TL;DR

AI is transforming risk and compliance by enabling real-time monitoring, auto-remediation, and intelligent reporting across highly regulated industries. This blog explains how modular AI agents ; like those built with Lyzr ; can be deployed across workflows to reduce manual errors, lower compliance costs, and accelerate audits, without compromising on data residency, traceability, or domain specificity.

What is AI in Risk and Compliance?

AI in risk and compliance refers to the application of artificial intelligence ; particularly intelligent agents ; to automate, augment, and orchestrate regulatory and risk-related workflows across the enterprise. This includes real-time risk monitoring, policy mapping, anomaly detection, fraud identification, and regulatory reporting. Unlike generic AI systems, agent-based frameworks enable modular and auditable decision-making tailored to enterprise logic and data ecosystems.

Read more about our AI Agents and how they reshape compliance automation.

Why Risk and Compliance Need AI Now

Enterprises are dealing with an overwhelming volume of regulatory obligations, increasing complexity in cross-border compliance, and rising penalties for non-compliance. Manual systems are brittle, slow, and error-prone. Simultaneously, new regulations like DORA, GDPR, and India’s DPDP are expanding accountability layers.

The opportunity? AI agents offer scalable precision ; identifying risk hotspots in real-time, flagging policy violations, and automating responses without waiting for quarterly reviews. Compliance teams are no longer gatekeepers ; they’re becoming architects of continuous assurance systems.

Explore use cases in our Banking Solutions section.

