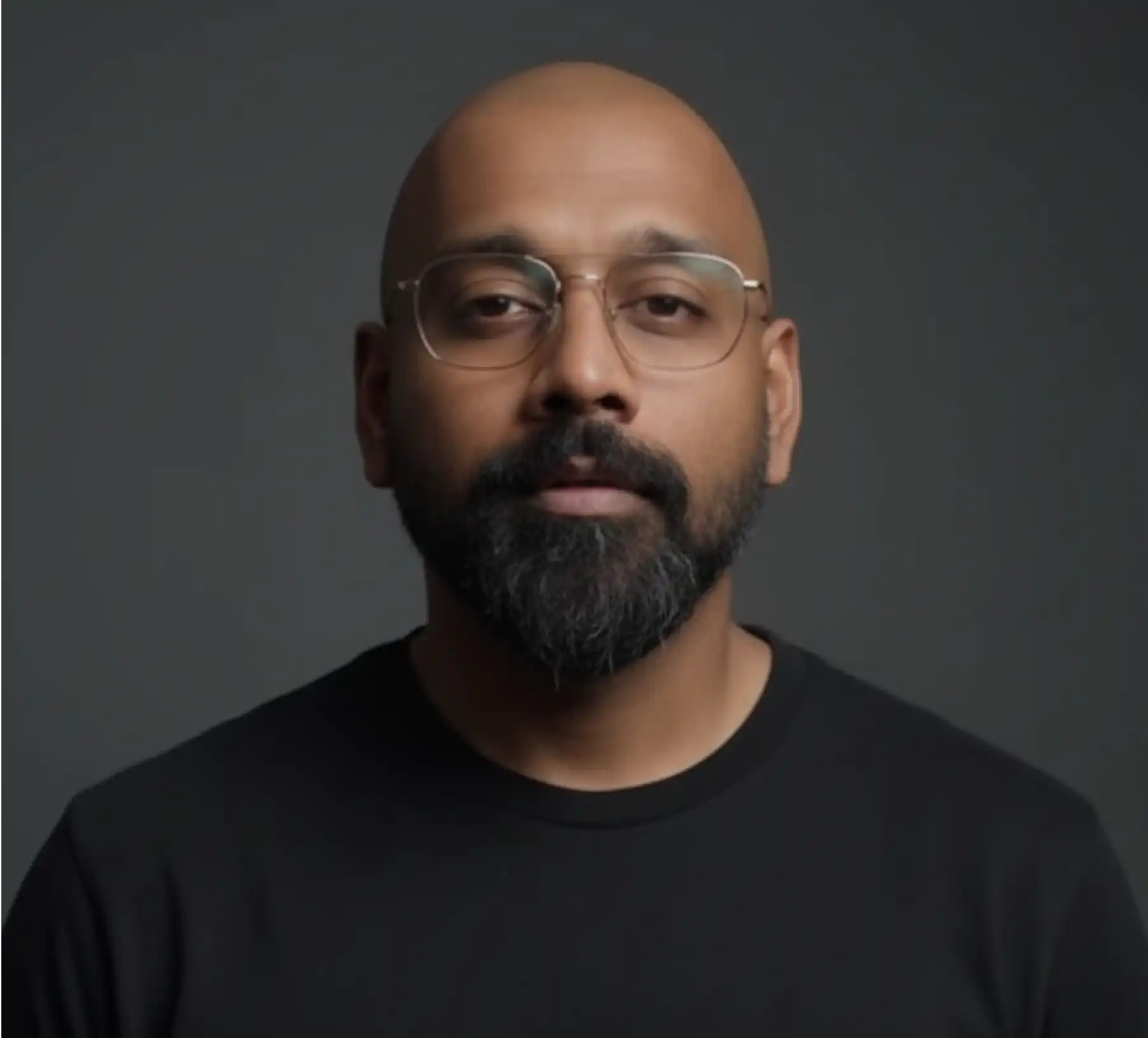

When a work visa costs as much as a senior engineer’s salary, the spreadsheet starts hiring agents.

Donald Trump says he’ll slap a $100,000 annual fee on every H-1B visa starting September 2025 – a price that dwarfs the sub-$2,000 filing costs that used to be rounding errors. That turns the H-1B from a staffing lever into a budget event.

System integrators have long run a tight equation: a small onsite pod of H-1Bs anchors a $1M time-and-materials deal; offshore delivery does the heavy lift. If each onsite H-1B now removes roughly 10 percentage points of gross margin, the old model collapses. The only way out is price hikes, fewer onsite bodies, or a different way to deliver.

And at $100k a head, “different” looks a lot like agents. A $100k budget can power roughly 100 capable AI agents for a year – units that don’t sleep, don’t churn, and can be scripted to company standards.

