Table of Contents

ToggleOver 60% of customers still visit bank branches for tasks that require human interaction, from opening accounts to resolving disputes.

Yet the in-branch experience hasn’t kept pace, especially for large corporations seeking comprehensive financial services.

Tellers are often buried under routine tasks, juggling multiple systems, and spending more time on data entry than on real conversations. Technology plays a crucial role in improving teller assistance by automating these routine tasks and enhancing overall efficiency.

Customers expect speed. Tellers need support. And banks can’t afford to expand headcount for every branch.

That’s where AI agents come in, not as a replacement for tellers, but as real-time assistants.

These agents help tellers fetch information faster, auto-fill forms, verify data, and even suggest next-best actions based on the customer’s profile, leading to significant efficiency gains.

More Branches, Fewer Hands: Modern Bank Teller’s Challenges

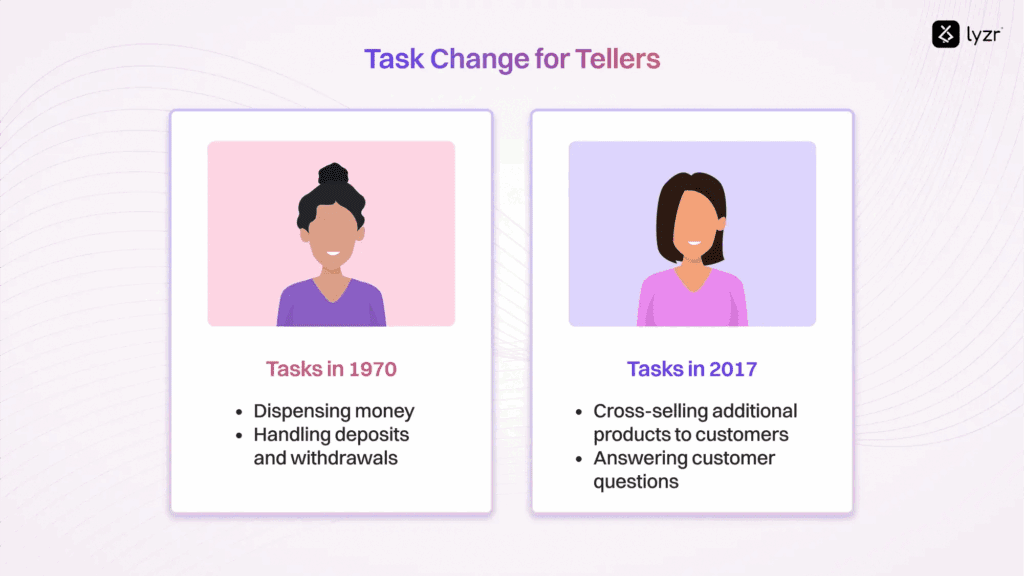

The role of the bank teller has evolved dramatically over the decades.

In the United States, the number of tellers doubled from 300,000 in 1970 to around 600,000 in 2010, largely because ATMs made it easier and cheaper to open more branches.

Instead of replacing tellers, automation initially created more demand for them.

But this trend reversed by the late 2010s. As online banking and digital services matured, branch traffic declined, and so did teller jobs, falling to around 364,100 by 2022.

But today’s tellers face a different challenge: doing more with fewer hands on deck. While the volume of routine tasks hasn’t disappeared, staffing levels have tightened. Tellers now handle:

- A high volume of repetitive queries like balance checks and account updates

- Manual verification of documents and processing of transactions

- Navigating multiple disconnected systems to complete everyday requests and banking procedures

With fewer tellers per branch and rising customer expectations, the pressure to deliver fast, accurate, and personalized service has never been higher. Efficiency in handling these tasks is crucial to maintaining customer satisfaction. The complexity of navigating various systems and procedures adds to the challenges faced by tellers.

