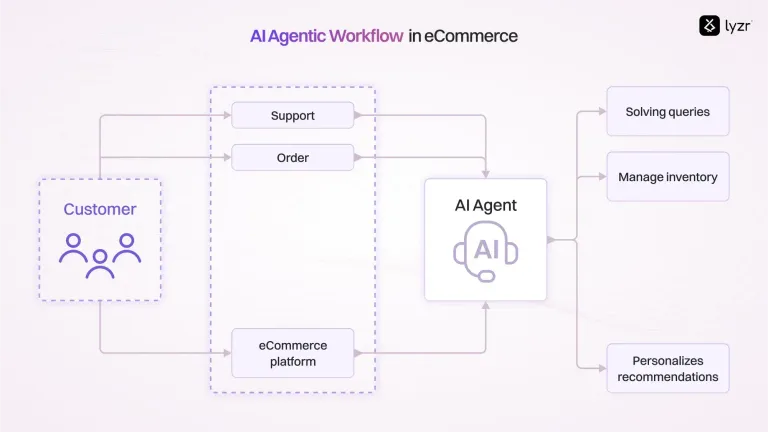

The Shift towards AI Agents

| Feature | Manual Process | AI Agents |

|---|---|---|

| Decision Making | Based on static rules | Dynamic, context-based decisions |

| System Integration | Multiple disconnected tools | Unified, real-time integration |

| Approval Process | Slow, full of handoffs | Instant for routine requests, flagged for review only when needed |

| Customer Communication | Reactive, slow updates | Proactive, instant notifications |

Proactive, instant notifications. AI agents contribute to continuous improvement in refund management by creating a feedback loop that allows product development teams to iteratively refine their offerings based on real customer feedback, thereby fostering ongoing enhancements and customer satisfaction.

Here’s how AI technology continues to advance and help with refund management.

1. Context-Aware Decisions

Imagine a loyal customer who asks for a refund on a product that’s beyond the return window. Under traditional systems, this request could be delayed or rejected.

With AI agents, the decision is based on the customer’s history. The AI uses historical data to recognize the loyal relationship and fast-tracks the refund.

Result? The customer gets an immediate, context-aware response that reinforces their trust in your brand. This efficient and transparent process significantly enhances customer trust, leading to sustainable business growth.

2. Automated Processing for Routine Requests

Every day, there are numerous refund requests that are straightforward and low-risk, like a customer wanting a refund for a wrong-size item or delayed delivery. These requests often end up waiting for approval, slowing things down.

AI agents automatically handle these types of requests based on preset policies, providing instant approvals for routine requests. For refunds below a certain amount, the AI approves them instantly, while higher-value refunds are flagged for further review by your team.

Result? Time is saved for your team, allowing them to focus on more complex issues, while routine refunds are processed without delay. This process enhances customer satisfaction by reducing errors, increasing efficiency, and personalizing the returns experience.

