Table of Contents

ToggleTL;DR

AI agents are revolutionizing banking customer service by automating high-volume workflows, improving resolution speed, and enabling 24/7 multilingual support across channels. With modular deployment, pre-integrated CRMs, and enterprise-grade controls, banks can launch secure, compliant AI agents in weeks,not months.

What Is AI in Customer Service for Banks?

AI in customer service for banks refers to the integration of intelligent agents that automate and augment end-to-end support workflows,ranging from KYC verification and loan status updates to fraud detection and multilingual query resolution. These AI agents utilize large language models (LLMs), reasoning engines, and vector search to deliver real-time, compliant, and personalized assistance across email, chat, IVR, WhatsApp, and mobile banking channels. Banks may also integrate secure voice routing systems or alternate phone number apps for business to better manage high call volumes while maintaining compliance, traceability, and separation between departments or service tiers.

Unlike legacy chatbots, AI agents for banks are modular, context-aware, and capable of orchestrating backend systems like Salesforce, Guidewire, or Duck Creek to resolve queries autonomously or escalate intelligently.

The Opportunity: Why Banks Must Rethink Customer Service Now

Retail and commercial banks face a trust-deficit in customer experience. According to McKinsey, over 40% of customers cite “poor service” as their top reason for switching banks. Legacy systems still rely on siloed IVR trees, email queues, and manually triaged queries.

Meanwhile, GenAI adoption across financial services is accelerating. Gartner reports that by 2026, 75% of customer service interactions in BFSI will be managed by AI agents. The opportunity is no longer about cost-cutting,it’s about speed, personalization, multilingual reach, and delivering agentic service that complies with regulatory frameworks like GDPR and FFIEC.

Architecture: How AI Agents Power Customer Service in Banks

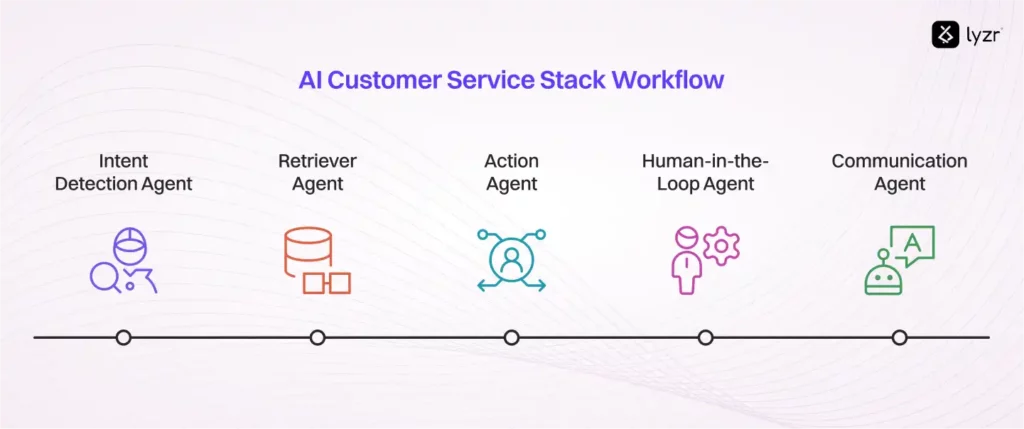

An enterprise-ready AI customer service stack starts with multi-agent orchestration, not just a chatbot. In Lyzr’s modular setup, the workflow begins with an Intent Detection Agent, powered by an LLM hosted on AWS Bedrock or Azure OpenAI, which parses incoming queries from channels like WhatsApp, IVR, or email.

This intent routes the request to a downstream Retriever Agent that taps into vectorized knowledge bases,policies, loan clauses, regulatory documents,stored in Pinecone or Weaviate. If structured data is required (like account balance or loan status), an Action Agent integrates with systems like Salesforce or Finacle via APIs.

For scenarios involving sensitive decisions (e.g., fraud alerts or claim denials), a Human-in-the-Loop Agent adds audit logging and escalates to a support officer. Finally, a Communication Agent delivers a multilingual, channel-appropriate response,formatted for email, SMS, or voice,while maintaining a complete audit trail.

This agentic pipeline ensures that banks move from static ticketing to dynamic, responsive, and fully traceable customer service.

Need a playbook for implementing Agents in Banking? check out the playbook.