Agentic Architecture for Risk and Compliance

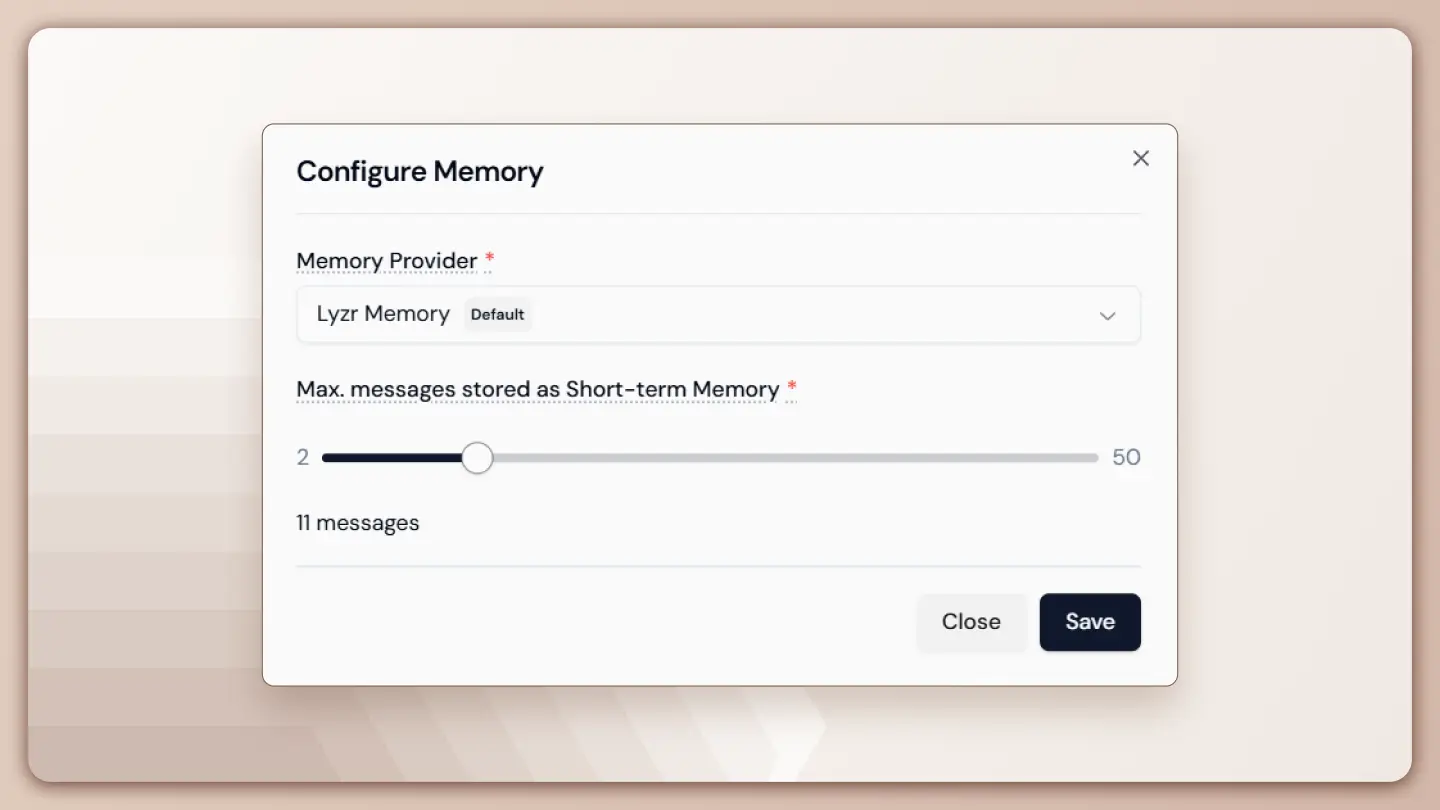

A modern risk and compliance stack begins with a Data Ingestion Agent that extracts structured insights from emails, documents, audio files, and web portals via OCR and NLP. These are passed to a Policy Mapping Agent, which classifies inputs against enterprise regulations; using vector databases and embeddings linked to SOPs, ISO standards, or internal rulebooks.

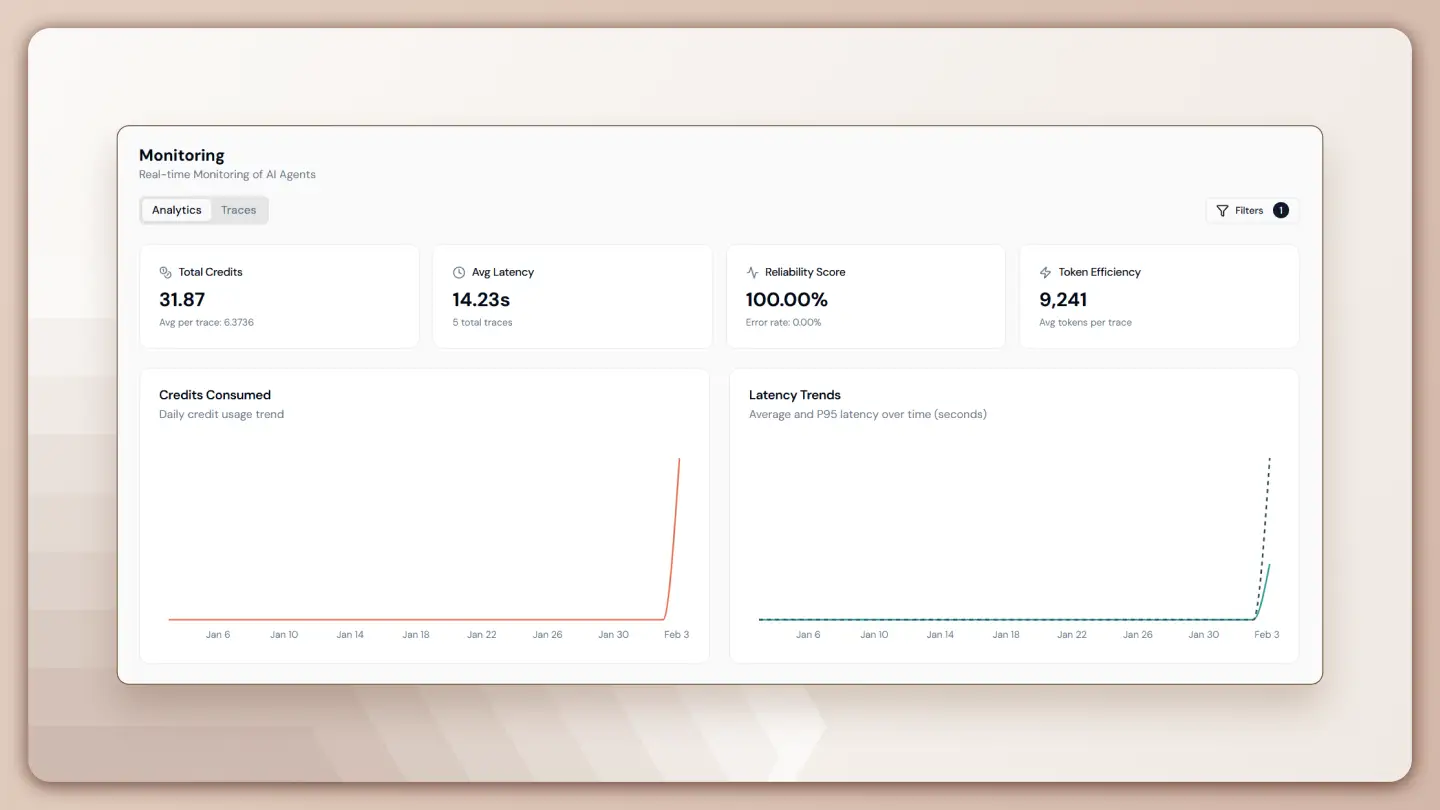

The Violation Detection Agent constantly scans transaction logs, communication threads, or event data for threshold breaches or behavioral anomalies. A Human-in-the-Loop Agent ensures high-risk escalations are reviewed with enterprise-specific controls. Finally, an Audit & Reporting Agent generates real-time logs, audit trails, and regulator-ready dashboards. These logs double as evidence for data compliance, capturing data lineage, access controls, and retention decisions alongside every agent action.