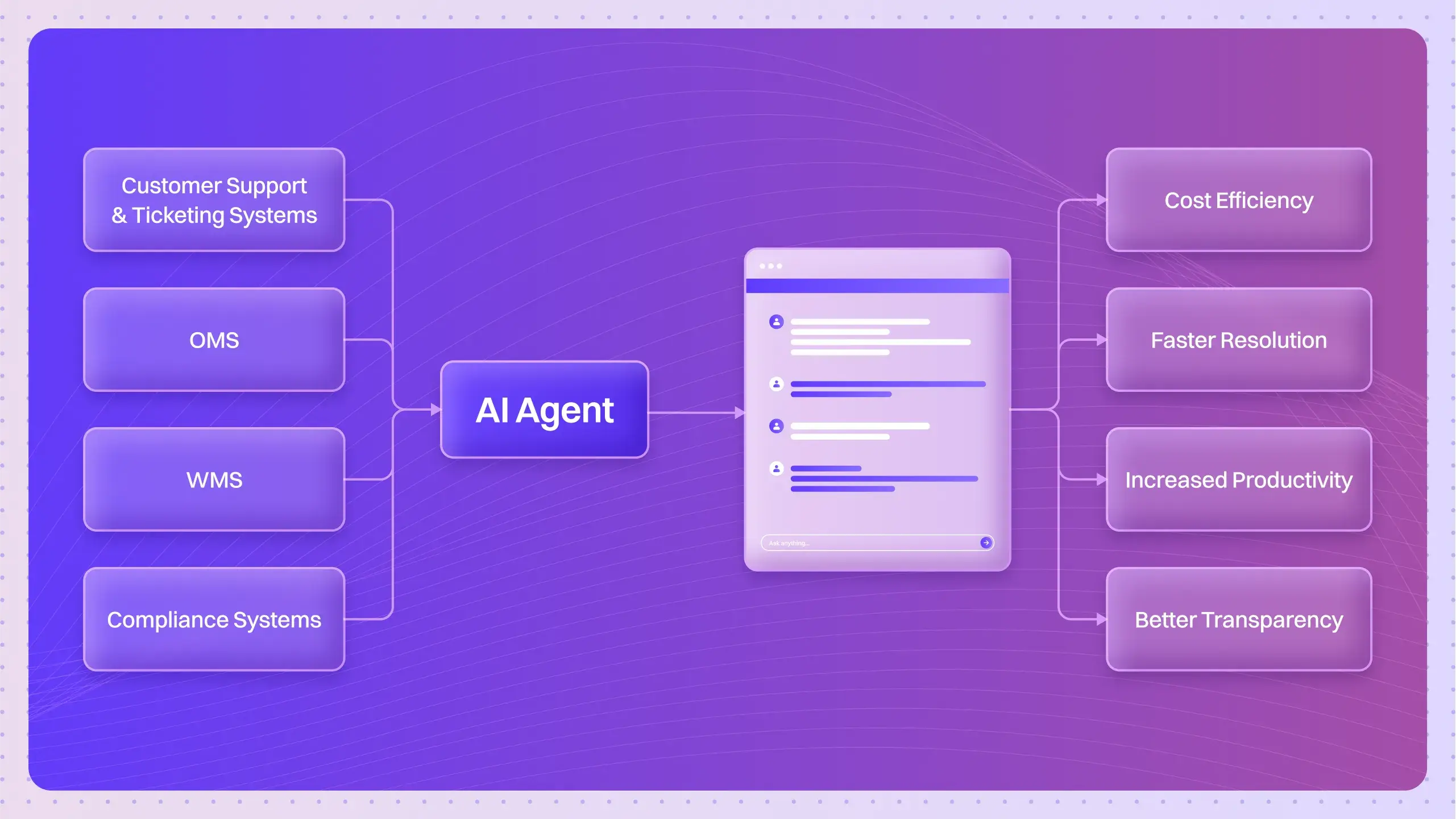

3. Effortless System Integration

In manual systems, refund requests often require jumping between different platforms, CRMs, payment systems, and finance tools, highlighting the challenges of integrating existing systems. This not only wastes time but can lead to missed information or errors.

AI agents eliminate this problem by integrating with all systems in real-time. They automatically update customer records, trigger the right approval workflows, and notify the relevant teams, all without manual input.

Result? No more fragmented data or switching between systems. Everything is handled within a single, unified platform. This seamless integration significantly improves operational efficiency, reducing workload for customer support and enhancing speed and accuracy in handling returns.

Real-World Examples Across Various Industries

To see how AI agents truly work, let’s look at some real-world examples across different industries. These show just how much time and effort AI agents save while delivering better results by optimizing the refunds process. AI agents also enhance customer engagement by transforming how businesses manage returns and refunds, turning these interactions into opportunities for building stronger customer relationships.