Real-World Use Cases of AI in Banking Customer Service

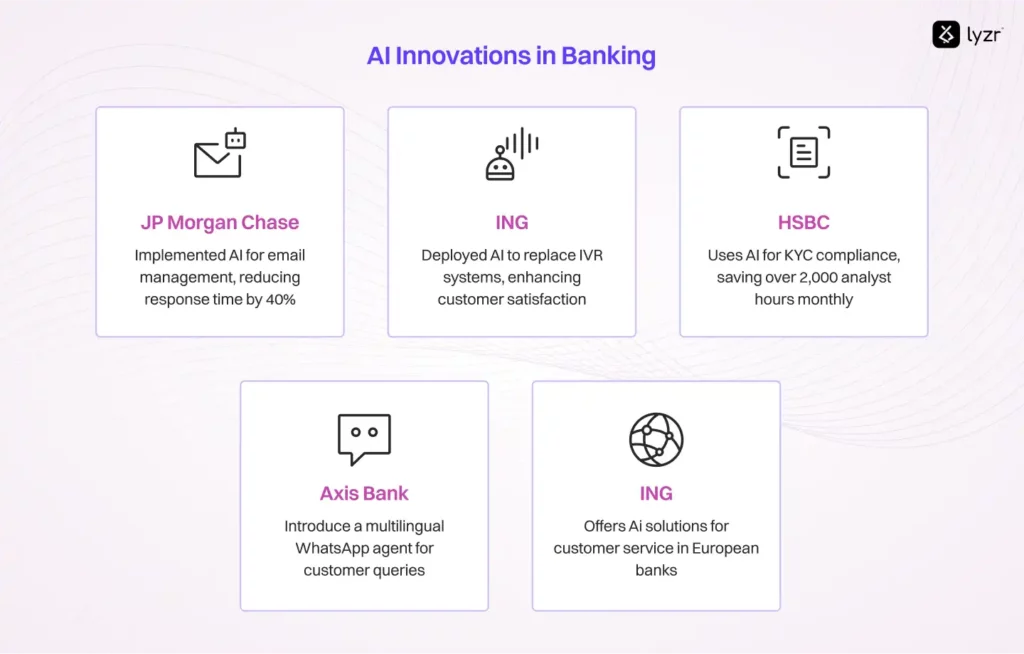

1. JPMorgan Chase : Smart Email Assistants

JPMorgan has implemented internal GenAI agents to summarize, categorize, and route high-volume email queries in their commercial banking operations, reducing first-response time by 40% (source: BCG).

2. ING : Natural Language IVR Replacement

ING deployed conversational agents that replace legacy IVR menus with voice-enabled AI, improving call resolution rates and customer satisfaction scores.

3. HSBC : AI for KYC Resolution

HSBC’s compliance support now includes agents that parse KYC submissions using OCR and validate them against internal rules and public databases, freeing up over 2,000 analyst hours per month.

4. Axis Bank : WhatsApp AI Agent

Through Haptik, Axis Bank has introduced a multilingual WhatsApp agent capable of resolving 100+ types of queries, integrated directly with their core banking system.

5. EY’s Managed AI Support Platform

EY offers GenAI customer service solutions to regional banks in Europe, using prebuilt agents for onboarding, fraud queries, and statement disputes, hosted securely on Azure.

Here are 50+ Agentic use cases across BFSI, Sales, Marketing & Others.

Lyzr’s Agentic Advantage for Banks

Unlike rigid AI products, Lyzr offers a full-stack Agent Studio where banking teams can build, orchestrate, and deploy modular AI agents in days. Each agent,whether it’s for KYC validation, customer onboarding, or query triage,comes with:

- Pre-integrated enterprise connectors (Salesforce, Twilio, LangChain)

- Safe AI controls (human-in-loop, audit logs, response moderation)

- Multilingual support across English, Hindi, Spanish, and more

- LLM flexibility with OpenAI, Claude, or private LLMs

- Data residency assurance (for GDPR, RBI, HIPAA compliance)

Enterprises can start with Lyzr’s banking use case templates and customize each agent using their own workflows, regulatory logic, and brand tone,reducing time to pilot from 12 weeks to under 7 days.

Explore more on our Banking Use Cases or try a workflow on Agent Studio.

Tradeoff Table: Build vs Buy vs Lyzr Hybrid

| Criteria | Build In-House | Buy Off-the-Shelf Chatbot | Lyzr Hybrid Agents |

| Customization | High but time-intensive | Low to Medium | High (modular agent control) |

| Time to Deploy | 3:6 months | 2:4 weeks | 3:10 days |

| Compliance & Controls | Requires internal tooling | Limited | Prebuilt with audit, logs, PII masking |

| LLM and API Flexibility | Varies by vendor | Fixed | Plug-and-play LLMs + CRM integrations |

| Cost Efficiency | High upfront & maintenance | Subscription-based | Pay-per-agent or flat enterprise pricing |

Diagram Suggestion: Agent-Powered Customer Service Stack

Visualize a left-to-right modular pipeline of agents:

- Channel Intake Agent → Pulls inputs from Email, IVR, WhatsApp, Web

- Intent Detection Agent (LLM via AWS Bedrock or Azure OpenAI)

- Retriever Agent → Connects to Pinecone, Weaviate, internal knowledge bases

- Action Agent → API calls to Salesforce, Guidewire, Finacle

- Compliance & Audit Agent → Logs escalations, human overrides, and flags PII

- Comms Agent → Multilingual output across preferred customer channels

Include logos for Salesforce, Twilio, Hugging Face, AWS, and Meta for integrations.

FAQs on AI in Customer Service for Banks

1. Can I swap out OpenAI for a private LLM in Lyzr?

Yes. Lyzr allows model swapping with providers like Claude, Mistral, or open-weight models via Hugging Face or Ollama. You can enforce model routing per workflow.

2. Does Lyzr integrate with CRMs like Salesforce or core systems like Finacle?

Absolutely. Lyzr supports native integrations with Salesforce, HubSpot, Finacle, and more via API orchestration and webhook-based triggers.

3. How is data residency and compliance handled?

Lyzr ensures data remains within client-defined regions. All agent logs, user inputs, and responses can be encrypted, stored locally, and audited for GDPR or RBI compliance.

4. Can I reuse the same agents for multiple departments?

Yes. For example, an Intent Detection Agent used in retail banking can be reused in mortgage operations with only minor configuration tweaks.

5. Is there human-in-the-loop support?

Every agent can be configured with escalation logic to hand off to humans based on confidence scores, thresholds, or workflow policies.

6. How long does a typical pilot take to go live?

Pilots can be operational within 5:10 days using prebuilt templates. Enterprise production rollouts typically take 3:5 weeks with compliance checks.

7. What technical skills are needed to build agents with Lyzr?

Minimal. Lyzr is a low-code platform. Non-technical teams can configure workflows, while dev teams can add integrations and governance layers.

8. How do you prevent hallucinations or unsafe outputs?

Agents are equipped with moderation layers, prompt guardrails, and fallback logic. You can also enforce a four-eyes review for sensitive queries.

Book A Demo: Click Here

Join our Slack: Click Here

Link to our GitHub: Click Here