As a baseline, maintaining strong endpoint protection with trusted antivirus software, like those reviewed by Cybernews, helps prevent malware from interfering with sensitive enterprise systems before such agents even engage. An example of such endpoint protection is MacKeeper antivirus, which protects Macs from malware while providing built-in cleaning and optimization features, helping organizations keep devices fast, clutter-free, and secure.

This architecture is modular, privacy-compliant, and integrates with tools like Salesforce, Snowflake, Guidewire, and AWS Bedrock.

Real-World Use Cases of AI in Risk & Compliance

Aviva deployed AI agents to continuously monitor sales communications for policy misrepresentation, using NLP agents embedded into their CRM and email systems.

EY has built internal compliance bots to auto-check client onboarding steps against country-specific AML and KYC norms, reducing onboarding errors by 40%.

Allstate uses multi-agent systems to track claims against regulatory timelines, ensuring TAT compliance with state-level insurance regulations.

PwC developed internal risk intelligence agents that synthesize alerts from multiple regulatory feeds like FINRA, FCA, and SEBI to update client-specific exposure reports.

DBS Bank deployed AI agents to pre-emptively flag potential fraud cases by correlating transaction behaviors with third-party blacklist databases and behavioral embeddings.

How Lyzr Accelerates Risk & Compliance Transformation

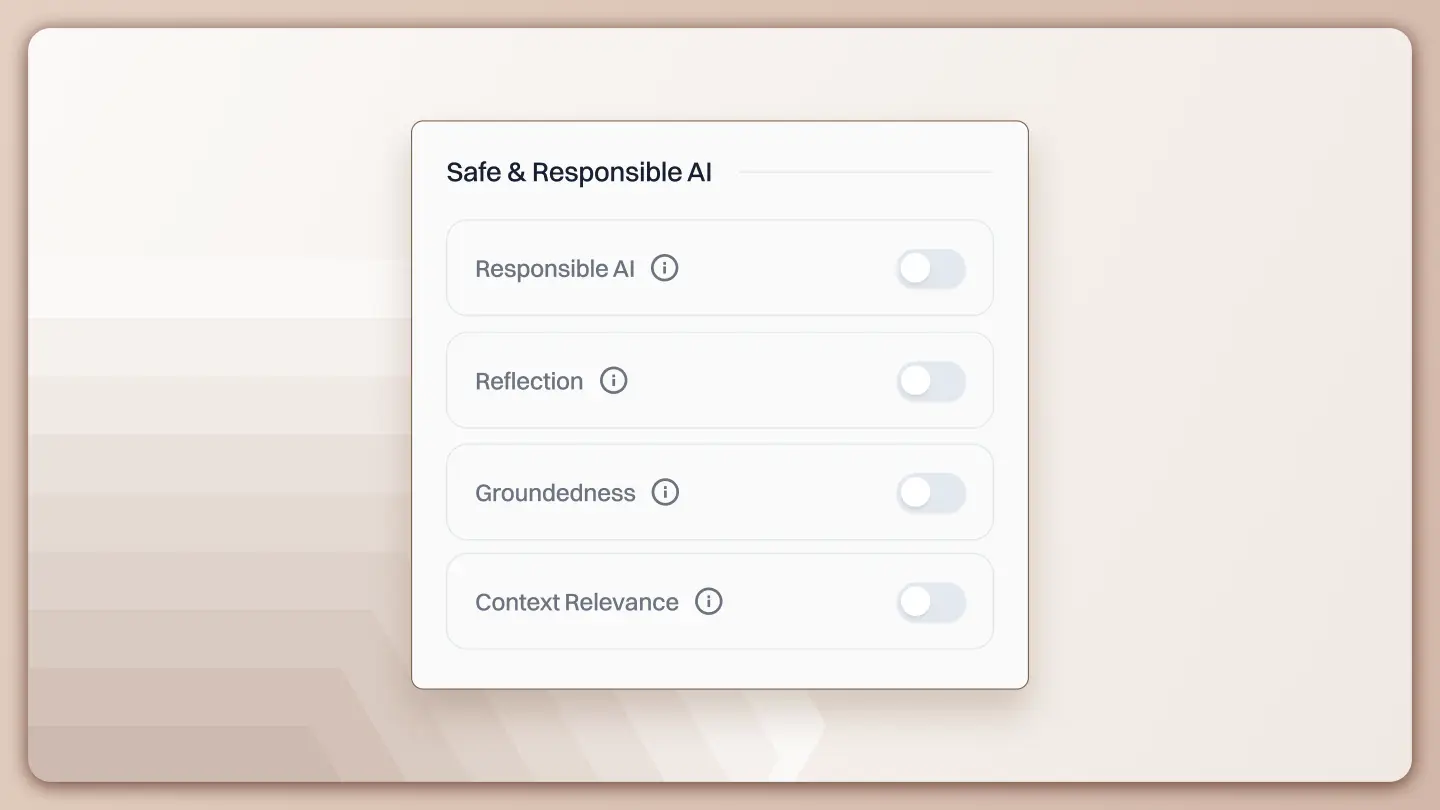

Lyzr’s Agent Studio offers pre-built agents designed for BFSI, pharma, energy, and telecom domains ; pre-mapped to enterprise workflows and integrated with safe and responsible AI layers. These agents include:

- Violation Detection Agents trained on domain-specific rulebooks

- Policy Mapping Agents with embedded vector stores for real-time classification

- Audit Agents with traceable logic, logging every decision made by the model

- Communication Agents for stakeholder notifications across email, Slack, or SMS

Deployment takes days, not quarters. Enterprises can begin with a single pilot ; like automated DLP monitoring or insider trading risk ; and scale across departments through orchestration. You can also browse examples in our Case Studies.

Tradeoff Table: Build vs Buy vs Lyzr Hybrid

| Factor | Build In-House | Buy Generic AI Tools | Lyzr Hybrid Platform |

| Customizability | High | Low | Very High |

| Time to Deploy | 6–12 months | 2–4 months | 1–3 weeks |

| Domain-Specific Expertise | Requires large team | Low | Pre-trained agents for each domain |

| Integration with Enterprise | Complex | Limited APIs | Natively integrates with CRMs, ERPs |