1. E-Commerce: Quick Returns, Happy Customers

For an e-commerce company, refund requests are a constant. From customers unhappy with their purchase to those simply changing their minds, the volume can be overwhelming.

AI Agent Solution: The AI agent automatically processes return requests based on predefined criteria, such as item condition, return window, and customer status. If a customer requests a refund for a defective product, the AI can cross-reference product data, trigger immediate approval, and notify both the customer and the warehouse team for return processing.

Results:

- 50% reduction in refund approval time

- 30% reduction in manual labor required for refund processing

- Higher customer satisfaction, with refunds processed in minutes instead of days

- AI agents create a customer-friendly return process by automating and optimizing returns management, enhancing customer communication, and providing timely updates.

2. Subscription Services: Handling Monthly Refunds with Ease

Subscription-based businesses often deal with refunds due to customer dissatisfaction or cancellation. These companies need to manage frequent refund requests, and doing it manually takes up valuable resources.

AI Agent Solution: An AI agent integrates directly with the subscription platform, pulling in customer data, analyzing customer behavior, and understanding refund policies. When a customer cancels, the agent can quickly process the refund, verify account history, and ensure the refund meets the criteria, without any delays.

Results:

- 60% faster processing for cancellation refunds

- Reduced customer churn due to faster response times

- Less burden on customer service agents, allowing them to focus on more complex queries

- Improved operational efficiency by streamlining the returns and refunds processes

3. Financial Services: Improving Client Experience for Refunds

In financial institutions, refunds can be complicated, especially when they involve multiple accounts or require regulatory checks. Manual approval processes add significant delays, and compliance issues can arise if the process isn’t tightly controlled.

AI Agent Solution: The AI agent integrates with the institution’s core banking systems, automatically verifying account details, ensuring compliance by checking compliance criteria, and processing refunds in real-time. It can even flag any potential fraud or policy breaches, ensuring the institution remains compliant while improving operational speed. Additionally, AI agents enhance fraud detection by analyzing customer behaviors and transaction patterns to identify potential fraudulent activities, thereby mitigating risks and improving overall customer satisfaction.

Results:

- 70% faster processing for eligible refund requests

- Improved compliance with regulatory guidelines

- Enhanced client experience with faster resolution times

Refund Management Agent by Lyzr

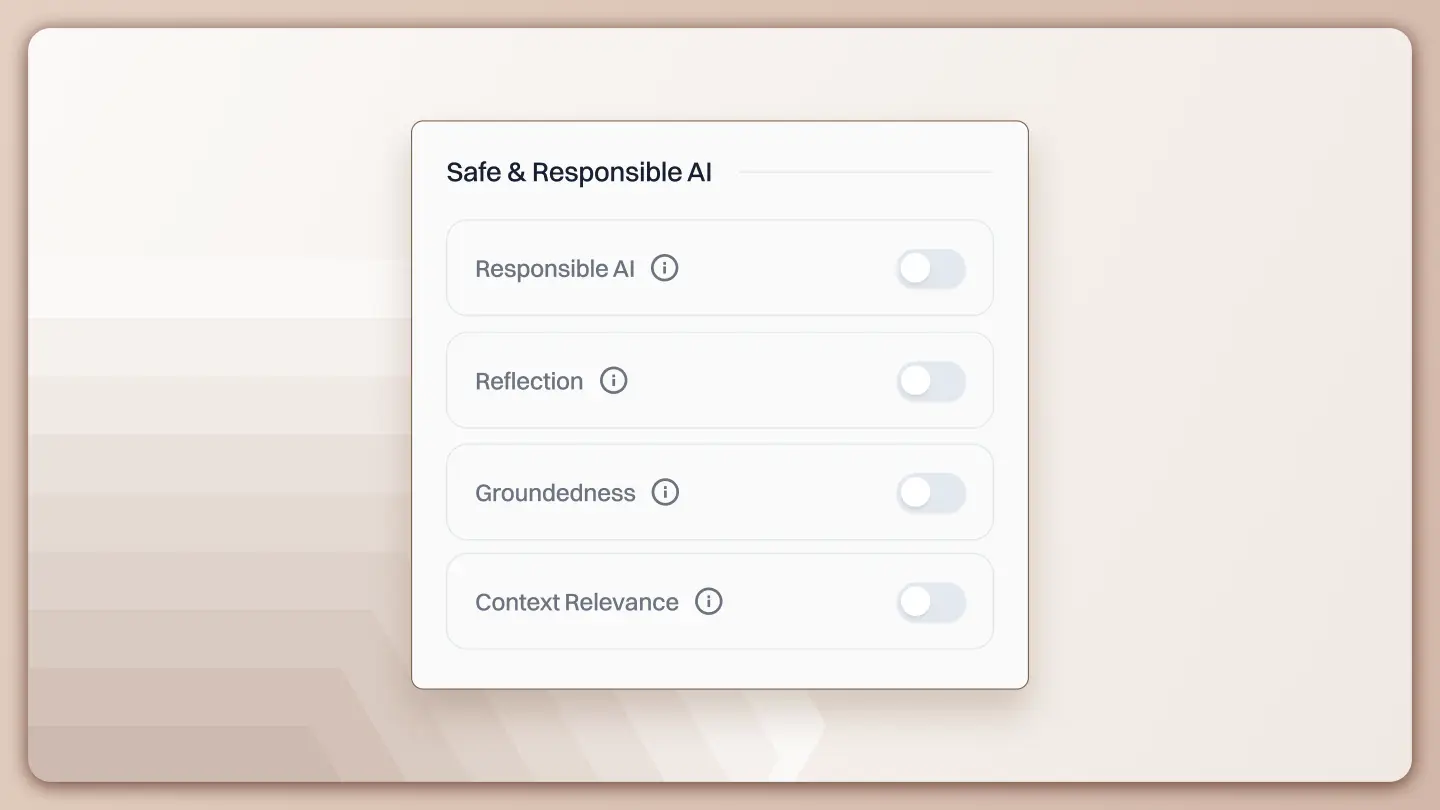

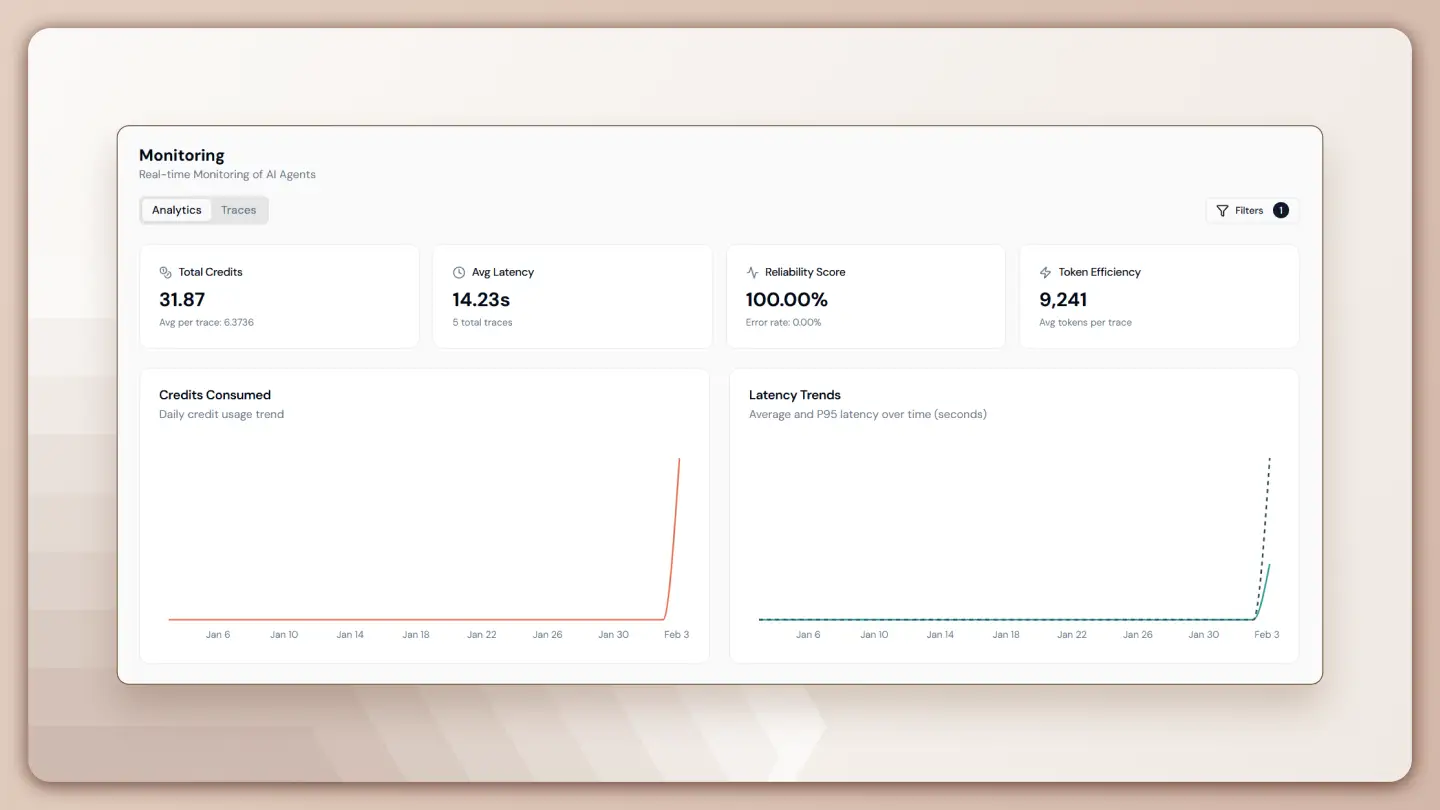

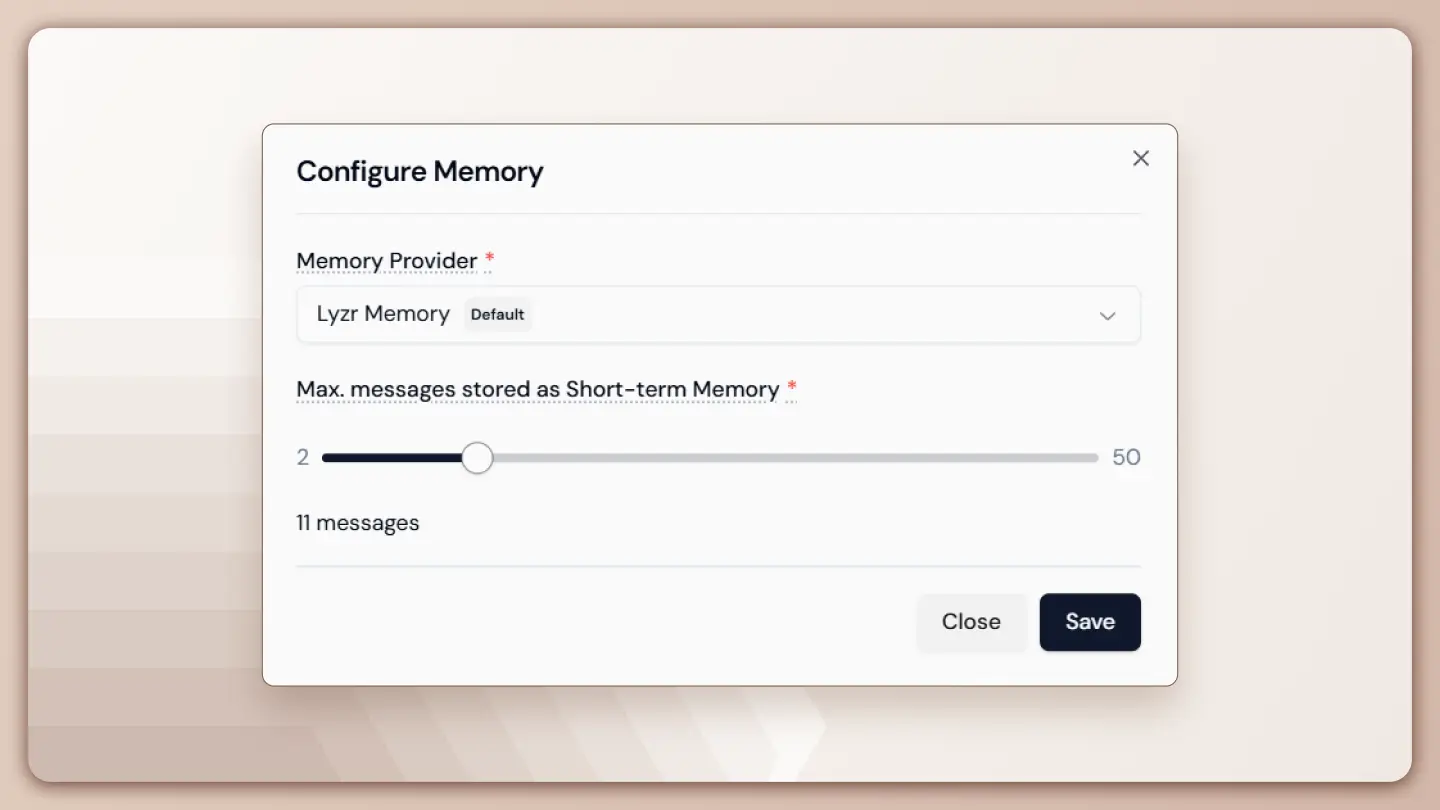

Managing credit card refunds can be tricky and time-consuming. Lyzr’s Refund Management Agent uses artificial intelligence to automate verification, transaction analysis, and decision-making.

It speeds up approvals, cuts down on fraud risks, and lightens the workload, all while delivering a better experience for customers.

AI agents use data analysis to improve the process by analyzing large volumes of customer data to identify patterns, enabling proactive measures and generating actionable insights that can influence business decisions related to product performance and customer satisfaction.