The Shift Begins: Why Tellers Need AI Agents Now

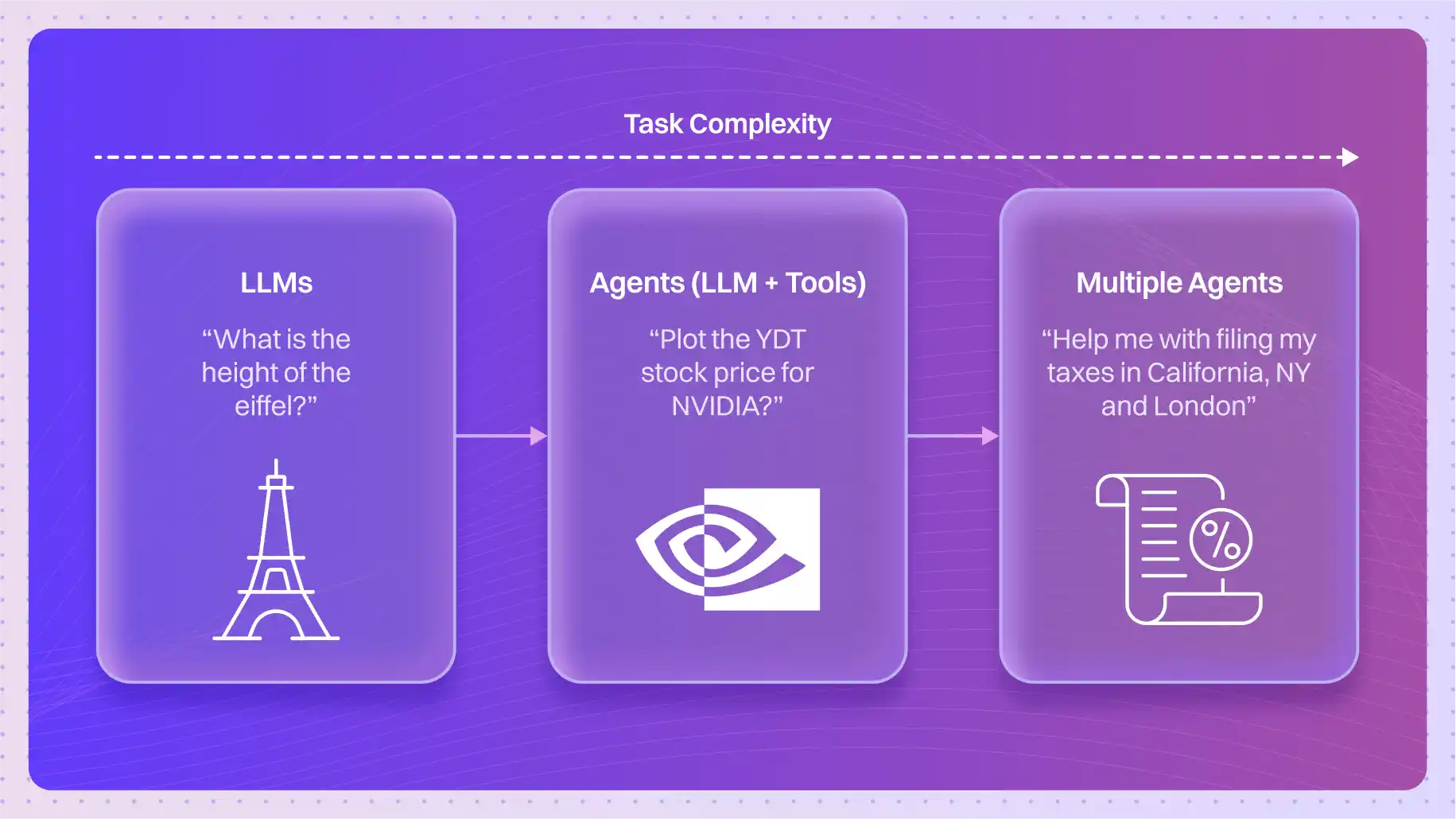

As teller staffing shrinks and branch operations grow more complex, AI agents are no longer optional, they are becoming critical to bridge the gap between workload and workforce. The efficient onboarding process for new tellers ensures they are quickly integrated and productive.

AI agents significantly enhance both customer and employee satisfaction by providing timely and accurate information, which builds trust and reduces stress, allowing staff to focus on essential tasks.

Additionally, the use of real-time guidance significantly lowers training costs and accelerates the learning curve for new tellers by offering immediate assistance on banking procedures and products.

| Task | Without AI Agents | With AI Agents |

|---|---|---|

| Average Transaction Time | 6–8 minutes per customer | 4–5 minutes per customer |

| Systems Teller Must Manually Access | 5–6 apps | 1 unified AI interface |

| Data Entry/Error Rate | 3–5% manual errors | Less than 1% AI-assisted errors |

| Document Verification Time | 3–5 minutes per customer | 30–60 seconds with AI pre-checks |

| Cross-Sell Conversion Rate | 8–10% | 15–20% (with AI recommendations) |

How tasks changes for Bank Tellers with AI Agents

- Real-Time Search Across Systems: Instead of switching between 5–6 apps, AI agents pull answers instantly from across platforms, saving critical minutes per transaction. AI agents also learn from interactions to improve efficiency over time.

- Form Autofill and Data Validation: AI agents can pre-populate 70–80% of routine fields and validate inputs using advanced tools, cutting down manual entry errors.

- Smart Nudges During Conversations: Based on customer profiles, AI agents can suggest relevant actions like opening a savings account, updating KYC, or offering a loan top-up, all in real time.

Early pilot programs show that AI-assisted tellers can reduce transaction times by 20–30% and improve cross-sell rates by 15–20%, significantly enhancing productivity.