| Data Privacy / Auditability | Risk of non-compliance | Black-box models | Transparent, agent-level logging |

In a left-to-right agent pipeline for compliance automation, the workflow starts at the Ingestion Layer, where data is pulled from sources like Gmail, PDFs, Salesforce records, and voice logs. This data is then processed by the Policy Mapping Layer, which leverages custom embeddings powered by AWS Bedrock, OpenAI, or Hugging Face to align content with regulatory frameworks.

Next, the Violation Detection Layer uses platforms like Shift Technology and Lyzr’s Risk Agents to flag potential compliance breaches in real time.

These flagged items are passed to the Human Review Layer, where analysts can assess them through tools like Slack, Jira, or internal review dashboards. The final step is the Audit Logging and Orchestration Layer, which ensures traceability and action routing using platforms such as Snowflake, LangChain, and Lyzr’s Agent Studio.

Each node shows modular agents plugged into enterprise tools via secure APIs.

Frequently Asked Questions (FAQs)

- Can I use different LLMs in Lyzr’s compliance agents?

Yes. Lyzr supports OpenAI, Anthropic, and open-source models. You can dynamically swap LLMs depending on sensitivity and cost. - Does Lyzr integrate with tools like Guidewire or Duck Creek?

Yes. We offer out-of-the-box tools that can be added with a single click ; just like Google or HubSpot integrations. For more niche platforms like Guidewire or Duck Creek, you can seamlessly plug them into Lyzr via custom adapters. - What data compliance standards does Lyzr follow?

Lyzr enables HIPAA, GDPR, and ISO 27001-aligned deployments, with options for on-prem, VPC, or SaaS hosting. - Is there a human-in-the-loop for high-stakes decisions?

Yes. All agentic workflows allow rule-based or threshold-based human review checkpoints. - Can the same agents be reused across functions?

Yes. A policy mapping agent used in sales compliance can be reused for claims or underwriting checks with minimal changes. - How long does a typical rollout take?

A POC or MVP can be delivered in under 72 hours. A fully orchestrated production rollout across departments can take 8–10 weeks depending on workflow complexity. - What kind of talent is needed to build agents in-house?

You’ll need ML engineers, DevOps, domain SMEs, and compliance specialists. Lyzr eliminates 70% of this need with pre-built templates. - How does Lyzr prevent hallucinations in compliance outputs?

All outputs are generated with grounding in enterprise-approved data sources and include rationale with link-backs to evidence.

Looking to bring AI agents into your company? Book a demo to see them in action.

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here