Who is it for?

- Fraud & Risk Teams: Catch fraudulent refund claims early and protect revenue with AI-driven risk analysis that identifies and flags high-risk cases for further review.

- Customer Support Teams: Automate routine refunds to reduce response times and let your team focus on more complex issues. Human agents play a crucial role in supporting AI agents, especially in handling complex scenarios and ensuring personalized service.

- Banking Operations: Simplify refund processes with seamless back-end integrations and automated validation.

How Lyzr Solves Refund Processing

- Slow, Manual Refunds: Lyzr automates refund verification by using AI agents to handle repetitive tasks, such as return initiation, validation, and communication, speeding up approvals and reducing delays.

- Fraudulent Claims: Advanced risk analysis flags high-risk refund requests to prevent fraud. By automating these processes, Lyzr significantly reduces the need for manual intervention, instantly verifying requests and minimizing human errors.

- High Operational Costs: Lyzr reduces manual review needs, cutting support overhead.

Major Benefits

- Faster Refund Approvals: Automated decision-making speeds up refund processing, creating a more efficient operation through the use of AI agents.

- Reduced Fraud Losses: Risk scoring helps identify and block suspicious refund requests.

- Better Customer Experience: Automated updates keep customers informed and satisfied. AI agents enhance customer satisfaction by making the process more efficient and responsive to individual needs.

Try out the Agent Or have a unique need? Book a demo with us today

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here