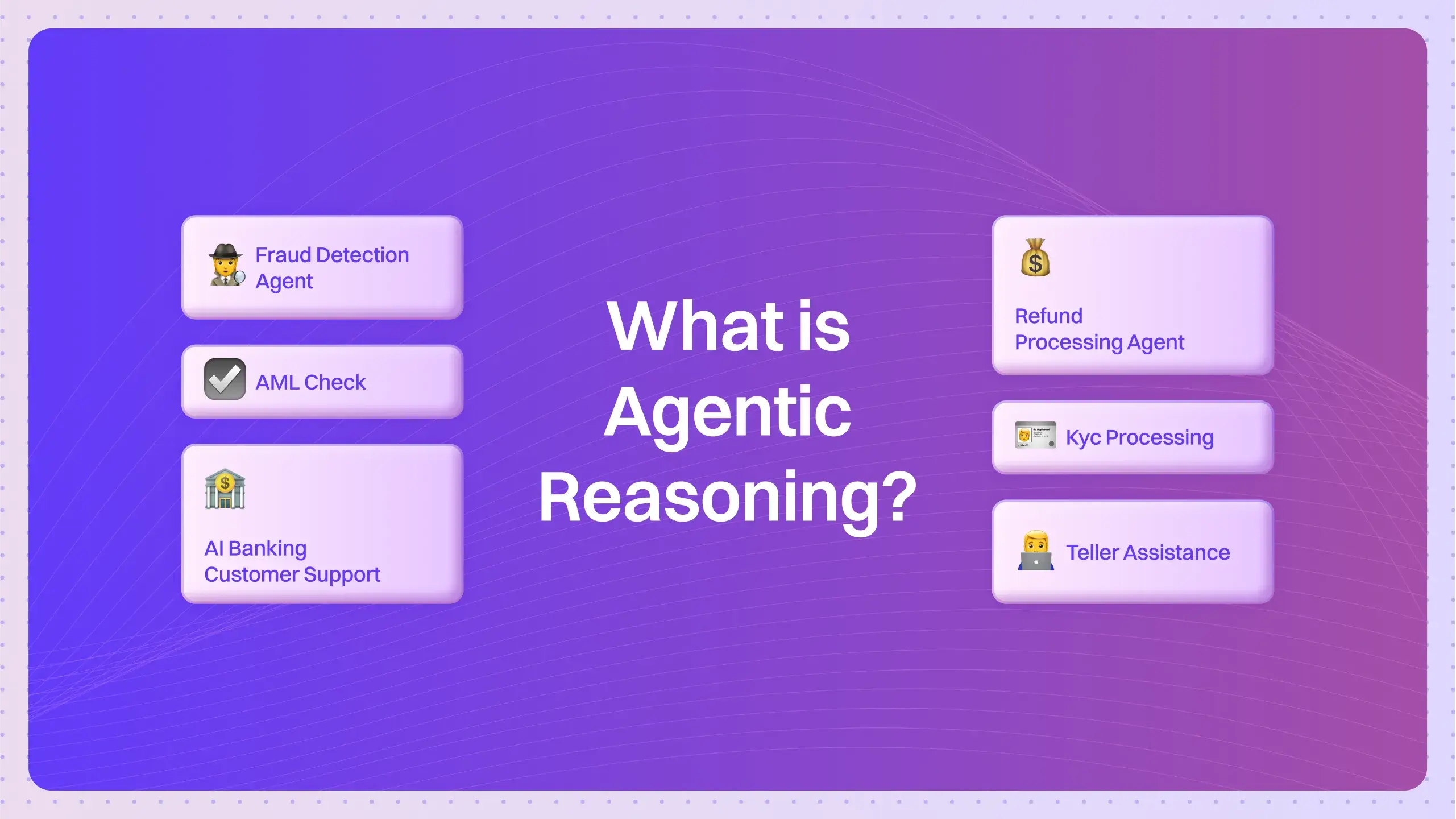

How Lyzr’s Teller Assistant Agent Is Transforming Teller Support

Lyzr’s Teller Assistant Agent is here to simplify the teller’s daily tasks and improve service efficiency by providing an innovative solution.

Here’s how it makes a difference:

- Instant Access to Critical Info: Tellers can quickly access customer data, product details, and policy updates, all within a user-friendly interface, ensuring faster and more accurate service. Customer support teams can effectively manage in-person inquiries and resolve minor issues without escalation.

- Streamlined Operations: The agent automates repetitive tasks like form filling, document verification, and compliance checks, freeing up tellers to focus on customer interactions.

- Secure and Compliant: With Lyzr’s Safe AI principles, the Teller Assistant Agent ensures all interactions comply with security and regulatory compliance standards, protecting sensitive information while improving efficiency.

Building AI Agents for a unique use case?? Book a demo today

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here