What’s New

- $100,000 annual fee per H-1B worker announced, effective September 2025; prior costs were typically under $2,000 for initial applications.

- Fee applies every year per worker, not just at filing.

- A $1M U.S. T&M deal usually includes ~1–3 onsite H-1B FTEs, with the rest offshore.

- Each onsite H-1B would shave ~10 percentage points off project gross margin; a standard mix (≈1.5–2.5 onsite) means a ~15–25 point margin hit unless pricing or delivery changes.

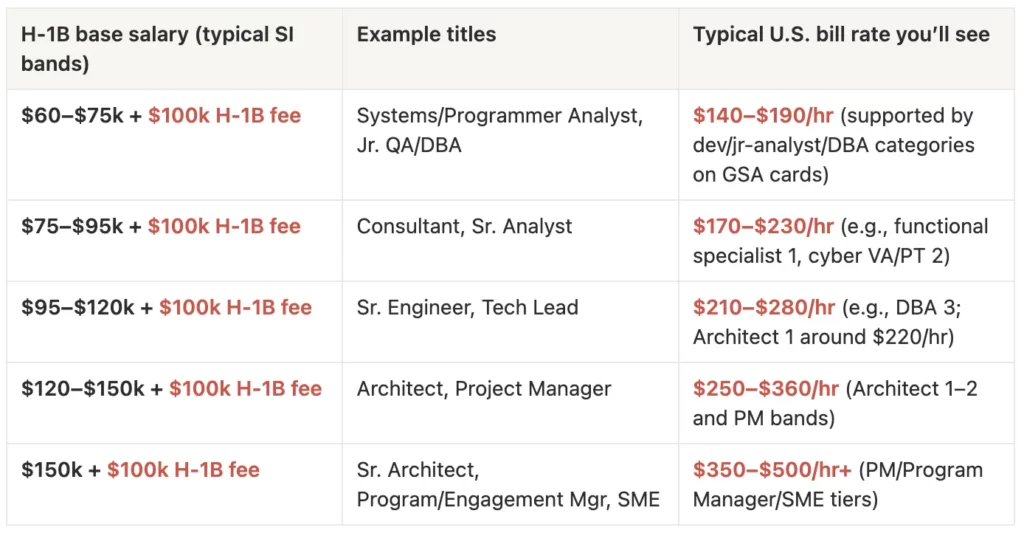

Here’s how the salary band and the onset billing art table looks like before the $100,000 annual fee.

And here’s how it looks after the $100,000 annual H-1B visa fee is applied.

Why Agents Win at This Price Onsite

H-1Bs have served as glue: translating requirements, stewarding delivery, and handling predictable build-and-run tasks. That glue now costs six figures before salary. Agents, once a novelty, are crossing into “good enough” for repeatable workstreams when wrapped with guardrails, repos, and playbooks.

The margin math forces speed. Raise client rates double digits and deals stall; eat the cost and projects bleed. Shift delivery to agent-led pods, and you can cut onsite headcount while improving responsiveness – especially for toil-heavy activities like QA triage, runbook execution, L2/L3 support, report generation, and routine data workflows.

A $100,000 budget can fund about 100 capable AI agents doing programming, SRE, project management, and data analysis/reporting – the roles often filled by H-1B staff.

From recent deployments (including Lyzr-backed pilots), buyers are pragmatic: they’ll pay for agents when they hit SLAs and show up in dashboards. Not hype – proof. The $100k fee doesn’t invent this shift; it accelerates it.

Strategic Implications

- Bold pricing reset. Rate cards must change or scope must shrink. Expect SIs to introduce “agent-backed delivery” SKUs with outcome-based pricing: per incident resolved, per feature completed, per test suite passed. Clients will accept it if they see faster cycle time and transparent audit trails.

- Agent-led delivery pods. Replace a portion of onsite roles with pods of 5–10 agents overseen by an Agent Architect. Think code generation, test automation, SRE runbooks, data pulls, and PM hygiene handled by agents; humans handle design, client navigation, exceptions, and sign-off.

- Onsite footprint shrinks. Reserve onsite for true client-facing roles: product owners, solution architects, compliance leads – ideally already authorized to work without visas. Everything else becomes remote and agent-assisted, collapsing handoffs and shortening feedback loops.

- Governance becomes the product. The win isn’t just lower cost; it’s reliable output. Expect hardened pipelines: policy-as-code, red teaming of prompts, PII filters, change windows, and immutable logs. Vendors that ship dashboards showing agent activity, error budgets, and rollback paths will win RFPs. A responsible AI becomes the most sought-after agent feature.

If visas become toll roads, the smartest move is to skip the tollbooth and send agents across the wire.